Dragon's Den: A Guide To Securing Investment

Table of Contents

Crafting a Winning Business Plan

A robust business plan is the cornerstone of securing investment. It's your roadmap to success, demonstrating your understanding of the market and your ability to execute your vision. Investors use it to assess the viability of your business and the potential for return on investment (ROI).

Market Research & Analysis

Thorough market analysis is crucial for securing investment. Investors need to see that you understand your target audience, the size of your market, and the competitive landscape.

- Data-driven insights: Use data, statistics, and market research reports to support your claims. Don't rely on assumptions; back up your statements with concrete evidence. Include charts and graphs to visually represent your findings.

- Identify your Unique Selling Proposition (USP): Clearly articulate what makes your business different and better than the competition. What is your unique value proposition that will attract customers and investors?

- Competitive analysis: Analyze your competitors' strengths and weaknesses. Identify market gaps and opportunities that your business can exploit. How will you differentiate yourself and gain market share?

- Risk assessment and mitigation: Address potential risks and challenges your business might face. Show investors that you've considered these risks and have strategies in place to mitigate them. This demonstrates foresight and preparedness.

Financial Projections

Realistic and well-supported financial projections are essential. Investors want to see a clear path to profitability and a strong return on their investment.

- Projected revenue: Provide detailed projections of your revenue streams over a period of 3-5 years, justifying your assumptions with market data and sales strategies.

- Expense analysis: Outline your operating expenses, including costs of goods sold, marketing, and administration. Show how you will manage these costs effectively.

- Profitability analysis: Present your projected profit margins and net income. Highlight key performance indicators (KPIs) that demonstrate your financial health.

- Break-even analysis: Show investors when your business is expected to become profitable. This demonstrates your understanding of your business’s financial sustainability.

- Funding requirements: Clearly state how much funding you are seeking and how you plan to use the funds.

Team & Management

Investors invest in people as much as ideas. Highlighting your team's experience and expertise is critical.

- Team member profiles: Provide brief biographies of key team members, highlighting their relevant experience, skills, and accomplishments.

- Advisory board (if applicable): If you have an advisory board, showcase their expertise and experience. This adds credibility to your business.

- Organizational structure: Illustrate your organizational structure and clearly define roles and responsibilities within the team.

- Commitment and passion: Convey your team's dedication, passion, and commitment to the business's success. Investors look for teams with the drive and determination to overcome challenges.

Mastering the Pitch

Your pitch is your opportunity to sell your vision and secure investment. It needs to be concise, compelling, and memorable.

Storytelling & Communication

A compelling narrative is key to a successful pitch. Focus on telling a story that resonates with investors.

- Problem/Solution: Clearly articulate the problem your business solves and how your solution is superior to existing alternatives.

- Value Proposition: Concisely communicate the value your business offers to customers and investors.

- Visual Aids: Use visuals, such as charts and graphs, to enhance your presentation and make your data more easily digestible.

- Practice, Practice, Practice: Rehearse your pitch extensively to ensure a smooth and confident delivery. Seek feedback from trusted advisors.

Handling Investor Questions

Anticipate tough questions and prepare thoughtful, concise answers. Be honest, transparent, and demonstrate your expertise.

- Market analysis questions: Be prepared to discuss your market research, competitive landscape, and market size in detail.

- Financial questions: Be ready to justify your financial projections and answer questions about your funding needs and ROI.

- Team and management questions: Be able to confidently discuss your team's experience, skills, and commitment.

- Contingency planning: Demonstrate that you have considered potential risks and have plans to overcome them.

Negotiating the Deal

Understanding the terms and conditions of any investment offer is crucial. Seek professional legal and financial advice.

- Valuation: Understand the valuation of your company and ensure it reflects your business's potential.

- Equity dilution: Be aware of the dilution of your ownership stake as a result of taking investment.

- Investment terms: Carefully review the terms of the investment agreement, including the amount of investment, the equity stake being offered, and any conditions or restrictions.

- Legal and financial counsel: Engage legal and financial professionals to review the investment agreement before signing it.

Different Funding Sources

Exploring various funding avenues increases your chances of securing investment.

Angel Investors

Angel investors are high-net-worth individuals who invest their own money in early-stage companies.

