Economic Uncertainty: The Next Fed Chair's Trump-Sized Problem

Table of Contents

Inflationary Pressures and the Fed's Response

Persistent Inflation

The current inflation rate, as measured by the Consumer Price Index (CPI), remains significantly above the Federal Reserve's target of 2%. This persistent inflation is driven by a confluence of factors, including lingering supply chain disruptions stemming from the pandemic, elevated energy prices exacerbated by the war in Ukraine, and robust consumer demand. These factors have combined to create a challenging environment for both consumers and policymakers.

- Effects of Inflation:

- Rising interest rates, making borrowing more expensive for businesses and consumers.

- Decreased purchasing power, eroding the value of savings and wages.

- Increased uncertainty, impacting investment decisions and economic growth.

The keywords associated with this section are inflation, interest rates, consumer price index (CPI), monetary policy, and purchasing power.

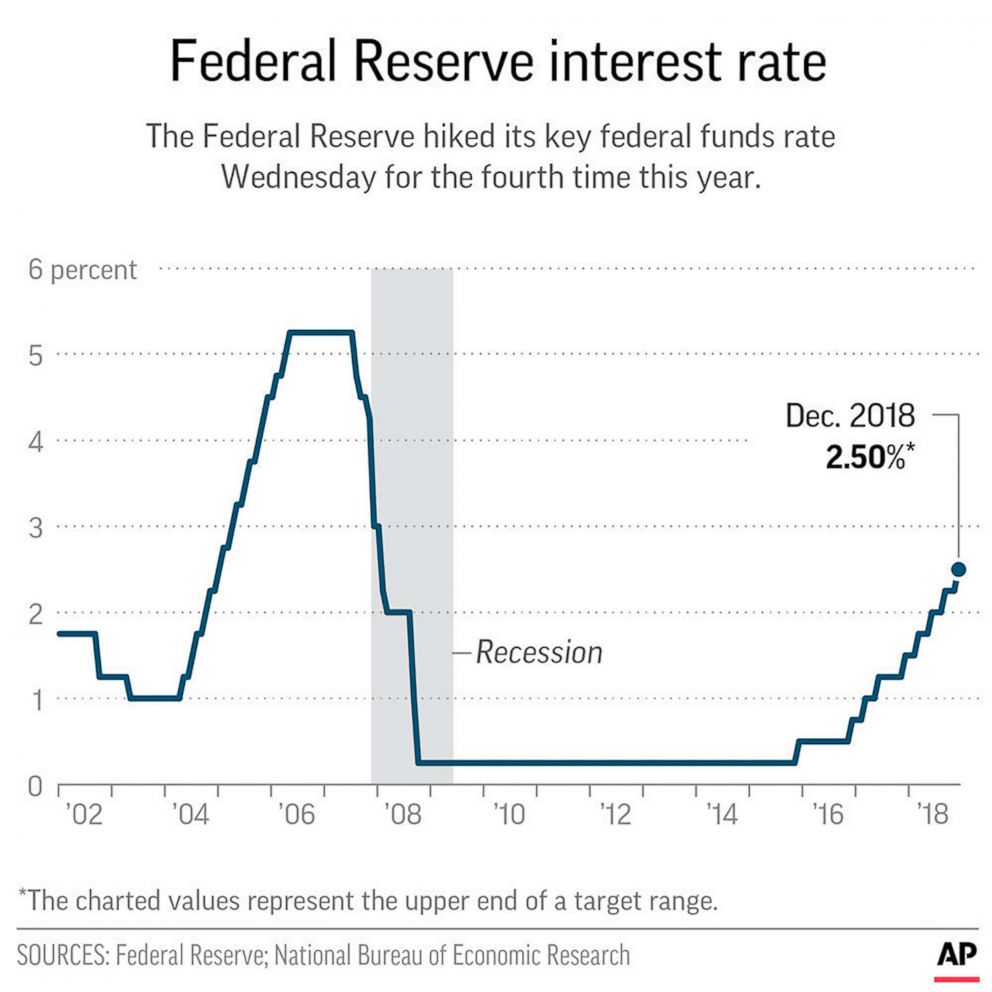

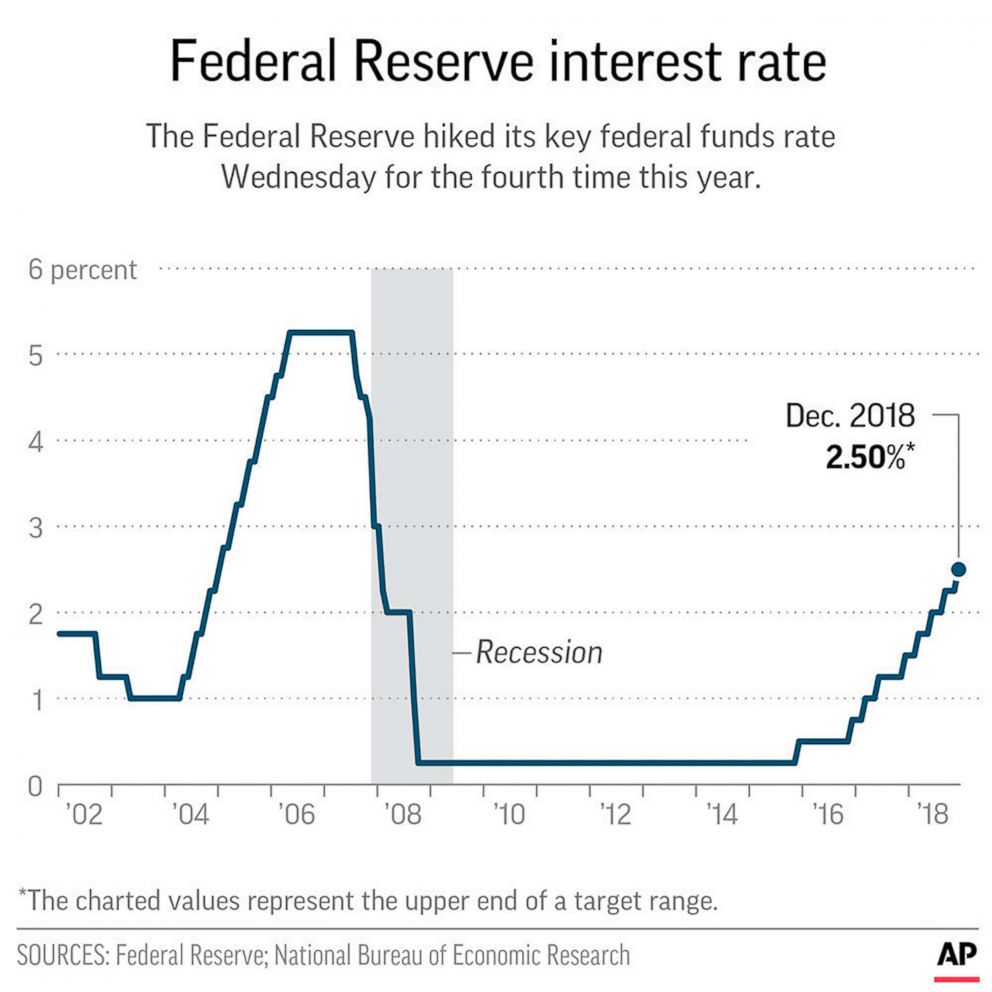

The Tightrope Walk of Monetary Policy

The Federal Reserve walks a tightrope in its efforts to control inflation. Aggressive tightening of monetary policy, through significant interest rate hikes and quantitative tightening (QT), risks triggering a recession by dampening economic activity. However, insufficient action risks allowing high inflation to become entrenched, potentially leading to a wage-price spiral and long-term economic instability. The Fed must carefully calibrate its response to balance inflation control with maintaining economic growth.

- Potential Policy Tools:

- Interest rate hikes: Increasing the federal funds rate makes borrowing more expensive, slowing down economic activity and reducing demand-pull inflation.

- Quantitative tightening (QT): Reducing the Fed's balance sheet by allowing bonds to mature without reinvestment, thus reducing the money supply.

