Decline In Gold Prices: Positive US-China Trade Talks Lead To Profit Booking

Table of Contents

Impact of Positive US-China Trade Talks on Investor Sentiment

Reduced trade tensions between the US and China have significantly impacted investor sentiment, leading to a decrease in demand for gold. Gold's traditional role as a safe-haven asset is directly tied to global economic uncertainty and geopolitical risks. When these risks lessen, as they have with the easing of trade tensions, investors often shift their focus away from safe-haven assets like gold. The improved outlook reduces the perceived need for a protective investment.

This shift is reflected in a growing optimism about global economic growth. Positive trade relations foster increased international trade and economic collaboration. This increased optimism encourages investors to move their funds into riskier, higher-potential-return assets.

- Reduced geopolitical uncertainty: The de-escalation of trade disputes lessens the fear of global economic instability.

- Increased global economic growth projections: Positive trade relations boost confidence in global economic expansion.

- Improved investor confidence: A more stable international trade environment leads to greater certainty and confidence in the markets.

- Shift from safe-haven assets to growth stocks: Investors are reallocating funds from gold to equities and other assets perceived as having higher growth potential.

Profit-Taking and its Role in the Gold Price Decline

Profit-booking is a significant factor contributing to the recent decline in gold prices. Profit-booking, where investors sell assets to realize gains, is a common practice in commodity markets, including gold. The recent positive news on US-China trade talks provided an opportune moment for many investors who had held gold positions for some time to take profits. This influx of selling pressure pushed gold prices downward.

The timing of this profit-taking is crucial. The positive trade developments created a surge in market optimism, encouraging investors to cash in on their gold investments before any potential reversal of the positive sentiment.

- Investors cashing in on previous gold investments: Many investors who bought gold during periods of heightened uncertainty are now selling to secure their profits.

- Increased selling pressure leading to price drops: The combined selling pressure from numerous investors contributed to the decline in gold prices.

- Technical analysis indicators suggesting potential for further price correction: Technical indicators may signal further price adjustments in the short term, depending on market dynamics.

Alternative Investment Opportunities and their Influence

The appeal of alternative investment opportunities is also influencing the current gold market trends. The improved outlook on global economic growth has made other asset classes more attractive to investors. The rising stock market indices and increased yields on government bonds offer compelling alternatives to gold.

- Rising stock market indices: Strong performance in equity markets diverts investment capital away from gold.

- Increased yields on government bonds: Higher bond yields provide competitive returns compared to the non-yielding nature of gold.

- Attractive returns in emerging markets: Opportunities in emerging markets are drawing investment away from traditional safe-haven assets.

Analyzing the Future of Gold Prices Considering Trade Relations

While positive US-China trade relations currently contribute to the decline in gold prices, it's crucial to maintain a cautious outlook. The future of gold prices remains uncertain, contingent on the ongoing evolution of trade relations. Continued positive developments could lead to sustained lower gold prices, while renewed trade tensions could trigger a resurgence in demand for gold as a safe haven.

- Potential for further price corrections depending on trade negotiations: Future price movements will heavily depend on the trajectory of trade negotiations.

- Gold's role as a safe-haven asset remains significant despite recent decline: Despite the current downturn, gold will likely maintain its role as a hedge against economic uncertainty.

- Long-term outlook for gold prices depends on various macroeconomic factors: Inflation, interest rates, and global economic growth will all play significant roles in determining the long-term price of gold.

Conclusion: Understanding the Decline in Gold Prices and Future Outlook

The recent decline in gold prices is primarily attributed to the positive developments in US-China trade talks, which have led to significant profit-booking among investors. This, combined with the attractiveness of alternative investment opportunities, has reduced demand for gold as a safe-haven asset. While the current trend suggests lower gold prices, the future remains contingent on ongoing US-China trade relations and broader macroeconomic conditions. Continued monitoring of these factors is crucial. It's important for investors to stay informed about gold price fluctuations and gold market trends, and to consider diversifying their investment portfolios with a strategic approach to gold investment to manage risk effectively.

