Digital Banking Giant Chime Files For US Initial Public Offering

Table of Contents

Chime's Growth and Market Position

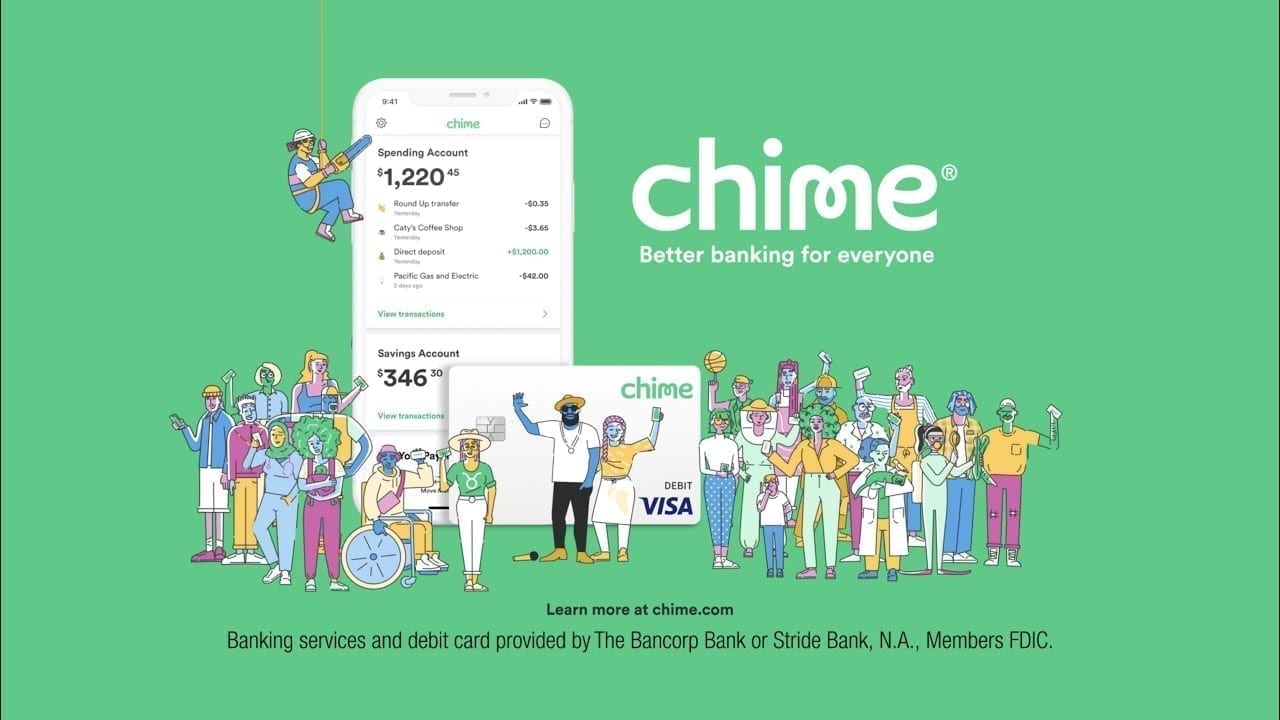

Chime's impressive growth trajectory is a key factor driving interest in its upcoming IPO. The company has rapidly gained market share in the burgeoning digital banking sector, attracting millions of customers with its innovative features and user-friendly platform. This success speaks volumes about the increasing demand for alternative banking solutions that prioritize transparency and customer experience. Key factors contributing to Chime's success include:

- Massive Customer Base: Chime boasts a substantial number of customers, solidifying its position as a major player in the neobank market. The exact figure is constantly evolving, but its size clearly demonstrates significant market penetration.

- Competitive Market Share: Chime's market share within the digital banking sector continues to grow, surpassing many established players. Its ability to capture a significant portion of the market indicates strong brand recognition and customer loyalty.

- Key Features Driving Growth: Features like no overdraft fees, early direct deposit access, and fee-free debit cards are major selling points for Chime, attracting customers frustrated by traditional banking practices. This focus on value proposition is a crucial element of their market success.

- Expansion into New Financial Services: Chime is not resting on its laurels. The company is actively expanding its service offerings beyond basic banking, venturing into areas like credit building and investing, further cementing its position as a comprehensive financial services provider. This diversification strengthens its long-term growth potential and enhances its attractiveness to investors.

