Despite Apple Price Target Cut, Wedbush's Bullish Outlook: Should You Invest?

Table of Contents

Wedbush's Rationale Behind the Bullish Outlook

Wedbush's optimistic outlook on Apple, despite the price target cut by other analysts, rests on several key pillars: strong iPhone sales, substantial growth in Apple's services sector, and the company's resilience in the face of economic uncertainty.

Strong iPhone Sales and Services Growth

Wedbush anticipates continued robust iPhone sales, fueled by several factors. The upcoming iPhone 15 launch is expected to generate significant excitement and drive sales, particularly in emerging markets where Apple still has significant growth potential. Furthermore, the strength of the Apple ecosystem, with its interconnected devices and services, fosters customer loyalty and encourages upgrades.

- Recent financial reports show consistent growth in iPhone sales, exceeding analyst expectations in several quarters.

- Predictions for strong iPhone 15 pre-orders and launch-day sales are prevalent among industry analysts.

- Expansion into new emerging markets offers untapped growth potential for Apple's flagship product.

- The robust Apple ecosystem, including Apple Watch, AirPods, and other peripherals, creates a sticky user base less likely to switch brands.

Long-Term Growth Potential in Services

Apple's services sector, encompassing Apple Music, iCloud, Apple TV+, Apple Arcade, and other subscription services, is a significant driver of recurring revenue and long-term growth. Wedbush sees this segment as a major contributor to Apple's overall valuation and future profitability.

- Apple's services revenue has shown consistent year-over-year growth, exceeding expectations.

- Compared to competitors, Apple's services ecosystem is highly integrated and offers a compelling value proposition.

- Future expansion into new services and geographic regions further strengthens Apple's potential for services revenue growth.

- This recurring revenue stream provides a strong foundation for stable and predictable future earnings.

Resilience Amidst Economic Uncertainty

Even amidst economic headwinds, Wedbush believes Apple possesses the resilience to weather market downturns. Its premium pricing strategy, strong brand loyalty, and diversified revenue streams contribute to its ability to withstand economic uncertainty.

- Apple's brand enjoys exceptional loyalty, making its products less susceptible to price sensitivity during economic downturns.

- The diversification of Apple's revenue streams across hardware, software, and services reduces reliance on any single product category.

- Apple's premium pricing strategy allows for higher profit margins, providing a buffer against economic fluctuations.

- A comparison with other tech companies reveals Apple's superior resilience to economic shocks.

Understanding the Apple Price Target Cut

While Wedbush maintains a bullish outlook, it's crucial to understand the reasons behind the price target cut by other analysts. This involves separating factual concerns from speculation.

Factors Contributing to the Price Target Reduction

Several factors contributed to the price target reduction by some analysts. These often include concerns about macroeconomic conditions, potential softening in demand for certain Apple products (such as iPads or Macs), and increased competition in specific market segments.

- Concerns regarding a potential global economic slowdown and its impact on consumer spending are key factors.

- Some analysts express concern about slower growth in certain product categories, leading to a less optimistic revenue outlook.

- Increased competition in specific markets might negatively affect Apple's market share and profitability in the short term.

- Supply chain disruptions, although less of a concern than in previous years, still pose a potential risk to Apple's production and sales.

Differing Analyst Opinions and Market Volatility

It's vital to remember that analyst opinions differ, and the stock market is inherently volatile. Relying solely on a single price target is unwise. A comprehensive approach considers various perspectives and market trends.

- Different analysts use varying methodologies and models, resulting in different price targets and ratings.

- Market sentiment plays a significant role in stock price fluctuations, influenced by news, events, and investor sentiment.

- Short-term market volatility should not overshadow the long-term potential of a company like Apple.

- Understanding the overall market trends and macroeconomic factors impacting the tech sector is crucial for informed decision-making.

Investment Implications and Considerations

Investing in Apple stock, like any investment, involves weighing potential risks and rewards.

Weighing the Risks and Rewards

While Apple offers substantial long-term growth potential and a history of strong returns, potential risks remain. Market downturns, increased competition, and unforeseen technological disruptions can all impact its performance.

- Rewards: Long-term growth potential, dividend potential (if Apple chooses to issue dividends), and the stability of a well-established company.

- Risks: Market volatility, competition from other tech giants, and the potential impact of economic slowdowns on consumer spending.

- Risk Mitigation: Diversification of your investment portfolio is a key strategy to reduce risk.

Your Investment Strategy and Risk Tolerance

Your investment decisions should always align with your individual financial goals and risk tolerance. This article is for informational purposes only and does not constitute financial advice.

- Assess your personal risk tolerance before making any investment decisions.

- Consider consulting a qualified financial advisor to get personalized guidance.

- Never invest more than you can afford to lose.

Conclusion: Should You Invest in Apple Despite the Price Target Cut?

Wedbush's bullish outlook on Apple, while contrasting with the price target cut by other analysts, presents a compelling argument. However, the decision to invest in Apple stock ultimately depends on your individual risk tolerance, investment goals, and a thorough understanding of the factors driving both the bullish and bearish perspectives. The Apple price target cut highlights the inherent volatility of the market, emphasizing the need for careful consideration and independent research before making any investment decisions. Remember to conduct your own due diligence, consult with a financial advisor, and only invest what you can afford to lose. This analysis serves as informational context related to the Apple price target cut, and it is not financial advice.

