Easing Bond Forward Regulations: A Key Demand From Indian Insurers

Table of Contents

Increased Investment Opportunities and Portfolio Diversification

Current bond forward regulations significantly limit the investment options available to Indian insurers, hindering their ability to effectively manage risk and maximize returns. Easing these restrictions would unlock a plethora of benefits:

-

Keywords: Portfolio diversification, investment options, risk management, fixed income, bond market access

-

Bullet Points:

- Restricted Access: Current regulations constrain insurers' access to a diverse range of investment opportunities within the Indian bond market, forcing them to rely heavily on a limited set of instruments.

- Improved Risk Management: Diversification is a cornerstone of effective risk management. Easing bond forward regulations would enable insurers to spread their investments across a wider range of fixed-income securities, mitigating the impact of potential losses in any single asset class.

- Enhanced Portfolio Returns: Access to a broader spectrum of fixed-income instruments, including corporate bonds, government securities, and other debt instruments, allows for optimized portfolio construction, potentially leading to higher overall returns.

- Increased Market Liquidity: Greater participation by insurers in the bond market would inject significant liquidity, benefiting all market participants. This improved liquidity leads to more efficient price discovery and reduced transaction costs.

-

Detailed explanation: The current regulatory framework often prioritizes safety over returns, leading to a conservative investment strategy for insurers. This limits their ability to participate in potentially higher-yielding segments of the bond market. For example, restrictions on investing in certain types of corporate bonds limit potential gains and also stifle the growth of the corporate bond market itself. Relaxing these restrictions, while maintaining appropriate risk oversight, could allow insurers to achieve better risk-adjusted returns and contribute to the overall growth of the Indian bond market. This could be modeled through comparative analysis of investment strategies in countries with more liberalized bond forward markets.

Enhanced Competitiveness and Growth of the Indian Insurance Market

Easing bond forward regulations would significantly enhance the competitiveness of the Indian insurance market, both domestically and internationally.

-

Keywords: Market competitiveness, insurance growth, global competitiveness, foreign investment, financial stability

-

Bullet Points:

- Attracting Foreign Investment: A more liberalized regulatory environment would attract substantial foreign direct investment (FDI) into the Indian insurance sector, injecting much-needed capital and expertise.

- Promoting Innovation: Increased competition, fostered by greater participation from both domestic and international players, would drive innovation in product offerings, service delivery, and risk management strategies. This ultimately benefits consumers through better choices and more competitive pricing.

- Improved Financial Stability: A more diversified investment portfolio, resulting from eased regulations, contributes to greater financial stability for insurance companies, reducing their vulnerability to market shocks.

- Global Benchmarks: Alignment with international best practices in bond forward regulations would enhance the credibility and attractiveness of the Indian insurance market on the global stage.

-

Detailed explanation: The current regulatory environment can be perceived as a barrier to entry for both domestic and international insurers. Easing these restrictions sends a positive signal to potential investors, demonstrating the government's commitment to promoting a more dynamic and competitive insurance sector. This, in turn, stimulates economic growth and creates more jobs.

Addressing Liquidity Concerns and Improving Market Efficiency

The Indian bond market's liquidity is often cited as an area needing improvement. Increased participation from insurers, facilitated by easing bond forward regulations, can significantly address this issue.

-

Keywords: Market liquidity, trading volume, price discovery, regulatory efficiency, market depth

-

Bullet Points:

- Increased Trading Volume: Greater insurer participation would lead to a substantial increase in trading volume in the bond market, enhancing liquidity and making it easier for investors to buy and sell bonds.

- Efficient Price Discovery: Improved liquidity leads to more efficient price discovery mechanisms, ensuring that bond prices accurately reflect their underlying value. This benefits all market participants.

- Reduced Volatility: A deeper and more liquid bond market is less susceptible to sudden price swings, providing greater price stability and reducing risk for investors.

- Streamlined Regulatory Framework: A more efficient and simplified regulatory framework surrounding bond forwards reduces operational complexities and fosters greater market participation.

-

Detailed explanation: Currently, the relatively low trading volumes in certain segments of the Indian bond market can lead to price volatility and inefficiencies. Greater participation by insurance companies, with their substantial investment capacity, would improve liquidity, resulting in tighter bid-ask spreads and more accurate price discovery.

Specific Regulatory Changes Needed for Improvement

To achieve these benefits, specific regulatory changes are necessary. These could include:

-

Keywords: Regulatory framework, policy changes, amendment proposals, legal reforms

-

Bullet Points:

- Relaxing Investment Limits: Review and potentially increase the permitted exposure of insurers to certain asset classes within the bond market, ensuring appropriate risk management frameworks are in place.

- Streamlining Approval Processes: Simplify and expedite the process for insurers to obtain approvals for bond forward transactions, reducing bureaucratic hurdles.

- Clarifying Regulatory Guidance: Issue clear and unambiguous guidelines on permissible investment strategies related to bond forwards, reducing ambiguity and fostering greater investor confidence.

- Strengthening Risk Management Frameworks: While easing regulations, it's crucial to strengthen risk management frameworks and supervisory mechanisms to ensure the stability of the insurance sector.

-

Detailed explanation: These specific proposals require detailed analysis of the current regulatory framework and careful consideration of potential risks. A phased approach, starting with targeted amendments and gradually increasing the degree of liberalization, might be a prudent strategy. Consultation with stakeholders, including insurers, regulators, and market participants, is crucial in designing effective and sustainable policy changes.

