ECB's Holzmann: How Trump Tariffs Could Curb Inflation

Table of Contents

Holzmann's Argument: A Counter-Intuitive Perspective

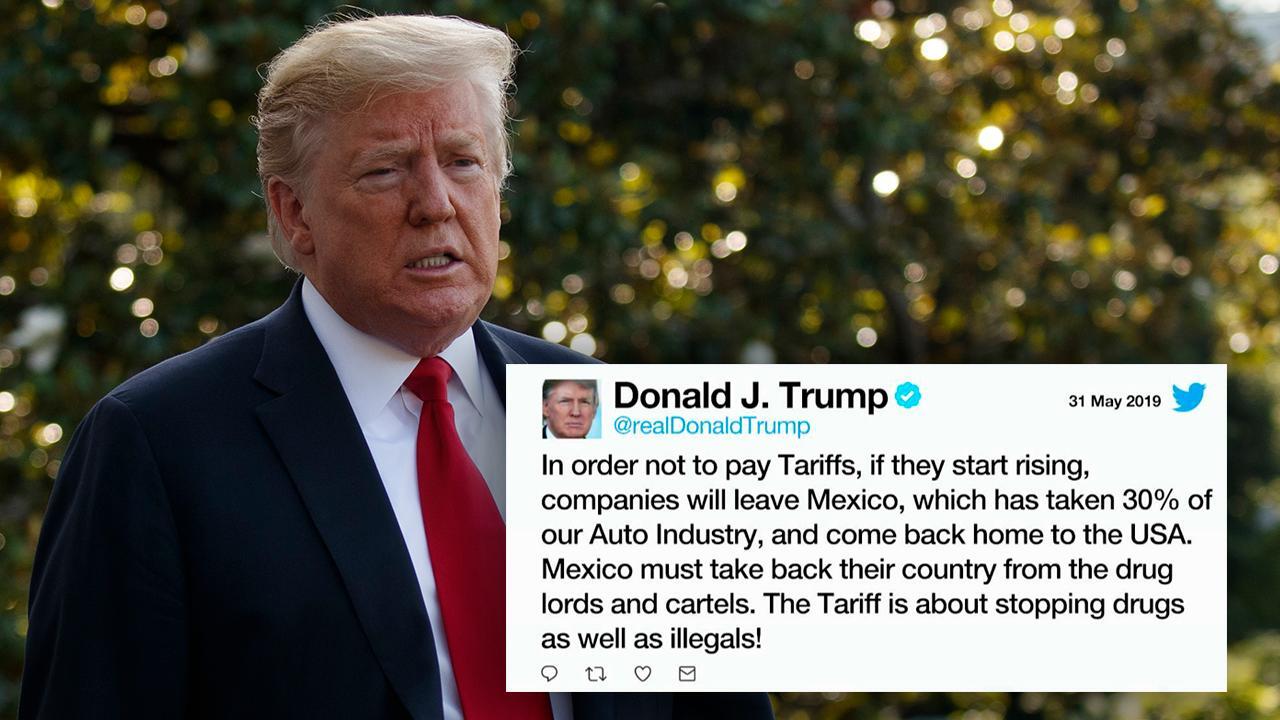

Holzmann's central thesis is that while Trump's tariffs initially increased import costs, leading to a short-term inflationary surge, their longer-term effect was deflationary. This seemingly paradoxical conclusion rests on several key elements:

-

Reduced Consumer Demand: Higher prices on imported goods, directly resulting from tariffs, led to decreased consumer spending. Consumers, facing higher costs for everyday items, cut back on non-essential purchases. This reduced aggregate demand played a significant role in curbing inflationary pressures.

-

Suppressed Investment: The uncertainty created by the trade war and the imposition of tariffs discouraged businesses from investing. Companies faced higher input costs and a less predictable market, leading them to postpone expansion plans and reduce capital expenditures. This dampened overall economic activity.

-

Weakening of the Global Economy: The trade war significantly weakened global economic growth. The uncertainty and decreased trade volumes led to a slowdown in various economies worldwide. This reduced aggregate demand on a global scale contributed to lower inflation rates.

While direct empirical evidence isolating the specific effect of tariffs from other economic factors remains a challenge, various economic analyses and ECB publications indirectly support aspects of Holzmann's argument. Further research is needed to definitively quantify the contribution of tariffs to the overall inflation picture.

