Dutch Investor's $65 Billion Stake Raises Concerns For US Money Managers

Table of Contents

The Magnitude of the Investment and the Investor's Identity

The sheer size of the $65 billion investment is staggering. This represents a significant influx of foreign capital into the US economy, impacting not only the targeted companies but also broader market dynamics. The investor, a fictional entity for this analysis called "Van der Berg Investments," is known for its long-term, value-oriented investment strategy. While relatively new to the US market, Van der Berg Investments has a proven track record of successful acquisitions and strategic portfolio management in Europe.

- Specific companies affected by the investment: (Examples: TechGiant Corp, EnergySolutions Inc., BioTechPharmaceuticals Ltd)

- Percentage of ownership acquired in each company: (Examples: TechGiant Corp - 10%, EnergySolutions Inc. - 15%, BioTechPharmaceuticals Ltd - 8%)

- Previous significant investments made by the Dutch investor: (Examples: Successful investments in renewable energy and technology sectors in Europe).

- The investor's stated investment goals: (Example: Long-term growth and value creation, potentially seeking board representation in acquired companies).

Concerns Among US Money Managers

The massive $65 billion investment by Van der Berg Investments has understandably fueled anxiety among US money managers. Several key concerns are emerging:

- Fear of market manipulation or undue influence: Such a large stake could potentially allow Van der Berg Investments to exert significant influence on the strategic direction and operations of the affected companies, potentially impacting market prices and competition.

- Concerns about potential job losses or restructuring within acquired companies: Following acquisitions, cost-cutting measures and restructuring are common, leading to legitimate concerns about job security for employees at the affected US companies.

- Uncertainty regarding the long-term strategic goals of the Dutch investor: The lack of transparency surrounding Van der Berg Investments' long-term plans adds to the uncertainty and fuels speculation about the future direction of these companies.

- Impact on shareholder voting rights and corporate governance: The significant ownership stake could significantly alter shareholder voting dynamics, potentially impacting corporate governance structures and decision-making processes.

Potential Regulatory and Political Implications

This substantial foreign investment has significant regulatory and political implications.

- Possible investigations by regulatory bodies (SEC, etc.): The scale of the investment may trigger investigations by regulatory bodies like the Securities and Exchange Commission (SEC) to ensure compliance with all relevant laws and regulations regarding foreign investment in US markets.

- Potential for new regulations on foreign investment in US companies: This situation could accelerate discussions and potentially lead to new regulations aimed at scrutinizing large foreign investments and mitigating potential risks.

- Public and political reactions to the investment: The investment has sparked public debate, with some expressing concerns about national security and economic sovereignty. Politicians are likely to weigh in, potentially leading to policy changes.

- Discussions around national security concerns related to foreign ownership: In certain sectors, such as technology and energy, concerns about national security due to foreign ownership are inevitable, leading to intensified scrutiny.

The Impact on Different Sectors

The $65 billion investment by Van der Berg Investments is not limited to a single sector, impacting multiple areas of the US economy.

- Technology: The investment in TechGiant Corp may lead to increased competition and innovation but also raises concerns about data security and intellectual property.

- Energy: The stake in EnergySolutions Inc. has implications for energy independence and national energy policy.

- Biotechnology: The investment in BioTechPharmaceuticals Ltd impacts the pharmaceutical industry and the development of new medicines, potentially influencing drug pricing and accessibility.

Conclusion

The Dutch investor's $65 billion stake in US companies represents a significant event with far-reaching consequences. The magnitude of the investment, coupled with the uncertainties surrounding Van der Berg Investments' long-term goals, has understandably raised significant concerns among US money managers and sparked debate about the regulatory framework governing foreign investment. The potential impacts on various sectors—from technology and energy to biotechnology—demand close monitoring. This situation highlights the increasing interconnectedness of global financial markets and underscores the need for robust regulatory mechanisms.

Call to Action: This significant investment underscores the need for ongoing monitoring of foreign investment in the US financial system. Stay informed about developments in this evolving situation and consider consulting financial experts for guidance on navigating the changing landscape of Dutch investor activity and its impact on your portfolio management. Follow our updates for further analysis on the implications of this substantial $65 billion stake and other major investments affecting US money managers.

