Deutsche Bank's London Fixed Income Traders And The €18m Bonus Disappearance

Table of Contents

The €18 Million Bonus Mystery: What We Know

The confirmed facts surrounding the missing bonus pool are currently limited. While Deutsche Bank has acknowledged a discrepancy, specific details remain undisclosed, fueling speculation and increasing scrutiny. Key questions remain unanswered:

- How were the bonuses allocated initially? Was the allocation process transparent and auditable? Were appropriate benchmarks and performance metrics used?

- What accounting methods were used? Did Deutsche Bank utilize industry-standard accounting practices for managing such a large bonus pool? Were there any inconsistencies or irregularities?

- What internal controls were in place? What safeguards were in place to prevent and detect financial irregularities? Were these controls adequate and properly enforced?

- When was the discrepancy discovered? The timing of the discovery is crucial in understanding the potential scale of the problem and the actions taken by the bank.

Deutsche Bank's initial reaction has been to launch an internal investigation and cooperate with regulatory authorities. However, the lack of transparency has led to increased concern and speculation amongst investors and the public. [Link to credible news source 1] [Link to credible news source 2]

Potential Explanations for the Missing Bonuses

Several theories attempt to explain the €18 million disappearance. These range from simple errors to potentially criminal activities.

Accounting Errors and Oversight

One possibility is that the missing funds resulted from simple accounting mistakes or inadequate internal controls. Managing substantial bonus pools for hundreds of traders in a complex financial environment is challenging. Potential vulnerabilities in Deutsche Bank's systems, including outdated software or a lack of robust reconciliation processes, might have contributed to the discrepancy. The sheer volume of transactions and the complexity of the financial instruments involved could also mask errors.

Intentional Misappropriation of Funds

A far more serious possibility is intentional misappropriation of funds through fraud or embezzlement. This could involve internal actors within the fixed income division, perhaps colluding with external parties. Such accusations are extremely serious and would lead to significant legal and reputational consequences for those involved, potentially including criminal charges.

Regulatory Scrutiny and Investigations

Regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK, are likely to conduct thorough investigations into this matter. Deutsche Bank faces potential penalties, including hefty fines, if the investigation reveals negligence, misconduct, or violations of financial regulations. The outcome of these investigations will be crucial in determining the full extent of the scandal and its implications for the bank.

Impact on Deutsche Bank's Reputation and Future

This scandal significantly damages Deutsche Bank's reputation, already tarnished by past controversies. Investor confidence is likely to decrease, potentially impacting stock prices and making it harder to attract and retain both clients and talent.

- Loss of trust among clients: The scandal erodes trust in the bank's ability to manage funds responsibly.

- Increased regulatory scrutiny: Expect a heightened level of regulatory oversight and potentially stricter regulations imposed on the bank.

- Potential lawsuits: Clients and shareholders might initiate legal action against Deutsche Bank seeking compensation for potential losses.

- Damage to employee morale: The scandal creates uncertainty and negatively affects the morale of employees within the bank.

Wider Implications for the Financial Industry

The €18 million bonus scandal highlights the need for robust internal controls and transparent bonus structures throughout the financial industry. It underscores the importance of ethical conduct and accountability at all levels.

- Need for stricter regulations: The incident could prompt calls for stricter regulations on executive compensation and bonus structures.

- Increased focus on ethical conduct: The financial industry must strengthen its focus on ethical conduct and corporate governance.

- Importance of transparency and accountability: Increased transparency in financial reporting and enhanced accountability mechanisms are vital.

Conclusion

The disappearance of €18 million in bonuses intended for Deutsche Bank's London fixed income traders remains a significant mystery. The ongoing investigation will be crucial in uncovering the truth behind this scandal, determining responsibility, and preventing similar incidents in the future. The potential consequences for Deutsche Bank are severe, ranging from substantial financial penalties to irreparable reputational damage. Stay informed about the developments in this ongoing Deutsche Bank bonus scandal. Further investigation is needed to uncover the truth behind the disappearance of the €18 million. Follow reputable news sources for updates on this significant financial mystery. Continue to monitor the situation surrounding Deutsche Bank's London fixed income traders and the €18 million bonus disappearance.

