Decline In Taiwanese Investment In US Bond ETFs: Causes And Implications

Table of Contents

Shifting Global Economic Landscape and its Impact on Taiwanese Investment

Several factors within the shifting global economic landscape are contributing to the decline in Taiwanese investment in US Bond ETFs.

Rising Interest Rates in Taiwan

Increased interest rates in Taiwan are making domestic investment options more appealing than US bond ETFs.

- Mechanics of Interest Rate Impact: Higher interest rates in Taiwan increase the returns on domestic investments, making US bonds, which often offer lower yields, less attractive. This basic principle of supply and demand directly impacts investment decisions.

- Data on Taiwanese Interest Rate Changes: [Insert data and source here, e.g., "The Central Bank of Taiwan raised its key interest rate by X% in Y, leading to a Z% increase in returns on certain domestic bonds."]

- Competing Investment Opportunities: Taiwanese investors are finding increasingly lucrative opportunities within the domestic market, including high-yield Taiwanese government bonds and corporate debt.

Concerns about US Economic Stability

Uncertainty surrounding the US economy, including persistent inflation and persistent recession fears, is impacting investor sentiment.

- Relevant Economic Indicators: Data points like the US inflation rate, GDP growth, and unemployment figures all influence investor confidence. Negative trends in these areas can deter investment in US assets. [Insert relevant data and sources here].

- Investor Concerns Reflected in News: Numerous financial news outlets have reported on the growing concerns of international investors regarding the stability of the US economy. [Insert links to relevant news articles].

- US Dollar Strength/Weakness: Fluctuations in the value of the US dollar against the Taiwanese dollar also play a role. A weakening dollar can reduce the returns for Taiwanese investors holding US dollar-denominated assets.

Geopolitical Risks and Diversification Strategies

Geopolitical tensions, particularly those related to US-China relations and regional instability, are prompting Taiwanese investors to diversify their portfolios.

- Diversification Strategies: To mitigate risk, many Taiwanese investors are diversifying their holdings into assets outside of the US, including investments in other Asian markets or European Union countries.

- Alternative Investment Destinations: Emerging markets in Southeast Asia and even some European nations are increasingly being considered as alternatives to US bond ETFs.

- Role of Risk Aversion: The heightened geopolitical uncertainty has led to a greater degree of risk aversion among Taiwanese investors, causing them to seek safer havens for their capital.

Regulatory Changes and Market Dynamics Affecting Taiwanese Investors

Regulatory shifts and the dynamics of the investment market are also playing a part in the decreased Taiwanese investment in US Bond ETFs.

Changes in Taiwanese Investment Regulations

Recent adjustments to Taiwanese investment regulations may have inadvertently impacted foreign investment, including investment in US bond ETFs.

- Specific Regulatory Changes: [Insert details of any relevant regulatory changes and provide links to official sources or regulatory documents]. For example, any changes to capital controls or tax regulations could influence investment decisions.

- Impact on Investment Flows: These regulatory changes could have either directly restricted investment flows to the US or indirectly made other investment options more attractive.

Competition from Other Asset Classes

The allure of alternative asset classes is also drawing Taiwanese investors away from US bond ETFs.

- Risk-Return Profiles: Real estate and private equity investments, for instance, might offer higher potential returns, even with potentially higher risk, compared to US bond ETFs. A comparative analysis of risk-return profiles is essential here. [Insert data comparing risk-return profiles of different asset classes].

- Investment Flows into Alternatives: Data showing increased investment flows into real estate or private equity within Taiwan would support this point. [Insert data and source].

Implications of Reduced Taiwanese Investment in US Bond ETFs

The decline in Taiwanese investment in US Bond ETFs has significant implications for both the US and Taiwanese economies.

Impact on US Bond Markets

Decreased Taiwanese demand could affect US bond prices and yields.

- Supply and Demand Dynamics: Reduced demand puts downward pressure on bond prices and potentially pushes yields higher.

- Potential for Market Volatility: This shift could contribute to increased volatility within the US bond market, making it more challenging for investors to predict and manage risk.

Implications for US-Taiwan Economic Relations

The reduced investment has broader ramifications for bilateral economic ties.

- Significance of Taiwanese Investment: Taiwanese investment plays a role in the US economy, and its reduction could have both economic and diplomatic consequences.

- Potential Diplomatic Ramifications: A significant decrease in investment could strain the already complex economic and political relationship between the two nations.

Conclusion: Understanding the Future of Taiwanese Investment in US Bond ETFs

The decline in Taiwanese investment in US Bond ETFs is a multifaceted issue driven by rising interest rates in Taiwan, concerns about US economic stability, geopolitical risks, regulatory changes, and competition from other asset classes. These factors have significant implications for both the US and Taiwanese economies, impacting bond markets and bilateral relations. The future trajectory of Taiwanese investment in US Bond ETFs will depend heavily on global economic conditions, geopolitical stability, and regulatory developments. To stay abreast of this evolving situation, it’s crucial to follow relevant financial news and analysis focusing on Taiwanese investment in US Bond ETFs and related market trends.

