Dragon Den Shock: Businessman Rejects Top Investors, Accepts Risky Deal

Table of Contents

The Appealing Offers from Established Investors

Olsen received several compelling investment offers from the Dragons. These offers represented a more traditional route to growth, prioritizing stability over rapid expansion.

Details of the Offers from Established Investors:

- Investor A's offer: Deborah Meaden offered £250,000 for 15% equity, emphasizing a phased rollout and a focus on securing large retail contracts. This represented a safe investment with a steady growth trajectory.

- Investor B's offer: Peter Jones offered £300,000 for 20% equity, highlighting his experience in scaling businesses and his network of contacts within the retail sector. His offer also included mentorship and strategic guidance.

- Commonalities of the offers: Both offers from these Dragon's Den investors promised a safe investment, focusing on steady growth and lower risk. They emphasized established market penetration strategies, minimizing the potential for substantial losses.

The Risky Deal: A High-Stakes Gamble

However, Olsen turned down these seemingly secure investment offers from established investors. Instead, he opted for a high-risk, high-reward deal with a smaller, less established venture capital firm, "GreenTech Ventures."

Details of the Risky Deal:

- Potential rewards of the risky deal: GreenTech Ventures offered £500,000 for 30% equity, but with a significantly higher growth target. Success meant potentially much faster scaling and a significantly higher valuation within a shorter timeframe.

- Potential drawbacks: The investment from GreenTech Ventures came with a considerably higher risk of failure. The upfront capital was less, and the aggressive growth strategy demanded substantial risk-taking, potentially jeopardizing the entire enterprise. The unique aspect making this deal particularly risky was GreenTech's focus on rapid expansion into a still-developing market segment.

- This high-risk deal involved a faster-paced, more aggressive market penetration strategy that involved higher manufacturing costs and less brand recognition initially, compared to working with established Dragon's Den investors.

The Businessman's Rationale: Why He Chose the Risky Path

Olsen's decision to reject the safer investment options in favor of the high-risk deal stems from a calculated assessment of his business, the market, and his own risk tolerance.

Analysis of Olsen's Decision-Making Process:

- His personal risk tolerance: Olsen demonstrated a high level of risk tolerance, believing in the potential of his business model and his capacity to manage the inherent uncertainties.

- His long-term vision for the business: Olsen's vision extended beyond incremental growth. He envisioned EcoPack Solutions becoming a dominant player in the sustainable packaging sector, a vision that required bolder, faster expansion.

- His assessment of the market potential: He saw a significant untapped market for sustainable packaging, believing that aggressive growth would allow him to capitalize on this opportunity before major competitors.

- His confidence in his business model: He had complete faith in the superior quality and marketability of his product, giving him the confidence to pursue a higher-risk, higher-reward strategy.

The Aftermath: Analyzing the Decision's Impact

The consequences of Olsen's choice are still unfolding, making this Dragon's Den episode a compelling case study in entrepreneurial decision-making.

Short-Term and Long-Term Consequences:

- Short-term results: Initial reports suggest promising sales figures, exceeding initial projections set by GreenTech Ventures. Market share is growing steadily.

- Long-term projections: While the future remains uncertain, analysts are cautiously optimistic, suggesting that Olsen's aggressive approach could lead to significant long-term rewards. The risky business deal appears to be paying off.

- Lessons learned: This Dragon's Den investment story highlights the importance of carefully assessing risk tolerance, having a clear long-term vision, and maintaining confidence in one's business model when making critical investment decisions.

Dragon's Den Shock: Learning from a Risky Investment

Mark Olsen's decision to reject safer offers in favor of a risky deal on Dragon's Den is a powerful testament to the complexities of investment strategies and entrepreneurial spirit. This high-risk business deal showcases the importance of understanding your risk tolerance and having a clear vision for your business. The key takeaways from this story revolve around careful risk assessment, the formulation of effective long-term strategies, and the importance of having confidence in one's business model. What would you have done? Share your thoughts on this Dragon's Den shock in the comments below! Are you ready to take a risky deal to reach your business goals? Let's discuss!