Featured Posts

-

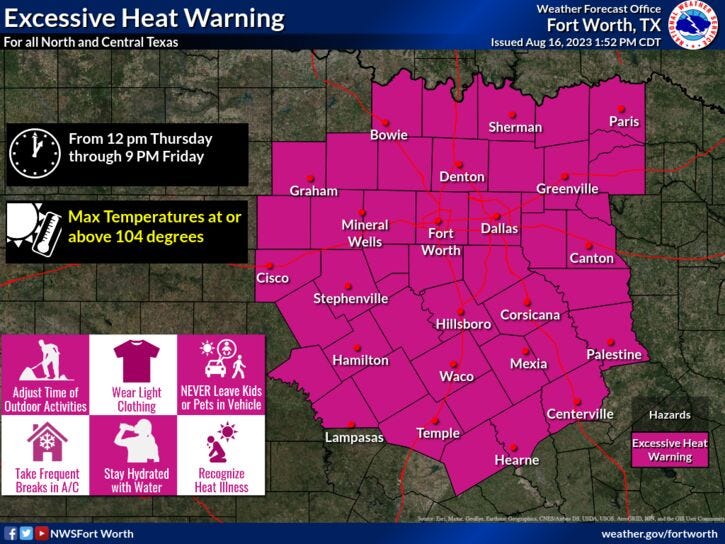

111 Degree Heat Warning Issued Across Parts Of Texas

May 30, 2025

111 Degree Heat Warning Issued Across Parts Of Texas

May 30, 2025 -

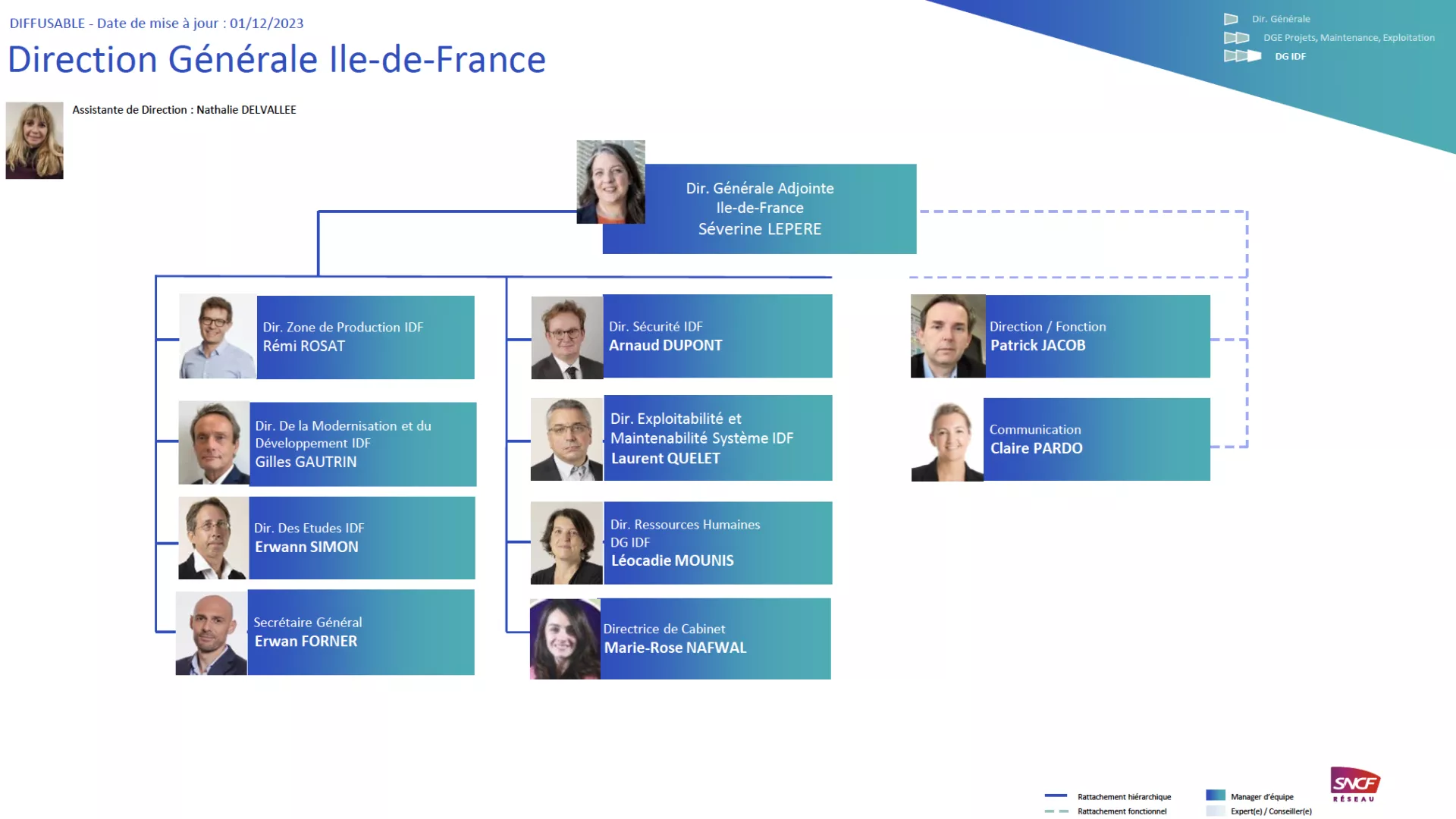

La Greve Sncf Du 8 Mai Tout Savoir Sur Les Risques Et Les Solutions

May 30, 2025

La Greve Sncf Du 8 Mai Tout Savoir Sur Les Risques Et Les Solutions

May 30, 2025 -

Oi Tileoptikes Metadoseis Tis Kyriakis 16 Martioy

May 30, 2025

Oi Tileoptikes Metadoseis Tis Kyriakis 16 Martioy

May 30, 2025 -

Rajinikanth Hails Ilaiyaraaja A Proud Moment For India

May 30, 2025

Rajinikanth Hails Ilaiyaraaja A Proud Moment For India

May 30, 2025 -

Jon Jones Petition Over 100 000 Signatures Demand Title Stripping

May 30, 2025

Jon Jones Petition Over 100 000 Signatures Demand Title Stripping

May 30, 2025