Conclusion

Easing bond forward regulations is not merely a desirable step; it's a crucial catalyst for the growth and development of the Indian insurance sector. It will unlock significant investment opportunities, foster greater market efficiency, and markedly enhance the sector's overall competitiveness. This will lead to increased financial stability, improved consumer services, and substantial contributions to the nation's economic progress. The Indian government should prioritize easing bond forward regulations to unlock the full potential of the insurance sector. This crucial step will facilitate sustainable growth and contribute to the nation's economic progress. Let's advocate for sensible reforms in bond forward regulations to benefit the entire Indian insurance market.

Featured Posts

-

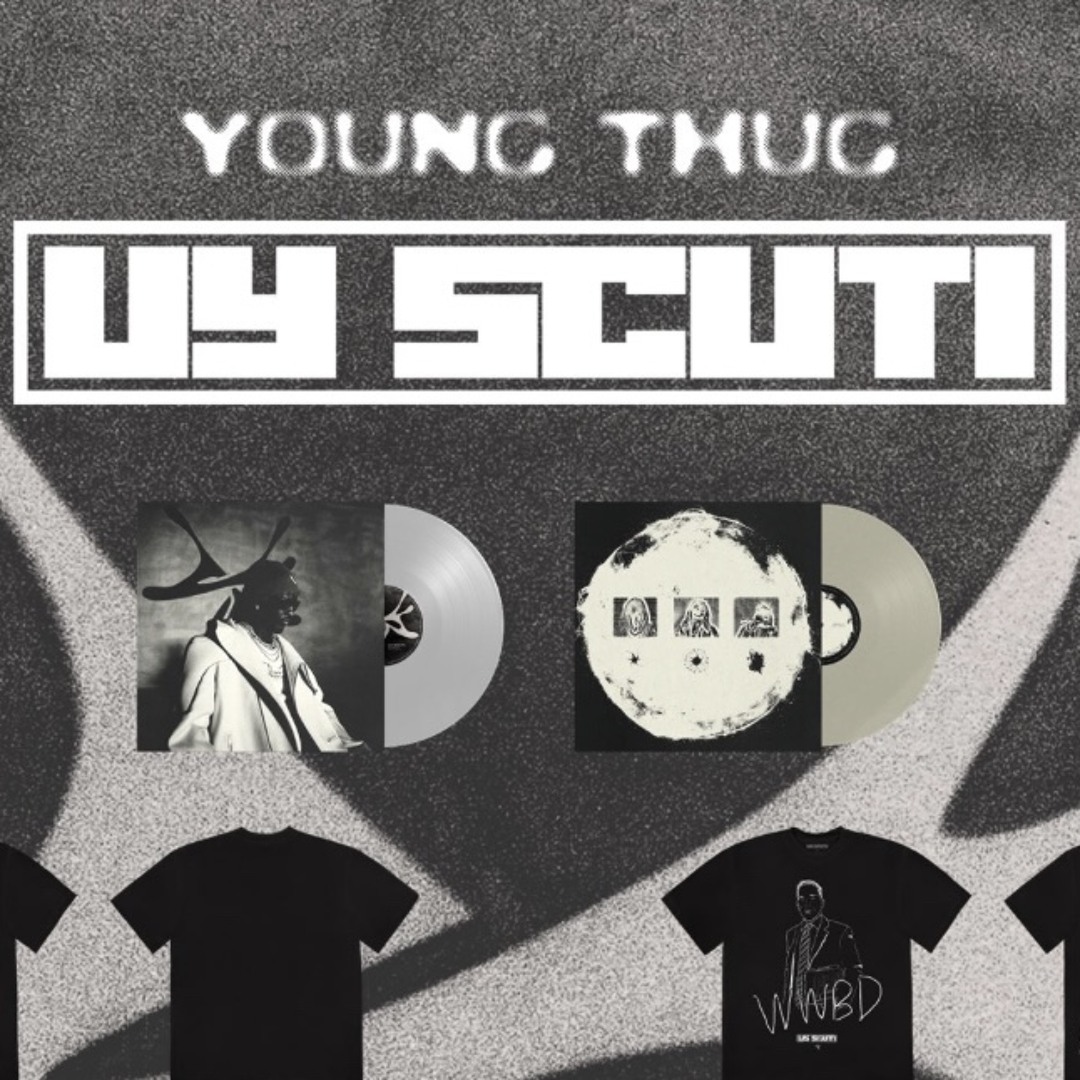

Uy Scuti Release Date Young Thug Drops Hints

May 10, 2025

Uy Scuti Release Date Young Thug Drops Hints

May 10, 2025 -

Pam Bondis Plan To Kill American Citizens A Closer Look

May 10, 2025

Pam Bondis Plan To Kill American Citizens A Closer Look

May 10, 2025 -

5 Theories On Davids Identity In High Potential Unraveling The He Morgan Brother Mystery

May 10, 2025

5 Theories On Davids Identity In High Potential Unraveling The He Morgan Brother Mystery

May 10, 2025 -

Stiven King Povernuvsya Komentari Pro Trampa Ta Maska

May 10, 2025

Stiven King Povernuvsya Komentari Pro Trampa Ta Maska

May 10, 2025 -

Post Trump Inauguration The 194 Billion Question For Tech Billionaire Donors

May 10, 2025

Post Trump Inauguration The 194 Billion Question For Tech Billionaire Donors

May 10, 2025