Dutch Stocks Suffer Another Setback Amidst Escalating US Trade War

Table of Contents

Impact of US Tariffs on Dutch Exports

The imposition of US tariffs on various Dutch goods has significantly impacted the country's export sector, triggering a ripple effect throughout the Dutch economy. This negative impact is felt through decreased demand and increased production costs.

Decreased Demand for Dutch Goods

Increased tariffs on Dutch exports to the US have directly reduced demand, leading to lower sales and, in some cases, production cuts. This is particularly noticeable in sectors heavily reliant on US trade.

- Agriculture: Dutch agricultural exports, including dairy products and flowers, have faced substantial challenges due to increased tariffs, leading to reduced export volumes and lower prices for farmers.

- Manufacturing: Industries like machinery and precision instruments, which rely on US markets, have seen a decline in orders and a subsequent slowdown in production. This impacts employment and overall economic growth.

- Impact on AEX-listed Companies: Several companies listed on the Amsterdam Stock Exchange (AEX), including those in the agricultural and manufacturing sectors, have reported lower profits and revised downward their growth forecasts as a direct result of reduced US demand. For example, [Insert example of a real or hypothetical AEX-listed company and its specific challenges]. Statistics showing a decline in Dutch exports to the US would further strengthen this point.

Increased Production Costs

Retaliatory tariffs imposed by other countries on US goods have indirectly impacted Dutch businesses by increasing the cost of raw materials and components. This increase in input costs directly affects the profitability of Dutch companies.

- Increased raw material prices: The trade war has led to increased prices for various raw materials essential for Dutch industries, impacting production costs across the board.

- Supply chain disruptions: The global uncertainty caused by the trade war has also led to disruptions in supply chains, making it more expensive and difficult for Dutch companies to source necessary components.

- Impact on profit margins: The combined effect of increased input costs and decreased demand has significantly squeezed profit margins for numerous Dutch companies, impacting their competitiveness and overall stock performance.

Investor Sentiment and Market Volatility

The ongoing US trade war has created significant uncertainty in global markets, leading to a shift in investor sentiment and increased market volatility. This uncertainty has negatively impacted Dutch stocks.

Flight to Safety

Global economic uncertainty driven by the trade war has prompted investors to move their money away from riskier assets, including Dutch stocks, and into safer havens like government bonds.

