DRC Cobalt Export Ban: Analyzing The Market's Response And Future Outlook

Table of Contents

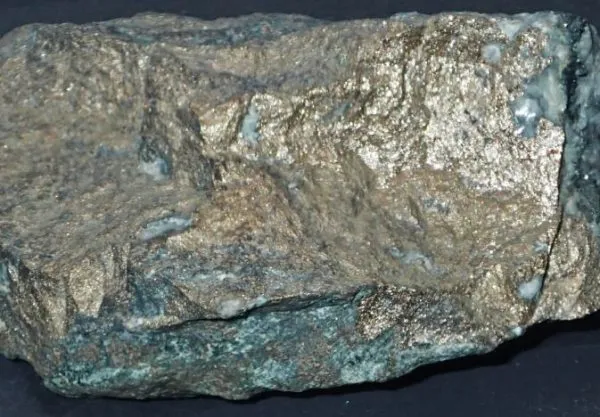

Immediate Market Reactions to a Potential DRC Cobalt Export Ban

A sudden DRC cobalt export ban would trigger immediate and significant market reactions, impacting various sectors globally.

Price Volatility and Supply Chain Disruptions

The most immediate consequence of a DRC cobalt export ban would be a sharp price surge. Cobalt prices, already subject to volatility, would likely skyrocket due to the drastically reduced supply. This would create significant supply chain bottlenecks, particularly affecting the EV manufacturing industry, which heavily relies on cobalt for battery production. Other cobalt-consuming sectors, including electronics and aerospace, would also experience disruptions, leading to production delays and increased costs.

- Increased cobalt prices: Expect a dramatic increase, potentially several-fold, depending on the duration of the ban.

- Delayed EV production: Automakers would face significant delays in meeting production targets.

- Search for alternative suppliers: A frantic scramble for alternative cobalt sources would ensue, potentially leading to less reliable and more expensive supply chains.

- Geopolitical tensions: The ban could exacerbate existing geopolitical tensions between the DRC and cobalt-importing nations.

Investor Sentiment and Market Uncertainty

A DRC cobalt export ban would severely impact investor sentiment. Investor confidence in cobalt mining companies and related industries would plummet, leading to stock market fluctuations and a decrease in investment in the sector. The overall market capitalization of cobalt-related businesses would likely suffer a significant decline. The uncertainty surrounding future cobalt supply would make investors highly risk-averse.

- Stock price drops: Expect sharp declines in the stock prices of companies involved in cobalt mining and processing.

- Reduced investment: New investment in cobalt exploration and development would likely dry up.

- Increased risk aversion: Investors would shift their capital towards less volatile sectors.

- Regulatory uncertainty: The lack of clarity surrounding future cobalt supply would increase regulatory uncertainty.

Strategic Responses to a DRC Cobalt Export Ban

Faced with a potential DRC cobalt export ban, industries and governments would need to implement strategic responses to mitigate the negative impacts.

Diversification of Cobalt Sources

Diversifying cobalt sourcing is paramount. Companies will need to actively seek alternative suppliers, investing in mining operations and exploration activities in countries like Australia, Canada, and Zambia, which possess significant cobalt reserves. However, scaling up production in these alternative locations presents logistical and economic challenges, including securing permits, building infrastructure, and attracting investment.

- Increased investment in alternative mines: Expect a surge in funding for cobalt projects outside the DRC.

- Exploration of new cobalt deposits: Significant investment will be directed toward exploring new cobalt deposits globally.

- Technological advancements in cobalt extraction: Innovation in extraction techniques could help make alternative sources more efficient and cost-effective.

Technological Innovation and Recycling Initiatives

Reducing reliance on cobalt altogether is a long-term strategic imperative. Research and development into cobalt-free battery technologies will become critical. The development and implementation of more efficient cobalt recycling technologies will also play a vital role in reducing demand for newly mined cobalt and securing a more sustainable supply chain.

- Development of cobalt-free batteries: Investment in alternative battery chemistries, such as lithium iron phosphate (LFP) batteries, will accelerate.

- Improvements in battery recycling technologies: Advances in recycling will increase the recovery rate of cobalt from end-of-life batteries.

- Increased demand for recycled cobalt: Recycled cobalt will become an increasingly important component of the supply chain.

Long-Term Outlook and Geopolitical Implications of a DRC Cobalt Export Ban

A DRC cobalt export ban would have profound long-term consequences, impacting the global EV industry and generating significant geopolitical ramifications.

Impact on the Global EV Industry

The long-term impact on the electric vehicle industry could be significant. A reduced cobalt supply could lead to slower EV adoption rates, increased EV production costs, and potential shifts in automotive industry strategies, potentially slowing down the global transition to electric vehicles and hindering climate change mitigation efforts.

- Slower EV adoption rates: Higher prices and supply constraints could dampen consumer demand for EVs.

- Increased EV production costs: The price of cobalt will directly influence the cost of EV batteries.

- Potential shifts in automotive industry strategies: Automakers may explore alternative battery technologies or vehicle designs.

Geopolitical and Economic Ramifications

A DRC cobalt export ban would likely increase geopolitical tensions. Countries reliant on DRC cobalt could exert diplomatic pressure, potentially leading to trade disputes or even conflict. The DRC itself would face significant economic implications, including potential loss of revenue and job losses, impacting its economic stability. International cooperation would be crucial to navigate this complex geopolitical landscape.

- Trade disputes: Expect potential trade conflicts between the DRC and its major trading partners.

- Diplomatic pressure: International bodies and governments may intervene to resolve the situation.

- Economic instability in the DRC: The ban could significantly harm the DRC's economy.

- Potential for conflict: The scarcity of cobalt could exacerbate existing tensions and conflicts in the region.

Conclusion

A potential DRC cobalt export ban presents significant challenges and uncertainties for the global market. The immediate impact would likely include price volatility and supply chain disruptions, while long-term consequences could affect the growth of the EV industry and have substantial geopolitical ramifications. Addressing this challenge requires a multi-pronged approach involving diversification of cobalt sources, technological innovation, and increased recycling efforts. Understanding the complexities of the DRC cobalt export ban is crucial for navigating the evolving landscape of the global cobalt market. Stay informed and prepared for the potential shifts in the cobalt market by researching further into alternative solutions and market trends surrounding the DRC cobalt export ban.

Featured Posts

-

Familiar Faces Top Baby Name Predictions For 2024

May 16, 2025

Familiar Faces Top Baby Name Predictions For 2024

May 16, 2025 -

Warriors Assessment Of Jimmy Butlers Game 3 Readiness

May 16, 2025

Warriors Assessment Of Jimmy Butlers Game 3 Readiness

May 16, 2025 -

Tom Cruises 1 Debt To Tom Hanks The Unpaid Role Story

May 16, 2025

Tom Cruises 1 Debt To Tom Hanks The Unpaid Role Story

May 16, 2025 -

Goldman Sachs On Trumps Ideal Oil Price Range 40 50 Per Barrel

May 16, 2025

Goldman Sachs On Trumps Ideal Oil Price Range 40 50 Per Barrel

May 16, 2025 -

Nhl Draft Lottery Fan Outrage Over Confusing Rules

May 16, 2025

Nhl Draft Lottery Fan Outrage Over Confusing Rules

May 16, 2025