Dow Futures And Dollar Decline After Moody's US Rating Cut

Table of Contents

Impact on Dow Futures: A Market in Turmoil

The news of the downgrade caused an immediate and sharp drop in Dow Futures. The Dow Jones Industrial Average futures contracts experienced significant volatility in the hours following the announcement, reflecting widespread investor concern. This market turmoil stemmed from several interconnected factors:

- Investor Sentiment and Risk Aversion: The downgrade fueled a surge in risk aversion, as investors sought safer havens for their assets. This led to a sell-off in equities, impacting Dow Futures heavily.

- Concerns about US Economic Growth: The rating cut raises questions about the long-term health of the US economy and its ability to manage its debt. This uncertainty dampened investor confidence, further contributing to the decline in futures.

- Potential Implications for Corporate Earnings: A weaker economy could negatively impact corporate profitability, leading to reduced investor expectations for future earnings and consequently impacting stock prices and Dow Futures. Futures trading activity surged as traders reacted to the changing market landscape. Market volatility reached levels unseen in recent times, highlighting the severity of the situation.

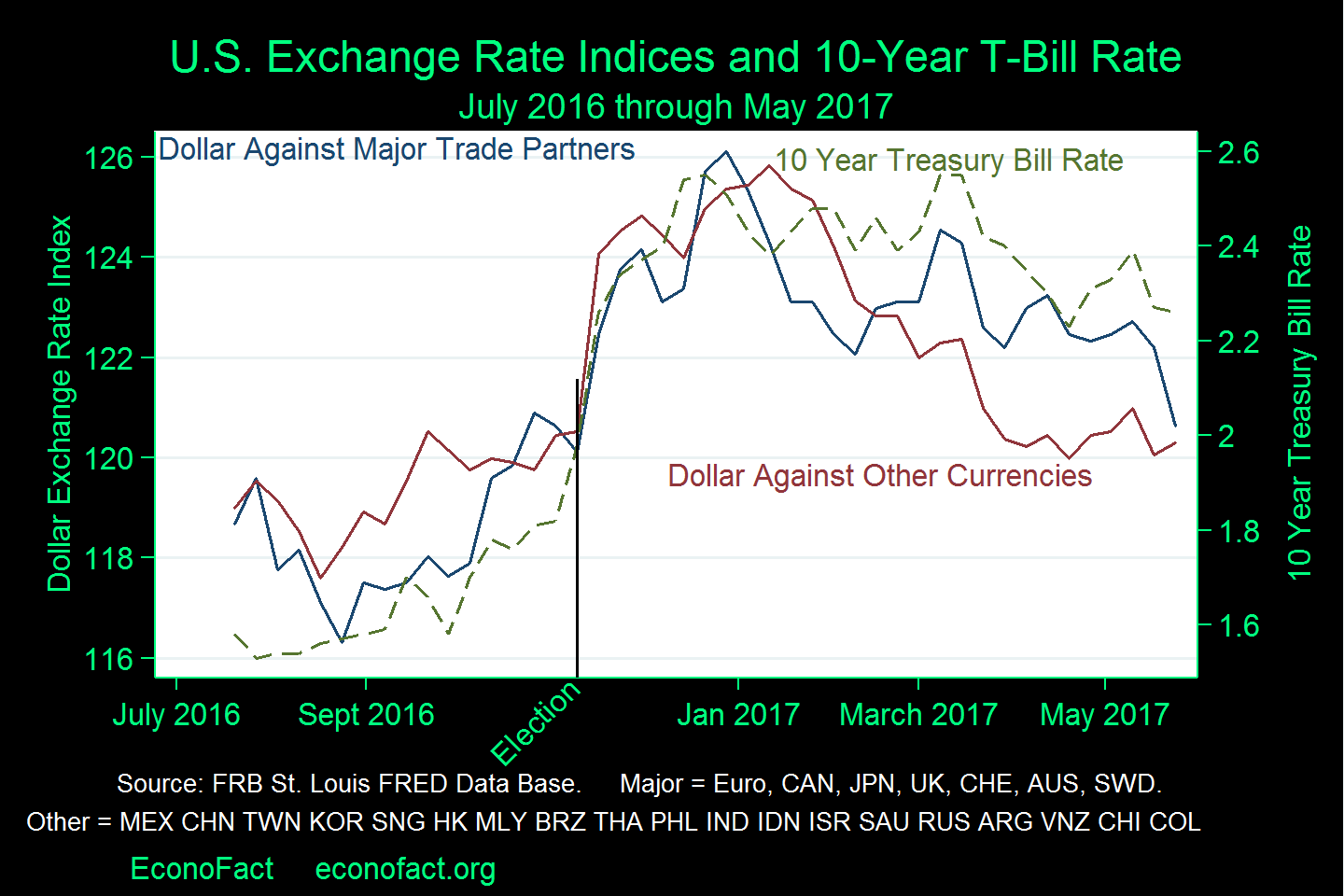

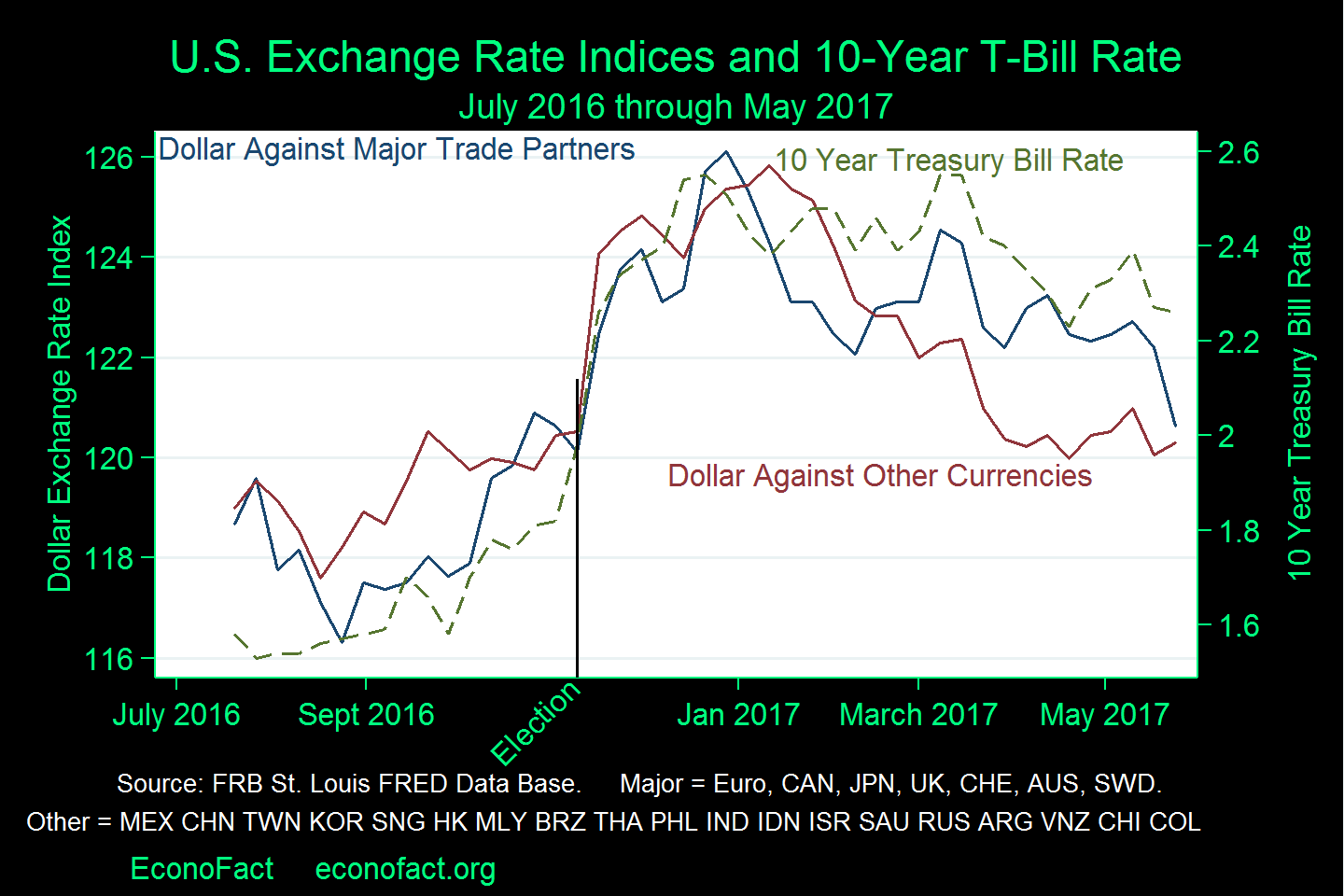

The Weakening Dollar: A Global Currency Shift?