Featured Posts

-

Los Angeles Wildfires The Rise Of Disaster Betting And Its Implications

May 18, 2025

Los Angeles Wildfires The Rise Of Disaster Betting And Its Implications

May 18, 2025 -

The Gops Medicaid Fight Internal Conflict And Consequences

May 18, 2025

The Gops Medicaid Fight Internal Conflict And Consequences

May 18, 2025 -

Mike Myers Three Word Shrek Review

May 18, 2025

Mike Myers Three Word Shrek Review

May 18, 2025 -

Turning Renovation Nightmares Into Dreams The Power Of A House Therapist

May 18, 2025

Turning Renovation Nightmares Into Dreams The Power Of A House Therapist

May 18, 2025 -

Alex Fine And Pregnant Wife Cassies Mob Land Premiere Debut

May 18, 2025

Alex Fine And Pregnant Wife Cassies Mob Land Premiere Debut

May 18, 2025

Latest Posts

-

Exploring Queer Identity And Family Conflict In The Wedding Banquet

May 18, 2025

Exploring Queer Identity And Family Conflict In The Wedding Banquet

May 18, 2025 -

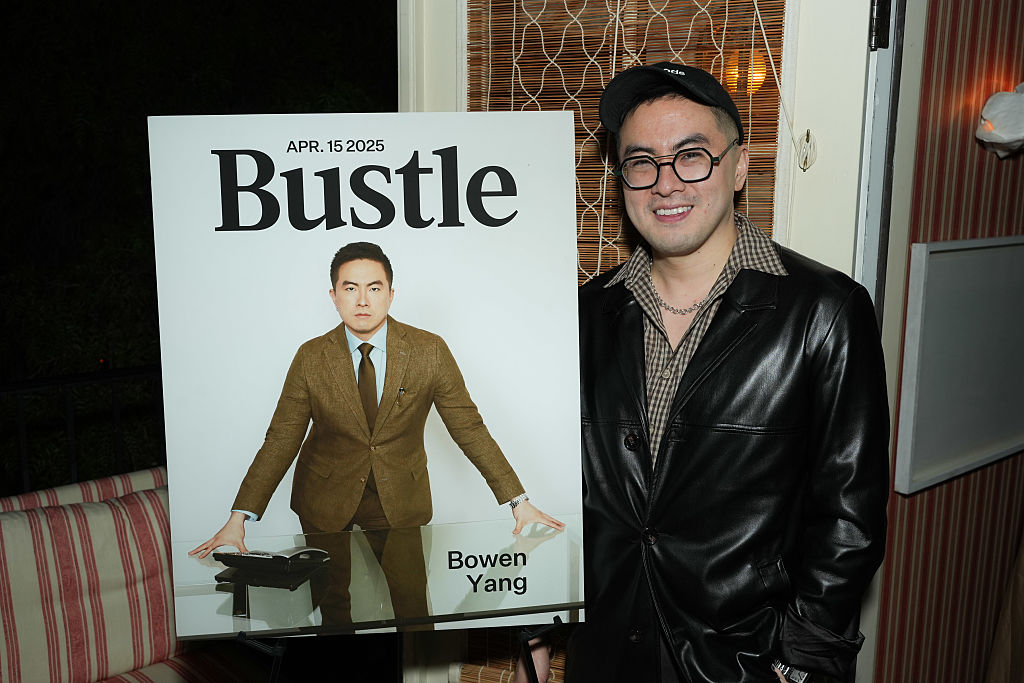

Snls White Lotus Parody Bowen Yang And Aimee Lou Woods Reactions

May 18, 2025

Snls White Lotus Parody Bowen Yang And Aimee Lou Woods Reactions

May 18, 2025 -

Bowen Yang On Snls White Lotus Parody Featuring Aimee Lou Wood

May 18, 2025

Bowen Yang On Snls White Lotus Parody Featuring Aimee Lou Wood

May 18, 2025 -

Bowen Yangs Hilarious Reaction To Snls White Lotus Parody With Aimee Lou Wood

May 18, 2025

Bowen Yangs Hilarious Reaction To Snls White Lotus Parody With Aimee Lou Wood

May 18, 2025 -

Snl Bowen Yangs Plea To Lorne Michaels For Jd Vance Role Change

May 18, 2025

Snl Bowen Yangs Plea To Lorne Michaels For Jd Vance Role Change

May 18, 2025