Desan's Potential Acquisition Of Mangalia Shipyard: A Romanian Restructuring?

Table of Contents

Mangalia Shipyard's Current Financial Situation and Challenges

Mangalia Shipyard's current predicament is a complex issue stemming from a confluence of factors. Years of underinvestment, coupled with fierce international competition and the cyclical nature of the global shipbuilding market, have severely impacted its financial health. The shipyard has accumulated substantial debt, faces operational inefficiencies, and has undertaken previous restructuring attempts with limited success. Understanding the depth of these challenges is crucial to assessing the potential impact of Desan's proposed acquisition.

- Specific financial data: While precise figures may not be publicly available, reports suggest significant accumulated debt and persistent losses in recent years, leading to Mangalia Shipyard financial problems.

- Key operational challenges: Outdated equipment, lack of skilled labor, and difficulties securing new contracts are among the critical operational hurdles. This contributes to the wider Romanian shipyard crisis.

- Previous restructuring attempts and their outcomes: Previous attempts at restructuring have largely failed to address the fundamental issues of underinvestment and competitive disadvantage within the challenging shipbuilding industry challenges.

Desan's Profile and Acquisition Strategy

Desan, a prominent Romanian business conglomerate, presents a compelling potential acquirer. While specifics regarding their acquisition strategy remain undisclosed, their financial strength and potential synergies with Mangalia Shipyard suggest a strategic move. Their established presence in the Romanian business landscape positions them to potentially revitalize the shipyard.

- Key facts about Desan's business activities: Desan’s diverse portfolio includes interests in various sectors, offering potential for leveraging expertise and resources within a broader economic context. This indicates the potential for a robust Desan acquisition strategy.

- Desan's financial strength and investment capacity: Desan's substantial financial resources indicate a capacity for significant investment in Mangalia Shipyard's modernization and expansion. This reflects their standing as a major Romanian business conglomerate.

- Potential synergy between Desan and Mangalia Shipyard: Synergies could include access to new markets, improved supply chains, and technological upgrades. This strategic investment could dramatically alter Mangalia’s prospects.

Potential Impacts of the Acquisition on the Romanian Economy

The acquisition’s potential impact on the Romanian economy is multifaceted. A successful restructuring could lead to significant positive outcomes, while failure could exacerbate existing challenges.

- Potential job creation or loss figures (estimations): While initial restructuring may involve job losses, long-term prospects suggest potential for job creation through modernization and increased order volume.

- Economic growth projections for the region: The acquisition could stimulate economic growth in the Mangalia region and potentially boost the national economy through increased exports and related industries. This highlights the importance of the Mangalia Shipyard restructuring impact on the regional economy.

- Environmental impact assessment considerations: Modernization efforts should incorporate environmental sustainability, minimizing any negative environmental impact assessment concerns. The acquisition's long-term viability will depend on its economic and social contributions within the wider foreign investment Romania context.

Regulatory and Political Aspects of the Acquisition

The acquisition will be subject to stringent regulatory scrutiny and political considerations. Securing necessary approvals from relevant government bodies will be crucial for the deal's success.

- Key regulatory bodies involved: The Romanian Competition Council and other relevant ministries will likely be involved in the approval process, highlighting the impact of Romanian government regulations.

- Potential government support or opposition: Government support will likely hinge on the potential economic benefits and job creation prospects. The level of political influence could significantly impact the acquisition's fate. This relates to the broader topic of shipyard privatization in Romania.

- Reactions from labor unions and other stakeholders: Labor unions and other stakeholders will play a key role, with their reactions potentially influencing the process. Their concerns will need to be addressed regarding potential job losses during acquisition approvals.

Conclusion: Desan's Potential Acquisition of Mangalia Shipyard: A Romanian Restructuring?

Desan's potential acquisition of Mangalia Shipyard presents both significant opportunities and challenges for Romania. While restructuring could lead to job losses initially, long-term prospects include job creation, regional economic growth, and the modernization of the Romanian shipbuilding industry. However, success hinges on careful planning, securing necessary approvals, and addressing the concerns of stakeholders. The acquisition’s outcome will significantly impact the future of Romanian shipbuilding. We encourage readers to follow future developments concerning Desan's potential acquisition of Mangalia Shipyard and the restructuring of the Romanian shipbuilding industry by consulting relevant government websites and industry publications. The successful restructuring of Mangalia Shipyard under Desan’s leadership could serve as a model for revitalizing other struggling industries in Romania.