- Networking: Attend industry events and connect with angel investor networks.

- Targeted pitch: Tailor your pitch to the specific interests and investment criteria of angel investors.

- Due diligence: Be prepared for a thorough due diligence process.

Venture Capitalists

Venture capitalists are professional investors who manage funds from institutions and individuals.

- VC networks: Identify venture capital firms that invest in your industry.

- Comprehensive business plan: Prepare a detailed business plan that showcases your market opportunity and growth potential.

- Due diligence: Expect a rigorous due diligence process, including financial audits and market research validation.

Crowdfunding

Crowdfunding platforms offer a way to raise capital from a large number of individuals.

- Platform selection: Choose a crowdfunding platform that aligns with your business and target audience.

- Compelling campaign: Develop a persuasive campaign that clearly communicates your business’s value proposition.

- Community building: Engage with potential backers and build a strong online community to support your campaign.

Conclusion

Securing investment is a challenging but achievable goal. By crafting a compelling business plan, mastering your pitch, understanding different funding sources, and diligently preparing for the process, you can significantly increase your chances of success. Remember, thorough preparation and a clear understanding of your target investors are crucial for navigating the complex world of securing investment. Don't hesitate to start working on your plan today and take the first step towards securing investment for your innovative idea and achieving your business goals!

Featured Posts

-

Sheens Million Pound Documentary Controversy And Response

May 01, 2025

Sheens Million Pound Documentary Controversy And Response

May 01, 2025 -

Zdravko Colic I Njegova Prva Ljubav Detalji O Pesmi Kad Sam Se Vratio

May 01, 2025

Zdravko Colic I Njegova Prva Ljubav Detalji O Pesmi Kad Sam Se Vratio

May 01, 2025 -

Rugby World Cup Duponts Performance Leads France To Victory Against Italy

May 01, 2025

Rugby World Cup Duponts Performance Leads France To Victory Against Italy

May 01, 2025 -

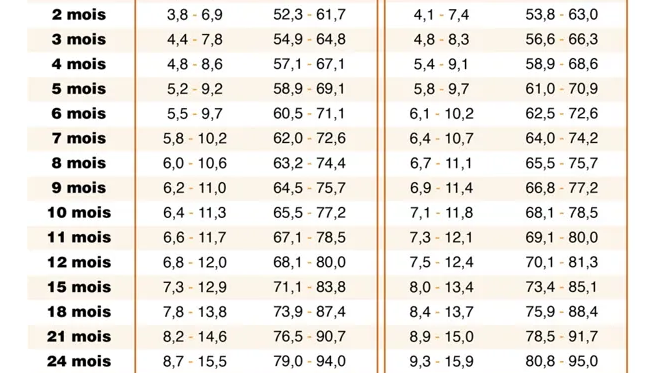

Offre Speciale Boulangerie Normande Le Poids En Chocolat Du Premier Bebe De L Annee

May 01, 2025

Offre Speciale Boulangerie Normande Le Poids En Chocolat Du Premier Bebe De L Annee

May 01, 2025 -

Assam Chief Minister Announces Action Against Aadhaar Cardholders Excluded From Nrc

May 01, 2025

Assam Chief Minister Announces Action Against Aadhaar Cardholders Excluded From Nrc

May 01, 2025

Latest Posts

-

Analyzing Ongoing Nuclear Litigation Key Issues And Challenges

May 01, 2025

Analyzing Ongoing Nuclear Litigation Key Issues And Challenges

May 01, 2025 -

Nuclear Litigation Current Cases And Legal Developments

May 01, 2025

Nuclear Litigation Current Cases And Legal Developments

May 01, 2025 -

Ongoing Nuclear Litigation Cases Trends And Impacts

May 01, 2025

Ongoing Nuclear Litigation Cases Trends And Impacts

May 01, 2025 -

A Look At Ongoing Nuclear Litigation A Comprehensive Overview

May 01, 2025

A Look At Ongoing Nuclear Litigation A Comprehensive Overview

May 01, 2025 -

Kogi Train Passengers Face Delays Following Mechanical Breakdown

May 01, 2025

Kogi Train Passengers Face Delays Following Mechanical Breakdown

May 01, 2025