Details Emerge: House Republicans Outline Trump's Tax Proposals

Table of Contents

Key Features of the Proposed Tax Cuts

The Republican tax plan, heavily influenced by Trump's campaign promises, aims for substantial tax cuts across the board. Its core components are designed to stimulate economic growth through lower taxes on individuals and corporations.

Individual Income Tax Changes

The proposed changes to individual income tax significantly alter the current system:

- Tax Brackets: The plan proposes adjustments to existing tax brackets, potentially lowering the overall tax burden for many individuals. Specific changes to the number of brackets and their respective rates would need to be detailed in the full proposal.

- Standard Deduction: An increase in the standard deduction is anticipated, simplifying tax filing for many and potentially reducing the number of taxpayers who itemize. This change could benefit lower and middle-income families significantly.

- Child Tax Credit: The plan may include adjustments to the child tax credit, possibly increasing the amount or expanding eligibility. This change could provide considerable relief to families with children.

- Impact on Income Groups: The effects on various income groups are complex and depend heavily on the specific details of the proposed changes. Lower-income families might see modest relief, while higher-income individuals could see substantial tax savings. This could exacerbate income inequality, a point of contention among critics.

Corporate Tax Rate Reductions

A cornerstone of the plan is a significant reduction in the corporate tax rate. The proposed decrease aims to boost business investment, spur job creation, and enhance US competitiveness globally.

- Corporate Tax Rate: The proposed reduction from the current rate is intended to incentivize businesses to invest more in the US economy.

- Economic Effects: Proponents argue this will lead to increased business investment, job creation, and ultimately, higher economic growth. Opponents, however, warn of potential negative consequences, such as increased budget deficits and a disproportionate benefit for large corporations.

- Arguments For and Against: Supporters believe that lower corporate taxes will unleash economic growth. Critics argue it primarily benefits corporations and wealthy shareholders at the expense of increased national debt and reduced social spending.

Other Notable Provisions

Beyond the headline-grabbing individual and corporate tax changes, other notable provisions within Trump's tax proposals include potential modifications to:

- Estate Taxes: Proposals to alter or eliminate estate taxes could significantly impact wealthy families.

- Capital Gains Taxes: Changes to capital gains taxes could affect investors and investment strategies.

- Pass-through Entities: Adjustments to the taxation of pass-through entities like small businesses and partnerships could have substantial implications for many small business owners.

Potential Economic Impact of Trump's Tax Proposals

The potential economic consequences of Trump's tax proposals are a subject of intense debate. Both short-term and long-term impacts will be substantial, and varying forecasts exist.

Impact on Economic Growth

Economic models used to project GDP growth under the proposed tax plan vary widely. Some forecasts predict a significant boost to GDP in the short term due to the "economic stimulus" effect of tax cuts. However, long-term growth projections are highly dependent on whether the tax cuts lead to sustained increases in investment and productivity. The success of the fiscal policy implemented alongside the tax cuts will be crucial.

Impact on the National Debt

A major concern surrounding Trump's tax proposals is their potential to significantly increase the national debt and widen the budget deficit. The cost of the tax cuts would need to be offset either through spending cuts elsewhere or through increased borrowing. The impact on fiscal responsibility will be a key factor in assessing the long-term sustainability of the plan.

Distributional Effects

The distributional effects of the proposed tax cuts—how they impact different income groups—are highly debated. While lower-income families may receive some benefit, a significant portion of the tax cuts will likely accrue to higher-income households and corporations. This could exacerbate income inequality, leading to further economic and social disparity. The tax burden shift needs careful consideration.

Political Ramifications and Public Reaction to Trump's Tax Proposals

The political landscape surrounding Trump's tax proposals is highly charged. The proposals' chances of passage depend largely on the level of support within Congress and public opinion.

Congressional Support and Opposition

While the Republican party largely supports the overall goals of tax cuts, internal divisions exist regarding the specific details of the plan. Democratic opposition is expected to be strong, making bipartisan support unlikely. Key figures in both parties will play pivotal roles in shaping the final legislation, and the potential for compromise remains unclear.

Public Opinion

Public opinion polls reveal a mixed response to the proposed tax cuts. While some favor lower taxes, others express concern about the potential impact on the national debt and income inequality. The level of political polarization surrounding this issue is notable, with strong opinions held on both sides. The public conversation around tax reform is actively ongoing.

Conclusion: Understanding the Details of Trump's Tax Proposals

House Republicans' tax proposals, closely linked to Trump's economic vision, represent a significant potential overhaul of the US tax code. The proposals offer substantial tax cuts for individuals and corporations, potentially stimulating economic growth but also raising concerns about the national debt and income inequality. The political ramifications are considerable, with varying levels of support within Congress and a divided public opinion. Understanding the intricate details of Trump's tax proposals, including their potential economic impact and political implications, is crucial for every American. Stay informed about the latest developments surrounding Trump's tax proposals and their potential impact on you and the nation. Continue your research and engage in the public conversation surrounding this crucial piece of legislation.

Featured Posts

-

Foot Lockers Results Signal Nikes Resurgence Analysts Suggest

May 15, 2025

Foot Lockers Results Signal Nikes Resurgence Analysts Suggest

May 15, 2025 -

Oklahoma City Doubleheader Dodgers Kim Hits Homer Steals Twice In Sweep

May 15, 2025

Oklahoma City Doubleheader Dodgers Kim Hits Homer Steals Twice In Sweep

May 15, 2025 -

Kerja Sama Pemerintah Dan Swasta Untuk Proyek Giant Sea Wall

May 15, 2025

Kerja Sama Pemerintah Dan Swasta Untuk Proyek Giant Sea Wall

May 15, 2025 -

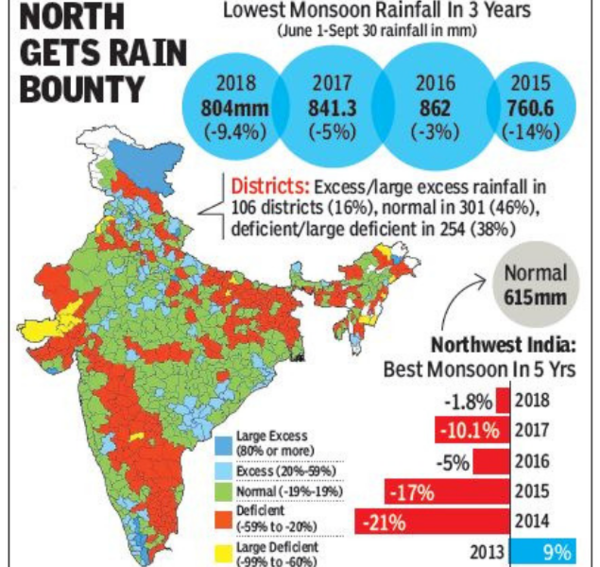

Monsoon Prediction Good News For Indian Agriculture And Consumption

May 15, 2025

Monsoon Prediction Good News For Indian Agriculture And Consumption

May 15, 2025 -

Knicks Biggest Problem Revealed By Brunson Injury

May 15, 2025

Knicks Biggest Problem Revealed By Brunson Injury

May 15, 2025