De Minimis Tariffs On Chinese Goods: A G-7 Discussion

Table of Contents

Understanding De Minimis Tariffs and Their Application to Chinese Imports

De minimis tariffs, often referred to as a "de minimis value," represent a threshold below which imported goods are exempt from customs duties. This tariff exemption is designed to simplify the import process for low-value shipments, primarily benefiting small businesses and individual consumers. However, the application and thresholds of de minimis tariffs vary significantly across G-7 nations, creating complexities for businesses dealing with Chinese imports. The customs valuation process for determining whether a shipment falls below the de minimis threshold can also be intricate and vary in implementation.

-

Definition of de minimis tariffs and their purpose: De minimis tariffs simplify import procedures for low-value goods by exempting them from standard customs duties, reducing administrative burdens.

-

Current de minimis thresholds for various G-7 countries: These thresholds differ significantly. For example, Canada might have a higher threshold than France, creating a competitive imbalance for businesses exporting from China. (Specific figures would need to be researched and inserted here, citing reputable sources).

-

Impact of different thresholds on small businesses importing from China: Inconsistent thresholds create uncertainty and added complexity for small and medium-sized enterprises (SMEs) sourcing goods from China. This can lead to higher administrative costs and compliance challenges.

-

Examples of goods commonly affected by de minimis tariff changes: These changes frequently impact everyday items like clothing, electronics, and small household goods commonly imported via e-commerce platforms.

The G-7's Role in Harmonizing De Minimis Tariffs on Chinese Goods

The G-7's role in harmonizing de minimis tariffs on Chinese goods is paramount to fostering a more predictable and efficient international trading environment. Currently, the lack of uniformity presents significant challenges. While some argue for harmonization to simplify trade and reduce bureaucratic hurdles, others express concerns about potential economic impacts and loss of national regulatory control.

-

Arguments for harmonizing de minimis tariffs: Harmonization could streamline import processes, reducing costs for businesses and promoting fairer competition. It could also facilitate cross-border e-commerce and increase transparency.

-

Arguments against harmonizing de minimis tariffs: Some argue that harmonization could lead to a loss of national sovereignty in setting import policies. Concerns also exist about potential negative impacts on domestic industries and revenue collection.

-

Potential impact of harmonization on global trade: Harmonization could lead to increased trade efficiency, reduced transaction costs, and potentially stimulate economic growth.

-

Challenges in achieving harmonization among G-7 nations: Achieving consensus among G-7 nations on trade policy is notoriously challenging due to differing national interests and economic priorities.

-

Past G-7 statements or actions related to trade with China: (This section requires research into official G-7 statements and actions regarding trade policies affecting Chinese imports, citing credible sources).

Economic Impacts and Implications of Varying De Minimis Tariffs

The economic implications of differing de minimis tariff levels are far-reaching, impacting consumers, businesses, and overall trade balances. The effects are particularly noticeable in the burgeoning e-commerce sector, where low-value goods are frequently traded across borders.

-

Impact on consumer prices: Inconsistent tariffs can lead to price variations for similar goods, impacting consumer purchasing power.

-

Impact on businesses, particularly SMEs: SMEs often face disproportionate challenges due to fluctuating tariffs, impacting their competitiveness and profitability.

-

Impact on the trade balance between G-7 countries and China: Varying tariff levels can significantly influence trade flows and potentially exacerbate trade imbalances.

-

Influence on global supply chains: Inconsistent tariffs can disrupt global supply chains, adding complexities and delays.

-

The role of e-commerce in the de minimis tariff debate: The rise of e-commerce has intensified the debate, highlighting the need for clear and consistent international standards for low-value goods.

Case Study: Specific Examples of Impact on Key Industries (Optional)

(This section would require detailed research into specific industries impacted by varying de minimis tariffs. For example, the impact on the textile industry or electronics sector could be explored, providing concrete examples and data to support the analysis.)

Conclusion

The complexities surrounding de minimis tariffs on Chinese goods within the G-7 framework highlight the significant challenges in balancing national interests with the need for a harmonized and efficient global trading system. The economic impacts of differing tariff levels are substantial, affecting businesses, consumers, and overall trade balances. While the arguments for and against harmonization are compelling, the lack of uniformity continues to create uncertainty and friction. Further discussion and potential policy changes are crucial to navigate these challenges and establish a more predictable and transparent international trade environment.

Call to Action: Learn more about the ongoing discussions on de minimis tariffs on Chinese goods and their impact on global trade. Stay informed about the G-7's role in shaping future trade policies. Engage in the conversation surrounding de minimis tariffs and their influence on international commerce. Subscribe to our newsletter for updates on de minimis tariff developments.

Featured Posts

-

Removing From Your Watchlist Hulus Movie Departures This Month

May 23, 2025

Removing From Your Watchlist Hulus Movie Departures This Month

May 23, 2025 -

Georgia Domina Armenia In Liga Natiunilor Scor Final 6 1

May 23, 2025

Georgia Domina Armenia In Liga Natiunilor Scor Final 6 1

May 23, 2025 -

The Untold Story Hurwitzs First Cobra Kai Trailer Pitch

May 23, 2025

The Untold Story Hurwitzs First Cobra Kai Trailer Pitch

May 23, 2025 -

Ask Hayati Icin Mayis Ayi 3 Burcta Romantik Firtina

May 23, 2025

Ask Hayati Icin Mayis Ayi 3 Burcta Romantik Firtina

May 23, 2025 -

Shadman Islams Strong Reply Leads Bangladesh To Victory Against Zimbabwe

May 23, 2025

Shadman Islams Strong Reply Leads Bangladesh To Victory Against Zimbabwe

May 23, 2025

Latest Posts

-

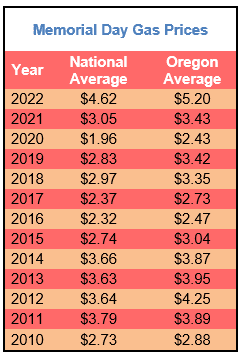

Low Gas Prices Forecast For Memorial Day Weekend

May 23, 2025

Low Gas Prices Forecast For Memorial Day Weekend

May 23, 2025 -

Memorial Day Gas Prices A Decade Low Prediction

May 23, 2025

Memorial Day Gas Prices A Decade Low Prediction

May 23, 2025 -

Memorial Day Gas Prices A Look At The Expected Low Costs

May 23, 2025

Memorial Day Gas Prices A Look At The Expected Low Costs

May 23, 2025 -

Arrows Damien Darhk Would Neal Mc Donough Return To The Dc Universe

May 23, 2025

Arrows Damien Darhk Would Neal Mc Donough Return To The Dc Universe

May 23, 2025 -

Actor Neal Mc Donough Takes On Pro Bull Riding In New Film

May 23, 2025

Actor Neal Mc Donough Takes On Pro Bull Riding In New Film

May 23, 2025