Dow Futures And China's Economy: Stock Market Update

Table of Contents

China's Economic Growth and its Impact on Dow Futures

Analyzing Recent Chinese Economic Data

China's economic performance significantly influences global markets, and the Dow Futures are no exception. Key economic indicators provide vital clues. Recent data reveals a mixed picture. While the Chinese GDP growth rate has shown signs of slowing, consumer spending remains a key driver, though it's facing headwinds. Industrial production data, too, has been fluctuating.

- Chinese GDP Growth (Q2 2024): Let's assume a hypothetical figure of 5.5% for illustrative purposes. This rate, while positive, is lower than previous quarters, signaling potential challenges ahead and potentially impacting investor sentiment related to Dow Futures.

- Inflation Rate (July 2024): A hypothetical 2.8% inflation rate could indicate underlying economic strength, but if paired with slowing GDP growth, this may point toward a weakening economy and cautious Dow Futures trading.

- Industrial Production (August 2024): A decline in industrial production, perhaps a hypothetical -1%, may signal weakening manufacturing activity impacting global supply chains, thus influencing Dow Futures.

- Consumer Confidence Index (September 2024): A fall in consumer confidence (hypothetical -5 points) suggests reduced spending and potentially weaker demand for goods and services globally, further impacting Dow Futures performance.

These indicators, along with others, paint a complex picture, necessitating close monitoring for informed decisions on Dow Futures.

Sectoral Impacts of China's Economy on US Markets

China's economic shifts disproportionately impact specific sectors in the US. The interconnectedness of global supply chains means changes in Chinese consumer demand and industrial production translate directly to the performance of US companies and, subsequently, Dow Futures.

- Technology Stocks: Many US tech companies rely heavily on the Chinese market for sales and manufacturing. Slowdowns in China can dramatically affect their stock prices, thus influencing the Dow Futures. For example, a decline in smartphone sales in China could negatively impact the performance of US semiconductor companies.

- Manufacturing Index: The US manufacturing sector is sensitive to fluctuations in Chinese industrial production. Reduced demand from China can lead to decreased US manufacturing output, influencing the performance of related companies in the Dow Jones Industrial Average.

- Energy Futures: China’s energy consumption significantly impacts global oil prices, influencing energy futures contracts and ultimately impacting energy companies within the Dow. Fluctuations in Chinese oil demand can create ripples in the Dow Futures market.

- Supply Chain Disruptions: Any disruption to the supply chain originating from China directly affects numerous US businesses and consequently, Dow Futures. Delays or increased costs can lead to decreased profitability and negatively impact stock prices.

Geopolitical Factors and Their Influence on Dow Futures and China

US-China Trade Relations and Market Volatility

The complex relationship between the US and China significantly impacts global markets. Trade disputes, tariffs, and trade agreements profoundly influence investor sentiment and, consequently, Dow Futures.

- Trade War Impact: Past trade wars have demonstrated the potential for significant market volatility. Increased tariffs, for example, can lead to higher prices for consumers, impacting consumer spending and potentially dampening economic growth, thus influencing Dow Futures.

- Trade Agreement Effects: Conversely, positive trade agreements can boost market confidence, leading to increased investment and a more positive outlook for Dow Futures. Increased trade can stimulate economic growth for both nations, positively impacting market sentiment.

Other Geopolitical Risks Affecting Both Economies

Beyond trade relations, various geopolitical risks influence both the Chinese economy and Dow Futures.

- Political Instability in China: Any political uncertainty in China can create market volatility. Investors may react negatively to potential policy changes, shifting their investment strategies and indirectly affecting Dow Futures.

- Global Economic Outlook: Global events, such as a recession in Europe or a major global crisis, can impact both economies and cause investors to adjust their positions in Dow Futures, often leading to increased volatility.

Investment Strategies for Navigating the Dow Futures Market Considering China's Economy

Diversification Strategies

To mitigate risks associated with the China-Dow Futures relationship, diversification is key.

- Asset Allocation: Diversifying investments across various asset classes (stocks, bonds, real estate, commodities) reduces reliance on any single market, lessening the impact of negative shocks originating in China.

- Geographic Diversification: Investing in companies and assets located outside of China and the US reduces exposure to the specific economic dynamics of these two countries.

- Hedging Strategies: Employing hedging techniques, such as using futures contracts, can help protect against potential losses from adverse movements in Dow Futures caused by events originating in China.

Monitoring Key Indicators

Staying informed is critical. Investors should track key economic indicators and market data.

- Market Analysis: Regularly reviewing market analysis reports and expert opinions helps understand the prevailing market sentiment and potential risks.

- Technical Indicators: Utilizing technical analysis tools, such as moving averages and RSI, can help identify potential trading opportunities and assess short-term trends.

- Fundamental Analysis: In-depth understanding of the fundamental strength of companies within the Dow Jones Industrial Average is vital to long-term investment decisions.