Featured Posts

-

Inters Stunning Champions League Win Against Bayern Munich

May 08, 2025

Inters Stunning Champions League Win Against Bayern Munich

May 08, 2025 -

7 Surprisingly Great Movies On Paramount

May 08, 2025

7 Surprisingly Great Movies On Paramount

May 08, 2025 -

Made In Pakistan Ahsans Plan To Enhance Global Competitiveness Through Technology

May 08, 2025

Made In Pakistan Ahsans Plan To Enhance Global Competitiveness Through Technology

May 08, 2025 -

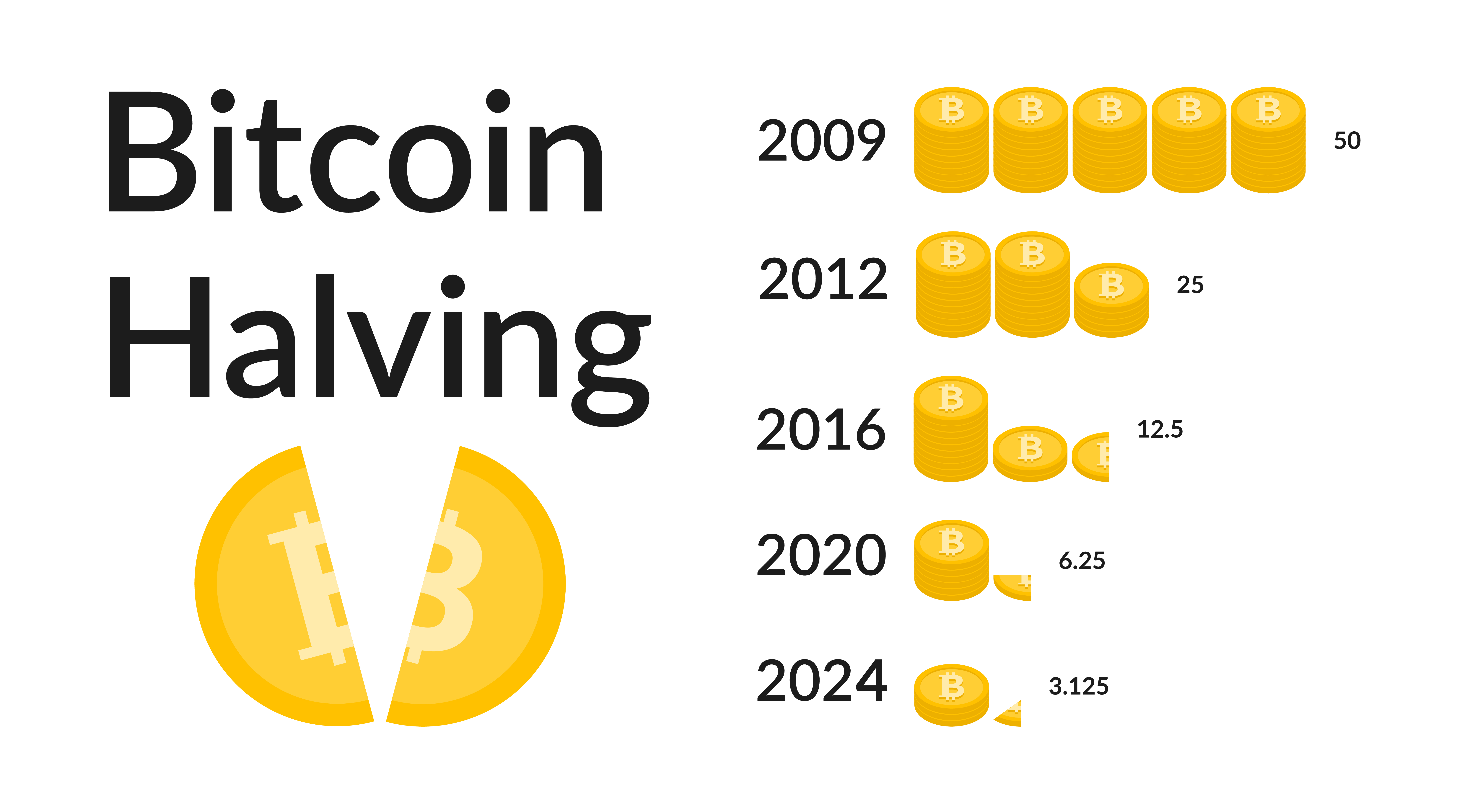

Bitcoins Future Analyzing The Potential Impact Of Trumps Economic Agenda

May 08, 2025

Bitcoins Future Analyzing The Potential Impact Of Trumps Economic Agenda

May 08, 2025 -

Taiwan Dollars Surge Pressure Mounts For Economic Reform

May 08, 2025

Taiwan Dollars Surge Pressure Mounts For Economic Reform

May 08, 2025