Dragon Den: Unexpected Twist As Entrepreneur Snubs Offers, Chooses Risky Investment

Table of Contents

The Pitch: A Novel Idea with High Risk, High Reward Potential

Anya Petrova pitched "Solar Bloom," a revolutionary solar panel technology designed for seamless integration into building facades. This innovative business idea boasts a unique selling proposition (USP): its aesthetically pleasing design and significantly higher energy efficiency compared to traditional panels. However, the inherent risks are considerable. The technology is still in the relatively early stages of development, requiring substantial investment for further research and development, and scaling production presents significant manufacturing challenges. Anya sought £500,000 in seed money for expansion, a substantial investment for a startup with unproven market penetration. Despite the high-risk investment involved, the potential for significant returns is immense given the growing global demand for sustainable energy solutions. If successful, Solar Bloom could disrupt the market and generate substantial profits.

The Dragons' Offers: A Range of Tempting Proposals

The Dragons responded with a range of tempting proposals. Deborah Meaden offered £500,000 for a 40% equity stake, emphasizing the need for rigorous due diligence before committing to such a high-risk venture. Peter Jones, known for his shrewd business acumen, offered £300,000 for a 30% stake, highlighting the need for a more conservative approach to mitigate risk. Touker Suleyman, meanwhile, proposed £400,000 for a 35% stake, focusing on the potential for rapid growth and market dominance. Each offer presented its own set of advantages and disadvantages, balancing the amount of investment with the level of equity control retained by Anya. The negotiation process highlighted the complexities of securing a business deal, forcing Anya to weigh the immediate financial gains against potential long-term implications.

Why the Entrepreneur Rejected the Offers: A Calculated Gamble

Anya's decision to reject these offers stemmed from her long-term vision and her unwavering belief in Solar Bloom's potential. She recognized the significant dilution of ownership implied by the Dragons’ offers. Her strategic goals centered around maintaining majority control over her company to ensure her innovative vision wasn't compromised. Anya's high risk tolerance and comfort level with uncertainty, fueled by her strong conviction in her product, played a crucial role in her decision. She prioritized long-term growth and independent control over immediate financial gain. This was clearly a calculated gamble, showcasing her entrepreneurial spirit.

The Risky Investment Chosen: A Path Less Traveled

Instead of accepting the Dragons' offers, Anya opted for a blend of alternative funding strategies. She secured a smaller investment from a group of angel investors, who provided £200,000 in exchange for a smaller equity stake, while simultaneously launching a carefully targeted crowdfunding campaign to raise the remaining capital. This unconventional approach, combining several independent financing options, involved significantly higher risk compared to accepting the Dragons' offers. However, it allowed Anya to maintain substantial control over her company and its direction. This bootstrapping approach was driven by her desire to preserve the unique vision and direction of Solar Bloom.

The Aftermath: Analyzing the Entrepreneur's Bold Decision

The long-term success of Anya's strategy remains to be seen. The short-term outcome is a smaller amount of immediate funding, increased operational pressure, and the ongoing challenge of managing the risks inherent in her chosen path. However, the potential long-term gains include greater equity ownership, sustained control over her company’s direction and a stronger brand identity, independent of external influences. The strategic implications of this decision are profound, showcasing the difficult choices entrepreneurs face and the trade-offs between short-term gains and long-term vision. Her bold move serves as a powerful case study in risk management and entrepreneurial grit.

Conclusion:

This episode of Dragon Den showcased Anya Petrova, a courageous entrepreneur who defied conventional wisdom by rejecting lucrative offers in favor of a riskier, yet potentially more rewarding investment strategy. Her decision highlights the importance of understanding your risk tolerance and aligning your funding strategy with your long-term business vision. Anya's actions serve as a valuable case study in the world of startup funding and risk management.

Are you an entrepreneur facing tough funding decisions? Learn from Anya Petrova's journey and explore various funding options, carefully weighing the risks and rewards of each potential risky investment. Remember to develop a solid business plan and seek expert advice before making crucial decisions. Don’t miss the next episode of Dragon Den to witness more thrilling investment pitches!

