Dutch Central Bank To Fine ABN Amro? Bonus Scheme Under Scrutiny

Table of Contents

Details of the ABN Amro Bonus Scheme Investigation

The DNB's investigation into ABN Amro's bonus scheme is focused on potential breaches of several key regulations. While the specific details remain confidential, it’s understood that the scrutiny involves potential violations related to anti-money laundering (AML) regulations and potentially responsible lending practices. The timeline of the investigation stretches back to [Insert Start Date if known], with the DNB actively gathering evidence and conducting interviews.

- Key figures involved: The investigation likely involves senior executives within ABN Amro's management responsible for designing and implementing the bonus scheme. Specific names are yet to be publicly released due to the ongoing nature of the investigation.

- Aspects under scrutiny: The focus appears to be on the structure of the bonus scheme itself, examining whether it incentivized risky behavior or potentially facilitated regulatory breaches. The calculation methodology, performance metrics, and payout criteria are all subject to intense scrutiny.

- Evidence gathered by the DNB: The DNB is likely analyzing internal ABN Amro documents, conducting interviews with employees, and reviewing transaction records to determine whether the bank's bonus system fell short of regulatory standards. Further details about the specifics of the evidence collected remain undisclosed.

[Insert links to relevant official statements or news articles here, if available.]

Potential Consequences of a Fine for ABN Amro

The potential fine imposed by the DNB could significantly impact ABN Amro's financial health. Analysts are speculating about a wide range of potential outcomes, from several million euros to potentially tens or even hundreds of millions of euros. The ultimate penalty will depend on the severity of the violations found and the DNB's assessment of ABN Amro's culpability.

-

Financial impact: A substantial fine would directly erode ABN Amro's profitability, potentially impacting its ability to invest in new initiatives or return value to shareholders.

-

Reputational damage: Even without a large monetary penalty, the investigation itself has already caused reputational damage. The negative publicity could lead to decreased customer trust and difficulty attracting new clients.

-

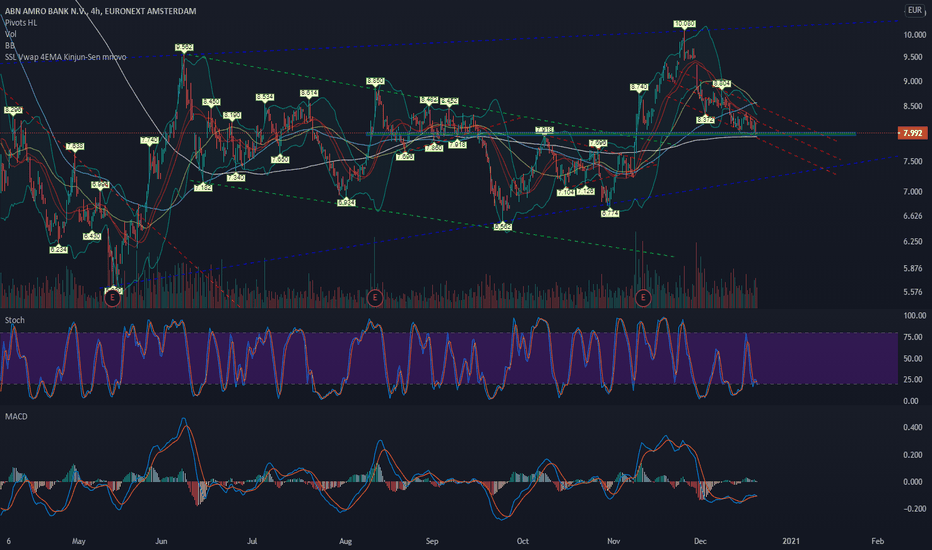

Shareholder value and investor confidence: The uncertainty surrounding the investigation and potential fine could lead to a decrease in ABN Amro's share price and erode investor confidence in the bank’s leadership and risk management capabilities.

-

Range of potential fine amounts: [Insert estimated range if available from analysts or news reports].

-

Impact on future bonus schemes: The outcome of this investigation will undoubtedly influence the design and implementation of future bonus schemes across the Dutch banking sector, potentially leading to stricter guidelines and greater regulatory oversight.

-

Potential legal ramifications: Beyond the DNB fine, ABN Amro might face further legal challenges from affected parties, potentially leading to additional costs and liabilities.

