Delaying ECB Rate Cuts: Economists Sound The Alarm

Table of Contents

Persistent Inflation and the ECB's Dilemma

High inflation remains a primary concern for the ECB, despite slowing growth. The ECB's mandate prioritizes price stability, making it hesitant to cut rates prematurely. The risk of fueling further inflation through rate cuts is a major factor in the delay. This dilemma forces the ECB to carefully balance its commitment to price stability with the need to stimulate economic growth.

- High Inflation Persists: Eurozone inflation, while declining from its peak, remains stubbornly above the ECB's target of 2%. This persistent inflation is driven by a complex mix of factors, including energy prices, supply chain disruptions, and strong demand.

- Core Inflation a Key Indicator: While headline inflation may be influenced by volatile energy prices, core inflation (excluding energy and food) provides a clearer picture of underlying price pressures. Monitoring core inflation is crucial for the ECB in assessing the effectiveness of its monetary policy.

- Geopolitical Factors and Supply Chains: The ongoing war in Ukraine and persistent supply chain bottlenecks continue to exert upward pressure on prices, complicating the ECB's efforts to control inflation. These external factors make accurate inflation forecasting challenging.

Stagflationary Risks and Economic Slowdown

The combination of high inflation and slow economic growth presents a significant stagflationary risk. This scenario, characterized by both high inflation and stagnant economic activity, is particularly challenging for policymakers. The Eurozone is facing a potential economic slowdown, as high interest rates impact businesses and consumer spending.

- Eurozone GDP Growth Slows: Recent data reveals a slowdown in Eurozone GDP growth, indicating a weakening economy. Projections for future growth are subdued, raising concerns about a potential recession.

- Impact on Businesses and Consumers: High interest rates increase borrowing costs for businesses, hindering investment and expansion. Consumers, facing higher prices and reduced purchasing power, are likely to cut back on spending, further dampening economic activity.

- Rising Unemployment: A prolonged economic slowdown could lead to significant job losses, exacerbating the economic hardship faced by many Eurozone citizens. The rise in unemployment could further depress consumer spending and economic growth.

- Historical Comparisons: A comparison with past instances of stagflation, particularly the 1970s, offers valuable lessons on the challenges of managing this difficult economic environment and the potential long-term consequences.

Alternative Policy Options and Their Implications

Beyond interest rate cuts, the ECB has alternative policy options to consider. These include further quantitative easing (QE) measures and a greater reliance on fiscal policy. Each option carries its own set of challenges and potential consequences.

- Quantitative Easing (QE): The ECB could restart its QE program, injecting liquidity into the financial system by purchasing government bonds and other assets. However, the effectiveness of QE in the current environment is debated, and concerns remain about potential inflationary pressures.

- Fiscal Policy Support: Governments within the Eurozone could implement expansionary fiscal policies, such as increased government spending or tax cuts, to stimulate economic growth. However, this approach faces political constraints and concerns about increasing government debt.

- Challenges and Effectiveness: Evaluating the effectiveness of past policy measures and considering the unique circumstances of the current economic climate is crucial for the ECB in making informed decisions. The ECB must carefully weigh the potential benefits and drawbacks of each policy option.

The Voice of Dissent: Economists' Concerns

Many prominent economists are expressing concern about the ECB's cautious approach to rate cuts. They argue that the risks of prolonged high interest rates outweigh the risks of further inflation. These dissenting voices highlight the uncertainty and complexity of the economic situation facing the Eurozone.

- Expert Opinions: Several influential economists have publicly criticized the ECB's stance, citing data and analysis to support their claims. Their arguments highlight the potential for a more severe economic downturn if interest rates remain high for an extended period.

- Range of Opinions: While there's a consensus on the need to address inflation, opinions diverge regarding the optimal pace of interest rate adjustments and the potential impact on economic growth. This diversity of perspectives underscores the challenges facing the ECB.

- Supporting Research: Numerous research papers and articles provide further insights into the potential consequences of delaying ECB rate cuts. These resources offer valuable context for understanding the complexities of the debate.

Conclusion

The decision to delay ECB rate cuts presents a significant challenge, balancing the risks of persistent inflation against the potential for a deeper economic downturn. Economists are increasingly voicing concerns about the potential for a prolonged period of stagnation or even a recession. Alternative policy options must be carefully considered to navigate this complex situation. Understanding the implications of delaying ECB rate cuts is crucial for investors and businesses operating within the Eurozone. Stay informed about the evolving economic situation and the ECB's response to ensure you're making informed decisions in the face of these significant economic challenges. Follow our updates for further analysis on ECB rate cuts and their impact on the Eurozone economy.