Featured Posts

-

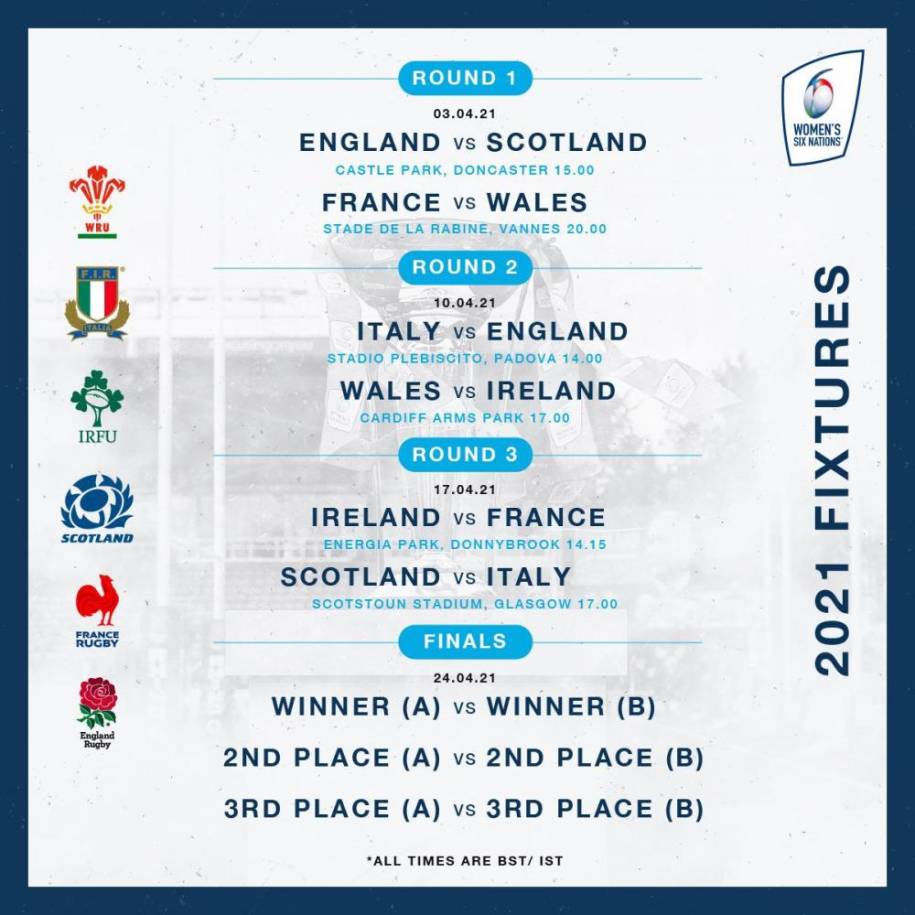

Frances Six Nations Championship A Victory Driven By Ramos

May 01, 2025

Frances Six Nations Championship A Victory Driven By Ramos

May 01, 2025 -

Legendary Dallas Star Dies At Age 100

May 01, 2025

Legendary Dallas Star Dies At Age 100

May 01, 2025 -

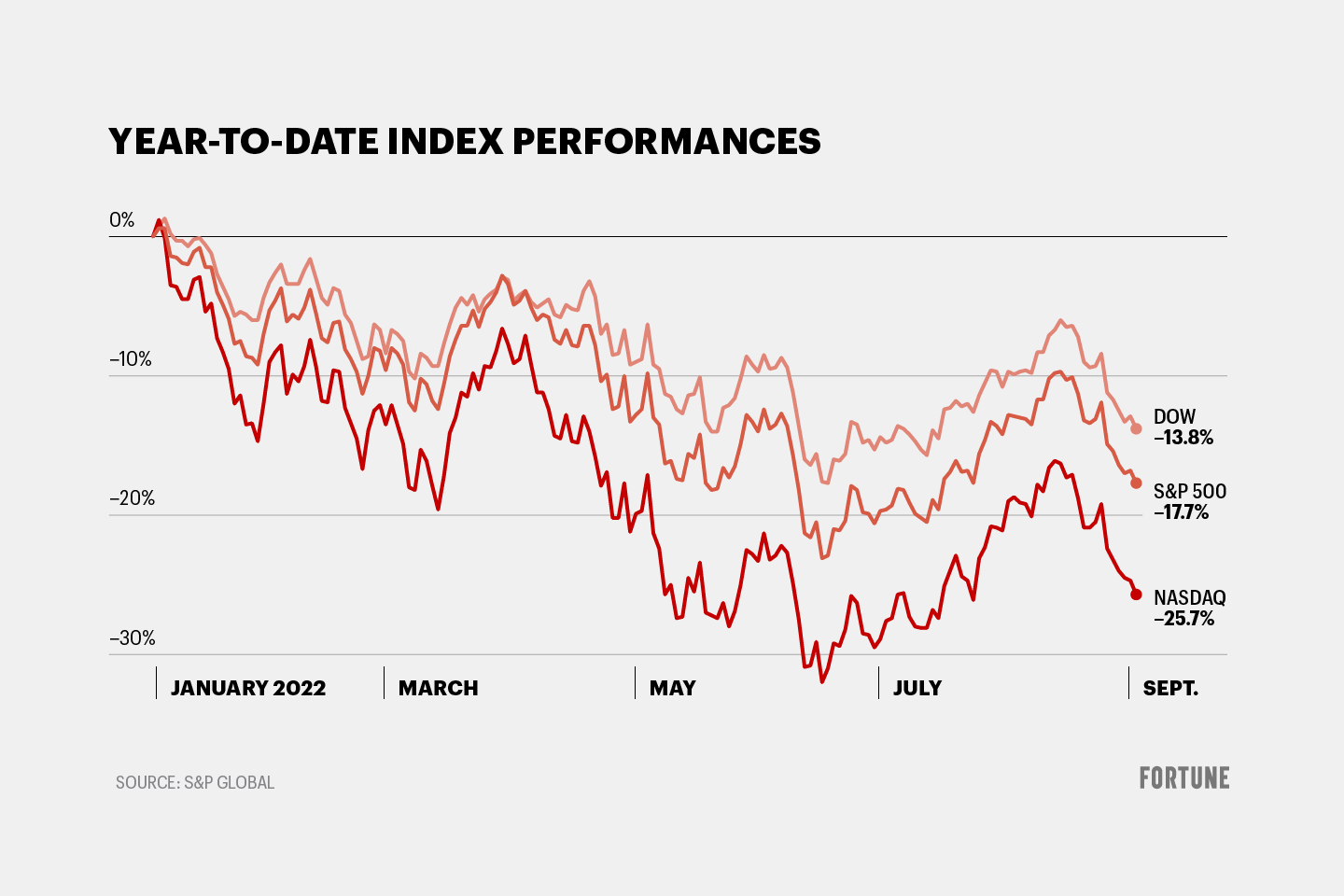

Analyzing Todays Stock Market Dow Futures Earnings And Market Trends

May 01, 2025

Analyzing Todays Stock Market Dow Futures Earnings And Market Trends

May 01, 2025 -

Mining Meaning From Mundane Data An Ai Approach To Creating A Poop Podcast

May 01, 2025

Mining Meaning From Mundane Data An Ai Approach To Creating A Poop Podcast

May 01, 2025 -

Voyage A Velo Trois Jeunes Du Bocage Ornais Relevent Un Defi De 8000 Km

May 01, 2025

Voyage A Velo Trois Jeunes Du Bocage Ornais Relevent Un Defi De 8000 Km

May 01, 2025

Latest Posts

-

Repetitive Documents An Ai Powered Podcast Solution For Streamlining Information

May 02, 2025

Repetitive Documents An Ai Powered Podcast Solution For Streamlining Information

May 02, 2025 -

Ai Digest Efficiently Transforming Repetitive Documents Into Informative Podcasts

May 02, 2025

Ai Digest Efficiently Transforming Repetitive Documents Into Informative Podcasts

May 02, 2025 -

Open Ai Unveils Streamlined Voice Assistant Creation At 2024 Event

May 02, 2025

Open Ai Unveils Streamlined Voice Assistant Creation At 2024 Event

May 02, 2025 -

Turning Poop Into Podcast Gold An Ai Powered Solution For Repetitive Documents

May 02, 2025

Turning Poop Into Podcast Gold An Ai Powered Solution For Repetitive Documents

May 02, 2025 -

Open Ais 2024 Developer Event Easier Voice Assistant Development

May 02, 2025

Open Ais 2024 Developer Event Easier Voice Assistant Development

May 02, 2025