Dow Delays Major Canadian Project Construction Amid Market Volatility

Table of Contents

The Impact of Market Volatility on Dow's Canadian Project

Fluctuations in the global market are significantly impacting Dow's decision to delay its Canadian project. Several interconnected factors have contributed to this postponement, creating a perfect storm of economic uncertainty. The current market volatility, characterized by unpredictable commodity prices, soaring inflation, increased interest rates, and persistent supply chain disruptions, has made the project financially unviable in its current form.

- Increased material costs exceeding projected budgets: The dramatic rise in the cost of raw materials, including steel, plastics, and specialized chemicals, has significantly increased project expenses, surpassing initial budget projections.

- Difficulty securing financing at favorable rates due to higher interest rates: The current interest rate environment makes securing the necessary financing for such a large-scale undertaking significantly more challenging and expensive. Higher borrowing costs directly impact the project's overall profitability.

- Supply chain bottlenecks leading to extended project timelines: Ongoing global supply chain disruptions have led to delays in receiving essential materials and equipment, further increasing costs and extending the project timeline.

- Uncertainty regarding future demand impacting project viability: Market volatility introduces uncertainty about future demand for the project's output, prompting Dow to reassess the project's long-term viability and profitability.

Specifics of the Delayed Canadian Project

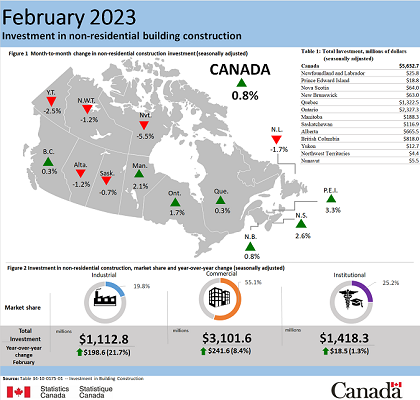

The delayed project, tentatively located in Alberta, Canada, was planned as a large-scale petrochemical facility. The initial investment was estimated at $5 billion CAD, and the project was anticipated to create approximately 10,000 direct and indirect jobs.

- Precise location within Canada: While the exact location within Alberta remains undisclosed for now, the province's established petrochemical industry and access to resources made it an attractive location.

- Type of facility being built: The project involved the construction of a state-of-the-art ethylene cracker and associated polyethylene production units.

- Original projected completion date and the new anticipated timeline: The original completion date was slated for late 2025. Dow has not yet announced a revised timeline, indicating the ongoing assessment of the project's feasibility.

- Impact on planned employment and local economies: The delay has immediate and significant impacts on job creation in Alberta, impacting both planned direct employment at the facility and numerous related industries. The economic ripple effect throughout the local community is considerable.

Concerns Regarding Long-Term Investment in the Canadian Energy Sector

Dow's decision raises serious concerns regarding long-term investment in the Canadian energy sector. This delay may signal a broader trend of decreased investor confidence, particularly for foreign investors. Several factors are contributing to this apprehension:

- Concerns about the stability of Canadian energy policies: Changes in government policy and regulatory frameworks can create uncertainty for investors, impacting long-term investment decisions.

- Increased regulatory scrutiny and permitting challenges: Lengthy permitting processes and stringent environmental regulations add to the complexities and costs of large-scale projects in Canada.

- Impact on attracting future foreign direct investment: This delay sends a negative signal to potential foreign investors considering similar projects in Canada.

- Potential for a chilling effect on other large-scale projects: Dow's decision might discourage other companies from initiating or continuing with large-scale projects in Canada, affecting overall economic growth.

Dow's Official Statement and Future Plans

Dow Chemical's official statement acknowledges the delay and cites "unprecedented market volatility" as the primary reason. The company emphasizes its commitment to reassessing the project's feasibility, conducting a thorough risk assessment, and developing contingency plans.

- Direct quotes from press releases or official statements: Dow's public statements highlight the challenges presented by the current macroeconomic climate and the need for a comprehensive review of project parameters.

- Details on the company's current strategy: The company is currently conducting a comprehensive review of the project’s economics, considering potential modifications, cost-saving measures, and alternative timelines.

- Plans for potential future restarts or adjustments: Dow suggests that the project may be restarted once market conditions improve, but a revised timeline remains undetermined.

- Assessment of the overall financial impact: The financial implications of the delay are substantial, but the precise figures have yet to be publicly released by Dow.

Conclusion

The Dow Chemical Company's decision to delay its major Canadian project highlights the significant challenges presented by current market volatility. The interconnected issues of rising inflation, interest rates, supply chain disruptions, and evolving regulatory landscapes are creating uncertainty for large-scale industrial projects, potentially impacting future investment and job creation in Canada. This delay serves as a crucial indicator of broader economic and political considerations impacting the energy sector. Understanding these market dynamics is crucial for informed decision-making in the energy sector.

Call to Action: Stay informed on developments related to Dow's Canadian project and other large-scale industrial projects by regularly checking our website for updates on market volatility and its impact on major construction projects. Understanding the implications of market fluctuations is vital for navigating investment decisions in uncertain times.

Featured Posts

-

Federal Government Appoints Anti Vaccination Advocate To Lead Autism Research

Apr 27, 2025

Federal Government Appoints Anti Vaccination Advocate To Lead Autism Research

Apr 27, 2025 -

Grand National 2025 How Many Horses Have Died

Apr 27, 2025

Grand National 2025 How Many Horses Have Died

Apr 27, 2025 -

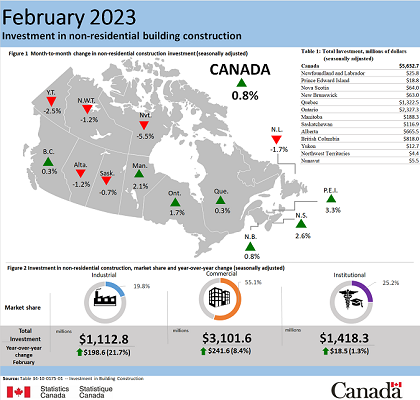

Canadian Sourcing A Key Strategy For Napoleon

Apr 27, 2025

Canadian Sourcing A Key Strategy For Napoleon

Apr 27, 2025 -

Canadas Divided Response To Trump Albertas Oil Industry And The National Mood

Apr 27, 2025

Canadas Divided Response To Trump Albertas Oil Industry And The National Mood

Apr 27, 2025 -

Horse Fatalities At The Grand National Pre 2025 Statistics

Apr 27, 2025

Horse Fatalities At The Grand National Pre 2025 Statistics

Apr 27, 2025

Latest Posts

-

Pne Ag Veroeffentlichung Gemaess Wp Hg 40 Abs 1 Ueber Eqs Pvr

Apr 27, 2025

Pne Ag Veroeffentlichung Gemaess Wp Hg 40 Abs 1 Ueber Eqs Pvr

Apr 27, 2025 -

Eqs Pvr Pne Ag Veroeffentlichung Gemaess 40 Abs 1 Wp Hg

Apr 27, 2025

Eqs Pvr Pne Ag Veroeffentlichung Gemaess 40 Abs 1 Wp Hg

Apr 27, 2025 -

The Toll Of The Grand National Examining Horse Deaths Before 2025

Apr 27, 2025

The Toll Of The Grand National Examining Horse Deaths Before 2025

Apr 27, 2025 -

Horse Fatalities At The Grand National Pre 2025 Statistics

Apr 27, 2025

Horse Fatalities At The Grand National Pre 2025 Statistics

Apr 27, 2025 -

Grand National 2025 How Many Horses Have Died

Apr 27, 2025

Grand National 2025 How Many Horses Have Died

Apr 27, 2025