Economic Slowdown: Analyzing President Biden's Role

Table of Contents

Fiscal Policy Under President Biden

President Biden's fiscal policy has been a central point of discussion surrounding the current economic slowdown. Two major legislative initiatives, the American Rescue Plan (ARP) and the Infrastructure Investment and Jobs Act (IIJA), have significantly shaped the economic landscape.

The American Rescue Plan and its Impact

The American Rescue Plan, enacted in March 2021, aimed to provide substantial economic relief in response to the COVID-19 pandemic. Its intended goals included supporting households and businesses, bolstering the healthcare system, and accelerating vaccine distribution.

-

Positive Impacts: The ARP provided significant support for struggling families and businesses through stimulus checks, enhanced unemployment benefits, and funding for state and local governments. This helped prevent a deeper economic crisis and cushioned the blow of the pandemic. Initial GDP growth following the ARP's implementation appeared strong.

-

Criticisms: A major criticism of the ARP is its potential contribution to inflation. The substantial injection of government spending into the economy, coupled with supply chain disruptions, is argued to have fueled a surge in prices. Many economists debate the extent to which the ARP directly caused inflation, versus other contributing factors.

-

Data Points: While the ARP did initially boost GDP growth, inflation rates also rose sharply in the months following its implementation. Analyzing these figures requires a nuanced understanding of the various economic factors at play. For example, comparing inflation rates to pre-pandemic levels and accounting for global inflation trends is crucial for a fair assessment.

-

Key Provisions:

- Increased unemployment benefits

- Stimulus checks for individuals and families

- Funding for state and local governments to maintain essential services

- Investment in vaccine distribution and healthcare infrastructure

Infrastructure Investment and Jobs Act

The Infrastructure Investment and Jobs Act (IIJA), signed into law in November 2021, focuses on long-term economic growth through investments in infrastructure. This act aims to modernize America's infrastructure, creating jobs and boosting economic productivity.

-

Long-Term Goals: The IIJA aims to improve roads, bridges, public transit, broadband internet access, and other critical infrastructure elements. The long-term goal is increased economic productivity and competitiveness.

-

Short-Term Impacts: The IIJA's short-term impacts include job creation in construction and related industries. It also aims to improve supply chain efficiency by upgrading transportation infrastructure.

-

Long-Term Effects: The potential long-term benefits include improved transportation networks, increased access to high-speed internet, and a more robust and resilient infrastructure. This should lead to increased economic activity and productivity.

-

Key Investments:

- Roads and bridges

- Public transportation

- Broadband internet access

- Water infrastructure

- Electric grid modernization

Monetary Policy and the Federal Reserve

The Federal Reserve (the Fed) plays a crucial role in managing the US economy through monetary policy. Its actions significantly influence inflation, interest rates, and overall economic growth.

The Federal Reserve's Response to Inflation

Facing rising inflation, the Fed has implemented a series of interest rate hikes. The goal is to cool down the economy and curb inflation.

-

The Fed's Mandate: The Fed's dual mandate is to promote maximum employment and price stability. Balancing these two goals during times of high inflation presents a significant challenge.

-

Interest Rate Hikes: The Fed's interest rate hikes increase borrowing costs, making it more expensive for businesses and consumers to borrow money. This reduces spending and investment, slowing economic growth and, ideally, lowering inflation.

-

Impact on Growth and Employment: Interest rate hikes can lead to slower economic growth and potentially increased unemployment as businesses reduce investment and hiring. This is the inherent trade-off the Fed faces in its efforts to control inflation.

-

Effectiveness: The effectiveness of the Fed's actions in curbing inflation is still being evaluated. The lag effect of monetary policy means that the full impact of these hikes will be felt over time.

-

Key Monetary Policy Tools:

- Interest rate increases

- Quantitative tightening (reducing the Fed's balance sheet)

The Coordination (or Lack Thereof) Between Fiscal and Monetary Policy

The relationship between fiscal and monetary policy is complex. Ideally, they should work in concert to achieve macroeconomic stability. However, disagreements or misalignments can lead to economic instability.