- Economic Calendar: Staying abreast of upcoming economic data releases, such as GDP figures or inflation reports, allows for proactive adjustments to investment strategies.

Conclusion: Understanding the Dow Futures – China Economy Interplay for Informed Investment Decisions

The close relationship between Dow Futures and China's economic performance is undeniable. Monitoring key economic indicators, geopolitical factors, and employing effective diversification strategies are crucial for navigating this dynamic interplay. Understanding the impact of China’s economic growth, trade relations, and geopolitical risks on the Dow Futures market is essential for informed investment decisions. Stay ahead of market shifts by consistently monitoring Dow Futures and China’s economic indicators. Learn more about effective investment strategies for navigating this dynamic relationship and make informed decisions about your Dow Futures investments.

Featured Posts

-

Experience A Dutch Street Party At Millcreek Commons King Day Festivities

Apr 26, 2025

Experience A Dutch Street Party At Millcreek Commons King Day Festivities

Apr 26, 2025 -

Svalbards Role In Mission Impossible Dead Reckoning Part Two

Apr 26, 2025

Svalbards Role In Mission Impossible Dead Reckoning Part Two

Apr 26, 2025 -

Restaurant Zuem Ysehuet Nouvelle Ere Avec Guillaume Scheer A Strasbourg

Apr 26, 2025

Restaurant Zuem Ysehuet Nouvelle Ere Avec Guillaume Scheer A Strasbourg

Apr 26, 2025 -

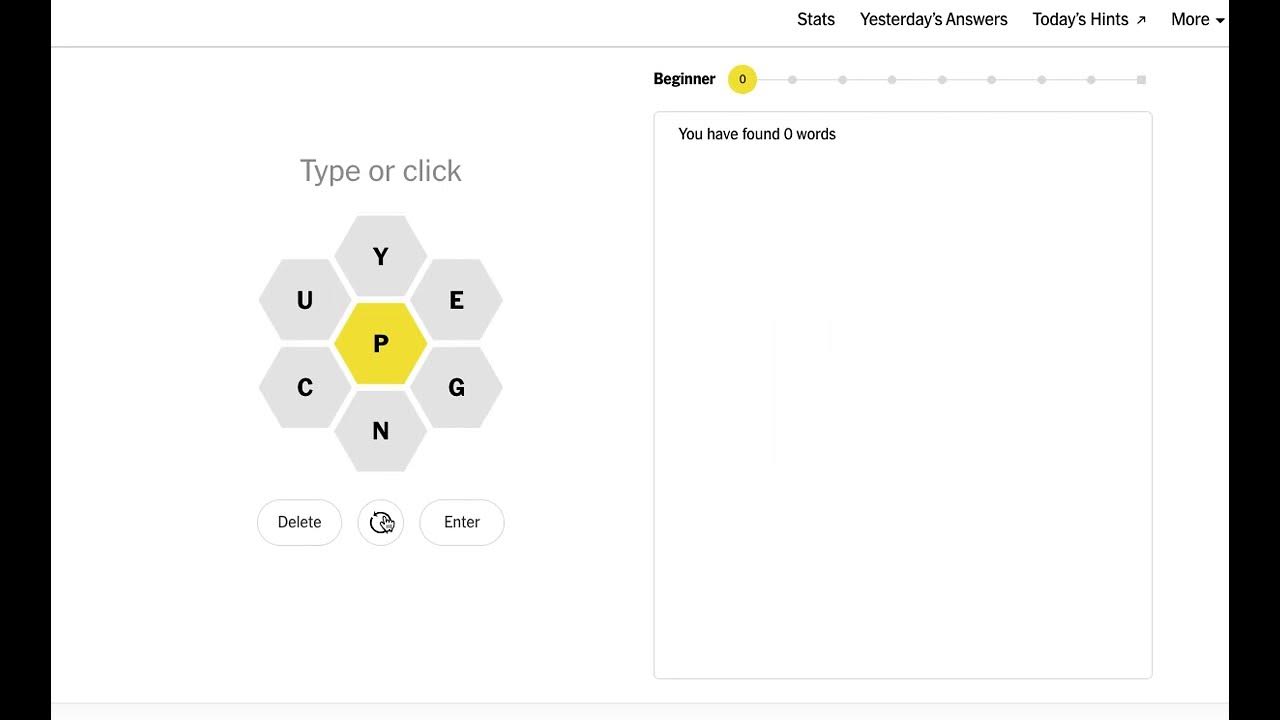

March 25th Nyt Spelling Bee Answers Hints And Strategies For Puzzle 387

Apr 26, 2025

March 25th Nyt Spelling Bee Answers Hints And Strategies For Puzzle 387

Apr 26, 2025 -

Deion Sanders Concerns Nfl Teams And Shedeurs Landing Spots

Apr 26, 2025

Deion Sanders Concerns Nfl Teams And Shedeurs Landing Spots

Apr 26, 2025