Dragon Den: Controversial Deal Stuns Investors

Table of Contents

The Deal Itself: A Deep Dive into the Controversial Pitch

[Name of Company/Entrepreneur] pitched their [Type of Business] to the Dragons, seeking [Investment Amount] for [Percentage] equity. Their business model revolved around [Briefly explain the business model, including key features]. While the company boasted impressive [Mention key strengths, e.g., revenue growth, market share, unique technology], concerns lingered about [Mention key weaknesses, e.g., scalability, competition, reliance on a single customer]. The valuation sought by the entrepreneur was [Valuation Amount], a figure that immediately became a point of contention.

- Entrepreneur's Background: [Describe the entrepreneur's experience and relevant skills. Highlight any previous successes or failures.]

- Financial Projections: [Summarize the financial projections presented, including projected revenue, expenses, and profitability.]

- Unique Selling Propositions (USPs): [Detail the unique aspects of the business that set it apart from competitors. Emphasize what made the pitch appealing, despite its flaws.]

The Dragons' Reactions: Divided Opinions and Heated Debate

The Dragons' responses were far from unanimous. [Dragon's Name] immediately expressed concerns about [Specific concern], citing [Reason for concern]. In contrast, [Dragon's Name] saw potential in [Specific aspect of the business], highlighting [Positive aspect]. This divergence in opinion led to a heated debate, with [Dragon's Name] and [Dragon's Name] engaging in a particularly contentious exchange regarding [Point of contention]. The disagreement centered on [Key issue causing the disagreement], specifically concerning [Specific aspect of the disagreement].

- Key Concerns:

- [Dragon's Name]: "[Quote expressing concern]"

- [Dragon's Name]: "[Quote expressing a different viewpoint]"

- [Dragon's Name]: "[Quote highlighting a specific risk]"

- Heated Exchanges: [Describe the most intense moments of the debate, focusing on specific quotes and actions.]

The Aftermath: Public Reaction and Market Impact

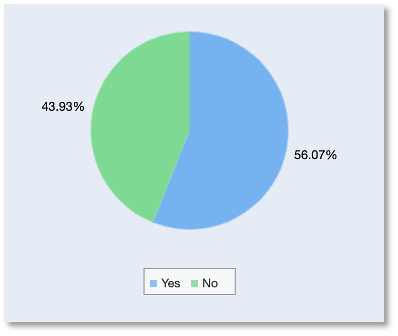

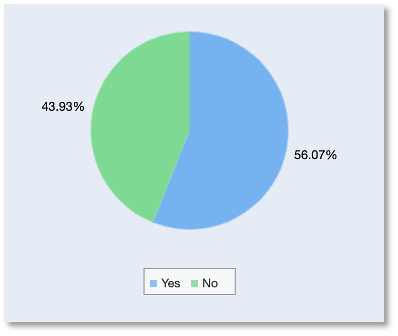

The deal sparked a firestorm of debate across social media platforms. Twitter and other channels were flooded with comments, with [Percentage]% of users expressing [Sentiment – positive, negative, or mixed]. Many questioned the Dragons' investment decision, highlighting [Specific reasons for criticism]. The potential market impact remains uncertain. Some analysts predict [Positive potential outcome], while others warn of [Negative potential outcome]. The long-term consequences for the business and the investors involved could be significant, depending on [Factors influencing long-term outcome].

- Social Media Statistics: [Include specific data or statistics about social media reaction, if available. Example: "Over 10,000 tweets mentioned the deal within 24 hours."]

- Risks and Rewards: [Analyze the potential risks and rewards associated with the investment, considering both short-term and long-term perspectives.]

- Ethical Considerations: [Discuss any ethical concerns surrounding the deal, such as potential conflicts of interest or unfair business practices.]

Lessons Learned: Analyzing the Controversy for Future Investments

This controversial Dragon's Den deal offers valuable lessons for both aspiring entrepreneurs and seasoned investors. The unexpected outcome underscores the importance of thorough due diligence, robust financial planning, and realistic valuations. Entrepreneurs must carefully consider potential weaknesses in their business model and be prepared to address potential concerns from investors. Investors, on the other hand, need to be aware of their own biases and be willing to challenge their assumptions.

- Common Mistakes to Avoid: [List common mistakes made by entrepreneurs seeking investment, such as unrealistic valuations or inadequate market research.]

- Importance of Market Research and Financial Planning: [Emphasize the necessity of detailed market research and comprehensive financial planning for successful investment pitches.]

- Strategies for Negotiating Investments: [Outline effective strategies for navigating challenging negotiations with investors, emphasizing clear communication and flexibility.]

Conclusion: Understanding the Dragon's Den Controversy and its Implications

This Dragon's Den deal stands as a stark reminder of the unpredictable nature of the investment world. The seemingly conflicting viewpoints of the Dragons, the subsequent social media backlash, and the uncertain market impact all contribute to a fascinating case study in investment strategy. The unexpected nature of the deal highlights the importance of thorough preparation and realistic expectations for both entrepreneurs and investors. What are your thoughts on this shocking Dragon's Den deal? Share your opinions below! Want to learn more about navigating the complexities of securing investment? Explore our other articles on Dragon's Den investment strategies and similar controversial deals.

Featured Posts

-

Rechtszaak Kampen Enexis Strijd Om Stroomnetaansluiting

May 01, 2025

Rechtszaak Kampen Enexis Strijd Om Stroomnetaansluiting

May 01, 2025 -

Pakstan Myn Kshmyr Ywm Ykjhty Ke Jlws Awr Rylyan

May 01, 2025

Pakstan Myn Kshmyr Ywm Ykjhty Ke Jlws Awr Rylyan

May 01, 2025 -

Kshmyr Ky Jng Pak Fwj Ka Astqamt Ka Mzahrh

May 01, 2025

Kshmyr Ky Jng Pak Fwj Ka Astqamt Ka Mzahrh

May 01, 2025 -

Xrp Price Prediction 2024 Analyzing The Potential For A 10 Surge

May 01, 2025

Xrp Price Prediction 2024 Analyzing The Potential For A 10 Surge

May 01, 2025 -

Xrp Explained Functionality Uses And Future Potential

May 01, 2025

Xrp Explained Functionality Uses And Future Potential

May 01, 2025

Latest Posts

-

Kogi Train Passengers Face Delays Following Mechanical Breakdown

May 01, 2025

Kogi Train Passengers Face Delays Following Mechanical Breakdown

May 01, 2025 -

Hundreds Stranded After Kogi Train Suffers Technical Failure

May 01, 2025

Hundreds Stranded After Kogi Train Suffers Technical Failure

May 01, 2025 -

Passengers Stranded In Kogi Train Breakdown Causes Chaos

May 01, 2025

Passengers Stranded In Kogi Train Breakdown Causes Chaos

May 01, 2025 -

Klas Recognizes Nrc Health As The Best In Healthcare Experience Management

May 01, 2025

Klas Recognizes Nrc Health As The Best In Healthcare Experience Management

May 01, 2025 -

Robinson Nuclear Plants Safety Inspection Success License Renewal Possible Until 2050

May 01, 2025

Robinson Nuclear Plants Safety Inspection Success License Renewal Possible Until 2050

May 01, 2025