The keywords associated with this section are monetary policy, quantitative easing (QE), quantitative tightening (QT), recession, economic growth, and federal funds rate.

Geopolitical Instability and its Economic Ripple Effects

The War in Ukraine and Global Supply Chains

The ongoing war in Ukraine has significantly disrupted global supply chains, particularly those related to energy and essential commodities. The war has led to soaring energy prices, impacting transportation costs and production across various sectors. Furthermore, the disruption of grain exports from Ukraine has contributed to food insecurity and price increases globally.

- Examples of Supply Chain Disruptions:

- Reduced availability of crucial inputs for manufacturing.

- Increased transportation costs, leading to higher consumer prices.

- Shortages of essential goods, further fueling inflationary pressures.

The keywords associated with this section are global supply chains, commodity prices, energy crisis, geopolitical risk, and war in Ukraine.

China's Economic Slowdown and its Global Impact

China's economic slowdown, driven by factors such as a real estate crisis and strict COVID-19 policies, presents significant challenges to the global economy. China plays a crucial role in global manufacturing, trade, and finance, and a substantial slowdown could have knock-on effects on global growth and financial markets.

- China's Role in the Global Economy:

- Major manufacturing hub for many global companies.

- Significant trading partner for numerous countries.

- Key player in global financial markets.

The keywords associated with this section are China, economic slowdown, global trade, financial markets, and supply chain.

The Legacy of the Trump Administration's Economic Policies

Fiscal Stimulus and its Long-Term Effects

The Trump administration's significant fiscal stimulus, including tax cuts and increased government spending, contributed to a substantial increase in the national debt and may have exacerbated inflationary pressures. While the stimulus provided a short-term boost to the economy, its long-term effects on economic stability remain a subject of debate.

- Trump-Era Policies and Economic Consequences:

- Tax cuts led to increased budget deficits.

- Increased government spending fueled economic growth but also added to the national debt.

The keywords associated with this section are fiscal policy, national debt, budget deficit, economic stimulus, and tax cuts.

Trade Wars and Their Lasting Impact

The Trump administration's trade wars, characterized by the imposition of tariffs on imported goods, disrupted global trade relations and contributed to uncertainty in international markets. The lingering effects of these trade disputes continue to impact supply chains and economic relations between countries.

- Examples of Trade Disputes and Consequences:

- Tariffs on imported steel and aluminum increased prices for U.S. manufacturers.

- Trade tensions with China disrupted global supply chains and contributed to uncertainty.

The keywords associated with this section are trade war, tariffs, trade agreements, global trade relations, and protectionism.

Conclusion

The next Fed Chair inherits a complex and challenging economic landscape. Managing persistent inflation, navigating geopolitical instability, and addressing the lingering effects of past economic policies represent significant hurdles. The pervasive nature of economic uncertainty necessitates careful and nuanced policy responses. Understanding the complexities of economic uncertainty is crucial for informed civic participation. Stay informed about the evolving economic landscape and engage in discussions about the crucial decisions facing the next Fed Chair, ensuring a proactive approach to mitigating future economic uncertainty.

Featured Posts

-

Nieuwe Combat Support Schip Van Damen Gedoopt In Den Helder

Apr 26, 2025

Nieuwe Combat Support Schip Van Damen Gedoopt In Den Helder

Apr 26, 2025 -

Congress Smelliest Member George Santos Controversial Claim

Apr 26, 2025

Congress Smelliest Member George Santos Controversial Claim

Apr 26, 2025 -

Indie Bookstore Day Kings Day And Tumbleweeds Film Fest An April Events Roundup

Apr 26, 2025

Indie Bookstore Day Kings Day And Tumbleweeds Film Fest An April Events Roundup

Apr 26, 2025 -

Lente Is Here Your Guide To Springtime Vocabulary

Apr 26, 2025

Lente Is Here Your Guide To Springtime Vocabulary

Apr 26, 2025 -

Californias Economy Now Larger Than Japans

Apr 26, 2025

Californias Economy Now Larger Than Japans

Apr 26, 2025