Dismissing Valuation Concerns: BofA's Argument For A Bullish Stock Market

Table of Contents

BofA's Core Argument: Earnings Growth Outpacing Valuation Concerns

BofA's central thesis rests on the belief that strong corporate earnings growth will ultimately offset current valuation levels, making the market attractive despite seemingly high prices. This bullish prediction hinges on several key factors.

Projected Earnings Growth

BofA projects robust earnings growth for the coming years. While specific figures may vary depending on the report and time of release, BofA consistently points to significant increases in S&P 500 earnings. For example, past reports have projected a substantial percentage increase (e.g., X%) in S&P 500 earnings over the next Y years. This growth is expected to be driven by several key sectors:

- Technology: Continued innovation and strong demand for tech products and services.

- Healthcare: Aging populations and advancements in medical technology fuel consistent growth.

- Financials: Benefiting from rising interest rates (though this requires careful nuance, as discussed later).

These sectors are expected to contribute significantly to the overall earnings growth projections.

Valuation Metrics Re-examined

BofA doesn't ignore the issue of valuations. Instead, they re-examine commonly used metrics like the Price-to-Earnings (P/E) ratio and Price/Earnings to Growth (PEG) ratio in light of projected earnings growth. Their argument centers on the idea that current valuations, while seemingly high compared to historical averages, are justifiable given the anticipated earnings expansion.

- Current P/E ratio is X, compared to historical average of Y. BofA argues the difference is less significant when considering future earnings growth.

- BofA argues that considering future earnings growth, the P/E ratio is justified. Their analysis incorporates forward-looking estimates, not just current earnings.

- PEG ratio analysis: BofA likely uses the PEG ratio, which incorporates earnings growth rate to provide a more nuanced picture of valuation relative to growth prospects.

Addressing Inflation and Interest Rate Risks

Inflation and rising interest rates are significant headwinds for the stock market. BofA acknowledges these risks but doesn't view them as insurmountable obstacles to their bullish outlook.

Inflation's Impact on Corporate Profits

BofA's analysis considers inflation's effect on corporate pricing power and profit margins. While inflation can squeeze margins, they argue that many companies have demonstrated the ability to pass increased costs onto consumers, mitigating the negative impact. Examples include companies with strong brands and pricing power in their respective markets.

Interest Rate Hikes and Their Influence

BofA acknowledges that Federal Reserve interest rate hikes can dampen economic growth and potentially impact stock valuations. However, their analysis suggests that rate hikes are likely to slow, rather than completely derail, economic expansion. This measured approach allows for a continued positive outlook, albeit one with moderated growth expectations.

Other Factors Supporting BofA's Bullish Stance

Beyond earnings growth and inflation considerations, other factors contribute to BofA's positive outlook.

Strong Corporate Balance Sheets

Many corporations are in a strong financial position, boasting healthy balance sheets and ample cash reserves. This financial resilience allows them to navigate economic uncertainty and continue investing in growth initiatives. Data on low debt levels and substantial cash reserves support this aspect of BofA's analysis.

Technological Innovation and Long-Term Growth

Technological innovation is a key driver of long-term economic growth, fueling productivity gains and creating new market opportunities. BofA highlights the transformative potential of AI, renewable energy, and other technological advancements as significant drivers for future stock market performance.

Conclusion

BofA's bullish stock market forecast is predicated on strong projected earnings growth outpacing current valuation concerns. They acknowledge the risks associated with inflation and rising interest rates but argue that these factors are unlikely to derail the overall positive trajectory. While geopolitical uncertainty and other unforeseen events could impact this forecast, BofA's analysis considers these factors to a degree. While caution is always warranted, BofA's analysis provides a compelling case for a bullish stock market in the medium term. Learn more about their detailed report to inform your investment strategy and assess the BofA Bullish Stock Market perspective for yourself.

Featured Posts

-

Wga And Sag Aftra Strike A Complete Shutdown Of Hollywood Production

Apr 29, 2025

Wga And Sag Aftra Strike A Complete Shutdown Of Hollywood Production

Apr 29, 2025 -

Social Media And The D C Midair Collision A Case Study In Misinformation

Apr 29, 2025

Social Media And The D C Midair Collision A Case Study In Misinformation

Apr 29, 2025 -

The Challenges Of Producing All American Goods

Apr 29, 2025

The Challenges Of Producing All American Goods

Apr 29, 2025 -

The Impact Of The 2012 Tornado On Louisville Long Term Effects

Apr 29, 2025

The Impact Of The 2012 Tornado On Louisville Long Term Effects

Apr 29, 2025 -

The U S Dollars Performance A 100 Day Assessment Following Presidential Inauguration

Apr 29, 2025

The U S Dollars Performance A 100 Day Assessment Following Presidential Inauguration

