Dax Performance: Impact Of German Elections And Business Data

Table of Contents

The Influence of German Elections on Dax Performance

Germany's political landscape significantly impacts investor sentiment and, consequently, DAX performance. The policies advocated by different political parties can dramatically alter investor expectations regarding future economic conditions. Manifestos outlining stances on taxation, regulation, and social spending directly influence market confidence. For example, policies promoting green energy might benefit related sectors while stricter regulations on certain industries could lead to decreased investment.

Analyzing historical data reveals a clear correlation between German elections and DAX volatility. The period leading up to an election often sees increased uncertainty, resulting in market fluctuations. The formation of coalition governments post-election can also introduce further uncertainty as policy negotiations unfold.

- Increased uncertainty before elections often leads to market volatility. Investors adopt a wait-and-see approach, potentially leading to selling pressure and price drops.

- Policy changes post-election can positively or negatively impact specific sectors. Pro-business policies might boost the DAX, while increased regulations could dampen growth in specific industries.

- Coalition negotiations can create further uncertainty influencing the DAX. The length and complexity of negotiations can prolong periods of market uncertainty.

For example, the 2017 German federal election resulted in a period of heightened market uncertainty before a coalition government was formed, impacting the DAX's short-term performance.

Key Business Data Affecting Dax Performance

Several key economic indicators strongly influence DAX performance. These metrics offer valuable insights into the overall health of the German economy and its potential impact on corporate profitability.

GDP Growth

GDP growth is a fundamental indicator directly correlating with company performance. Strong GDP growth generally translates to increased corporate earnings and a positive DAX trajectory. Conversely, slowing GDP growth can signal reduced consumer spending and lower corporate profits, potentially leading to a DAX decline. Historical data consistently demonstrates this strong correlation.

Inflation Rates

Inflation significantly influences consumer spending and corporate profits. High inflation erodes purchasing power, impacting consumer demand. This can negatively affect corporate profitability and, consequently, the DAX. Conversely, moderate inflation can indicate a healthy economy, potentially supporting positive DAX performance.

Unemployment Figures

Unemployment levels directly reflect consumer confidence and business investment. Low unemployment generally boosts consumer spending and business confidence, supporting positive DAX performance. High unemployment, conversely, can signal decreased consumer demand and reduced business investment, impacting the DAX negatively.

Manufacturing PMI (Purchasing Managers' Index)

The Manufacturing PMI acts as a leading economic indicator, predicting future economic activity. A PMI above 50 generally suggests expansion in the manufacturing sector, indicating positive economic momentum and potentially supporting the DAX. A PMI below 50, conversely, signals contraction and potential economic slowdown, which can negatively influence the DAX.

- Strong economic indicators generally lead to positive DAX performance. Positive news regarding GDP growth, low inflation, and low unemployment often boosts investor confidence.

- Negative economic data can trigger sell-offs and DAX decline. Unexpectedly poor economic data can lead to investors exiting the market, causing price drops.

- Unexpected economic data releases often cause short-term volatility. Surprises, whether positive or negative, can lead to significant short-term fluctuations in the DAX.

Analyzing Dax Volatility: Short-Term vs. Long-Term Trends

Understanding DAX volatility requires differentiating between short-term fluctuations and long-term trends. Short-term volatility is often driven by news events, global market trends, and investor sentiment. Long-term trends, however, are more closely tied to fundamental economic factors, such as economic cycles and structural changes within the German economy.

- Short-term volatility is often influenced by news and speculation. Daily news events, geopolitical developments, and market sentiment can cause significant short-term price swings.

- Long-term trends are more closely tied to fundamental economic factors. Sustained economic growth, technological advancements, and structural reforms significantly influence long-term DAX performance.

- Understanding both short-term and long-term trends is crucial for informed investment decisions. Investors need to consider both short-term market noise and long-term economic fundamentals to make rational investment choices.

Conclusion: Navigating the Dax – Informed Decisions Based on Elections and Business Data

The DAX's performance is intricately linked to German elections and key business data. Understanding the impact of political developments and economic indicators is crucial for making informed investment decisions. Investors must analyze both short-term market fluctuations and long-term economic trends to navigate the complexities of the German stock market. By closely monitoring upcoming elections, analyzing economic data like GDP growth and inflation rates, and understanding the significance of indicators such as the Manufacturing PMI, investors can better anticipate DAX performance and develop effective investment strategies.

