ECB's Final Rate Hikes: Economists' Warning On Potential Delays

Table of Contents

Inflationary Pressures and the ECB's Response

The Eurozone has been grappling with persistent inflation, significantly exceeding the ECB's target of 2%. The ECB, mandated to maintain price stability, has responded with a series of rate hikes aimed at cooling down the economy and curbing inflationary pressures. These increases, while substantial, haven't yet fully brought inflation under control.

- Current Inflation Figures: Inflation remains stubbornly high, exceeding the ECB's target by a considerable margin, prompting ongoing concerns. The latest figures show a deviation from the target, necessitating continued vigilance.

- Impact of Previous Rate Hikes: While previous rate hikes have shown some impact, their effectiveness in curbing inflation remains a subject of debate. The impact on economic growth is also a key consideration, with concerns about a potential recession.

- ECB Communication: The ECB's communication regarding future rate hikes has been carefully worded, leaving room for interpretation and fueling uncertainty in the markets. This lack of clarity has contributed to the ongoing debate about the timing and scale of future increases.

Economists' Concerns Regarding Further Rate Hikes

Not all economists agree with the ECB's strategy. A growing number express concerns about the potential negative consequences of further aggressive rate hikes. These dissenting voices argue that a more cautious approach might be necessary to avoid triggering a recession.

- Specific Concerns: Prominent economists highlight the risks of overtightening monetary policy, citing the potential for a sharp economic slowdown or even a recession.

- Risks of Overtightening: The concern is that excessively aggressive rate hikes could stifle economic growth, leading to job losses and further economic hardship. A delicate balance must be struck between controlling inflation and supporting economic activity.

- Arguments for a Cautious Approach: Alternative economic perspectives suggest that a more gradual approach to rate hikes, combined with other policy measures, could be more effective in managing inflation while mitigating the risk of a recession.

Underlying Economic Factors Influencing the Decision

The ECB's decision-making process is complex and influenced by various economic factors. Geopolitical events, supply chain disruptions, and the overall economic outlook all play significant roles.

- Impact of the Energy Crisis: The ongoing energy crisis, exacerbated by the war in Ukraine, has significantly contributed to inflationary pressures, making the ECB's task even more challenging.

- Supply Chain Bottlenecks: Persistent supply chain disruptions continue to impact prices, adding to inflationary pressures and complicating the ECB's efforts to control inflation.

- Eurozone Economic Outlook: The Eurozone's economic outlook and growth forecasts are key factors influencing the ECB's decisions on future rate hikes. Any significant deterioration in the economic outlook could lead to a more cautious approach.

Potential Scenarios and Their Implications

Several scenarios regarding the timing of the ECB's final rate hikes are possible, each with its own implications for the Eurozone economy and financial markets.

- Scenario 1: Further Aggressive Rate Hikes: This scenario could effectively curb inflation but carries a significant risk of triggering a recession.

- Scenario 2: A Pause in Rate Hikes: A pause could provide time to assess the impact of previous hikes and avoid overtightening, but might allow inflation to persist.

- Scenario 3: Gradual Rate Hikes: A gradual approach could strike a balance between controlling inflation and supporting economic growth, but could be a slower path to price stability.

- Economic Consequences: Each scenario carries different economic consequences for businesses, consumers, and investors, impacting everything from investment decisions to employment rates.

Conclusion: The Uncertain Future of ECB's Final Rate Hikes

The timing of the ECB's final rate hikes remains uncertain, with economists voicing concerns about potential delays. The persistence of inflation, coupled with the risks of overtightening monetary policy, necessitates a careful assessment of the economic situation. While the ECB aims to bring inflation back to its target, the path forward is fraught with challenges. The ongoing debate underscores the complexity of navigating the current economic environment and highlights the crucial need for careful monitoring of economic indicators. To stay informed about this evolving situation, follow reputable sources for the latest developments regarding ECB rate hike predictions, ECB monetary policy updates, and future ECB interest rate decisions.

