Dubai Holding's REIT IPO: A $584 Million Offering

Table of Contents

Understanding the Dubai Holding REIT IPO

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-producing real estate. REITs offer investors several advantages, including diversification, relatively stable income streams through dividends, and professional management of the underlying real estate assets. Dubai Holding's REIT IPO offers a unique opportunity to gain exposure to a diversified portfolio of prime Dubai properties. The specifics of the offering will be detailed in the official prospectus, but key highlights typically include the number of shares offered, the price range per share, the expected listing date on a major exchange (likely the Dubai Financial Market or a similar exchange), and a detailed description of the underlying assets.

- Overview of Dubai Holding's real estate portfolio: The portfolio is expected to comprise a mix of commercial and residential properties strategically located across key areas of Dubai, offering exposure to diverse income streams. Details on the specific properties will be unveiled closer to the IPO date.

- Breakdown of the IPO offering structure: This will include information on the number of shares being offered to the public, the allocation process, the timeline for the IPO, and any potential over-allotment options.

- Key financial highlights and projected returns: The prospectus will contain projected financial statements, including details on projected rental income, property appreciation potential, and estimated dividend payouts.

- Expected listing exchange: The exact exchange where the REIT will be listed will be announced officially.

Investment Potential and Market Analysis

The Dubai real estate market is currently experiencing a period of robust growth fueled by factors such as increasing tourism, infrastructure development, and a favorable regulatory environment. This positive trajectory makes Dubai Holding's REIT IPO an attractive proposition for investors looking for substantial capital appreciation and consistent dividend income. The potential returns for investors will depend on several factors including rental income generated by the properties in the REIT's portfolio, potential appreciation in property values, and the frequency and level of dividend payouts.

- Growth projections for the Dubai real estate market: Independent market analyses provide positive forecasts for continued growth in the Dubai real estate sector.

- Analysis of comparable REITs and their performance: Comparing the Dubai Holding REIT to similar REITs in the region and globally will provide valuable benchmarks for potential performance.

- Assessment of the risks associated with investing in Dubai real estate: Like any investment, there are inherent risks. These include market fluctuations, interest rate changes, and potential regulatory shifts.

- Expected dividend yield and payout frequency: The projected dividend yield and the frequency of dividend payouts (e.g., annually, semi-annually, quarterly) will be crucial factors for income-oriented investors.

Who Should Invest in the Dubai Holding REIT IPO?

The Dubai Holding REIT IPO is likely to appeal to a range of investors, but it's essential to assess your personal risk tolerance and investment goals before committing. This IPO is suitable for investors with a medium-to-high risk tolerance and a long-term investment horizon.

- Ideal investor risk profile: Investors comfortable with market fluctuations and potential short-term price volatility are better suited for this investment.

- Investment time horizon suitability: This is a long-term investment suitable for investors who are not expecting immediate returns.

- Minimum investment requirements: The minimum investment amount will be specified in the IPO prospectus.

- Comparison to alternative investment opportunities in Dubai: The REIT offers a diversified approach compared to direct property investment or off-plan purchases.

Alternative Investment Options in Dubai Real Estate

Investing in Dubai real estate extends beyond the REIT IPO. Investors can consider direct property purchases (either existing or off-plan properties), private equity investments focused on real estate development, or investing in other UAE real estate investment trusts. Each option carries its own set of risks and potential rewards, demanding careful consideration of individual financial circumstances and investment objectives.

Conclusion

Dubai Holding's $584 million REIT IPO presents a significant investment opportunity for those seeking exposure to the dynamic Dubai real estate market. The potential for both capital appreciation and consistent dividend income is considerable, making it attractive to a broad range of investors. However, potential investors must carefully weigh the associated risks and ensure the investment aligns with their overall risk tolerance and financial goals. Conduct thorough due diligence, review the official prospectus, and consult with a qualified financial advisor before making any investment decisions regarding the Dubai Holding REIT IPO. For more information, visit the official Dubai Holding website to learn more about this exciting opportunity in UAE investment and Dubai real estate.

Featured Posts

-

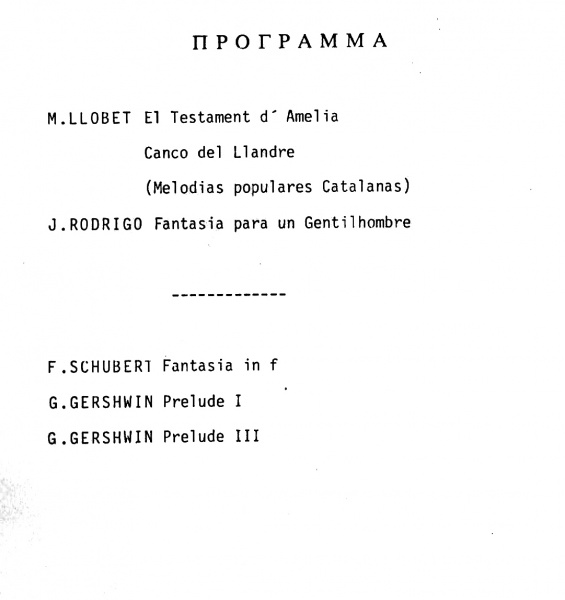

Dimotiko Odeio Rodoy Synaylia Ton Kathigiton Sti Dimokratiki

May 20, 2025

Dimotiko Odeio Rodoy Synaylia Ton Kathigiton Sti Dimokratiki

May 20, 2025 -

The Making Of A Billionaire Boy Inheritance Entrepreneurship And Luck

May 20, 2025

The Making Of A Billionaire Boy Inheritance Entrepreneurship And Luck

May 20, 2025 -

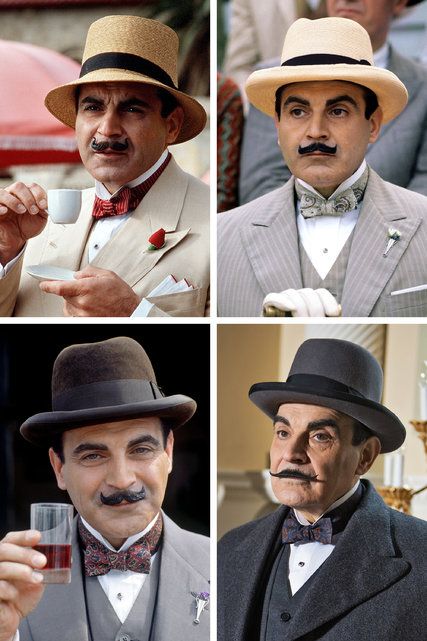

Exploring The Enduring Appeal Of Agatha Christies Poirot

May 20, 2025

Exploring The Enduring Appeal Of Agatha Christies Poirot

May 20, 2025 -

Urgent Action Needed Recent Murders Underscore The Pervasive Threat Of Femicide

May 20, 2025

Urgent Action Needed Recent Murders Underscore The Pervasive Threat Of Femicide

May 20, 2025 -

Femicide Understanding The Rise In Incidents

May 20, 2025

Femicide Understanding The Rise In Incidents

May 20, 2025