Featured Posts

-

Us Cruise Lines A Travelers Guide To Popular Choices

May 01, 2025

Us Cruise Lines A Travelers Guide To Popular Choices

May 01, 2025 -

Nieuw Schoolgebouw Kampen Stroomnet Aansluiting In Kort Geding

May 01, 2025

Nieuw Schoolgebouw Kampen Stroomnet Aansluiting In Kort Geding

May 01, 2025 -

Lady Raiders Close Home Loss To Cincinnati 56 59

May 01, 2025

Lady Raiders Close Home Loss To Cincinnati 56 59

May 01, 2025 -

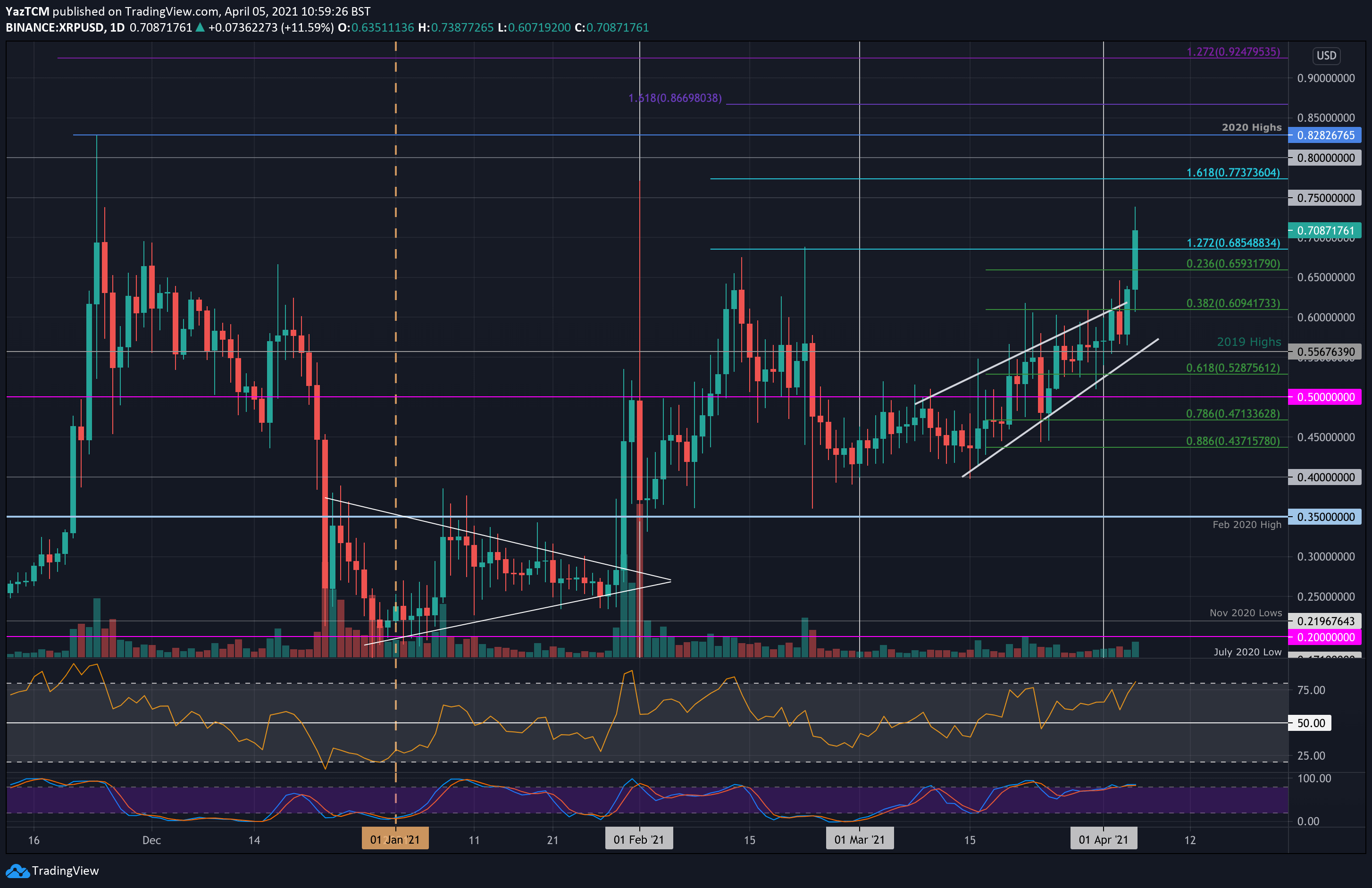

Is Xrp A Good Investment A Practical Analysis

May 01, 2025

Is Xrp A Good Investment A Practical Analysis

May 01, 2025 -

Prince William Witnesses Launch Of New Partnership With Royal Foundation Initiative

May 01, 2025

Prince William Witnesses Launch Of New Partnership With Royal Foundation Initiative

May 01, 2025

Latest Posts

-

Avrupa Ile Is Birligimizi Gueclendirecegiz Son Dakika Gelismeleri

May 02, 2025

Avrupa Ile Is Birligimizi Gueclendirecegiz Son Dakika Gelismeleri

May 02, 2025 -

Sulm Me Thike Ne Ceki Detajet E Ngjarjes Ne Qender Tregtare

May 02, 2025

Sulm Me Thike Ne Ceki Detajet E Ngjarjes Ne Qender Tregtare

May 02, 2025 -

Lotto 6aus49 Ziehung Vom Mittwoch 09 04 2025 Gewinnzahlen

May 02, 2025

Lotto 6aus49 Ziehung Vom Mittwoch 09 04 2025 Gewinnzahlen

May 02, 2025 -

6aus49 Lottozahlen Mittwoch 9 April 2025

May 02, 2025

6aus49 Lottozahlen Mittwoch 9 April 2025

May 02, 2025 -

Tragjedi Ne Qender Tregtare Ceke Viktima Te Sulmit Me Thike

May 02, 2025

Tragjedi Ne Qender Tregtare Ceke Viktima Te Sulmit Me Thike

May 02, 2025