Economic Risks And The Fed: Why Powell Is Hesitant On Interest Rate Cuts

Table of Contents

Persistent Inflationary Pressures

Core Inflation Remains Sticky

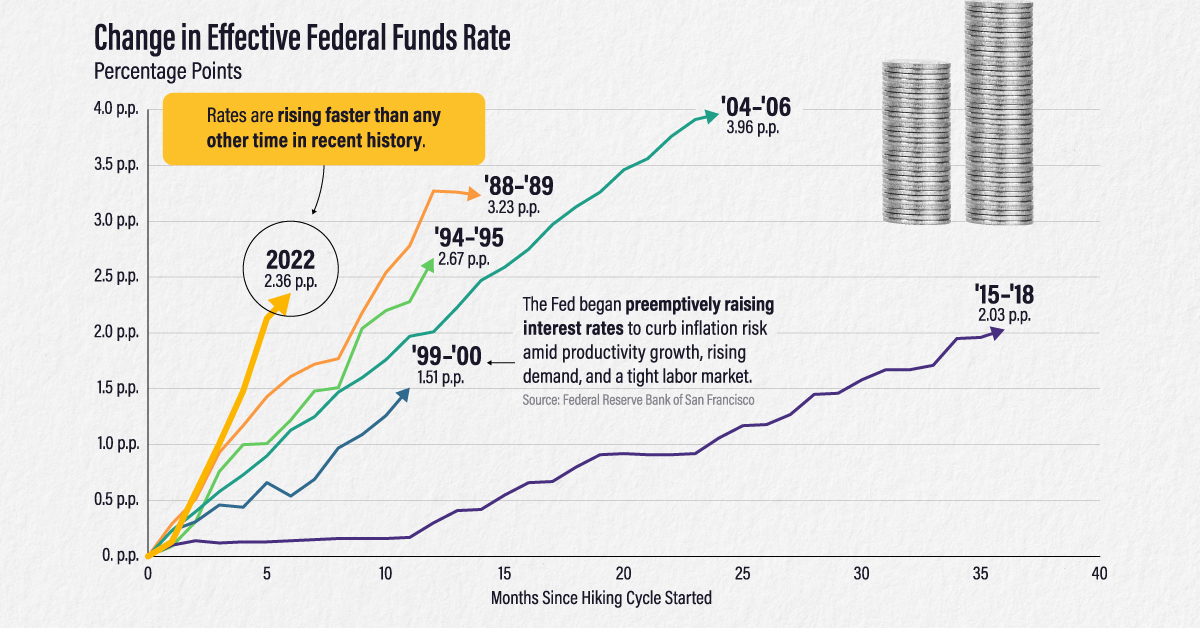

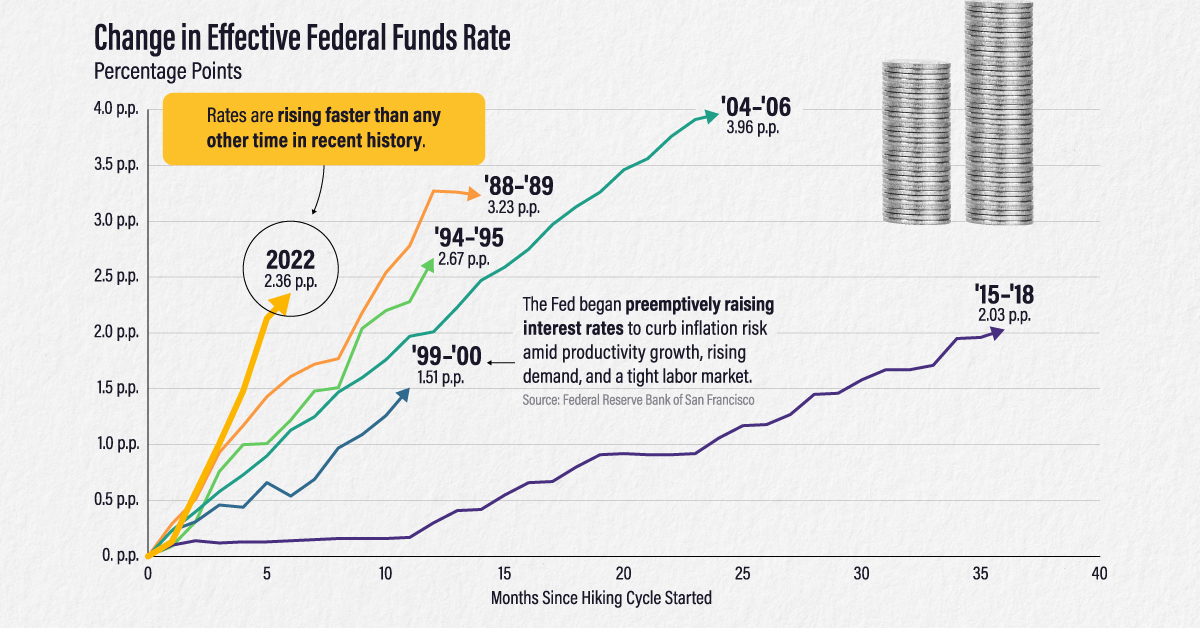

While headline inflation, which includes volatile food and energy prices, may be showing signs of cooling, core inflation – a more reliable indicator of underlying price pressures – remains stubbornly high. This persistence indicates that inflationary pressures are deeply embedded in the economy, despite the Federal Reserve's aggressive interest rate hikes. This is a significant factor in Powell's reluctance to consider interest rate cuts.

- High service sector inflation: Services inflation, which makes up a significant portion of the consumer price index (CPI), remains elevated, suggesting that inflationary pressures are not confined to goods.

- Wage growth exceeding productivity gains: Strong wage growth exceeding productivity gains contributes to upward pressure on prices as businesses pass increased labor costs onto consumers. This is a key component of the potential for a wage-price spiral.

- Supply chain disruptions still impacting prices: Though easing, lingering supply chain disruptions continue to affect the availability and cost of goods, contributing to overall inflation.

- Strong consumer demand contributing to price increases: Robust consumer demand, fueled by factors such as strong labor markets, continues to put upward pressure on prices.

Premature interest rate cuts risk reigniting this persistent inflation, potentially leading to a more painful and prolonged period of price increases. The Fed aims for a "soft landing," but cutting rates too soon could jeopardize this goal.

The Risk of a Wage-Price Spiral

The Danger of Self-Perpetuating Inflation

