Dow Jones & S&P 500: Stock Market News For May 5

Table of Contents

Dow Jones Performance on May 5th

The Dow Jones Industrial Average (DJIA) experienced a 0.7% increase, closing at 33,826.69 on May 5th. This positive movement can be attributed to several key factors:

-

Economic Data Releases: The April employment report, showing a robust increase in non-farm payrolls, boosted investor confidence. This positive jobs report, exceeding expectations, signaled continued economic strength, despite concerns about inflation. The positive employment numbers outweighed concerns about rising interest rates.

-

Corporate Earnings Reports: Strong earnings reports from several Dow components, particularly in the technology and consumer goods sectors, contributed to the upward trend. For example, Apple's better-than-expected quarterly earnings fueled positive sentiment, impacting its stock price and contributing to the overall index rise. Conversely, disappointing results from some energy companies slightly dampened the overall gains.

-

Geopolitical Events: Relatively calm geopolitical conditions on May 5th contributed to a stable market. The absence of major international conflicts or significant political surprises allowed investors to focus on domestic economic data and corporate performance. This lack of significant geopolitical uncertainty fostered a more positive investment climate.

-

Sector-Specific Performance: The technology sector led the gains on May 5th, with strong performances from major tech companies driving the Dow's upward momentum. The consumer discretionary sector also saw significant gains, while the energy sector showed more moderate growth. This sector-specific performance highlights the diverse influences impacting the overall index.

S&P 500 Performance on May 5th

The S&P 500, a broader measure of the US stock market, mirrored the Dow Jones's positive performance on May 5th, closing up 0.9% at 4,137.64. This upward movement was influenced by:

-

Broader Market Sentiment: A generally bullish market sentiment prevailed on May 5th, driven by the positive economic data and strong corporate earnings. This positive sentiment, reflected across various market sectors, contributed to the broad-based gains in the S&P 500. Investor confidence was clearly strengthened by the positive news.

-

Small-Cap and Mid-Cap Performance: Small-cap and mid-cap companies within the S&P 500 generally outperformed larger companies, indicating a broader-based market rally rather than one driven solely by a few large corporations. This suggests a more widespread improvement in economic outlook.

-

Interest Rate Expectations: While the Federal Reserve's anticipated interest rate hikes remain a concern, the positive employment data somewhat tempered investor anxieties. The market seemed to price in the possibility of further rate increases without exhibiting excessive panic. The market's relative calm suggests a degree of resilience to anticipated interest rate adjustments.

-

Technological Advancements: Continued positive developments in artificial intelligence and other technological areas contributed to the strong performance of the technology sector within the S&P 500, further supporting the overall market increase. This sector continues to be a major driver of market growth.

Correlation between Dow Jones and S&P 500

On May 5th, the Dow Jones and S&P 500 showed a strong positive correlation. This suggests a broad market trend driven by positive economic data and overall investor confidence. The similar upward movements in both indices indicate a widespread positive sentiment rather than a sector-specific rally. This synchronized movement reflects a healthy and robust market environment.

Conclusion

The Dow Jones and S&P 500 both experienced positive growth on May 5th. Understanding the interplay of economic data, corporate earnings, geopolitical factors, and investor sentiment is essential for navigating the stock market's complexities. Staying informed about daily market movements is crucial for making well-informed investment decisions. Continue to monitor the Dow Jones and S&P 500 for further updates and analysis. For continuous updates on the Dow Jones and S&P 500, subscribe to our newsletter or check back regularly for more insightful stock market news.

