Diminished Optimism: Strategists Reassess European Stocks Following Trump's Trade Actions

Table of Contents

The Impact of Trump's Trade Actions on European Economies

Trump's trade actions have significantly impacted European economies, leading to diminished optimism and increased market uncertainty. Specific trade tariffs, particularly those imposed on steel and aluminum, have directly harmed European businesses. These tariffs, coupled with threats of further levies on various goods, have created a climate of fear and uncertainty.

-

Tariffs and their ripple effect: The tariffs haven't just affected the targeted industries. Increased production costs due to tariffs on raw materials have rippled through supply chains, affecting manufacturers across various sectors. This has led to decreased competitiveness in global markets and reduced profitability for many European companies.

-

Reduced Exports and GDP Growth: The decline in exports, a direct consequence of tariffs and retaliatory measures by the EU, is significantly impacting GDP growth forecasts across Europe. Many analysts are revising their predictions downwards, reflecting the dampening effect of trade friction on economic activity. Data from Eurostat (or other relevant sources) will further illustrate this point, providing concrete numbers to support this claim.

-

Decreased Consumer Confidence: The uncertainty surrounding future trade policies is eroding consumer confidence, further impacting economic growth. Consumers are hesitant to spend when faced with economic instability and potential price increases. This reduced consumer spending feeds back into decreased demand, impacting businesses and contributing to the overall economic slowdown.

How Strategists are Reassessing European Stock Portfolios

Facing increased uncertainty and diminished optimism, investment strategists are fundamentally reassessing their European stock portfolios. Risk management is now paramount. The increased volatility demands a more cautious approach to investment decisions.

-

Shift Towards Defensive Stocks: Many strategists are rotating out of cyclical stocks, which are more sensitive to economic downturns, and moving towards more defensive stocks – companies perceived as less vulnerable to economic fluctuations. Utilities, consumer staples, and healthcare sectors are often considered more resilient during periods of economic uncertainty.

-

Portfolio Diversification and Risk Mitigation: Diversification strategies are being refined to mitigate the risks associated with increased market volatility. This might involve diversifying across geographies, sectors, and asset classes. Reducing exposure to European stocks in favor of other markets or asset classes such as bonds or precious metals is a common strategy currently employed.

-

Hedging Strategies: Sophisticated hedging techniques are being utilized to protect portfolios against further downside risk. These may include options strategies or currency hedging to limit losses from exchange rate fluctuations.

The Future Outlook for European Stocks: A Cautious Perspective

The future outlook for European stocks remains cautiously pessimistic. While some sectors might exhibit resilience, the overall climate of uncertainty stemming from ongoing trade tensions and other geopolitical factors casts a shadow on the short-term and long-term prospects.

-

Geopolitical Risks Beyond Trade: Brexit remains a significant source of uncertainty, further compounding the challenges faced by European markets. The long-term consequences of Brexit for the UK and EU economies are still unclear and contribute significantly to the diminished optimism.

-

Multiple Scenarios and Their Impacts: Several scenarios are possible. A resolution of trade disputes could lead to a rebound in market sentiment and economic growth. However, an escalation of trade tensions could lead to a more protracted period of uncertainty and slower economic growth, impacting European stock performance.

-

Potential Opportunities Amidst Uncertainty: While risks are substantial, opportunities might emerge for shrewd investors. A careful and selective approach, focusing on undervalued companies with strong fundamentals and a proven track record, could yield positive returns even in a challenging market.

Conclusion

The impact of Trump's trade actions has created a climate of diminished optimism in European stock markets, forcing strategists to reassess their investment strategies and portfolio allocations. The resulting economic uncertainty, compounded by other geopolitical risks, demands careful risk management and diversification. Managing diminished optimism in European stock investments requires a proactive approach, including thorough due diligence and a willingness to adapt strategies as the situation unfolds. By understanding the diminished optimism affecting European markets and carefully considering the outlined factors, investors can better navigate the complexities of the current environment. Further research into specific economic forecasts and sector analyses is crucial for informed decision-making. Proactive monitoring of the situation and a flexible investment strategy are paramount in mitigating the risks associated with this period of uncertainty.

Featured Posts

-

Brian Brobbey Physical Prowess Poses Europa League Threat

Apr 26, 2025

Brian Brobbey Physical Prowess Poses Europa League Threat

Apr 26, 2025 -

Fugro And Damen Partner To Bolster Royal Netherlands Navy Capabilities

Apr 26, 2025

Fugro And Damen Partner To Bolster Royal Netherlands Navy Capabilities

Apr 26, 2025 -

Santierul Naval Mangalia Sindicalistul Naval Cere Ajutorul Ambasadei Olandei Pentru Rezolvarea Conflictului

Apr 26, 2025

Santierul Naval Mangalia Sindicalistul Naval Cere Ajutorul Ambasadei Olandei Pentru Rezolvarea Conflictului

Apr 26, 2025 -

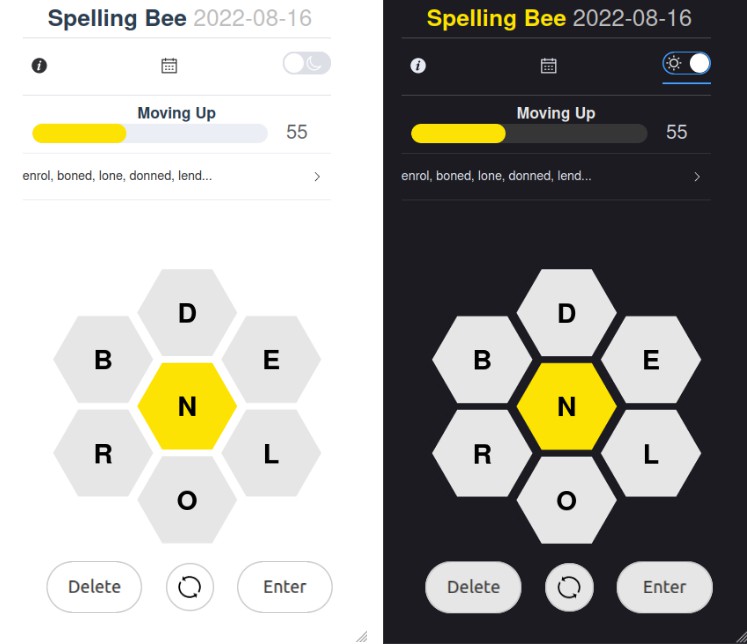

Conquering The Nyt Spelling Bee A Guide To Puzzle 387 March 25th

Apr 26, 2025

Conquering The Nyt Spelling Bee A Guide To Puzzle 387 March 25th

Apr 26, 2025 -

The Trump Factor Unforeseen Unity In Canadas Upcoming Election

Apr 26, 2025

The Trump Factor Unforeseen Unity In Canadas Upcoming Election

Apr 26, 2025