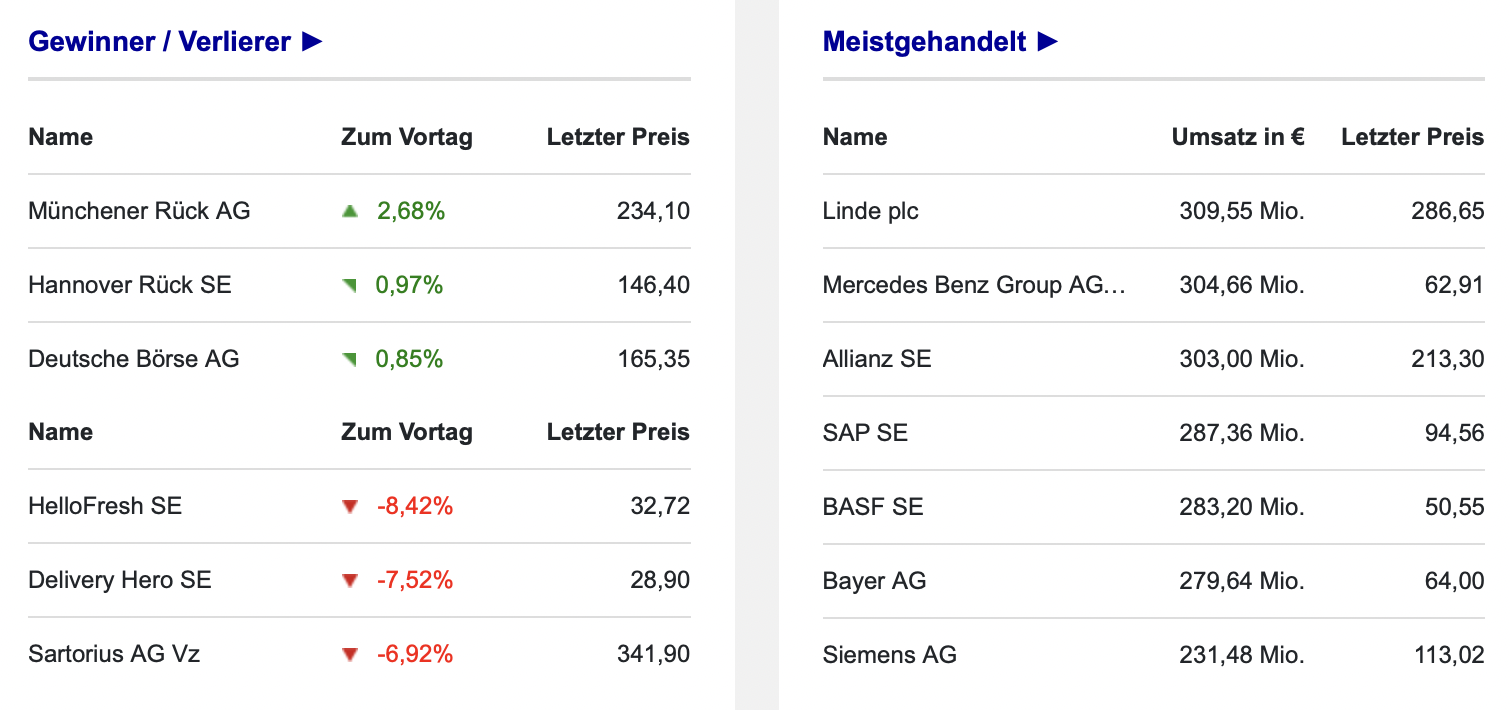

- AEX Index Performance: The AEX index, a benchmark for Dutch stocks, has shown a [Insert actual or hypothetical performance data, e.g., "significant decline" or "underperformance compared to other major indices like the DAX or CAC 40"] in recent months, reflecting this flight to safety.

- Reduced Investor Confidence: The negative outlook for global trade has eroded investor confidence, leading to reduced investment in Dutch equities.

Currency Fluctuations

Fluctuations in the Euro against the US dollar directly affect the competitiveness of Dutch exports and the value of Dutch stocks.

- Impact on export competitiveness: A weaker Euro can make Dutch exports more competitive in international markets, potentially offsetting some of the negative impact of US tariffs. However, a stronger dollar can hurt competitiveness.

- Impact on stock valuations: Currency fluctuations influence the value of Dutch stocks held by international investors, impacting the overall performance of the AEX. Charts illustrating Euro/USD exchange rate fluctuations could visually reinforce this point.

Government Response and Economic Outlook

The Dutch government has implemented measures to mitigate the negative impact of the US trade war, but the overall economic outlook remains uncertain.

Government Measures

The Dutch government has responded with several measures aimed at supporting businesses and boosting the economy. These measures may include:

- Economic stimulus packages: [Insert details on any actual or planned stimulus packages, for example: "The government has announced a €X billion stimulus package focused on supporting affected industries."]

- Support for affected industries: [Insert details of specific industry support measures, for example: "Specific programs have been created to provide financial aid and tax breaks to companies in the agricultural and manufacturing sectors."]

Future Economic Projections

Forecasts for the Dutch economy vary depending on the resolution (or lack thereof) of the US trade war.

- Potential for recovery: If the trade war de-escalates, the Dutch economy could potentially recover relatively quickly, given its strong fundamentals.

- Potential for further decline: A prolonged trade war could lead to a more significant and lasting negative impact on the Dutch economy, resulting in slower growth and potentially even recession. [Insert forecasts from reputable institutions like the CPB Netherlands Bureau for Economic Policy Analysis].

Conclusion

The escalating US trade war is having a significant negative impact on Dutch stocks. Factors such as decreased demand for Dutch goods due to US tariffs, increased production costs, investor flight to safety, and currency fluctuations all contribute to this downturn. While the Dutch government is taking steps to mitigate the negative consequences, the future economic outlook remains uncertain and heavily dependent on the resolution of the US trade war.

Call to Action: Stay informed about the evolving situation regarding the US trade war and its impact on Dutch stocks. Regularly review economic news, consult financial experts, and monitor the AEX index and other relevant indicators to make informed decisions regarding your investments in Dutch stocks and the Dutch economy. Understanding the dynamics of the US trade war is crucial for navigating the current challenges facing Dutch stocks and making sound investment choices.

Featured Posts

-

Nyr Porsche Macan 100 Rafdrifinn

May 25, 2025

Nyr Porsche Macan 100 Rafdrifinn

May 25, 2025 -

Zhizn Posle Evrovideniya Konchita Vurst O Kaming Aute I Buduschikh Rolyakh

May 25, 2025

Zhizn Posle Evrovideniya Konchita Vurst O Kaming Aute I Buduschikh Rolyakh

May 25, 2025 -

Controversy Erupts Ferrari Boss Condemns Hamiltons Remarks

May 25, 2025

Controversy Erupts Ferrari Boss Condemns Hamiltons Remarks

May 25, 2025 -

Dax Verluste Bei Frankfurter Aktienmarktoeffnung Am 21 Maerz 2025

May 25, 2025

Dax Verluste Bei Frankfurter Aktienmarktoeffnung Am 21 Maerz 2025

May 25, 2025 -

Classic Art Week 2025 Porsche Hadirkan Perpaduan Seni Dan Otomotif Di Indonesia

May 25, 2025

Classic Art Week 2025 Porsche Hadirkan Perpaduan Seni Dan Otomotif Di Indonesia

May 25, 2025

Latest Posts

-

Jan 6th Allegations Trump Supporter Ray Epps Files Defamation Suit Against Fox News

May 25, 2025

Jan 6th Allegations Trump Supporter Ray Epps Files Defamation Suit Against Fox News

May 25, 2025 -

Cocaine Found At White House Secret Service Announces Conclusion Of Investigation

May 25, 2025

Cocaine Found At White House Secret Service Announces Conclusion Of Investigation

May 25, 2025 -

Ray Epps Sues Fox News For Defamation Jan 6th Claims At The Center Of The Lawsuit

May 25, 2025

Ray Epps Sues Fox News For Defamation Jan 6th Claims At The Center Of The Lawsuit

May 25, 2025 -

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025