EToro's Return To The IPO Market: A $500 Million Goal

Table of Contents

eToro's Previous IPO Attempt and Lessons Learned

eToro's previous attempt at an IPO ended in withdrawal. While the exact reasons weren't publicly detailed, several factors likely contributed to the decision.

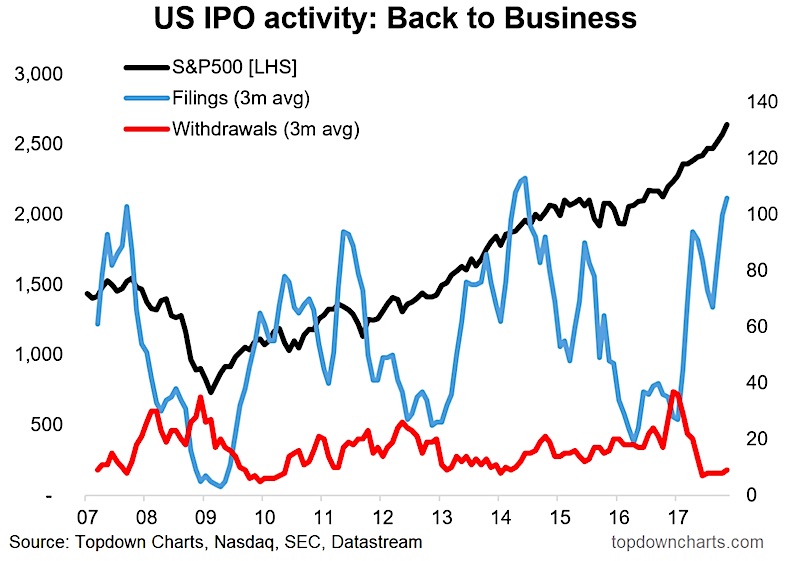

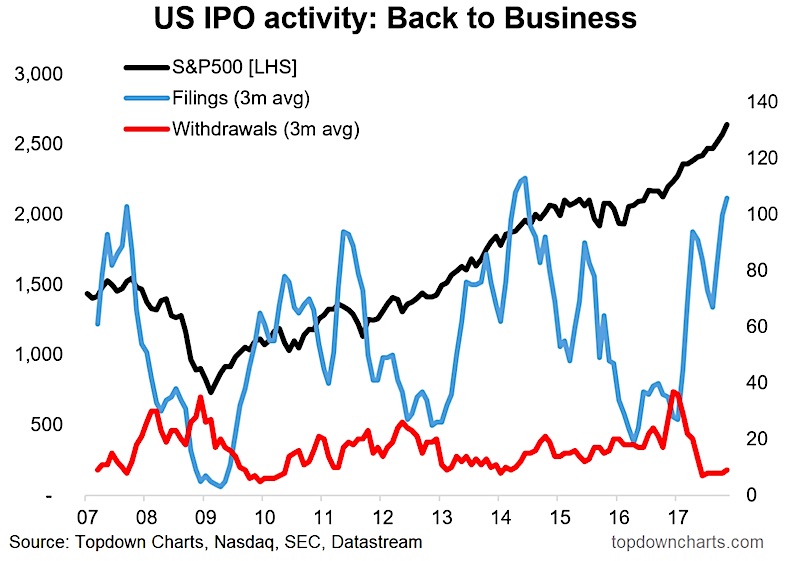

- Market conditions at the time of the previous attempt: The global economic climate and investor sentiment played a significant role. A volatile market and uncertainty surrounding regulatory changes likely influenced the decision to postpone.

- Specific challenges encountered: eToro might have faced challenges in meeting specific investor expectations regarding valuation or demonstrating sufficient growth to justify the IPO price.

- Strategic adjustments made since the previous attempt: Since the last attempt, eToro has likely refined its business strategy, focusing on areas like profitability and regulatory compliance. They may have also adjusted their growth trajectory and market approach.

- Improved financial performance since the last attempt: Demonstrating improved financial performance, including increased revenue and user growth, is crucial for a successful eToro IPO. Stronger financials significantly boost investor confidence.

These strategic changes and improved performance are key factors behind eToro's renewed confidence in pursuing an IPO. Understanding the lessons learned from the previous eToro IPO failure is vital in assessing the feasibility of this new attempt.

The $500 Million Valuation: Realistic Expectations?

A $500 million valuation for eToro is ambitious. Whether it's achievable depends on several factors.