Apr 29, 2025

Latest Posts

-

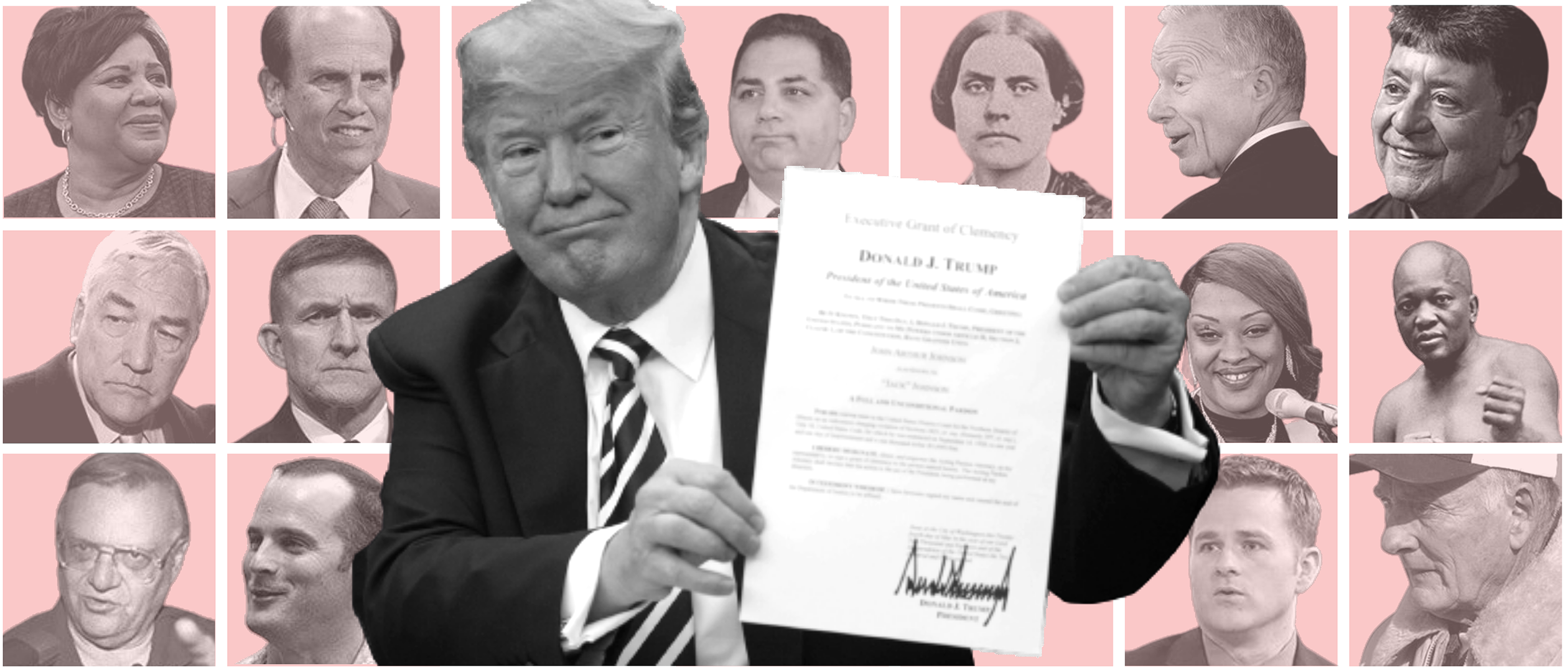

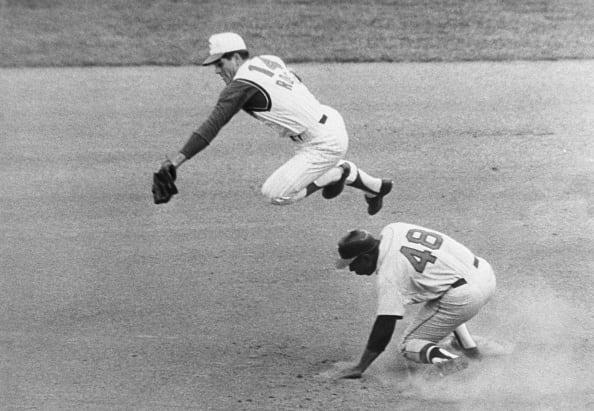

The Pete Rose Pardon Debate Trump Baseball And The Legacy Of A Betting Ban

Apr 29, 2025

The Pete Rose Pardon Debate Trump Baseball And The Legacy Of A Betting Ban

Apr 29, 2025 -

Trumps Potential Pardon For Pete Rose A Look At The Mlb Betting Ban

Apr 29, 2025

Trumps Potential Pardon For Pete Rose A Look At The Mlb Betting Ban

Apr 29, 2025 -

The Pete Rose Pardon Trumps Decision And Baseballs Reaction

Apr 29, 2025

The Pete Rose Pardon Trumps Decision And Baseballs Reaction

Apr 29, 2025 -

Will Pete Rose Be Pardoned President Trump Weighs In

Apr 29, 2025

Will Pete Rose Be Pardoned President Trump Weighs In

Apr 29, 2025 -

Trumps Outrage Pete Rose And A Promised Posthumous Pardon From The Former President

Apr 29, 2025

Trumps Outrage Pete Rose And A Promised Posthumous Pardon From The Former President

Apr 29, 2025