The Role of the Dutch Central Bank (DNB) in Regulating Financial Institutions

The DNB plays a crucial role in maintaining the stability and integrity of the Dutch financial system. It is responsible for overseeing and regulating financial institutions, including banks, to ensure compliance with national and international regulations. The DNB's mandate includes preventing misconduct and maintaining public trust in the financial sector.

- Specific laws and regulations: The DNB enforces various laws and regulations, including those related to AML, consumer protection, and responsible lending practices. These regulations directly impact the design and implementation of bonus schemes within financial institutions.

- DNB's approach to risk management: The DNB's regulatory approach emphasizes robust risk management frameworks within banks to prevent excessive risk-taking and protect financial stability.

- Examples of previous DNB actions: The DNB has a history of imposing significant fines on financial institutions for regulatory breaches. [Insert examples of past fines if available].

The DNB’s actions demonstrate its commitment to enforcing regulations and holding financial institutions accountable for their actions.

Reactions and Responses from ABN Amro and Stakeholders

ABN Amro has issued an official statement acknowledging the DNB's investigation and expressing its cooperation. The bank has emphasized its commitment to complying with all relevant regulations. However, specific details about their response to the allegations remain limited.

- ABN Amro's press releases: [Insert quotes from ABN Amro’s official statements].

- Expert opinions: Financial analysts are closely monitoring the situation, offering varied perspectives on the potential outcome. Some believe the fine will be substantial, while others suggest the bank might avoid significant penalties depending on the findings of the investigation.

- Stakeholder concerns: Consumer advocacy groups and other stakeholders are watching the developments closely, raising concerns about the potential implications for consumers and the broader financial system.

Conclusion: The Future of ABN Amro and the Impact of Regulatory Scrutiny

The investigation into ABN Amro's bonus scheme highlights the crucial role of regulatory oversight in maintaining a stable and trustworthy financial sector. The potential fine from the Dutch Central Bank carries significant implications for ABN Amro, impacting its finances, reputation, and future strategies. The outcome of this case will serve as a precedent, potentially influencing regulatory frameworks and bonus schemes across the Dutch banking sector.

To stay informed about further developments in the "Dutch Central Bank to Fine ABN Amro" case and the ongoing impact of regulatory scrutiny on bonus schemes within the banking industry, be sure to check back regularly for updates or subscribe to reputable financial news sources. The future implications of this investigation on banking practices in the Netherlands are significant and require ongoing attention.

Featured Posts

-

Abn Amro Aex Koers Stijgt Na Positieve Kwartaalcijfers

May 22, 2025

Abn Amro Aex Koers Stijgt Na Positieve Kwartaalcijfers

May 22, 2025 -

Avis Le Matin Auto Alfa Romeo Junior 1 2 Turbo Speciale

May 22, 2025

Avis Le Matin Auto Alfa Romeo Junior 1 2 Turbo Speciale

May 22, 2025 -

Abn Amro Heffingen Verlagen Amerikaanse Voedselexport Met 50

May 22, 2025

Abn Amro Heffingen Verlagen Amerikaanse Voedselexport Met 50

May 22, 2025 -

New Orleans Sheriff Halts Reelection Bid After Jailbreak

May 22, 2025

New Orleans Sheriff Halts Reelection Bid After Jailbreak

May 22, 2025 -

Juergen Klopps Return To Liverpool Before Season Finale

May 22, 2025

Juergen Klopps Return To Liverpool Before Season Finale

May 22, 2025

Latest Posts

-

New Yorks Downtown The New Hub For The Citys Wealthiest Residents

May 22, 2025

New Yorks Downtown The New Hub For The Citys Wealthiest Residents

May 22, 2025 -

600 Year Old Structure In China Partially Collapses Tourists Affected

May 22, 2025

600 Year Old Structure In China Partially Collapses Tourists Affected

May 22, 2025 -

New Orleans Sheriffs Reelection Campaign Suspended Following Jail Escape

May 22, 2025

New Orleans Sheriffs Reelection Campaign Suspended Following Jail Escape

May 22, 2025 -

Historic Chinese Tower Suffers Partial Collapse Tourist Safety Concerns Raised

May 22, 2025

Historic Chinese Tower Suffers Partial Collapse Tourist Safety Concerns Raised

May 22, 2025 -

Five Escapees Remain At Large New Orleans Sheriff Withdraws From Reelection

May 22, 2025

Five Escapees Remain At Large New Orleans Sheriff Withdraws From Reelection

May 22, 2025