ECB's Simkus: Two More Interest Rate Cuts Possible Amidst Trade War Impact

Table of Contents

Simkus's Rationale for Further ECB Interest Rate Cuts

The Eurozone economy is currently facing headwinds. Inflation remains stubbornly low, below the ECB's target of close to 2%, and GDP growth is slowing. Šimkus has voiced serious concerns about the trade war's detrimental effect on the region's economic health. He sees the risks to growth as significant, warranting a proactive response from the ECB. His assessment points to several key factors justifying further interest rate reductions:

- Weakening global demand: The trade war is dampening global trade and investment, directly impacting Eurozone export-oriented industries.

- Uncertainty in investment: Businesses are hesitant to commit to new investments in the face of ongoing trade uncertainty, hindering economic expansion.

- Potential deflationary pressures: Low inflation combined with weak demand raises the specter of deflation, a dangerous spiral of falling prices and reduced economic activity.

- Need to stimulate economic activity: Lower interest rates aim to encourage borrowing and investment, boosting economic activity and combating the slowdown.

The Trade War's Impact on the Eurozone Economy

The trade war's negative impact on the Eurozone is multifaceted and far-reaching. The imposition of tariffs and trade restrictions disrupts supply chains, reduces exports, increases uncertainty for businesses, and erodes consumer confidence. This translates into tangible economic consequences:

- Supply chain disruptions: Tariffs and trade barriers complicate international supply chains, increasing costs and delaying production.

- Reduced exports: Eurozone businesses reliant on exports to countries involved in the trade war are facing reduced sales and lost revenue. This is particularly impactful for sectors like manufacturing and automobiles.

- Increased uncertainty for businesses: The unpredictable nature of the trade conflict makes it difficult for businesses to plan for the future, hindering investment and growth.

- Impact on consumer confidence: Uncertainty about the future and the potential for higher prices can lead to reduced consumer spending, further dampening economic activity. Recent data shows a decline in consumer confidence across several Eurozone countries, correlating with the escalation of trade tensions.

Potential Consequences of Further ECB Interest Rate Cuts

Lowering interest rates aims to stimulate the Eurozone economy by making borrowing cheaper for businesses and consumers. This should lead to increased investment and spending, boosting growth. However, this isn't without potential downsides:

- Stimulating economic growth: Lower borrowing costs can encourage businesses to invest and expand, creating jobs and boosting economic output.

- Impact on borrowing costs: Reduced interest rates make mortgages, loans, and other forms of borrowing more affordable.

- Potential inflationary risks: While currently low, excessively low interest rates could eventually fuel inflation if demand outpaces supply.

- Effect on the Euro's exchange rate: Lower interest rates can weaken the Euro's exchange rate, potentially boosting exports but also impacting the cost of imports. The ECB needs to carefully balance these competing effects.

Alternative Policy Options Considered by the ECB

The ECB is not limited to interest rate cuts. Other monetary policy tools are available, which might be deployed alongside or instead of further interest rate reductions:

- Quantitative easing (QE): This involves the ECB purchasing government bonds and other assets to increase the money supply and lower long-term interest rates.

- Targeted long-term refinancing operations (TLTROs): These offer cheap loans to banks, encouraging them to lend to businesses and consumers.

- Forward guidance: The ECB can communicate its intentions regarding future monetary policy, influencing market expectations and shaping economic behavior.

Conclusion: The Future of ECB Interest Rate Cuts and the Trade War's Influence

Šimkus's statements highlight the growing concern within the ECB about the trade war's negative impact on the Eurozone economy. The potential for further ECB interest rate cuts underscores the urgency of the situation. While such cuts can stimulate growth, they also carry risks. The ECB faces a delicate balancing act, weighing the need for economic stimulus against the potential for inflation and other unintended consequences. The Eurozone's economic outlook remains uncertain, heavily influenced by the evolving trade war. To stay informed about further developments concerning ECB interest rate cuts and their broader implications for the global economy, it is crucial to follow reputable financial news sources and monitor economic indicators closely. This is particularly important for investors and businesses making crucial financial decisions in this challenging environment. Stay informed about future ECB interest rate cuts and their impact on your investments and business strategies.

Featured Posts

-

Alberto Ardila Olivares Y La Consecucion De Goles

Apr 27, 2025

Alberto Ardila Olivares Y La Consecucion De Goles

Apr 27, 2025 -

Nosferatu The Vampyre Now Torontos Detour Recommendation

Apr 27, 2025

Nosferatu The Vampyre Now Torontos Detour Recommendation

Apr 27, 2025 -

Office365 Security Breach Millions Stolen Through Executive Email Compromise

Apr 27, 2025

Office365 Security Breach Millions Stolen Through Executive Email Compromise

Apr 27, 2025 -

Mc Cooks Helping Hands A Local Jewelers Support For Nfl Players

Apr 27, 2025

Mc Cooks Helping Hands A Local Jewelers Support For Nfl Players

Apr 27, 2025 -

Ariana Grande Debuts Stunning New Look Hair And Tattoo Update

Apr 27, 2025

Ariana Grande Debuts Stunning New Look Hair And Tattoo Update

Apr 27, 2025

Latest Posts

-

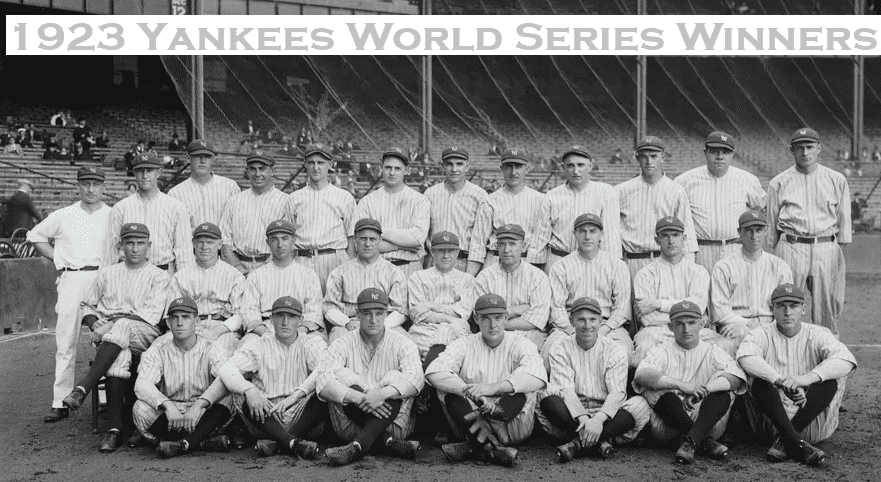

Walk Off Win For Pirates Yankees Lose In Extra Innings

Apr 28, 2025

Walk Off Win For Pirates Yankees Lose In Extra Innings

Apr 28, 2025 -

A Win For The Yankees Judge And Goldschmidts Impact

Apr 28, 2025

A Win For The Yankees Judge And Goldschmidts Impact

Apr 28, 2025 -

Yankees Fall To Pirates On Walk Off In Extra Innings Game

Apr 28, 2025

Yankees Fall To Pirates On Walk Off In Extra Innings Game

Apr 28, 2025 -

Aaron Judge Paul Goldschmidt Propel Yankees To Hard Fought Victory

Apr 28, 2025

Aaron Judge Paul Goldschmidt Propel Yankees To Hard Fought Victory

Apr 28, 2025 -

Pirates Win Walk Off Thriller Against Yankees In Extras

Apr 28, 2025

Pirates Win Walk Off Thriller Against Yankees In Extras

Apr 28, 2025