David Gentile's 7-Year Sentence: The GPB Capital Ponzi Scheme Verdict

Table of Contents

The GPB Capital Ponzi Scheme: Unveiling the Fraud

The GPB Capital Ponzi scheme, a sophisticated operation orchestrated over several years, defrauded thousands of investors out of millions of dollars. It operated by falsely promising high returns on investments in various businesses, primarily in the automotive and healthcare sectors. The scheme's deceptive nature was carefully concealed, making it difficult for investors to detect the fraudulent activity.

- Investment Strategies (or lack thereof): GPB Capital marketed itself as an expert in niche industries, promising substantial profits through seemingly lucrative investment opportunities. The reality, however, was a complete fabrication. Funds were often misused or simply pocketed by those running the scheme.

- Attracting Investors: The scheme used sophisticated marketing tactics and employed financial advisors to attract investors, including high-net-worth individuals and retirement funds. Promises of high returns and seemingly secure investments lured many into the trap.

- Concealing the Fraud: GPB Capital used complex financial structures and misleading accounting practices to mask the true nature of its operations. False financial reports and manipulated performance data were used to deceive investors and regulators.

- Scale of the Fraud: The scheme's massive scale resulted in significant financial losses for countless victims, leaving many individuals and families facing substantial financial hardship. The sheer number of victims highlights the widespread nature of the deception.

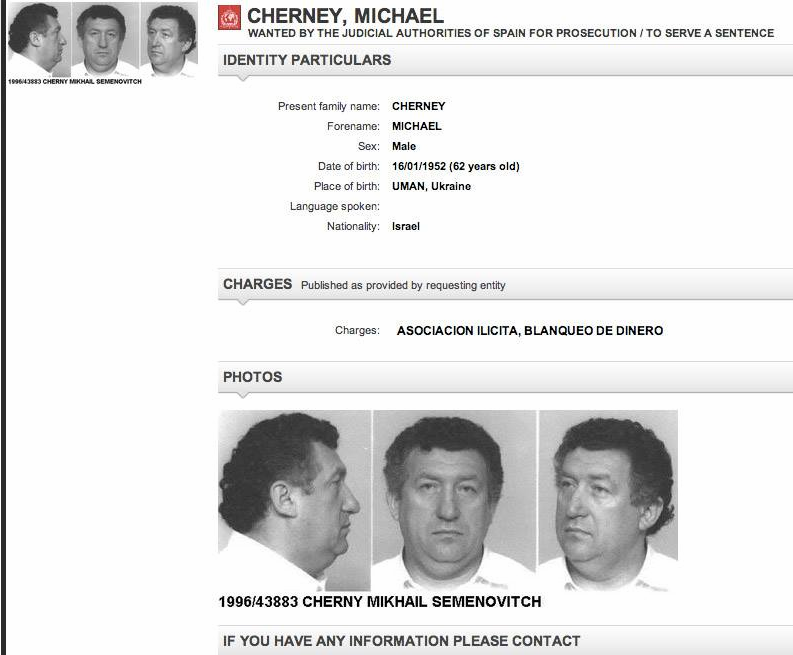

David Gentile's Role in the GPB Capital Ponzi Scheme

David Gentile, a managing partner at GPB Capital, played a central role in orchestrating and perpetuating the Ponzi scheme. He was directly involved in the scheme's deceptive practices and benefited significantly from the fraudulent activity.

- Specific Actions: Evidence presented during the trial demonstrated Gentile's direct involvement in misleading investors, misappropriating funds, and creating false financial documents. His actions were instrumental in the scheme's success in defrauding investors.

- Trial Evidence: Prosecutors presented compelling evidence, including emails, financial records, and testimony from former employees and investors, to demonstrate Gentile's culpability in the GPB Capital Ponzi scheme.

- Gentile's Defense: While Gentile attempted to defend his actions, the evidence overwhelmingly pointed towards his direct involvement and responsibility for the devastating consequences of the fraud.

The Trial and the 7-Year Sentence

The trial surrounding the GPB Capital Ponzi scheme lasted several months, involving extensive testimony and the presentation of a large amount of evidence. Gentile faced multiple charges related to securities fraud and wire fraud. The jury ultimately found him guilty, leading to the 7-year prison sentence.

- Key Events and Testimony: The trial featured testimony from numerous investors who detailed their devastating financial losses and the emotional toll the scheme had taken. Key witnesses included former employees and financial experts who shed light on the fraudulent practices employed by GPB Capital.

- Reasoning Behind the Sentence: The judge considered the severity of the fraud, the significant financial losses suffered by victims, and Gentile's role in perpetrating the scheme when determining the sentence. The 7-year sentence reflects the seriousness of his crimes.

- Penalties and Restitution: In addition to the prison sentence, Gentile faces significant financial penalties and is likely to be ordered to make restitution to the victims of the GPB Capital Ponzi scheme.

Impact on Investors and the Financial Landscape

The GPB Capital Ponzi scheme had a devastating impact on numerous investors, resulting in significant financial and emotional distress. The case also highlighted vulnerabilities in regulatory oversight and investor protection.

- Financial Losses: The financial losses suffered by investors in the GPB Capital Ponzi scheme totaled hundreds of millions of dollars. Many victims lost their life savings, retirement funds, and other crucial assets.

- Emotional Toll: The emotional impact on victims is immeasurable. Many individuals and families experienced significant stress, anxiety, and feelings of betrayal due to the fraudulent nature of the investment.

- Regulatory Changes: The case has prompted increased scrutiny of investment schemes and strengthened calls for stricter regulatory oversight to prevent similar fraudulent activities from occurring in the future.

Lessons Learned from the GPB Capital Ponzi Scheme

The GPB Capital Ponzi scheme serves as a cautionary tale for investors. It underscores the importance of due diligence, independent verification, and awareness of red flags.

- Identifying Ponzi Schemes: Investors should be wary of promises of exceptionally high returns with minimal risk. Independent verification of investment opportunities and thorough research are crucial.

- Independent Verification: Never rely solely on information provided by the investment firm. Seek independent verification of financial statements, investment strategies, and the firm’s track record.

- Resources for Fraud Prevention: Numerous resources are available to help investors learn more about fraud prevention and identify potential red flags. Consult with financial advisors and utilize reputable online resources.

Conclusion

The GPB Capital Ponzi scheme and David Gentile's conviction highlight the devastating impact of investment fraud and the importance of investor awareness. The scheme resulted in significant financial losses and emotional distress for countless victims. Understanding the intricacies of the GPB Capital Ponzi scheme and David Gentile's conviction is crucial to protecting yourself from future investment fraud. Learn more about identifying red flags and safeguarding your investments. Don't become another victim of a Ponzi scheme; take steps today to protect your financial future.

Featured Posts

-

Chief Justice Roberts Recounts Being Mistaken For Former House Republican Leader

May 10, 2025

Chief Justice Roberts Recounts Being Mistaken For Former House Republican Leader

May 10, 2025 -

Two Pedestrians Killed In Elizabeth City Hit And Run

May 10, 2025

Two Pedestrians Killed In Elizabeth City Hit And Run

May 10, 2025 -

Brutal Racist Murder Leaves Family In Pieces

May 10, 2025

Brutal Racist Murder Leaves Family In Pieces

May 10, 2025 -

Harry Styles On Snl Impression Disaster The Full Story

May 10, 2025

Harry Styles On Snl Impression Disaster The Full Story

May 10, 2025 -

Understanding Pam Bondis Comments On The Elimination Of American Citizens

May 10, 2025

Understanding Pam Bondis Comments On The Elimination Of American Citizens

May 10, 2025