Desjardins Forecasts Three Further Bank Of Canada Rate Cuts

Table of Contents

Reasons Behind Desjardins' Rate Cut Forecast

Desjardins' forecast of three additional Bank of Canada rate cuts is based on a complex interplay of economic factors. Their analysis points to persistent challenges in achieving the Bank of Canada's inflation target, a slowing economy, and considerable global economic uncertainty.

Persistent Inflation Concerns

Despite recent decreases, inflation remains a significant concern. Desjardins' analysis suggests that bringing inflation down to the Bank of Canada's target of 2% will be a prolonged process.

- Current inflation rate: While the rate has decreased from its peak, it still sits above the Bank of Canada's target.

- Projected inflation path: Desjardins' models likely project a slower-than-expected decline in inflation, necessitating further rate cuts to stimulate the economy without fueling inflation.

- Impact of global factors: Global supply chain disruptions and elevated commodity prices continue to exert upward pressure on inflation in Canada.

- Government policies: Fiscal policies implemented by the government can also impact inflation, influencing the Bank of Canada's response. Keywords: Inflation rate Canada, CPI Canada, Bank of Canada inflation target.

Slowing Economic Growth

Desjardins' forecast also considers the potential for a significant economic slowdown in Canada. Concerns exist regarding weakening consumer spending and potential recessionary pressures.

- GDP growth forecasts: Desjardins likely anticipates lower-than-expected GDP growth figures for the coming quarters.

- Employment figures: While the unemployment rate may remain relatively low, job growth might slow, indicating weakening economic momentum.

- Consumer confidence: Declining consumer confidence could further dampen spending and economic activity.

- Housing market trends: A cooling housing market, potentially caused by higher interest rates, also signals broader economic weakness. Keywords: Canadian GDP growth, Canadian economic slowdown, Canadian recession.

Global Economic Uncertainty

Global factors significantly influence the Canadian economy, and Desjardins' forecast incorporates these uncertainties.

- Impact of global events: Geopolitical instability, particularly the ongoing war in Ukraine, and other global conflicts contribute to economic volatility.

- Commodity prices: Fluctuations in commodity prices, especially energy, directly impact Canada's economy due to its significant resource sector.

- International trade: Global trade tensions and slowdowns in major economies can negatively affect Canadian exports and overall economic growth.

- Global inflation: Persistent global inflation adds pressure on the Bank of Canada to manage inflation domestically. Keywords: Global economic outlook, Geopolitical risk, Commodity prices.

Potential Impacts of Further Rate Cuts

Desjardins' predicted rate cuts will have widespread consequences across the Canadian economy.

Impact on Borrowing Costs

Lower interest rates will directly impact borrowing costs for consumers and businesses.

- Changes in mortgage rates: Reduced Bank of Canada rates typically translate to lower mortgage rates, making homeownership more affordable.

- Impact on consumer spending: Lower borrowing costs could stimulate consumer spending and boost economic activity.

- Business investment: Reduced interest rates incentivize businesses to invest in expansion and new projects. Keywords: Mortgage rates Canada, Interest rates Canada, Borrowing costs.

Effects on the Canadian Dollar

Rate cuts can affect the value of the Canadian dollar.

- Exchange rate fluctuations: Lower interest rates can make the Canadian dollar less attractive to foreign investors, potentially leading to a weaker CAD.

- Impact on imports and exports: A weaker CAD can make Canadian exports more competitive but increase the cost of imports.

- Implications for tourism: A weaker CAD could boost tourism by making Canada a more affordable destination for international visitors. Keywords: Canadian dollar exchange rate, CAD exchange rate.

Influence on Investment Decisions

Lower interest rates can influence investor behavior.

- Stock market reactions: Lower rates can initially boost stock prices as investors seek higher returns.

- Bond yields: Reduced interest rates typically lead to lower bond yields, potentially impacting returns for fixed-income investors.

- Real estate market: Lower rates can stimulate the real estate market, potentially leading to increased house prices.

- Business investment: As mentioned earlier, lower borrowing costs can encourage increased business investment. Keywords: Canadian stock market, Canadian bond market, Investment strategy Canada.

Conclusion: Navigating the Implications of Desjardins' Bank of Canada Rate Cut Forecast

Desjardins' forecast of three further Bank of Canada rate cuts reflects a complex economic picture marked by persistent inflation, slowing economic growth, and global uncertainty. These rate cuts will likely lead to lower borrowing costs, influencing consumer spending, business investment, and the value of the Canadian dollar. While lower rates can stimulate economic activity, they also carry risks, potentially fueling inflation if not managed carefully. Understanding the potential impacts of these predicted changes is crucial for navigating the evolving economic landscape.

