Dogecoin's Price Volatility: The Role Of Elon Musk And Tesla's Performance

Table of Contents

Elon Musk's Tweets and Dogecoin's Price

Elon Musk's tweets have a demonstrably significant impact on Dogecoin's price. His pronouncements, often cryptic or humorous, can trigger massive price surges or equally dramatic drops in a matter of hours. This influence stems from his massive social media following and his established reputation as a market mover. His actions effectively create a self-fulfilling prophecy: positive tweets generate buying pressure, while negative ones can spark sell-offs. This manipulation of investor sentiment is a key driver of Dogecoin's price volatility.

- Example of a tweet causing a significant price surge: In 2021, a single tweet from Musk mentioning Dogecoin sent its price soaring by over 20% in a matter of minutes.

- Example of a tweet causing a significant price drop: Conversely, other tweets expressing doubt or hinting at selling have resulted in substantial price declines.

- Analysis of the sentiment expressed in these tweets and its correlation with price movement: A positive sentiment, often expressed through playful language or endorsements, generally leads to price increases. Conversely, negative or even ambivalent statements lead to price drops.

- Discussion of the regulatory implications of such influential social media activity: The influence of a single individual on a cryptocurrency's price raises concerns about market manipulation and the need for clearer regulations regarding social media influence on financial markets.

Tesla's Stock Performance and its Correlation with Dogecoin

While a direct causal relationship between Tesla's stock price and Dogecoin's price isn't definitively established, there's evidence suggesting a correlation, particularly driven by investor sentiment. When Tesla performs well, investor optimism often extends to other assets associated with Musk, including Dogecoin. Conversely, negative news concerning Tesla can negatively impact Dogecoin's price. However, this correlation is not consistent and is likely influenced by other market factors. Tesla's decision to not widely adopt Dogecoin as a payment method further demonstrates the lack of a fundamental, intrinsic link between the two.

- Statistical data showcasing the correlation (positive or negative) between Tesla's stock and Dogecoin's price: While precise statistical correlations fluctuate, periods of positive Tesla performance often coincide with increased Dogecoin trading volume and price appreciation (though not always).

- Analysis of market events that influenced both Tesla and Dogecoin simultaneously: Major market events, such as broad cryptocurrency market corrections, or significant Tesla announcements, often impact both assets simultaneously.

- Discussion of investor behavior and diversification strategies involving both assets: Investors often treat Tesla and Dogecoin as related assets within their portfolios, reflecting a belief in the intertwined fates of the two due to Musk's involvement.

Other Factors Contributing to Dogecoin's Volatility

Dogecoin's price volatility isn't solely dependent on Elon Musk and Tesla. Several other factors significantly influence its price:

-

News cycles and media coverage: Positive media attention can drive up the price, while negative news or controversies can cause sharp declines.

-

Overall cryptocurrency market trends: Dogecoin is susceptible to broader market movements. A significant downturn in Bitcoin's price, for example, typically drags down Dogecoin with it.

-

Regulatory announcements and changes in policy: Government regulations concerning cryptocurrencies have a direct impact on the entire market, including Dogecoin.

-

Major exchange listings or delistings: Listing on major cryptocurrency exchanges can boost Dogecoin's liquidity and price. Conversely, delisting can lead to price drops.

-

Specific examples of news events and their impact on Dogecoin's price: A significant news story about cryptocurrency regulation could lead to a widespread market correction, affecting Dogecoin's price.

-

Discussion of the interplay between broader market trends and Dogecoin's performance: Dogecoin often mirrors the overall sentiment within the broader crypto market. A period of bullish sentiment often boosts Dogecoin's price, while a bear market tends to suppress it.

-

Analysis of regulatory actions and their influence on the cryptocurrency market in general: Regulatory uncertainty remains a significant factor influencing cryptocurrency markets' volatility, including Dogecoin.

Analyzing the Risks of Investing in Highly Volatile Cryptocurrencies

Investing in highly volatile cryptocurrencies like Dogecoin carries significant risks. The potential for rapid price swings exposes investors to substantial losses. Fear of missing out (FOMO) can often lead to impulsive, irrational investment decisions, exacerbating the risks. Therefore, responsible investment practices are crucial.

- Examples of significant Dogecoin price drops and their impact on investors: Several instances demonstrate that significant price drops can wipe out a considerable portion of an investor's portfolio.

