Economists Forecast Bank Of Canada Interest Rate Cuts Due To Tariff Impacts

Table of Contents

Weakening Economic Growth Due to Tariffs

Tariffs are significantly impacting Canadian exports and overall GDP growth, creating a ripple effect throughout the economy. The ongoing trade war is leading to a slowdown, forcing economists to revise their economic forecasts downward.

- Decreased demand for Canadian goods in international markets: Tariffs imposed by trading partners make Canadian products more expensive, reducing their competitiveness and leading to decreased demand. This is particularly true for sectors heavily reliant on exports, such as agriculture and manufacturing.

- Increased production costs for businesses relying on imported materials: Many Canadian businesses rely on imported raw materials and intermediate goods. Tariffs on these imports increase production costs, squeezing profit margins and potentially leading to reduced output and job losses.

- Reduced business investment due to uncertainty: The uncertainty surrounding trade policy is discouraging business investment. Businesses are hesitant to commit to expansion or new projects when faced with unpredictable trade costs and market access.

- Potential for job losses in affected sectors: The combination of decreased demand and increased costs is leading to job losses in sectors heavily exposed to international trade. This contributes to a weakening labor market and further dampens economic growth.

Data from Statistics Canada and the Bank of Canada itself show a clear correlation between the escalation of tariffs and the slowing of GDP growth. These figures paint a concerning picture for the Canadian economy, highlighting the urgent need for policy intervention.

Inflationary Pressures and the Bank of Canada's Mandate

While tariffs directly impact exports and economic growth, they also contribute to inflationary pressures. This presents a significant challenge for the Bank of Canada, whose primary mandate is to maintain price stability.

- Increased import costs leading to higher consumer prices: Tariffs increase the cost of imported goods, which are then passed on to consumers in the form of higher prices. This contributes to a rise in the consumer price index (CPI) and overall inflation.