One of the most significant risks driving Powell's hesitancy is the potential for a wage-price spiral. This dangerous scenario unfolds when rising wages lead to higher prices, prompting further wage demands and creating a self-perpetuating cycle of inflation that is difficult to control.

- Strong labor market with low unemployment: A historically tight labor market gives workers increased bargaining power, leading them to demand higher wages to keep pace with inflation.

- Increased bargaining power for workers: Low unemployment rates empower workers to negotiate for higher wages, potentially pushing businesses to increase prices to offset rising labor costs.

- Potential for businesses to pass on increased labor costs to consumers: Businesses facing higher labor costs often pass these costs on to consumers in the form of higher prices, further fueling inflation.

The Fed is acutely aware of this risk. Cutting interest rates prematurely could exacerbate this cycle, making it significantly harder to bring inflation down to the target level. The current economic environment presents a delicate balancing act – controlling inflation without triggering a recession.

Uncertainty Surrounding Economic Data

Lagging Effects of Monetary Policy

The full impact of the Federal Reserve's previous interest rate hikes is yet to be fully realized in the economy. This lag effect creates significant uncertainty about the current state of the economy and its future trajectory. This uncertainty is a primary reason for Powell's cautious approach to further monetary policy adjustments.

- Time lag between interest rate changes and their impact on inflation and economic growth: Interest rate changes don't immediately impact the economy; there's a considerable lag before their full effects are felt.