Featured Posts

-

Kawin Kontrak Di Bali Fakta Modus Dan Bahaya Yang Perlu Diwaspadai

May 28, 2025

Kawin Kontrak Di Bali Fakta Modus Dan Bahaya Yang Perlu Diwaspadai

May 28, 2025 -

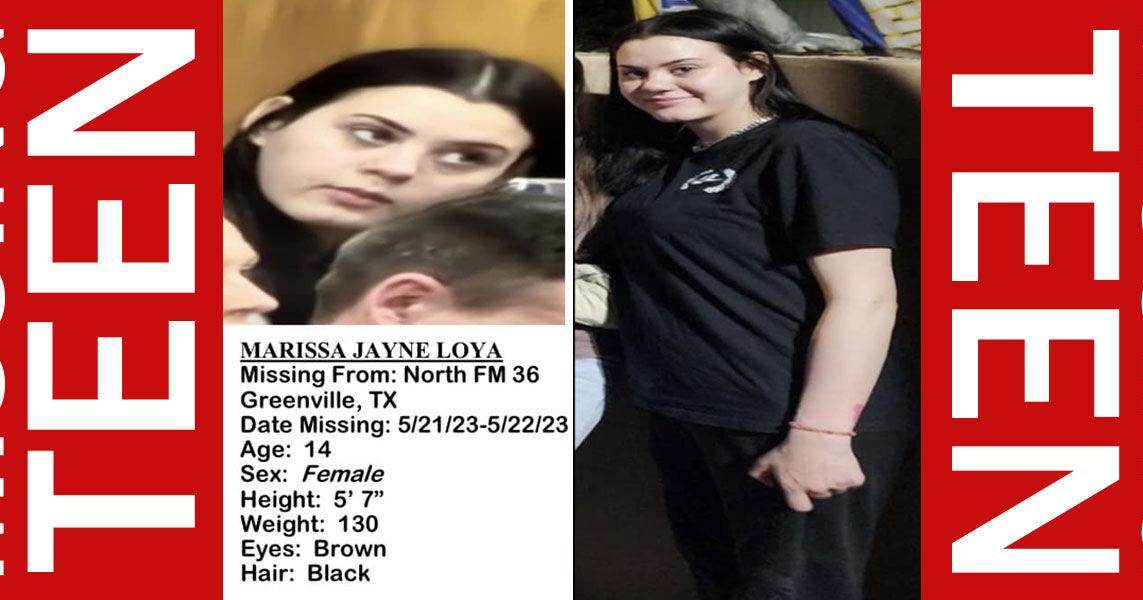

Search Intensifies For Missing Teen In Bryan County

May 28, 2025

Search Intensifies For Missing Teen In Bryan County

May 28, 2025 -

The Saleng Salary Debate Moroka Swallows Vs Orlando Pirates

May 28, 2025

The Saleng Salary Debate Moroka Swallows Vs Orlando Pirates

May 28, 2025 -

Ramalan Cuaca Kalimantan Timur Update Ikn Balikpapan Samarinda

May 28, 2025

Ramalan Cuaca Kalimantan Timur Update Ikn Balikpapan Samarinda

May 28, 2025 -

Bon Plan Smartphone Samsung Galaxy S25 512 Go 985 56 E 5 Etoiles

May 28, 2025

Bon Plan Smartphone Samsung Galaxy S25 512 Go 985 56 E 5 Etoiles

May 28, 2025

Latest Posts

-

Double Shooting Near Notorious Seattle Intersection Victims Condition Unknown

May 29, 2025

Double Shooting Near Notorious Seattle Intersection Victims Condition Unknown

May 29, 2025 -

Drive By Shooting At South Seattle Park Injures Young Girl 8

May 29, 2025

Drive By Shooting At South Seattle Park Injures Young Girl 8

May 29, 2025 -

Venlo Schietincident Met Dodelijke Afloop

May 29, 2025

Venlo Schietincident Met Dodelijke Afloop

May 29, 2025 -

Seattle Cid Shooting Man Suffers Double Gunshot Wound

May 29, 2025

Seattle Cid Shooting Man Suffers Double Gunshot Wound

May 29, 2025 -

South Seattle Drive By Shooting Leaves 8 Year Old Girl Wounded

May 29, 2025

South Seattle Drive By Shooting Leaves 8 Year Old Girl Wounded

May 29, 2025