Dow Futures And Dollar Decline Following Moody's US Credit Rating Cut

Table of Contents

Moody's Rationale Behind the US Credit Rating Downgrade

Moody's cited several key factors in justifying its decision to downgrade the US credit rating. Their report highlighted persistent fiscal challenges, exacerbated by the repeated debt ceiling crises and a growing trend of political gridlock. These issues significantly impact the US's fiscal strength and long-term creditworthiness.

- Fiscal Challenges: The US faces a growing national debt and persistent budget deficits. Continued increases in government spending, without corresponding revenue increases, contribute to this unsustainable fiscal trajectory.

- Debt Ceiling Crisis: The recurring debt ceiling debates demonstrate a lack of political consensus on fiscal policy. These near-miss defaults create uncertainty and negatively impact investor confidence in the US government's ability to manage its debt.

- Political Polarization: Deep political divisions hinder the implementation of effective fiscal policies. The inability to address long-term fiscal issues erodes investor confidence and poses a significant risk to the US's creditworthiness. This political gridlock contributes to a weakening of the US's overall fiscal strength.

These factors, according to Moody's, collectively undermine the US government's fiscal strength and increase the risk of default, ultimately leading to the credit rating downgrade.

Impact on Dow Futures

The Moody's downgrade immediately impacted investor sentiment, leading to a decline in Dow Jones futures. Market volatility increased significantly as investors reacted to the news. The predicted effects extend beyond the immediate drop, potentially leading to a period of sustained uncertainty.

- Increased Market Volatility: The downgrade injected significant uncertainty into the market, leading to increased volatility in stock prices.

- Investor Confidence Eroded: Investor confidence in the US economy suffered a blow following the downgrade, resulting in a sell-off in various sectors.

- Sectoral Impacts: Sectors sensitive to interest rate changes, like the technology sector and real estate, were particularly vulnerable. The increased borrowing costs that may follow the downgrade could significantly impact these sectors' profitability.

The impact on Dow Jones futures reflects a broader concern about the implications of the downgrade on corporate profitability and overall economic growth.

The Weakening US Dollar

The decline in the US dollar's value is directly correlated with the Moody's credit rating downgrade. A weaker US dollar is a common response to decreased confidence in a nation's fiscal strength. This weakening affects international trade and capital flows.

- Currency Exchange Rates: The downgrade impacted various currency pairs, with the US dollar depreciating against major currencies like the Euro and the Japanese Yen.

- International Trade: A weaker US dollar makes US exports more competitive but simultaneously increases the cost of imports. This can contribute to inflationary pressures.

- Capital Flows: Investors may shift their investments away from US assets, leading to capital outflows and further downward pressure on the dollar. This reduction in foreign investment adds to economic uncertainty.

The weakening of the US Dollar Index (DXY) is a clear sign that the market is reacting negatively to the perceived increase in risk associated with the US economy.

Potential Long-Term Implications

The long-term implications of the Moody's downgrade are significant and far-reaching. The impact extends beyond the immediate market reactions and poses potential challenges to the US economy's future trajectory.

- Increased Borrowing Costs: The downgrade will likely increase borrowing costs for the US government and businesses, making it more expensive to finance government operations and private investment.

- Inflationary Pressures: The combined effect of increased borrowing costs and a weaker dollar could lead to higher inflation, eroding purchasing power.

- Economic Growth: The uncertainty created by the downgrade could dampen economic growth, impacting consumer and investor confidence. The potential for decreased investment could significantly hinder long-term economic outlook.

The long-term effects could impact future economic growth, creating a challenging environment for policymakers and businesses alike.

Conclusion: Understanding the Dow Futures and Dollar Decline After the Moody's Downgrade

Moody's downgrade of the US credit rating has had a significant impact on Dow Jones futures and the US dollar, reflecting a broader loss of confidence in the US economy's fiscal strength. The rationale behind the downgrade centers on persistent fiscal challenges, recurring debt ceiling crises, and political gridlock. The weakening US Dollar and decline in Dow Futures are symptomatic of this underlying issue. The long-term implications could include increased borrowing costs, inflationary pressures, and slower economic growth. Understanding these interconnected factors is crucial for navigating the evolving market landscape. To stay informed, continuously monitor Dow Jones Futures, the US Dollar Index, and related market analysis. Consult reputable financial news sources and economic forecasts to stay up-to-date on the evolving situation following the Moody's credit rating cut.

Featured Posts

-

Robin Roberts Response To Gma Layoffs Focusing On The Positive

May 21, 2025

Robin Roberts Response To Gma Layoffs Focusing On The Positive

May 21, 2025 -

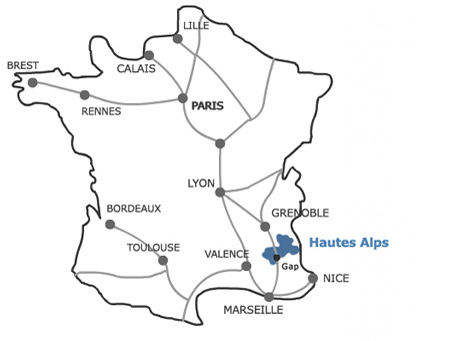

Current Conditions Late Season Snow In The Southern French Alps

May 21, 2025

Current Conditions Late Season Snow In The Southern French Alps

May 21, 2025 -

D Wave Quantum Qbts A Quantum Computing Stock Investment Analysis

May 21, 2025

D Wave Quantum Qbts A Quantum Computing Stock Investment Analysis

May 21, 2025 -

Brexits Impact On Uk Luxury Exports To The Eu

May 21, 2025

Brexits Impact On Uk Luxury Exports To The Eu

May 21, 2025 -

Four Star Admiral Burke Found Guilty Bribery Scandal Details

May 21, 2025

Four Star Admiral Burke Found Guilty Bribery Scandal Details

May 21, 2025

Latest Posts

-

Mainzs Henriksen The Next Klopp Or Tuchel

May 21, 2025

Mainzs Henriksen The Next Klopp Or Tuchel

May 21, 2025 -

Kaellmanin Ja Hoskosen Puolalaisjakso Paeaettyi

May 21, 2025

Kaellmanin Ja Hoskosen Puolalaisjakso Paeaettyi

May 21, 2025 -

Mainz Henriksen Following In The Footsteps Of Klopp And Tuchel

May 21, 2025

Mainz Henriksen Following In The Footsteps Of Klopp And Tuchel

May 21, 2025 -

Huuhkajat Kaksikko Kaellman Ja Hoskonen Palaavat Kotimaahan

May 21, 2025

Huuhkajat Kaksikko Kaellman Ja Hoskonen Palaavat Kotimaahan

May 21, 2025 -

Fremantle Q1 Financial Results 5 6 Revenue Decrease Attributed To Budget Cuts

May 21, 2025

Fremantle Q1 Financial Results 5 6 Revenue Decrease Attributed To Budget Cuts

May 21, 2025