- Strategies for mitigating risks in volatile cryptocurrency markets: Diversification across different asset classes, setting stop-loss orders, and only investing money one can afford to lose are key strategies.

- Advice on diversifying investments to reduce overall portfolio risk: Avoid concentrating investments solely in Dogecoin. Spread your portfolio across multiple assets to minimize potential losses.

Conclusion: Understanding Dogecoin's Price Volatility and Making Informed Decisions

Dogecoin's price volatility is significantly influenced by Elon Musk's actions and statements, along with Tesla's performance, yet other factors such as broader market trends and regulatory changes also play a crucial role. Understanding Dogecoin's price volatility is crucial for making informed investment decisions. The inherent risk of investing in such a volatile asset should not be underestimated. Conduct your research, manage your risk carefully, and approach the Dogecoin market with caution. Remember to diversify your portfolio and never invest more than you can afford to lose. Responsible investment strategies are paramount when dealing with the volatile nature of Dogecoin and other similar cryptocurrencies.

Featured Posts

-

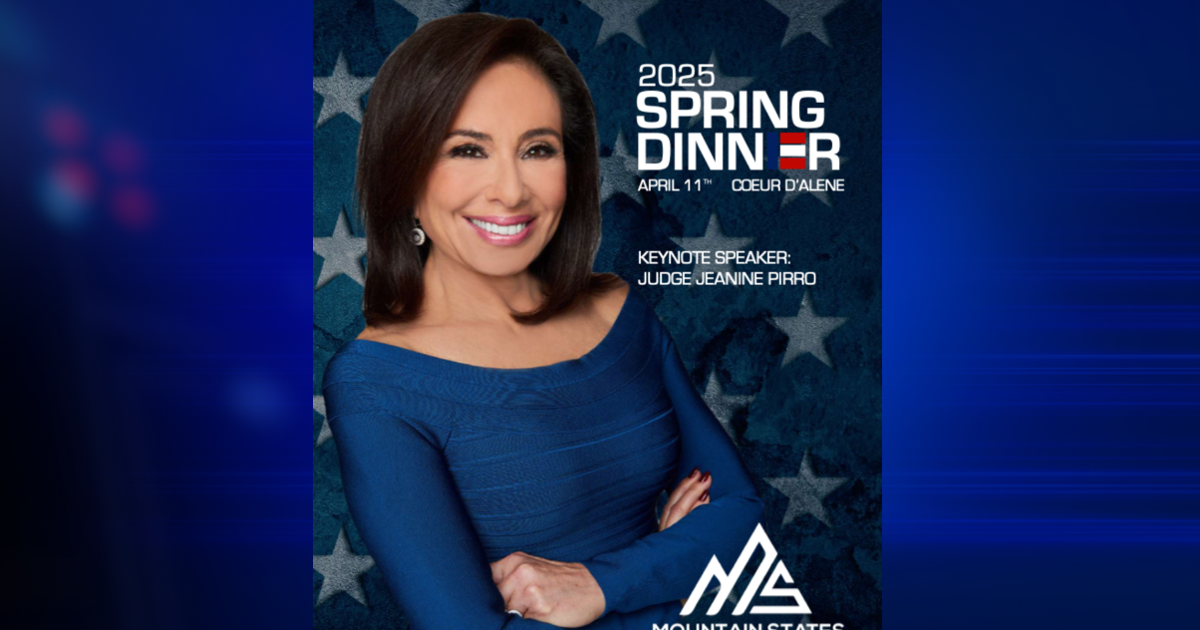

Jeanine Pirro To Speak In North Idaho Event Information

May 09, 2025

Jeanine Pirro To Speak In North Idaho Event Information

May 09, 2025 -

From Scatological Data To Engaging Podcast Ais Role In Content Transformation

May 09, 2025

From Scatological Data To Engaging Podcast Ais Role In Content Transformation

May 09, 2025 -

Champions League Inter Milans First Leg Triumph Over Bayern Munich

May 09, 2025

Champions League Inter Milans First Leg Triumph Over Bayern Munich

May 09, 2025 -

Kucherov And Lightning Dominate Oilers In 4 1 Win

May 09, 2025

Kucherov And Lightning Dominate Oilers In 4 1 Win

May 09, 2025 -

Kaitlin Olson And The Abc March 2025 Repeat Episodes A Deeper Look

May 09, 2025

Kaitlin Olson And The Abc March 2025 Repeat Episodes A Deeper Look

May 09, 2025