Details of the Chime IPO

The Chime IPO filing with the SEC provides crucial details about the upcoming offering. While specifics like the exact Chime IPO date remain to be finalized, several key aspects have been revealed, offering insights into the company's valuation and future plans:

- Estimated IPO Valuation: The anticipated valuation of Chime during its IPO is a highly anticipated figure, attracting significant interest from investors. While the exact number remains subject to market conditions, it's expected to be substantial, reflecting Chime's impressive growth and market position.

- Number of Shares Offered: The number of shares Chime plans to offer to the public will significantly impact the IPO's success and the overall market liquidity of the Chime stock.

- Expected IPO Date Range: While a precise date hasn't been announced, the SEC filing provides a timeframe for the expected Chime IPO launch, allowing investors to prepare.

- Lead Underwriters: The selection of reputable underwriters is crucial for a successful IPO. Chime's choice of underwriters speaks to the company's confidence and their commitment to a smooth and efficient process.

- Use of Proceeds from the IPO: The prospectus will detail how Chime intends to use the funds raised through the IPO. This information provides insights into the company's growth strategy and its long-term investment plans. The use of proceeds will typically include expansion, product development, and debt repayment.

Potential Impact on the Fintech Industry

Chime's IPO has significant implications for the broader fintech industry. Its successful public debut is likely to:

- Increase Investment in the Fintech Sector: The Chime IPO could act as a catalyst, attracting further investment into innovative fintech companies. This influx of capital will fuel innovation and competition, benefiting consumers and the industry as a whole.

- Impact on Competition Among Digital Banks: The IPO will intensify competition among digital banks, prompting further innovation and potentially leading to better products and services for consumers. Established banks will feel increased pressure to adapt to the changing landscape.

- Potential for Consolidation Within the Neobank Market: Increased competition may lead to mergers and acquisitions, reshaping the competitive landscape of the neobank market. Successful players like Chime may seek to consolidate their market positions through acquisitions.

- Attraction of Further Talent to the Fintech Industry: The success of Chime's IPO will undoubtedly attract skilled professionals to the fintech industry, boosting innovation and the development of cutting-edge financial technologies.

Risks and Challenges for Chime

Despite its impressive growth, Chime faces several risks and challenges:

- Regulatory Compliance Issues: Navigating the complex regulatory landscape of the financial industry poses a significant challenge. Maintaining compliance is crucial for long-term success and maintaining investor confidence.

- Competition from Established Banks and Other Fintech Companies: The digital banking space is becoming increasingly competitive. Chime faces stiff competition from established banks modernizing their services and from other rapidly growing fintech players.

- Economic Risks and their Impact on Customer Spending and Loan Defaults: Economic downturns can significantly impact consumer spending and increase the risk of loan defaults, potentially affecting Chime's profitability.

- Maintaining Profitability While Expanding Services: Balancing expansion into new financial services with maintaining profitability is a delicate task. Chime needs to carefully manage its growth to ensure financial sustainability.

Conclusion

Chime's upcoming IPO represents a pivotal moment for the digital banking and fintech industries. The company's impressive growth, innovative features, and substantial customer base have made it a highly anticipated offering. While risks and challenges remain, the potential rewards are significant, both for Chime and the broader fintech ecosystem. The Chime IPO will likely shape the future of digital banking and attract further investment in the sector.

Stay tuned for updates on the Chime IPO and its impact on the future of digital banking. Follow our blog for further insights into the Chime stock and the fintech industry. Understanding the Chime Initial Public Offering is crucial for anyone interested in the evolving landscape of digital banking and investing in the future of finance.

Featured Posts

-

Episode 58 Travelogue Exploring Serbia Denmark And Germany In 2025

May 14, 2025

Episode 58 Travelogue Exploring Serbia Denmark And Germany In 2025

May 14, 2025 -

Mlb 2025 Season Biggest Winners And Losers After 30 Games

May 14, 2025

Mlb 2025 Season Biggest Winners And Losers After 30 Games

May 14, 2025 -

Bournemouths Huijsen A Liverpool Transfer Target

May 14, 2025

Bournemouths Huijsen A Liverpool Transfer Target

May 14, 2025 -

Latest Newcastle News Setback In Pursuit Of Premier League Star

May 14, 2025

Latest Newcastle News Setback In Pursuit Of Premier League Star

May 14, 2025 -

Programas Hope Help En Haiti Crecimiento Sostenibilidad Y Expansion

May 14, 2025

Programas Hope Help En Haiti Crecimiento Sostenibilidad Y Expansion

May 14, 2025