-

Potential for Conflict: Expansionary fiscal policy (like the ARP) can put upward pressure on inflation, while contractionary monetary policy (like interest rate hikes) aims to curb inflation. This can create tension and potentially undermine the effectiveness of either policy.

-

Coordination between the Biden Administration and the Fed: The extent of coordination between the Biden administration and the Federal Reserve is a subject of ongoing debate. While there is communication, the independence of the Fed is crucial to its effectiveness.

-

Effectiveness of Coordination (or Lack Thereof): The effectiveness of the coordination (or lack thereof) in managing the economic slowdown is still unfolding. Assessing this requires evaluating both the short-term and long-term impacts of the combined fiscal and monetary policies.

Other Contributing Factors to the Economic Slowdown

Beyond domestic policy, several other factors have contributed to the current economic slowdown.

Global Economic Conditions

Global events significantly impact the US economy.

-

The War in Ukraine: The war in Ukraine has disrupted global energy markets and supply chains, leading to higher energy prices and increased inflation worldwide.

-

Global Inflation: Global inflation pressures have exacerbated domestic inflation in the US, making it more challenging for the Fed to control prices.

-

Other International Factors: Other international factors, such as geopolitical instability and changes in global trade patterns, also contribute to economic uncertainty.

Supply Chain Disruptions

Lingering effects of the COVID-19 pandemic continue to disrupt global supply chains.

-

Pandemic's Impact: The pandemic caused widespread factory closures, port congestion, and transportation bottlenecks, leading to shortages of goods and increased prices.

-

Contribution to Inflation: Supply chain disruptions have significantly contributed to inflation by limiting the availability of goods and increasing production costs.

-

Potential Solutions: Addressing supply chain disruptions requires a multi-faceted approach, including investments in infrastructure, diversification of supply chains, and improved logistics management.

Conclusion

The current economic slowdown is a complex issue influenced by a multitude of factors, including the global economic climate, supply chain disruptions, and domestic policy decisions. While President Biden's economic policies, such as the American Rescue Plan and the Infrastructure Investment and Jobs Act, aimed to stimulate economic growth and create jobs, their impact on inflation and the current economic climate remains a subject of ongoing debate. The Federal Reserve's response to inflation through interest rate hikes further complicates the economic picture. A thorough understanding of these interacting forces is crucial for informed discussion and policy decisions moving forward. To stay informed on the ongoing developments regarding the economic slowdown and President Biden's role, continue following reputable news sources and economic analysis. Further research into the economic policies and their long-term consequences is needed to fully assess the president's impact on the economic slowdown.