The Mechanism: How Tariffs Affected Inflation

The mechanism through which Trump's tariffs potentially curbed inflation involves a complex interplay of factors affecting supply chains and prices.

-

Supply Chain Disruptions: Tariffs disrupted global supply chains. Businesses faced delays, increased transportation costs, and difficulties sourcing raw materials and finished goods from countries subject to tariffs.

-

Impact on Import and Consumer Prices: Increased costs for importing goods directly translated into higher import prices. Businesses then passed these increased costs onto consumers through higher retail prices.

-

Reduced Global Economic Activity: The slower global economic growth resulting from the trade war had a significant impact on inflation. Lower overall demand meant less pressure on wages and prices.

-

Substitution Effects: Some businesses sought to mitigate the impact of tariffs by finding alternative suppliers in countries not subject to the tariffs. This led to some substitution effects, potentially limiting the overall price increases.

In essence, the initial inflationary shock from tariffs was eventually countered by the reduction in aggregate demand caused by higher prices, reduced investment, and slower global economic growth.

Limitations and Counterarguments to Holzmann's Thesis

It's crucial to acknowledge the limitations and potential counterarguments to Holzmann's analysis. Attributing a specific inflation dampening effect solely to tariffs is challenging due to the multitude of interacting economic forces.

-

Difficulty in Isolating the Tariff Effect: Separating the impact of tariffs from other concurrent global events (like changes in oil prices or shifts in monetary policy) is statistically complex and requires sophisticated econometric modeling.

-

Sector-Specific Inflationary Pressures: While the overall impact might have been deflationary, certain sectors heavily reliant on imported goods directly affected by tariffs experienced significant price increases. This created localized inflation in specific areas.

-

Short-Term Inflationary Spikes: Before the longer-term dampening effects manifested, there were likely short-term spikes in inflation due to the immediate increase in import prices. These spikes might have been overshadowed by the later deflationary trends.

Implications for Monetary Policy and Future Trade Wars

Holzmann's analysis has significant implications for monetary policy and the management of future trade disputes.

-

Nuanced Monetary Policy: Central banks need to adopt more nuanced approaches to monetary policy when facing trade-related inflation. A simplistic response might exacerbate the economic situation.

-

Anticipating Trade Dispute Impacts: Understanding the potential long-term deflationary effects of trade disputes is vital for policymakers to anticipate and effectively mitigate their impacts on inflation.

-

Globalization and Protectionism: Holzmann's work provides valuable lessons for policymakers in managing inflation in a globalized economy increasingly subject to protectionist measures.

Conclusion: Understanding the ECB's Holzmann and Trump Tariffs' Impact on Inflation

ECB's Holzmann's analysis offers a compelling, albeit counter-intuitive, perspective on the relationship between Trump's tariffs and inflation. His argument highlights the complex interplay between trade policy, supply chains, and aggregate demand in shaping inflation dynamics. While isolating the specific effect of tariffs from other economic factors remains a challenge, his work underscores the need for a nuanced understanding of these interconnections. Learn more about ECB's Holzmann's analysis on how Trump tariffs could curb inflation and gain valuable insights into managing economic volatility. Understanding these complexities is crucial for policymakers navigating the turbulent waters of global trade and inflation.

Featured Posts

-

Anna Wongs Warning Prepare For Empty Shelves

Apr 26, 2025

Anna Wongs Warning Prepare For Empty Shelves

Apr 26, 2025 -

Learn Lente Mastering The Language Of Spring

Apr 26, 2025

Learn Lente Mastering The Language Of Spring

Apr 26, 2025 -

Ftc Appeals Activision Blizzard Acquisition Microsoft Deal In Jeopardy

Apr 26, 2025

Ftc Appeals Activision Blizzard Acquisition Microsoft Deal In Jeopardy

Apr 26, 2025 -

Pogacars Custom Colnago Speed Technology And The Pursuit Of Victory

Apr 26, 2025

Pogacars Custom Colnago Speed Technology And The Pursuit Of Victory

Apr 26, 2025 -

Fugro And Damen Partner To Bolster Royal Netherlands Navy Capabilities

Apr 26, 2025

Fugro And Damen Partner To Bolster Royal Netherlands Navy Capabilities

Apr 26, 2025