Featured Posts

-

Los Angeles Style Patrick Schwarzeneggers Bronco Ride

May 06, 2025

Los Angeles Style Patrick Schwarzeneggers Bronco Ride

May 06, 2025 -

Ddgs Dont Take My Son A Detailed Look At The Halle Bailey Diss Track

May 06, 2025

Ddgs Dont Take My Son A Detailed Look At The Halle Bailey Diss Track

May 06, 2025 -

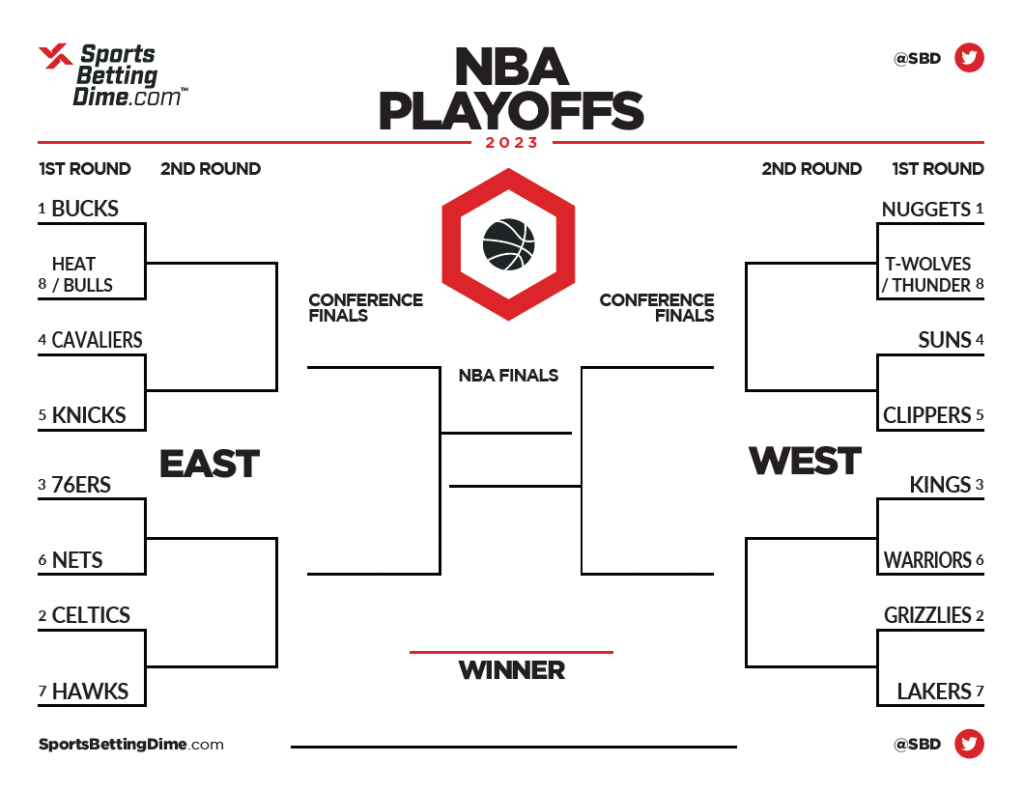

Nba Round 1 Playoffs 2025 Your Guide To The Games And Tv Schedule

May 06, 2025

Nba Round 1 Playoffs 2025 Your Guide To The Games And Tv Schedule

May 06, 2025 -

Russia Ukraine War Putin Addresses Nuclear Weapons Concerns

May 06, 2025

Russia Ukraine War Putin Addresses Nuclear Weapons Concerns

May 06, 2025 -

Nba Playoffs 2025 Conference Semifinals Schedule

May 06, 2025

Nba Playoffs 2025 Conference Semifinals Schedule

May 06, 2025

Latest Posts

-

Nikes Super Bowl 2025 Ad Faces Backlash Bill Mahers Zombie Lie Accusation

May 06, 2025

Nikes Super Bowl 2025 Ad Faces Backlash Bill Mahers Zombie Lie Accusation

May 06, 2025 -

The Rise Of Black Women Athletes In The Fashion Industry

May 06, 2025

The Rise Of Black Women Athletes In The Fashion Industry

May 06, 2025 -

Bill Mahers Super Bowl 2025 Nike Ad Critique Dissecting The Controversy

May 06, 2025

Bill Mahers Super Bowl 2025 Nike Ad Critique Dissecting The Controversy

May 06, 2025 -

Breaking Barriers And Boundaries Black Women Athletes Impact On Fashion

May 06, 2025

Breaking Barriers And Boundaries Black Women Athletes Impact On Fashion

May 06, 2025 -

Mahers Criticism Nikes Super Bowl 2025 Ad And The Patriarchy Debate

May 06, 2025

Mahers Criticism Nikes Super Bowl 2025 Ad And The Patriarchy Debate

May 06, 2025