Dow Jones Rallies: PMI Beat Fuels Continued, Cautious Growth

Table of Contents

Strong PMI Data Surpasses Expectations

The PMI, a key economic indicator, measures the activity levels of purchasing managers in the manufacturing and services sectors. A reading above 50 indicates expansion, while a reading below 50 signals contraction. Today's report revealed a [Insert Manufacturing PMI Number] for the manufacturing sector and a [Insert Services PMI Number] for the services sector, exceeding analyst forecasts of [Insert Analyst Forecast for Manufacturing] and [Insert Analyst Forecast for Services], respectively.

- Manufacturing PMI: [Insert Manufacturing PMI Number] (vs. [Insert Previous Month's Manufacturing PMI Number] and forecast of [Insert Analyst Forecast for Manufacturing])

- Services PMI: [Insert Services PMI Number] (vs. [Insert Previous Month's Services PMI Number] and forecast of [Insert Analyst Forecast for Services])

- Key Sectors: The strongest performances were seen in [Insert Strongest Performing Sectors], driven by [Insert Reasons, e.g., increased consumer confidence, easing supply chain pressures]. Weaker performances were observed in [Insert Weakest Performing Sectors].

- Reasons for exceeding expectations: The positive surprise is likely due to a combination of factors, including increased consumer spending, a gradual easing of supply chain bottlenecks, and continued government stimulus.

Dow Jones Reaction to Positive Economic Sentiment

The Dow Jones responded positively to the robust PMI data, reflecting a surge in investor confidence. The index saw a [Insert Percentage]% increase, with significant gains across several sectors.

- Dow Jones Closing Price: [Insert Closing Price] (a [Insert Percentage]% increase)

- Sector Performance: The technology and financial sectors experienced the most substantial gains, reflecting investor optimism about future earnings.

- Trading Volume and Market Breadth: Trading volume was [Insert Description, e.g., significantly higher than average], indicating strong investor participation. Market breadth was also positive, suggesting broad-based buying.

- Investor Sentiment: The market's reaction points to a generally positive investor sentiment, although cautious optimism prevails due to persistent economic uncertainties.

Cautious Outlook Despite Positive PMI

Despite the encouraging PMI data, a cautious outlook remains warranted. Several significant economic headwinds continue to pose challenges to sustained growth.

- Inflationary Pressures: Persistent inflationary pressures remain a key concern, potentially prompting further interest rate hikes by central banks.

- Interest Rate Hikes: The prospect of future interest rate increases could dampen economic activity and impact corporate investment.

- Geopolitical Uncertainties: Ongoing geopolitical tensions and global uncertainties contribute to market volatility and investor hesitancy.

- Supply Chain Vulnerabilities: While supply chains are showing signs of improvement, vulnerabilities remain, potentially disrupting production and impacting economic growth.

Analyzing Long-Term Growth Prospects

The positive PMI data suggests continued economic expansion in the short term. However, the long-term growth prospects depend heavily on how effectively these economic headwinds are managed.

- Future Economic Growth Projections: Based on the current PMI data, various economic models suggest [Insert Range of Growth Projections] for the next quarter/year.

- Impact on Corporate Earnings and Investment: Stronger economic growth would likely lead to increased corporate earnings, stimulating further investment. Conversely, persistent economic headwinds could lead to reduced profits and decreased investment.

- Expert Opinions and Market Forecasts: Experts [Insert Expert Opinions and Market Forecasts, e.g., remain divided on the long-term outlook, with some predicting continued moderate growth, while others warn of a potential slowdown].

Dow Jones Rallies – A Cautious Celebration

In conclusion, the Dow Jones rally is a testament to the positive economic sentiment fueled by the unexpectedly strong PMI report. This suggests continued, albeit cautious, economic growth. While the positive data is encouraging, investors remain wary of persistent inflation, potential interest rate hikes, and geopolitical uncertainties. The future trajectory of the Dow Jones will largely depend on how these factors evolve.

Stay updated on the latest Dow Jones news and PMI reports to make informed investment decisions. Monitor the Dow Jones for continued growth and volatility. Understanding the nuances of economic indicators like the PMI is crucial for navigating the complexities of the stock market.

