Dragon's Den: A Guide To Successfully Pitching Your Business

Table of Contents

Understanding Your Audience: The Dragons' Perspective

Before you even craft your pitch, you must understand the investor mindset. What are they looking for? Dragons, whether on television or in real-life venture capital firms, aren't just looking for a good idea; they're looking for a profitable idea with high growth potential. Their primary concern is return on investment (ROI).

- High-Growth Potential: Investors want to see significant potential for growth and scalability. Can your business expand rapidly and capture a large market share?

- Strong Management Team: Investors invest in people as much as ideas. They need to believe in your team's ability to execute the business plan. Demonstrate experience, expertise, and a strong work ethic.

- Clear Market Opportunity: A well-defined target market with a significant need for your product or service is essential. Show your market research and demonstrate a clear understanding of your customer base.

- Defensible Business Model: How will you protect your business from competition? Do you have intellectual property protection, a strong brand, or a unique business model that creates a barrier to entry?

- Realistic Financials: Accurate financial projections and forecasting are critical. Investors want to see a clear path to profitability and a realistic assessment of potential risks.

Understanding due diligence is also critical. Investors will thoroughly investigate your business, so anticipate questions about your financials, your team's background, your market analysis, and your competitive landscape. Being prepared for these questions shows professionalism and builds trust. Keywords like "investor mindset," "due diligence," "high-growth potential," and "market opportunity" are crucial here.

Crafting a Compelling Narrative: Tell Your Story

Forget dry facts and figures; your pitch needs to be a compelling story. Investors connect with narratives that resonate emotionally and intellectually. Structure your pitch around a clear narrative arc:

- Problem: Clearly define the problem your business solves.

- Solution: Present your solution as the perfect answer to that problem.

- Market: Showcase the size and potential of your target market.

- Business Model: Explain how you generate revenue and achieve profitability.

- Team: Highlight the expertise and experience of your team.

- Financials: Present realistic and well-supported financial projections.

- Ask: Clearly state how much funding you are seeking and how it will be used.

Develop a concise and engaging pitch deck that visually supports your narrative. Practice your delivery until it's smooth and confident. Highlight your unique selling proposition (USP) – what makes your business different and better than the competition? Show passion and conviction; investors are drawn to entrepreneurs who believe in their vision. This section emphasizes keywords like "pitch deck," "storytelling," "unique selling proposition," and "investor presentation."

Mastering the Art of Delivery: Presenting with Confidence

Your delivery is as important as the content of your pitch. Non-verbal communication speaks volumes. Maintain strong eye contact, use confident body language, and project your voice clearly. Avoid jargon and communicate your ideas concisely and clearly.

- Practice: Rehearse your pitch extensively until you can deliver it flawlessly.

- Handle Tough Questions: Anticipate tough questions and prepare thoughtful answers. Maintain your composure even under pressure.

- Professionalism: Dress appropriately and maintain a professional demeanor throughout the presentation.

Strong presentation skills and public speaking confidence are essential. Knowing how to handle tough questions professionally is crucial. This section focuses on keywords like "presentation skills," "public speaking," "non-verbal communication," and "handling tough questions."

The Numbers Don't Lie: Financial Projections and Forecasting

Financial projections are the bedrock of any successful pitch. Investors need to see a clear path to profitability. Develop realistic and well-supported financial models that include:

- Key Financial Metrics: Revenue, expenses, profit margins, customer acquisition cost (CAC), and lifetime value (LTV) are vital metrics.

- Path to Profitability: Show how your business will become profitable and sustain growth.

- Risk Mitigation: Address potential risks and outline your mitigation strategies.

Accurate financial modeling and the ability to discuss key financial projections are critical. This section emphasizes keywords such as "financial projections," "financial modeling," "profitability," and "risk mitigation."

Beyond the Pitch: Post-Presentation Follow-Up

The pitch itself is only the first step. Effective follow-up is crucial.

- Thank-You Note: Send a personalized thank-you email reiterating your key points and expressing your gratitude for their time.

- Additional Information: Provide any additional information requested promptly and professionally.

- Maintain Contact: Follow up strategically, but avoid being pushy. Networking and building relationships with potential investors are long-term strategies.

This section focuses on keywords like "follow-up," "networking," "building relationships," and "investor relations."