- Comparison to similar companies' valuations: Comparing eToro's valuation to other publicly traded companies in the fintech and social trading sectors is crucial. This benchmark helps determine if the $500 million target is realistic.

- Assessment of eToro's market position and growth potential: eToro's market share, user base growth, and overall market penetration are key indicators. Strong growth and a robust market position enhance the likelihood of achieving the target valuation.

- Examination of current market conditions and investor sentiment: Positive investor sentiment and favorable market conditions are essential for a successful IPO. A bearish market could negatively impact eToro's valuation.

- Analysis of eToro's revenue streams and profitability: Consistent revenue growth and profitability are crucial for attracting investors. A clear path to profitability enhances investor confidence and supports the proposed eToro market capitalization.

Achieving the $500 million valuation requires a compelling narrative showcasing robust growth, strong financials, and a clear path to future success. This includes demonstrating a sustainable business model and managing the risks associated with the eToro stock price prediction.

Key Factors Driving eToro's Return to the IPO Market

Several factors motivate eToro's renewed pursuit of an IPO.

- Capital raising for expansion and growth initiatives: An IPO provides access to significant capital that can fuel expansion plans, new product development, and further market penetration. This is a major driver for growth-focused companies like eToro.

- Increased brand awareness and market visibility: A successful IPO significantly boosts brand visibility and recognition, attracting new users and strengthening eToro's market position.

- Potential for attracting top talent: IPO status enhances eToro's attractiveness to top talent, contributing to its ability to innovate and compete effectively.

- Enhanced liquidity for existing investors: An IPO allows existing investors to sell their shares, creating liquidity and enabling them to realize their investment returns.

These factors underscore the strategic rationale behind eToro's decision to revisit the IPO route, highlighting the potential benefits for both the company and its investors. Analyzing eToro's expansion plans and growth strategy provides further insights into their ambitions.

Regulatory Landscape and Potential Hurdles

Navigating the regulatory landscape is a critical aspect of eToro's IPO journey.

- Compliance with relevant regulations in different jurisdictions: eToro operates globally, requiring compliance with diverse and evolving regulations. This presents significant complexities.

- Potential scrutiny from regulatory bodies: Regulatory bodies scrutinize IPOs, requiring eToro to demonstrate robust compliance and transparent business practices.

- Navigating the complexities of the IPO process: The IPO process itself is complex, involving legal, financial, and marketing considerations. Effective management is crucial.

Understanding the eToro regulation and compliance requirements is paramount in assessing the potential risks and challenges associated with the IPO.

Impact on Investors and the Broader Market

A successful eToro IPO would have a significant impact on investors and the broader market.

- Opportunities for investors to participate in eToro's growth: The IPO presents an opportunity for investors to gain exposure to a rapidly growing company in the fintech sector.

- Potential risks associated with investing in eToro's stock: Investing in stocks carries inherent risks. Factors influencing the eToro stock investment include market volatility and the company's performance.

- Influence on the broader social trading and investment sector: eToro's success could influence the broader social trading sector, attracting further investment and innovation.

Investors must carefully weigh the potential benefits and risks before investing in eToro stock. Understanding the intricacies of social trading stocks is crucial for informed decision-making.

Conclusion

eToro's renewed attempt at a $500 million IPO is a significant development in the fintech world. While challenges remain, the potential rewards are substantial. The success of the eToro IPO hinges on factors such as favorable market conditions, effective regulatory navigation, and the company's continued strong financial performance. Stay updated on all developments regarding the eToro IPO and consider its implications for your investment strategy. Learn more about the intricacies of the eToro IPO and its implications for the future of social trading by following reputable financial news sources. Stay informed about the progress of the eToro IPO and its potential impact on your investment strategy.

Featured Posts

-

The 10 Strongest Pokemon Teams Used By Ash Ketchum

May 14, 2025

The 10 Strongest Pokemon Teams Used By Ash Ketchum

May 14, 2025 -

Cannonball U Tv Show Episode Guide And Air Dates

May 14, 2025

Cannonball U Tv Show Episode Guide And Air Dates

May 14, 2025 -

Premier League Interest In Youngster Dean Huijsen The Latest Transfer Talk

May 14, 2025

Premier League Interest In Youngster Dean Huijsen The Latest Transfer Talk

May 14, 2025 -

Nominations Recentes Chez Societe Generale

May 14, 2025

Nominations Recentes Chez Societe Generale

May 14, 2025 -

Michigan Coffee Creamer Recall Potential Health Risks

May 14, 2025

Michigan Coffee Creamer Recall Potential Health Risks

May 14, 2025