Featured Posts

-

Your Dream Country Escape Awaits A Step By Step Planning Guide

May 24, 2025

Your Dream Country Escape Awaits A Step By Step Planning Guide

May 24, 2025 -

La Chine En France Une Repression Impitoyable Des Dissidents

May 24, 2025

La Chine En France Une Repression Impitoyable Des Dissidents

May 24, 2025 -

Get Tickets For Bbc Radio 1s Big Weekend 2025 At Sefton Park

May 24, 2025

Get Tickets For Bbc Radio 1s Big Weekend 2025 At Sefton Park

May 24, 2025 -

Understanding Frank Sinatras Four Marriages Love Loss And Legacy

May 24, 2025

Understanding Frank Sinatras Four Marriages Love Loss And Legacy

May 24, 2025 -

Securing Bbc Radio 1s Big Weekend 2025 Tickets In Sefton Park

May 24, 2025

Securing Bbc Radio 1s Big Weekend 2025 Tickets In Sefton Park

May 24, 2025

Latest Posts

-

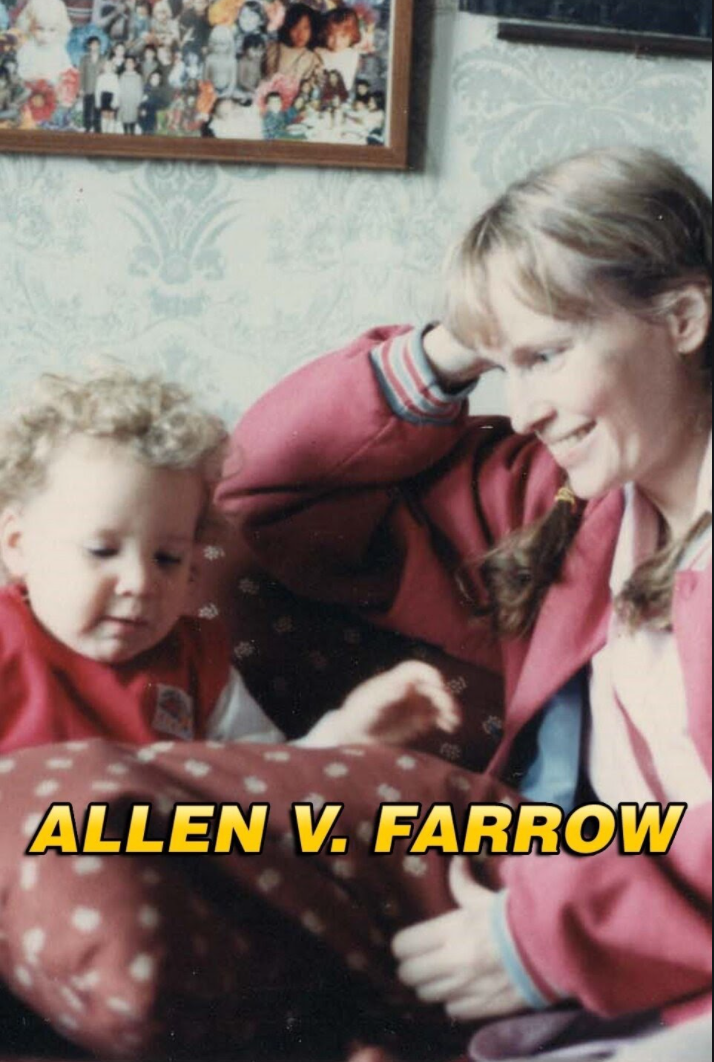

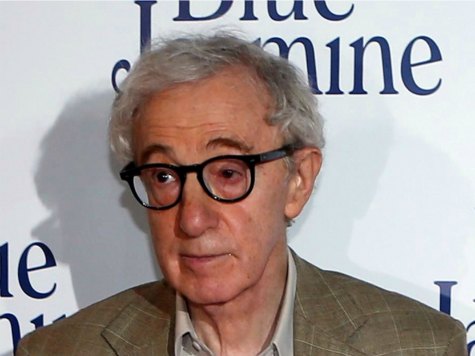

Dispute Over Dylan Farrows Accusations Sean Penns Perspective

May 24, 2025

Dispute Over Dylan Farrows Accusations Sean Penns Perspective

May 24, 2025 -

Dylan Farrow And Woody Allen Sean Penn Weighs In

May 24, 2025

Dylan Farrow And Woody Allen Sean Penn Weighs In

May 24, 2025 -

Sean Penns View On The Dylan Farrow Woody Allen Case

May 24, 2025

Sean Penns View On The Dylan Farrow Woody Allen Case

May 24, 2025 -

Dylan Farrows Woody Allen Accusations Sean Penns Skepticism

May 24, 2025

Dylan Farrows Woody Allen Accusations Sean Penns Skepticism

May 24, 2025 -

Sean Penn Casts Doubt On Dylan Farrows Sexual Assault Claims Against Woody Allen

May 24, 2025

Sean Penn Casts Doubt On Dylan Farrows Sexual Assault Claims Against Woody Allen

May 24, 2025