To stay informed and make well-informed decisions regarding your DAX investments, continue to monitor DAX performance and its influencing factors. Utilize reputable financial news sources and market research tools for ongoing analysis. Successful DAX investing relies on a comprehensive understanding of the interplay between German politics, economic data, and market trends.

Featured Posts

-

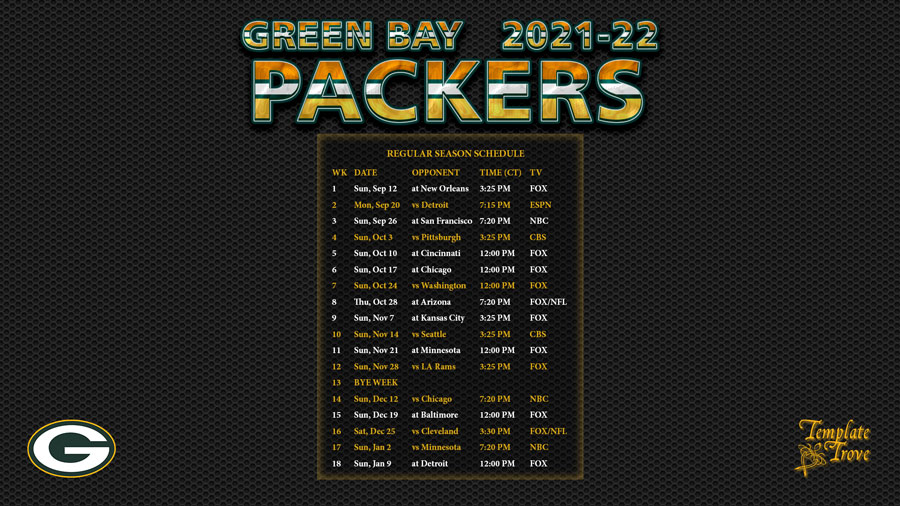

Packers International Game Schedule 2025 Outlook And Possibilities

Apr 27, 2025

Packers International Game Schedule 2025 Outlook And Possibilities

Apr 27, 2025 -

Former Dubai Champ Svitolinas Strong Start Kalinskaya Defeat

Apr 27, 2025

Former Dubai Champ Svitolinas Strong Start Kalinskaya Defeat

Apr 27, 2025 -

Swarovskis Latest Campaign Ariana Grandes Striking Dip Dyed Hair

Apr 27, 2025

Swarovskis Latest Campaign Ariana Grandes Striking Dip Dyed Hair

Apr 27, 2025 -

A Night Of Fear Robert Pattinsons Horror Movie Experience

Apr 27, 2025

A Night Of Fear Robert Pattinsons Horror Movie Experience

Apr 27, 2025 -

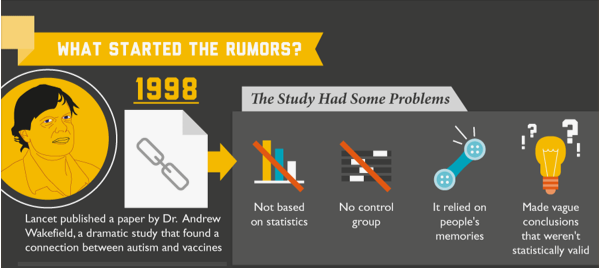

Federal Study On Immunizations And Autism Headed By Vaccine Skeptic Concerns Raised

Apr 27, 2025

Federal Study On Immunizations And Autism Headed By Vaccine Skeptic Concerns Raised

Apr 27, 2025

Latest Posts

-

Understanding Ariana Grandes Style Choices Hair Tattoos And Professional Guidance

Apr 27, 2025

Understanding Ariana Grandes Style Choices Hair Tattoos And Professional Guidance

Apr 27, 2025 -

Hair And Tattoo Transformations Learning From Ariana Grandes Style

Apr 27, 2025

Hair And Tattoo Transformations Learning From Ariana Grandes Style

Apr 27, 2025 -

Ariana Grandes Bold New Look The Role Of Professional Expertise

Apr 27, 2025

Ariana Grandes Bold New Look The Role Of Professional Expertise

Apr 27, 2025 -

Celebrity Style Transformation Ariana Grandes Hair And Tattoos

Apr 27, 2025

Celebrity Style Transformation Ariana Grandes Hair And Tattoos

Apr 27, 2025 -

Professional Help For Hair And Tattoo Transformations Ariana Grandes Inspiration

Apr 27, 2025

Professional Help For Hair And Tattoo Transformations Ariana Grandes Inspiration

Apr 27, 2025