Deutsche Bank Targets Global Investors In Saudi Arabia's Growing Market

Table of Contents

Saudi Arabia's Investment Landscape and its Appeal to Global Investors

Vision 2030 and Economic Diversification

Saudi Arabia's Vision 2030 is a transformative economic and social reform plan aimed at diversifying the economy away from its reliance on oil. This ambitious initiative is attracting substantial foreign direct investment (FDI) by creating a more dynamic and competitive business environment. Key sectors experiencing rapid growth include:

- Renewable Energy: Massive investments are underway in solar and wind power projects, presenting lucrative opportunities for international players.

- Tourism: The development of world-class tourist destinations is attracting significant investment in hospitality, infrastructure, and entertainment.

- Technology: Saudi Arabia is actively fostering a thriving tech ecosystem, encouraging investment in startups, digital infrastructure, and technological innovation.

Successful FDI projects demonstrating this growth include:

- The NEOM project, a futuristic megacity focused on technology and sustainable development.

- Significant investments in renewable energy projects across the country, partnering with global energy giants.

- The development of luxury resorts and entertainment venues to boost the tourism sector.

These initiatives are attracting significant FDI, making Saudi Arabia a compelling destination for global investors seeking high-growth potential.

Government Initiatives Supporting Foreign Investment

The Saudi Arabian government has implemented several policies and regulations to support foreign investment, creating a more attractive business environment. These include:

- Simplified investment procedures: Streamlined processes for obtaining licenses and permits.

- Tax incentives: Attractive tax benefits and exemptions for qualifying businesses.

- 100% foreign ownership: Allowing foreign companies to own businesses in several key sectors.

- Ease of doing business reforms: Significant improvements in ranking on global ease of doing business indices.

Examples of government support programs include:

- The Saudi Industrial Development Fund (SIDF) provides financing for industrial projects.

- The Saudi Export-Import Bank (Saudi EXIM Bank) supports Saudi Arabian exports and foreign investment.

These supportive measures significantly reduce the barriers to entry for foreign investors, encouraging greater participation in the Saudi Arabian economy.

Deutsche Bank's Strategy for the Saudi Arabian Market

Service Offerings and Expertise

Deutsche Bank offers a comprehensive suite of financial services tailored to global investors in Saudi Arabia, leveraging its extensive global expertise. These services include:

- Investment Banking: Providing advisory services, mergers & acquisitions support, and equity and debt capital markets solutions.

- Asset Management: Offering a diverse range of investment products and portfolio management services.

- Wealth Management: Providing personalized wealth planning and investment solutions to high-net-worth individuals.

- Corporate Banking: Providing comprehensive financial solutions for corporations operating in Saudi Arabia.

Deutsche Bank's extensive experience in successfully managing large-scale projects and its deep understanding of global markets provide a significant competitive advantage.

Successful projects and clients in the region (though specific details may need to be sourced independently for factual accuracy) could include examples of involvement in large infrastructure projects or work with major corporations investing in Saudi Arabia.

Partnerships and Collaborations

Deutsche Bank has actively pursued strategic partnerships and collaborations within Saudi Arabia to expand its reach and enhance its service offerings. These partnerships provide access to local market expertise and strengthen its network.

- (Insert specific examples of partnerships here – this section requires factual information about Deutsche Bank's partnerships in Saudi Arabia). This could include partnerships with local banks, investment firms, or government agencies.

These partnerships are crucial for navigating the local market effectively and providing clients with comprehensive, tailored solutions.

Potential Challenges and Opportunities for Deutsche Bank

Competitive Landscape

The Saudi Arabian financial services market is competitive, with both local and international players vying for market share. Key competitors include other major international banks and established local financial institutions.

- (List key competitors in the Saudi Arabian financial market).

Deutsche Bank's competitive advantages lie in its global network, its deep expertise in various financial sectors, and its strong brand reputation.

Regulatory Environment

Understanding and complying with the regulatory environment in Saudi Arabia is crucial for Deutsche Bank's operations. This involves navigating:

- The Saudi Central Bank (SAMA) regulations concerning banking activities.

- Capital markets regulations governing investment activities.

- Data privacy and cybersecurity regulations.

Compliance and risk management are paramount to ensure the long-term success of Deutsche Bank's operations within the Kingdom.

Conclusion

Deutsche Bank's expansion into Saudi Arabia represents a strategic move to capitalize on the significant investment opportunities presented by Vision 2030. Its comprehensive range of financial services, coupled with strategic partnerships, positions it well within the competitive landscape. While navigating the regulatory environment and competition remain key challenges, the long-term potential for growth is substantial. For global investors seeking to capitalize on the exciting opportunities in Saudi Arabia's burgeoning market, Deutsche Bank offers unparalleled expertise and a comprehensive suite of financial services. Contact us today to explore how we can help you achieve your investment goals in the Kingdom.

Featured Posts

-

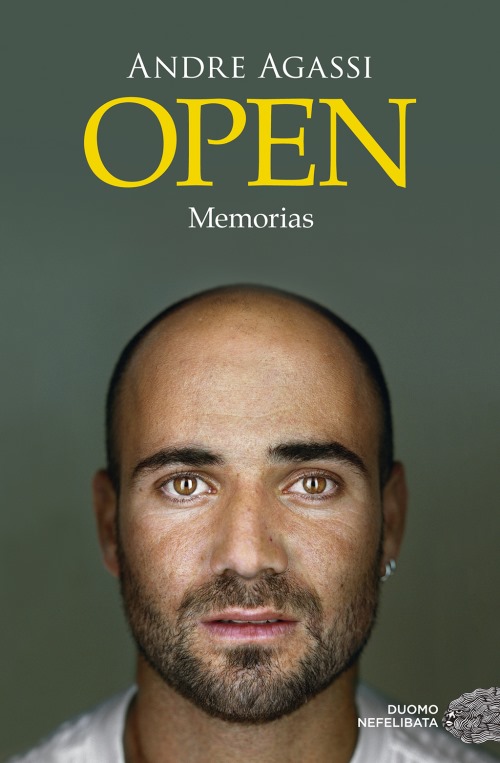

El Regreso De Andre Agassi Del Tenis A Un Desafio Impresionante

May 30, 2025

El Regreso De Andre Agassi Del Tenis A Un Desafio Impresionante

May 30, 2025 -

Top Seed Pegula Claims Charleston Title After Collins Upset

May 30, 2025

Top Seed Pegula Claims Charleston Title After Collins Upset

May 30, 2025 -

Bill Gates Accuses Elon Musk Of Contributing To Child Mortality Musks Response

May 30, 2025

Bill Gates Accuses Elon Musk Of Contributing To Child Mortality Musks Response

May 30, 2025 -

Proces Rn Verdict En Appel En 2026 Une Justice Plus Rapide

May 30, 2025

Proces Rn Verdict En Appel En 2026 Une Justice Plus Rapide

May 30, 2025 -

Ticketmaster Entendiendo El Precio Total De Tus Boletos

May 30, 2025

Ticketmaster Entendiendo El Precio Total De Tus Boletos

May 30, 2025