Featured Posts

-

Trump Effect On Ripple Xrp Price Reaction

May 02, 2025

Trump Effect On Ripple Xrp Price Reaction

May 02, 2025 -

Acquisition Attempt Toronto Firm Challenges For Hudsons Bay Brand And Charter

May 02, 2025

Acquisition Attempt Toronto Firm Challenges For Hudsons Bay Brand And Charter

May 02, 2025 -

Analysis A Fortnite Refund And Its Implications For Cosmetic Sales

May 02, 2025

Analysis A Fortnite Refund And Its Implications For Cosmetic Sales

May 02, 2025 -

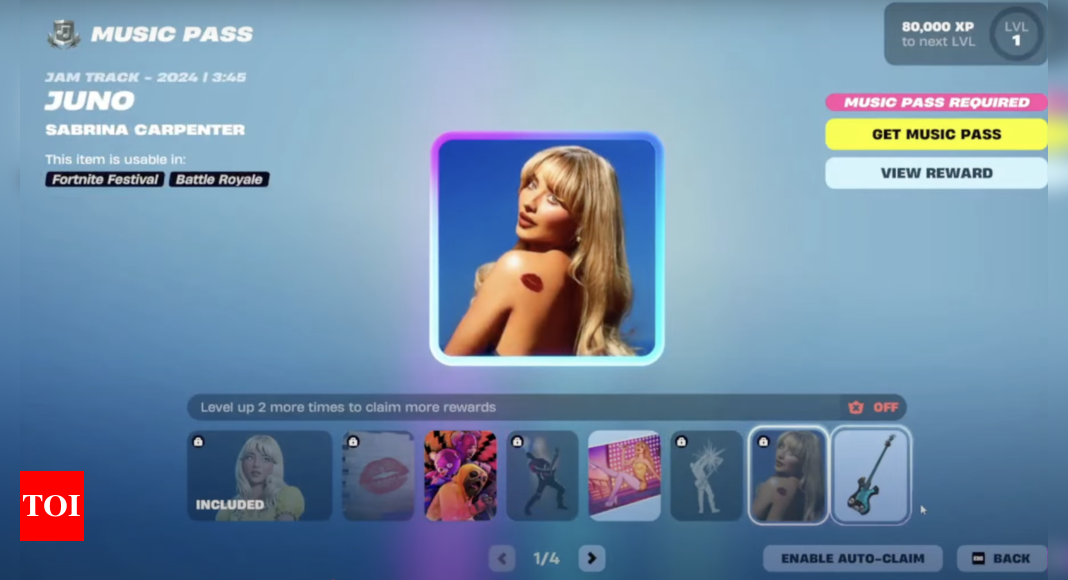

Fortnite Update V34 30 Sabrina Carpenter Collaboration Gameplay Changes And Downtime

May 02, 2025

Fortnite Update V34 30 Sabrina Carpenter Collaboration Gameplay Changes And Downtime

May 02, 2025 -

Check The Lotto Results Saturday April 12 2025

May 02, 2025

Check The Lotto Results Saturday April 12 2025

May 02, 2025

Latest Posts

-

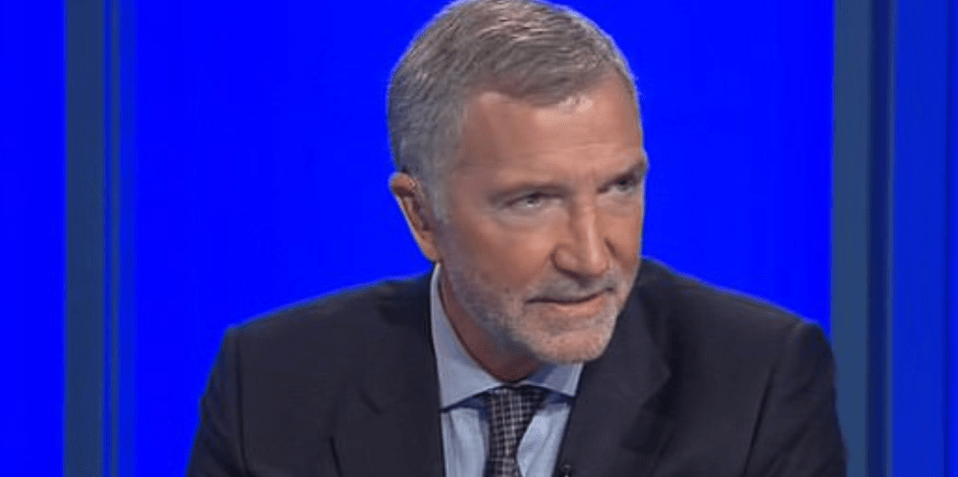

Graeme Souness Reveals His Premier League Favourite

May 02, 2025

Graeme Souness Reveals His Premier League Favourite

May 02, 2025 -

Sounesss Double Channel Swim A Powerful Act Of Support For Isla

May 02, 2025

Sounesss Double Channel Swim A Powerful Act Of Support For Isla

May 02, 2025 -

Political Communication On X An Analysis Of Rupert Lowes Reform Efforts

May 02, 2025

Political Communication On X An Analysis Of Rupert Lowes Reform Efforts

May 02, 2025 -

Graeme Souness To Swim The Channel Twice Inspired By Islas Condition

May 02, 2025

Graeme Souness To Swim The Channel Twice Inspired By Islas Condition

May 02, 2025 -

Dundee Man Jailed For Sexual Assault Graeme Sounes Sentenced

May 02, 2025

Dundee Man Jailed For Sexual Assault Graeme Sounes Sentenced

May 02, 2025