Featured Posts

-

A Plastic Glove Project Bridging The Gap Between Rcn And Vet Nursing Professionals

May 31, 2025

A Plastic Glove Project Bridging The Gap Between Rcn And Vet Nursing Professionals

May 31, 2025 -

Posthaste Canadas Response To The Recent Global Tariff Decision

May 31, 2025

Posthaste Canadas Response To The Recent Global Tariff Decision

May 31, 2025 -

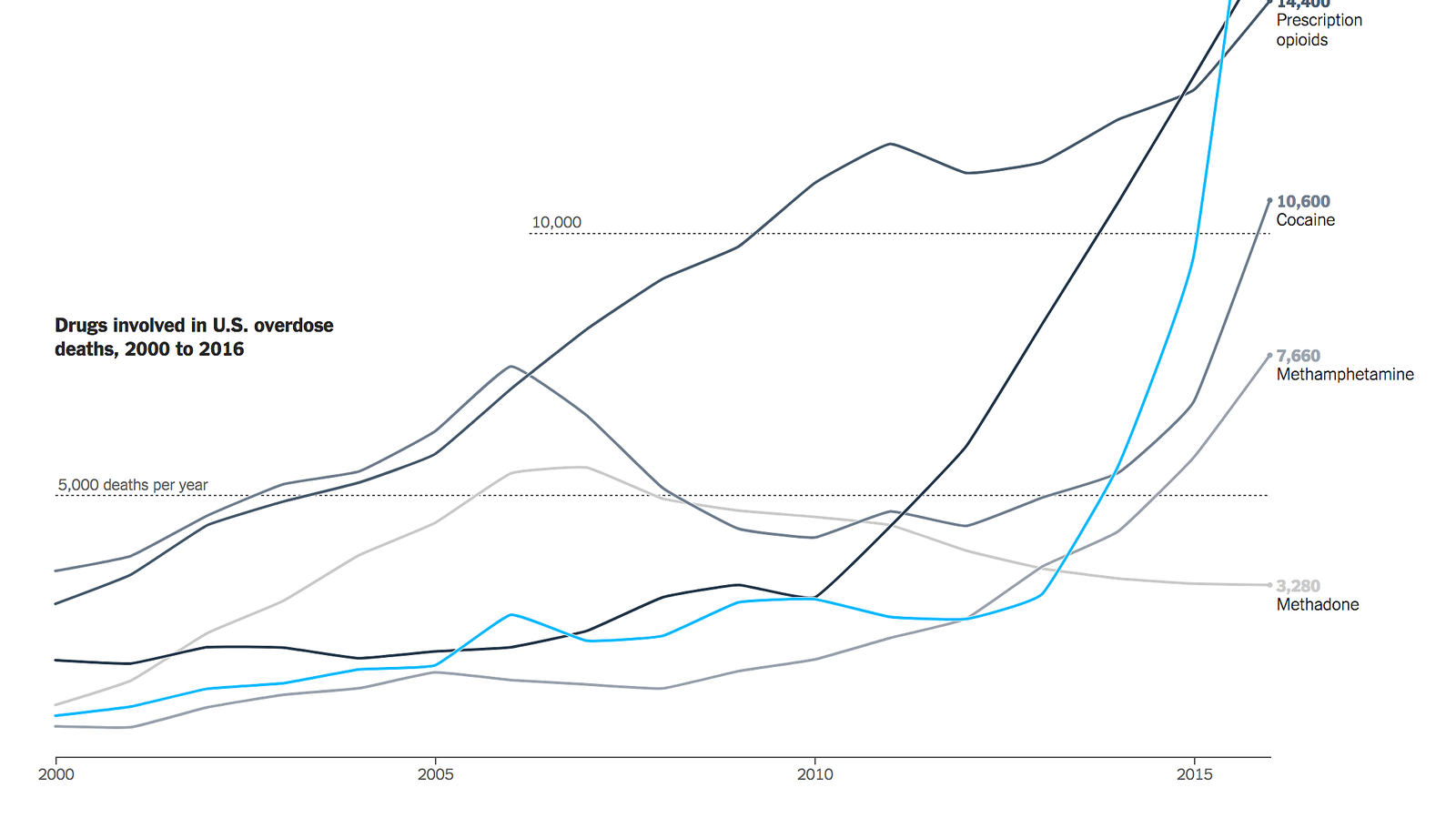

Princes Fatal Overdose Fentanyl Levels Reported On March 26

May 31, 2025

Princes Fatal Overdose Fentanyl Levels Reported On March 26

May 31, 2025 -

Novak Djokovic In Rekor Kiran Basarisi Nadal In Efsanevi Yillarinin Sonu Mu

May 31, 2025

Novak Djokovic In Rekor Kiran Basarisi Nadal In Efsanevi Yillarinin Sonu Mu

May 31, 2025 -

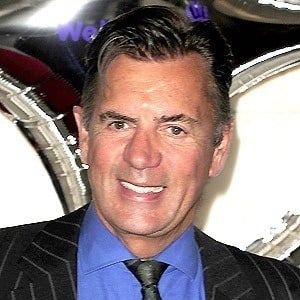

Duncan Bannatynes Support For Moroccan Childrens Charity

May 31, 2025

Duncan Bannatynes Support For Moroccan Childrens Charity

May 31, 2025