Featured Posts

-

Victor Osimhen Manchester Uniteds Pricey Transfer Target

Apr 26, 2025

Victor Osimhen Manchester Uniteds Pricey Transfer Target

Apr 26, 2025 -

Chat Gpt And Open Ai Face Ftc Investigation Key Questions Answered

Apr 26, 2025

Chat Gpt And Open Ai Face Ftc Investigation Key Questions Answered

Apr 26, 2025 -

Mission Impossible Dead Reckoning Part One A Teaser Review

Apr 26, 2025

Mission Impossible Dead Reckoning Part One A Teaser Review

Apr 26, 2025 -

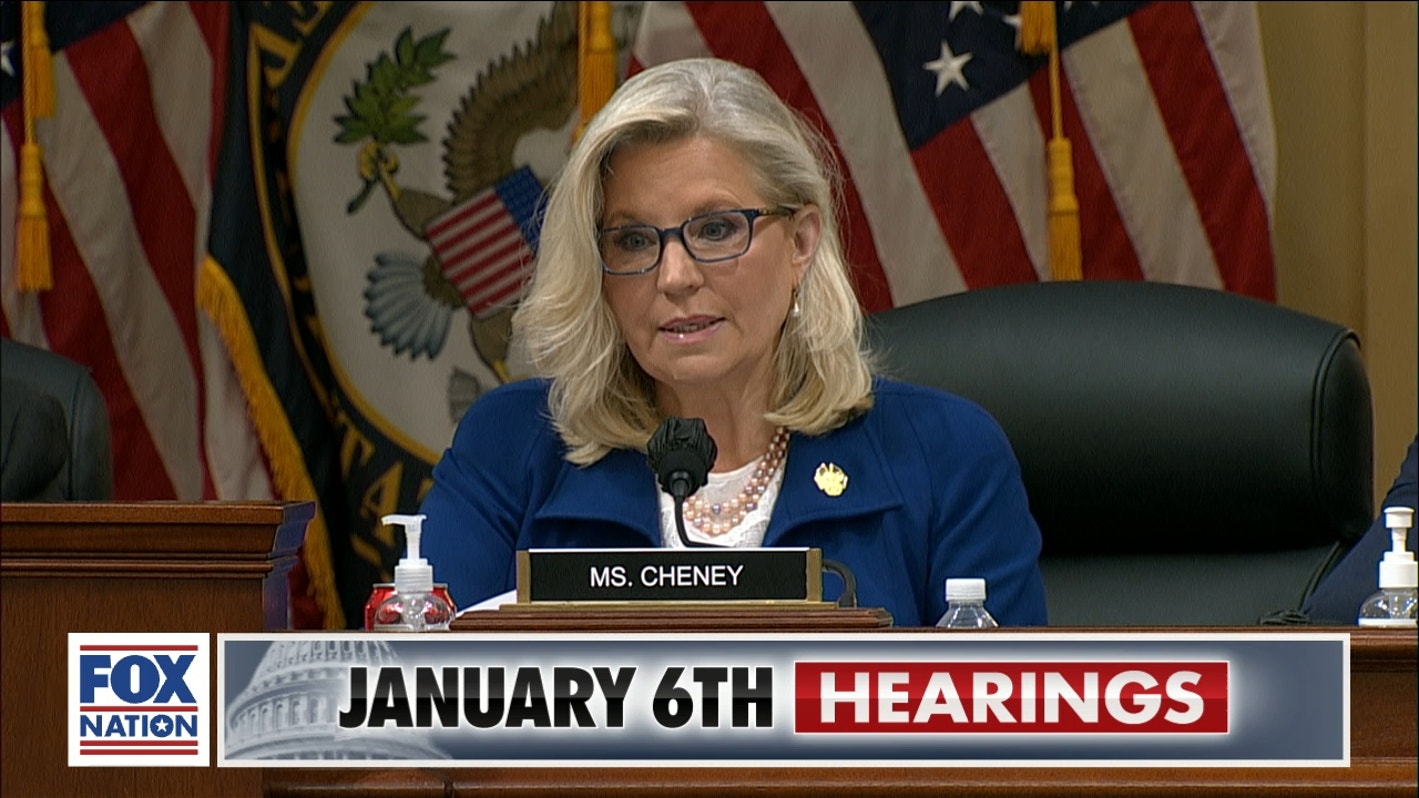

Cassidy Hutchinson Memoir Inside The January 6th Hearings

Apr 26, 2025

Cassidy Hutchinson Memoir Inside The January 6th Hearings

Apr 26, 2025 -

Amanda Seyfrieds Fiery Rebuttal To Nepo Baby Critics

Apr 26, 2025

Amanda Seyfrieds Fiery Rebuttal To Nepo Baby Critics

Apr 26, 2025