Featured Posts

-

Wherry Vet Planning Application Approved In Bungay Suffolk

May 31, 2025

Wherry Vet Planning Application Approved In Bungay Suffolk

May 31, 2025 -

Katastrophenschutz Am Bodensee Uebungsszenario In Hard Simuliert Ernstfall

May 31, 2025

Katastrophenschutz Am Bodensee Uebungsszenario In Hard Simuliert Ernstfall

May 31, 2025 -

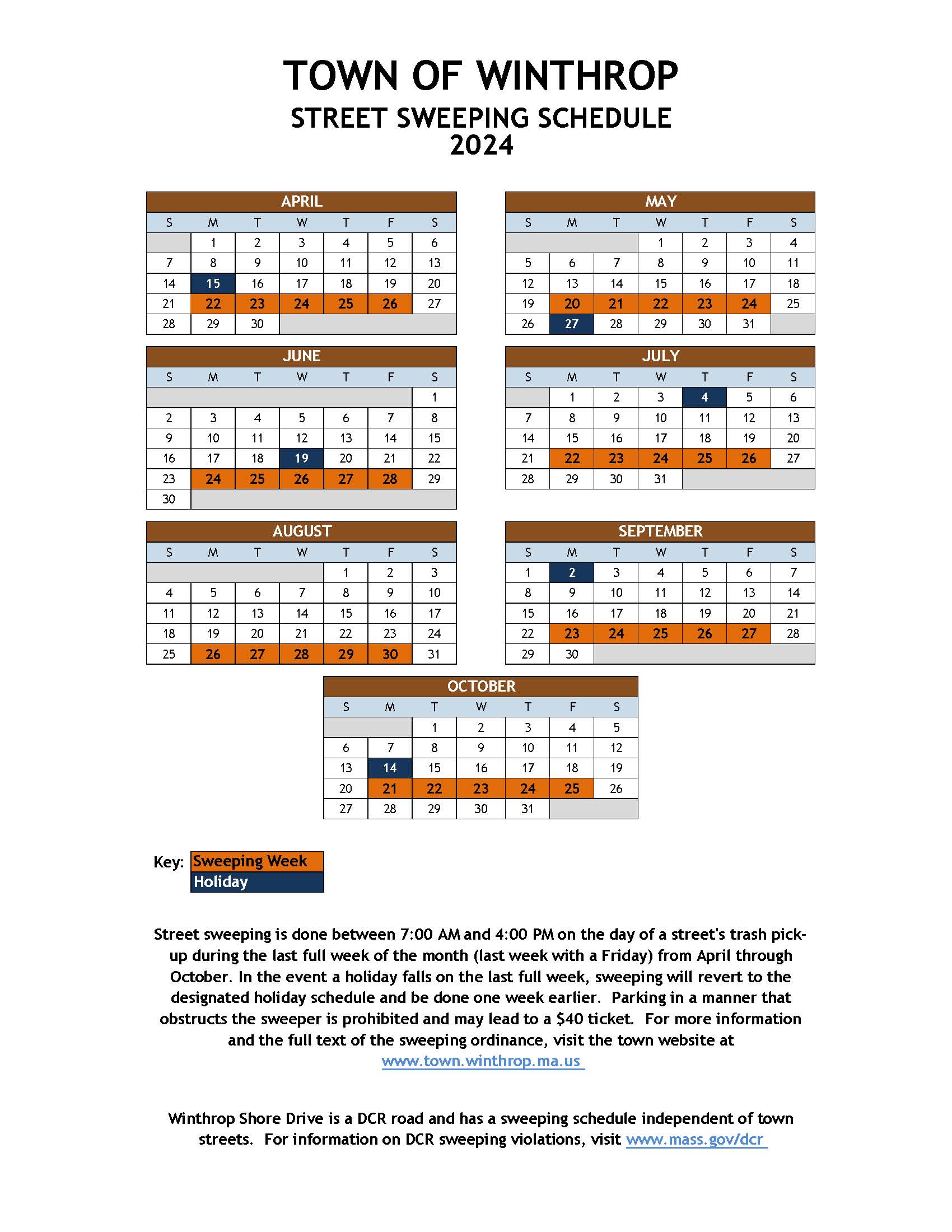

Estevan Street Sweeping Schedule 2024 Full Dates Released

May 31, 2025

Estevan Street Sweeping Schedule 2024 Full Dates Released

May 31, 2025 -

Dragon Dens Duncan Bannatyne Supports Moroccan Childrens Charity

May 31, 2025

Dragon Dens Duncan Bannatyne Supports Moroccan Childrens Charity

May 31, 2025 -

Isabelle Autissier L Interview Collaboration Et Leadership

May 31, 2025

Isabelle Autissier L Interview Collaboration Et Leadership

May 31, 2025