Featured Posts

-

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025 -

Philips Shareholders Meeting 2024 A Recap Of Decisions And Discussions

May 25, 2025

Philips Shareholders Meeting 2024 A Recap Of Decisions And Discussions

May 25, 2025 -

Rio Tinto Responds To Forrests Pilbara Criticism A Detailed Analysis

May 25, 2025

Rio Tinto Responds To Forrests Pilbara Criticism A Detailed Analysis

May 25, 2025 -

China Us Trade Soars Exporters Rush To Meet Trade Truce Deadline

May 25, 2025

China Us Trade Soars Exporters Rush To Meet Trade Truce Deadline

May 25, 2025 -

Onrust Op Amerikaanse Beurs Maar Aex Stijgt Analyse Van De Markten

May 25, 2025

Onrust Op Amerikaanse Beurs Maar Aex Stijgt Analyse Van De Markten

May 25, 2025

Latest Posts

-

Flash Flood Warning Texas North Central Texas Bathed In Heavy Rain

May 25, 2025

Flash Flood Warning Texas North Central Texas Bathed In Heavy Rain

May 25, 2025 -

Severe Thunderstorms Trigger Flash Flood Warning In Bradford And Wyoming Counties

May 25, 2025

Severe Thunderstorms Trigger Flash Flood Warning In Bradford And Wyoming Counties

May 25, 2025 -

Flash Flood Warning Issued For Bradford And Wyoming Counties Through Tuesday

May 25, 2025

Flash Flood Warning Issued For Bradford And Wyoming Counties Through Tuesday

May 25, 2025 -

Floods And Severe Weather A Guide To Safety During Awareness Week

May 25, 2025

Floods And Severe Weather A Guide To Safety During Awareness Week

May 25, 2025 -

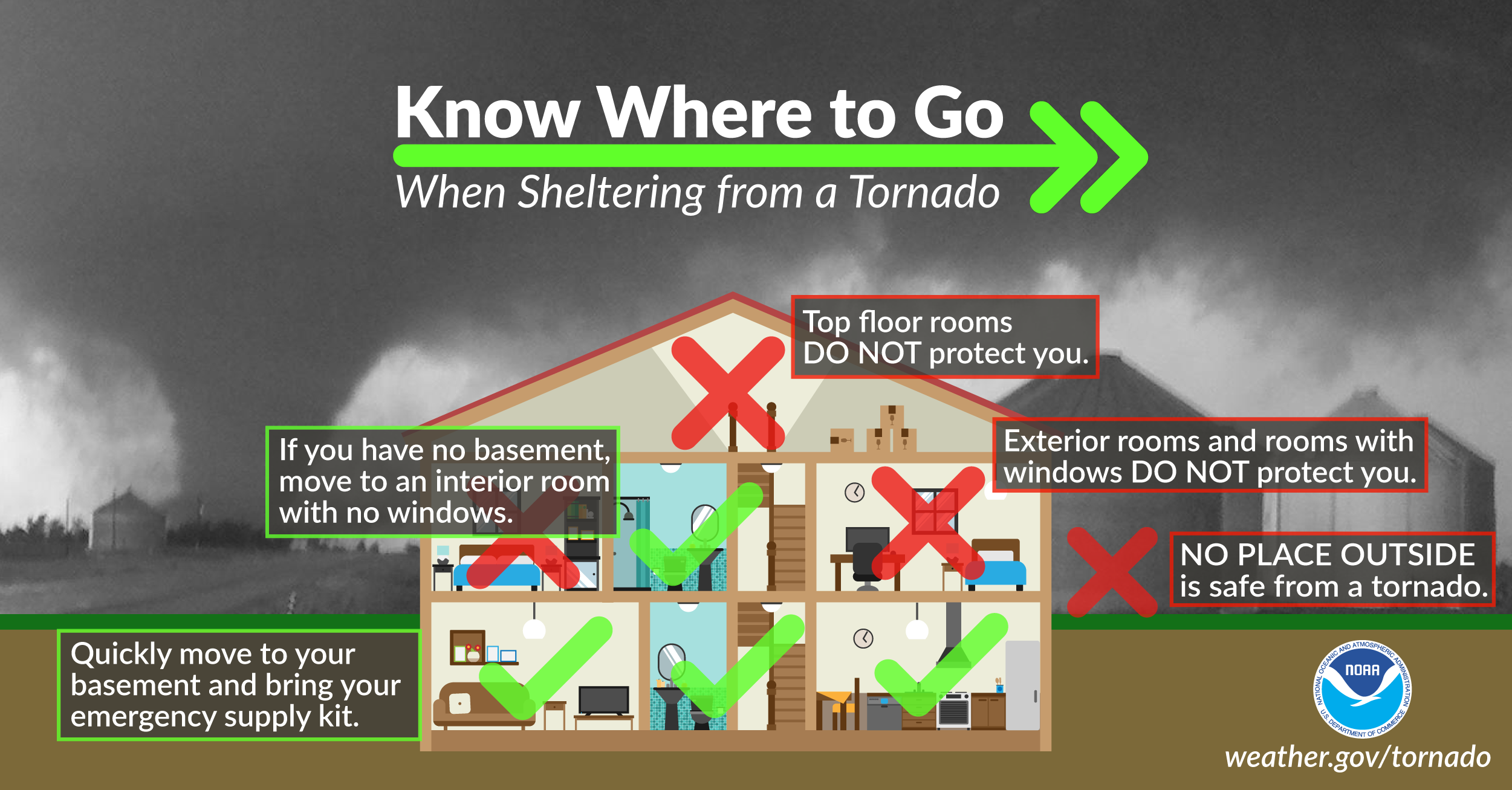

April 2025 Tornado And Flash Flood Summary April 4th Update

May 25, 2025

April 2025 Tornado And Flash Flood Summary April 4th Update

May 25, 2025