The US credit rating downgrade has a direct correlation with the weakening of the US dollar. A lower credit rating increases uncertainty surrounding the US economy and its ability to repay its debts, making the dollar less attractive to foreign investors. This has several implications:

- Impact on International Trade and Foreign Exchange Markets: A weaker dollar makes US exports more competitive but simultaneously increases the cost of imports. This impacts trade balances and creates ripples across global foreign exchange markets. Currency exchange rates experienced significant fluctuations as investors reassessed their positions.

- Potential for Further Dollar Depreciation: Several factors could contribute to further dollar depreciation, including:

- Safe-Haven Assets: Investors may shift towards safe-haven assets like gold and other precious metals, further decreasing demand for the dollar.

- Interest Rate Differentials: Changes in US interest rates relative to other countries will also affect the dollar's value.

- Geopolitical Factors: Global geopolitical events can influence investor sentiment and impact the demand for the dollar.

Analyzing Moody's Rationale for the Downgrade

Moody's cited several factors in its decision to downgrade the US credit rating. These included:

- Fiscal Policy Challenges: Concerns about the US government's ability to manage its debt and the ongoing political gridlock surrounding the debt ceiling contributed significantly to the downgrade.

- Erosion of Governance: The rating agency pointed to a deterioration in the quality of US governance and a weakening of its institutional capacity to manage its fiscal challenges.

- Long-Term Implications: The downgrade is expected to lead to:

- Increased Borrowing Costs: The US government will likely face higher borrowing costs as lenders demand greater risk premiums.

- Impact on US Treasury Yields: Treasury yields are anticipated to increase, reflecting the higher perceived risk.

- Effect on Future Government Spending and Debt Management: The downgrade could necessitate significant changes in government spending and debt management strategies.

Looking Ahead: Forecasting Market Reactions

The long-term consequences of this credit rating downgrade remain uncertain, but several potential scenarios are emerging. Short-term market reactions are likely to continue to be volatile, while the long-term impact will depend on various factors, including government policy responses and broader economic developments. Investors should consider:

- Market Forecast: Closely monitor market indicators and economic news to gauge the trajectory of the market.

- Economic Outlook: Analyze expert opinions and forecasts to understand potential scenarios.

- Investment Strategy: Implement risk management strategies and diversify your portfolio to mitigate potential losses. This could include monitoring key economic indicators like inflation and unemployment.

Conclusion: Navigating the Aftermath of the Dow Futures and Dollar Decline

Moody's downgrade of the US credit rating has had a significant and multifaceted impact, causing a decline in Dow Futures and weakening the dollar. Understanding the complex interplay between credit ratings, government fiscal policy, and market performance is crucial for navigating these uncertain times. To stay informed about further developments regarding Dow Futures and Dollar Decline After Moody's US Rating Cut, follow reputable financial news sources and consider consulting with a financial professional before making any investment decisions. Regularly monitoring market trends and adjusting investment strategies accordingly will be essential in navigating this evolving situation.

Featured Posts

-

Wwe Raw Sami Zayn Caught In The Crossfire Of Rollins And Breakker

May 20, 2025

Wwe Raw Sami Zayn Caught In The Crossfire Of Rollins And Breakker

May 20, 2025 -

Tampoy Anakalyptontas Nea Stoixeia Gia Toys Fonoys

May 20, 2025

Tampoy Anakalyptontas Nea Stoixeia Gia Toys Fonoys

May 20, 2025 -

Tyler Bate Returns To Wwe Raw Reaction And Analysis

May 20, 2025

Tyler Bate Returns To Wwe Raw Reaction And Analysis

May 20, 2025 -

Philippines Deployment Of Us Typhon Missiles A Detailed Analysis

May 20, 2025

Philippines Deployment Of Us Typhon Missiles A Detailed Analysis

May 20, 2025 -

I Ypothesi Giakoymaki Bullying Vasanismoi Kai Thanatos Enos 20xronoy

May 20, 2025

I Ypothesi Giakoymaki Bullying Vasanismoi Kai Thanatos Enos 20xronoy

May 20, 2025