To effectively manage your finances in light of these predictions, stay informed about Bank of Canada interest rate changes and seek professional financial advice. Consult resources like Desjardins' website for further information on their economic forecasts and stay updated on the latest economic news to make informed financial decisions. Understanding the intricacies of Bank of Canada interest rate changes and their impact on your personal financial situation is crucial in these dynamic times.

Featured Posts

-

Sergey Yurskiy Vecher Pamyati V Teatre Mossoveta

May 24, 2025

Sergey Yurskiy Vecher Pamyati V Teatre Mossoveta

May 24, 2025 -

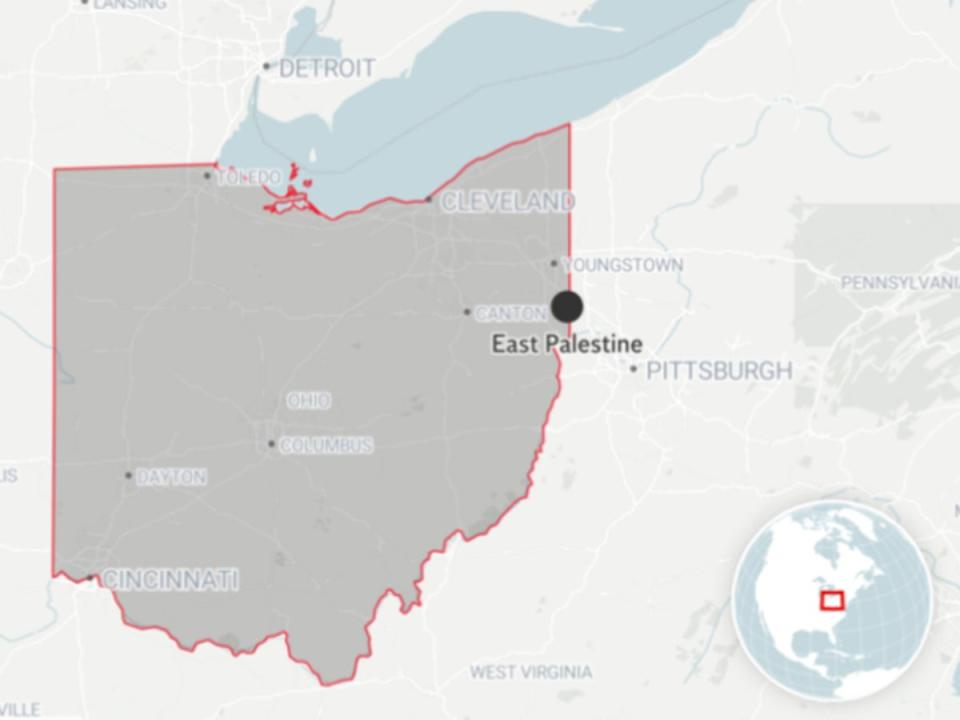

Toxic Chemical Residue From Ohio Train Derailment Building Contamination

May 24, 2025

Toxic Chemical Residue From Ohio Train Derailment Building Contamination

May 24, 2025 -

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Details On The Jan 6th Claims

May 24, 2025

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Details On The Jan 6th Claims

May 24, 2025 -

South Floridas Ferrari Challenge A Weekend Of High Octane Racing

May 24, 2025

South Floridas Ferrari Challenge A Weekend Of High Octane Racing

May 24, 2025 -

Nemecko Prepustanie V Tisickach H Nonline Sk Prinasa Analyzu

May 24, 2025

Nemecko Prepustanie V Tisickach H Nonline Sk Prinasa Analyzu

May 24, 2025

Latest Posts

-

Joe Jonas And The Marital Dispute His Classy Response

May 24, 2025

Joe Jonas And The Marital Dispute His Classy Response

May 24, 2025 -

The Jonas Brothers A Couples Unexpected Dispute And Joes Reaction

May 24, 2025

The Jonas Brothers A Couples Unexpected Dispute And Joes Reaction

May 24, 2025 -

Jonathan Groff And Just In Time A Tony Awards Contender

May 24, 2025

Jonathan Groff And Just In Time A Tony Awards Contender

May 24, 2025 -

Joe Jonas Addresses Couples Argument About Him

May 24, 2025

Joe Jonas Addresses Couples Argument About Him

May 24, 2025 -

Joe Jonas Responds To Couples Dispute The Full Story

May 24, 2025

Joe Jonas Responds To Couples Dispute The Full Story

May 24, 2025