Securing Your Investment in the Dragon's Den

Successfully navigating the "Dragon's Den," whether it’s a formal pitch competition, seeking angel investors, or presenting to venture capitalists, requires a multifaceted approach. Remember these key takeaways: understand your audience (investor mindset), craft a compelling narrative, master your delivery, present strong financials, and follow up effectively. A well-prepared and confidently delivered pitch is your key to securing the funding you need. Prepare for your own "Dragon's Den" moment. Use the strategies outlined in this guide to confidently approach angel investors, venture capital firms, or any pitch competition, and secure the funding to make your business dreams a reality.

Featured Posts

-

Duizenden Limburgse Bedrijven Op De Wachtlijst Van Enexis Wat Nu

May 02, 2025

Duizenden Limburgse Bedrijven Op De Wachtlijst Van Enexis Wat Nu

May 02, 2025 -

Ex Wallaby Phipps Australian Rugbys Global Struggle

May 02, 2025

Ex Wallaby Phipps Australian Rugbys Global Struggle

May 02, 2025 -

The Impact Of A Boycott Targets Experience With Shifting Dei Priorities

May 02, 2025

The Impact Of A Boycott Targets Experience With Shifting Dei Priorities

May 02, 2025 -

Review Hasbros Star Wars Shadow Of The Empire Dash Rendar Figure

May 02, 2025

Review Hasbros Star Wars Shadow Of The Empire Dash Rendar Figure

May 02, 2025 -

Kshmyrywn Ke Hqwq Jnwby Ayshyae Myn Amn Ky Dmant

May 02, 2025

Kshmyrywn Ke Hqwq Jnwby Ayshyae Myn Amn Ky Dmant

May 02, 2025

Latest Posts

-

Measles Surge Prompts Increased Us Vaccine Oversight

May 02, 2025

Measles Surge Prompts Increased Us Vaccine Oversight

May 02, 2025 -

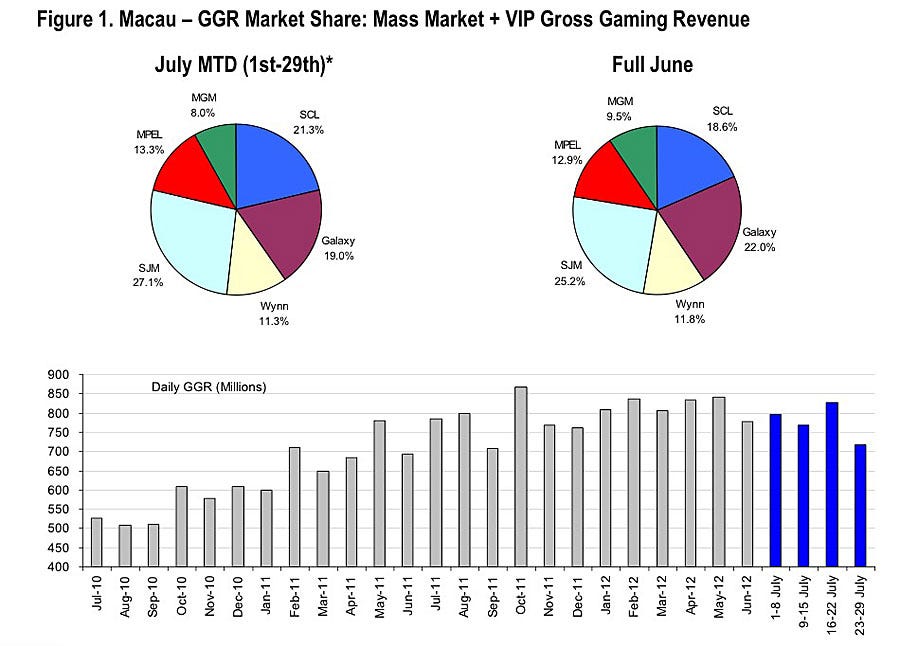

Post Golden Week Outlook Positive For Macau Gaming Revenue

May 02, 2025

Post Golden Week Outlook Positive For Macau Gaming Revenue

May 02, 2025 -

Stronger Than Feared Macaus Gaming Revenue Before Golden Week

May 02, 2025

Stronger Than Feared Macaus Gaming Revenue Before Golden Week

May 02, 2025 -

Rubio Seeks De Escalation As India Reasserts Call For Justice

May 02, 2025

Rubio Seeks De Escalation As India Reasserts Call For Justice

May 02, 2025 -

Macaus Gaming Revenue Beats Expectations Ahead Of Golden Week

May 02, 2025

Macaus Gaming Revenue Beats Expectations Ahead Of Golden Week

May 02, 2025