DAX Rally: Potential Threats From A US Market Rebound

Table of Contents

The Current State of the DAX Rally

The recent surge in the DAX index can be attributed to a confluence of factors. The weakening Euro, compared to other major currencies, has boosted the competitiveness of German exports, supporting corporate earnings. Easing inflation expectations in Europe, though still elevated, have also contributed to investor optimism. Furthermore, strong corporate earnings from several key DAX companies have further fueled the rally.

- DAX Performance: The DAX has seen X% gains in the last Y months (replace X and Y with actual data).

- Key Performance Indicators: Positive growth in industrial production, improving consumer confidence, and robust export figures have underpinned the rally.

- Strong Performing Sectors: The automotive, technology, and luxury goods sectors have been particularly strong performers within the DAX. Keywords: DAX performance, German economy, European markets, stock market indices.

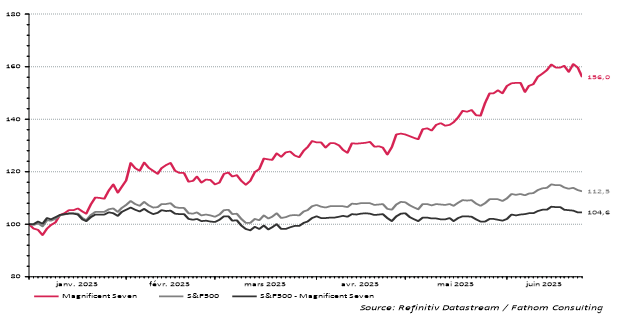

The Anticipated US Market Rebound and its Implications

The US market is expected to rebound based on several factors. Easing inflationary pressures, a potential shift in the Federal Reserve's monetary policy (a "Fed pivot"), and continued robust corporate profits are all contributing to this anticipation. However, a strong US dollar, a likely consequence of this rebound, poses a significant threat to the DAX rally.

- Strong US Dollar Impact: A stronger dollar makes German exports more expensive in international markets, potentially harming German companies' competitiveness and reducing their profitability.

- Capital Flight: A robust US market could attract significant capital flight from European markets, including the DAX, as investors seek higher returns in the US.

- Global Market Trends: The interconnectedness of global markets means that a significant shift in the US market will inevitably impact other markets, including the DAX. Keywords: US stock market, dollar strength, global market trends, capital flows, investment portfolio.

Identifying Specific Threats to the DAX Rally

Several specific threats could derail the DAX rally, even with a recovering US market.

Currency Fluctuations

The EUR/USD exchange rate is crucial. A further strengthening of the US dollar would directly impact the DAX's performance by reducing the value of earnings from German companies operating internationally.

Geopolitical Risks

Ongoing geopolitical events, such as the war in Ukraine and the ongoing energy crisis in Europe, create considerable uncertainty. These factors could negatively influence both the DAX and the US markets, leading to market volatility.

Inflationary Pressures

Persistent inflationary pressures, even if easing, could trigger a market correction in both the US and Europe. Higher inflation erodes purchasing power and increases the cost of borrowing, impacting corporate profitability and investor sentiment.

Interest Rate Hikes

Further interest rate hikes by both the European Central Bank (ECB) and the Federal Reserve (Fed) could dampen economic growth and negatively affect stock market performance, including the DAX. Higher interest rates increase borrowing costs for businesses and make investments less attractive. Keywords: currency exchange rates, geopolitical uncertainty, inflation risk, interest rate policy, economic outlook.

Mitigating the Risks and Developing Investment Strategies

Navigating this potential market shift requires a proactive approach to risk management.

- Diversification: A well-diversified investment portfolio, including assets beyond the DAX and even beyond European markets, is crucial to mitigate risk.

- Hedging Strategies: Investors may consider hedging strategies to protect against potential losses due to currency fluctuations or market downturns. This could involve using derivatives like currency futures or options.

- Risk Assessment: A thorough assessment of your risk tolerance is paramount. Investors with a low risk tolerance may need to adjust their portfolio allocation to minimize exposure to potential market volatility. Keywords: risk management, investment diversification, hedging strategies, portfolio protection, market volatility.

Conclusion: Navigating the DAX Rally and US Market Rebound

The continued DAX rally faces significant headwinds from a potential US market rebound. A stronger US dollar, capital flight, and persistent geopolitical and economic uncertainties pose considerable risks. Understanding the intricate interplay between the DAX and US markets is crucial for investors. Careful risk management, a diversified investment strategy, and staying informed about DAX index performance and related market risks are paramount. Conduct thorough research and consider consulting a financial advisor before making investment decisions related to the DAX rally and the potential impact of the US market rebound. Staying informed about the DAX index and understanding market risks is key to successful investing.

Featured Posts

-

Lewis Hamiltons Comments Ferrari Chiefs Furious Response

May 24, 2025

Lewis Hamiltons Comments Ferrari Chiefs Furious Response

May 24, 2025 -

Hawaii Keiki Artistic Talent Memorial Day Lei Making Poster Competition

May 24, 2025

Hawaii Keiki Artistic Talent Memorial Day Lei Making Poster Competition

May 24, 2025 -

Imcd N V Shareholders Approve All Resolutions At Annual General Meeting

May 24, 2025

Imcd N V Shareholders Approve All Resolutions At Annual General Meeting

May 24, 2025 -

New York Times Connections Hints And Answers For 646 March 18 2025

May 24, 2025

New York Times Connections Hints And Answers For 646 March 18 2025

May 24, 2025 -

Analyzing The Net Asset Value Of The Amundi Msci World Ex Us Ucits Etf Acc

May 24, 2025

Analyzing The Net Asset Value Of The Amundi Msci World Ex Us Ucits Etf Acc

May 24, 2025

Latest Posts

-

Zal De Recente Koersverschuiving Tussen Europese En Amerikaanse Aandelen Aanhouden

May 24, 2025

Zal De Recente Koersverschuiving Tussen Europese En Amerikaanse Aandelen Aanhouden

May 24, 2025 -

Europese Aandelen Vs Wall Street Doorzetting Van De Snelle Koerswijziging

May 24, 2025

Europese Aandelen Vs Wall Street Doorzetting Van De Snelle Koerswijziging

May 24, 2025 -

Gryozy Lyubvi Istoriya Ili Ilicha Iz Gazety Trud

May 24, 2025

Gryozy Lyubvi Istoriya Ili Ilicha Iz Gazety Trud

May 24, 2025 -

Ilya Ilich I Ego Gryozy Lyubvi Analiz Publikatsii V Gazete Trud

May 24, 2025

Ilya Ilich I Ego Gryozy Lyubvi Analiz Publikatsii V Gazete Trud

May 24, 2025 -

8 Stock Market Surge On Euronext Amsterdam Trumps Tariff Impact

May 24, 2025

8 Stock Market Surge On Euronext Amsterdam Trumps Tariff Impact

May 24, 2025