- Difficulty in predicting future economic conditions with accuracy: Economic forecasting is inherently challenging, and unexpected events can easily disrupt predictions.

- Potential for unexpected economic shocks (e.g., geopolitical events): Geopolitical instability or other unforeseen events can significantly alter economic conditions, making accurate predictions even more difficult.

This uncertainty makes it risky for the Fed to make drastic moves, such as implementing interest rate cuts, before the full impact of existing policies is clear.

Maintaining Credibility and Inflation Expectations

The Importance of Anchoring Inflation Expectations

The Federal Reserve's actions heavily influence inflation expectations. Rapidly reversing course on interest rate hikes could undermine the Fed's credibility and potentially lead to higher inflation expectations, a scenario the Fed wants to avoid at all costs.

- The importance of the Fed’s communication strategy: Clear and consistent communication is crucial for anchoring inflation expectations and guiding market behavior.

- Impact of inflation expectations on actual inflation: If people expect higher inflation, they may demand higher wages and prices, leading to a self-fulfilling prophecy.

- The risk of losing control over inflation if the Fed appears to be inconsistent: Inconsistency in monetary policy can erode the Fed's credibility and make it harder to control inflation.

Maintaining credibility is paramount for the Fed. Acting decisively and consistently, even in the face of pressure for interest rate cuts, is vital for managing inflation expectations and ultimately achieving price stability.

Conclusion

Powell's hesitation to cut interest rates stems from a complex interplay of persistent inflation, the risk of a wage-price spiral, uncertainty about economic data, and the crucial need to maintain the Fed's credibility. These factors are deeply interconnected, making the decision regarding interest rate cuts exceedingly challenging. Understanding these interconnected risks is critical for navigating the current economic environment. Stay informed about the latest developments in interest rate cuts and Federal Reserve monetary policy to make informed financial decisions.

Featured Posts

-

The Price Of A Suspension Anthony Edwards And The Timberwolves

May 07, 2025

The Price Of A Suspension Anthony Edwards And The Timberwolves

May 07, 2025 -

Cavaliers Offseason Plans The Caris Le Vert Question

May 07, 2025

Cavaliers Offseason Plans The Caris Le Vert Question

May 07, 2025 -

Analyzing The Carney Trump Meeting Key Issues And Resolutions

May 07, 2025

Analyzing The Carney Trump Meeting Key Issues And Resolutions

May 07, 2025 -

San Francisco Giants Young Pitching Stars Harrison And Whisenhunt Shine

May 07, 2025

San Francisco Giants Young Pitching Stars Harrison And Whisenhunt Shine

May 07, 2025 -

Unveiling The Truth Princess Dianas Risque Met Gala Dress

May 07, 2025

Unveiling The Truth Princess Dianas Risque Met Gala Dress

May 07, 2025

Latest Posts

-

Hackers Office365 Intrusions Result In Multi Million Dollar Scheme Say Feds

May 08, 2025

Hackers Office365 Intrusions Result In Multi Million Dollar Scheme Say Feds

May 08, 2025 -

Office365 Executive Inboxes Targeted Hacker Makes Millions Authorities Report

May 08, 2025

Office365 Executive Inboxes Targeted Hacker Makes Millions Authorities Report

May 08, 2025 -

Federal Investigation Office365 Data Breaches Yield Millions For Hacker

May 08, 2025

Federal Investigation Office365 Data Breaches Yield Millions For Hacker

May 08, 2025 -

Exec Office365 Breaches Net Millions For Crook Fbi Says

May 08, 2025

Exec Office365 Breaches Net Millions For Crook Fbi Says

May 08, 2025 -

Impact Of Lingering Toxic Chemicals From Ohio Train Derailment On Buildings

May 08, 2025

Impact Of Lingering Toxic Chemicals From Ohio Train Derailment On Buildings

May 08, 2025