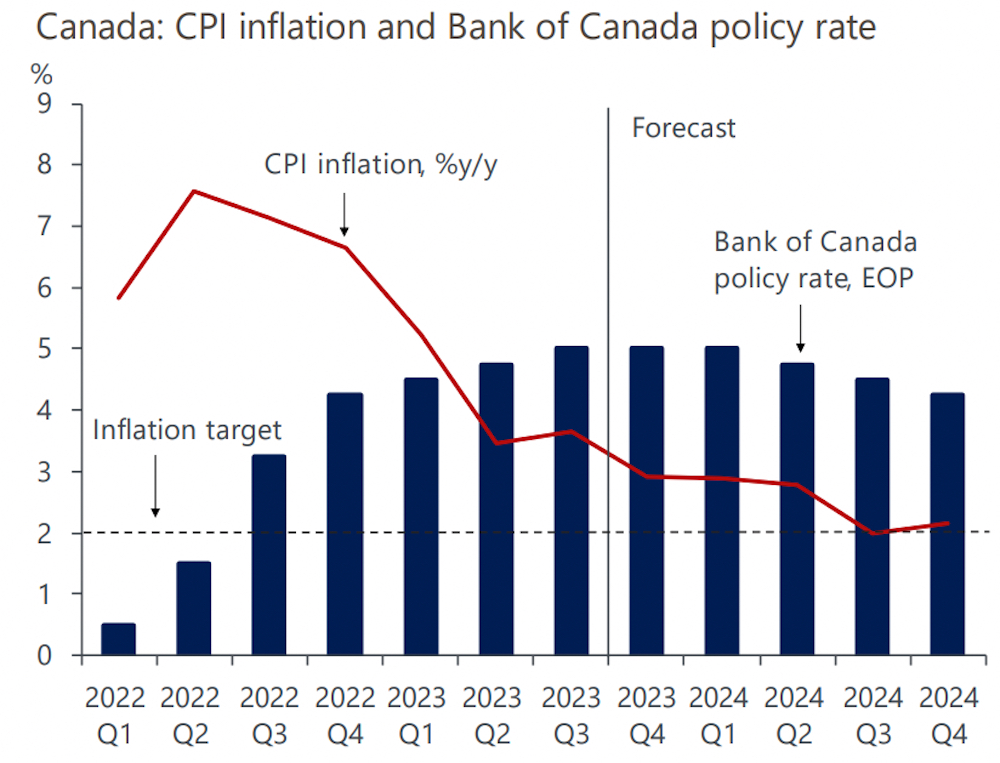

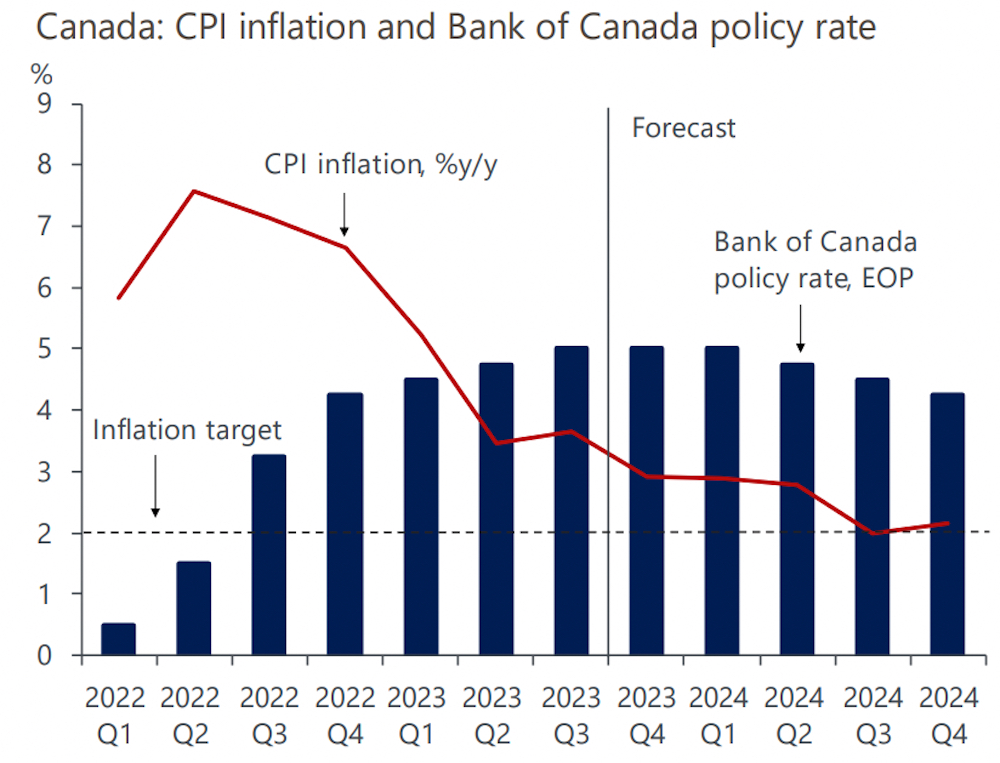

- The Bank of Canada's inflation target and its deviation from the target: The Bank of Canada typically aims for an inflation rate of around 2%. However, tariff-induced inflation pushes the actual inflation rate upwards, potentially exceeding the target range.

- The trade-off between inflation control and economic growth: The Bank of Canada faces a difficult trade-off. It needs to control inflation to maintain price stability, but aggressive measures to combat inflation could further stifle already weakening economic growth.

- How interest rate cuts can combat inflationary pressures caused by tariffs: Lower interest rates can stimulate economic activity, offsetting some of the negative impacts of tariffs on growth. However, this approach risks exacerbating inflationary pressures if not carefully managed. The Bank of Canada must carefully balance these competing concerns.

Alternative Economic Responses and Their Limitations

While interest rate cuts are a primary tool for the Bank of Canada (monetary policy), the government could also employ fiscal policy measures. However, these alternatives have their own limitations in addressing the rapid economic slowdown spurred by tariffs.

- The potential for fiscal stimulus measures: The government could increase government spending or implement tax cuts to boost economic activity.

- The challenges of implementing effective fiscal policy: Fiscal policy changes often face significant political hurdles and require time to take effect, making them less effective as an immediate response to a sudden economic shock.

- The limitations of government spending in the face of global trade uncertainty: Increased government spending may be less effective if businesses remain hesitant to invest due to ongoing trade uncertainty.

- Why interest rate cuts might be the most effective immediate response: Interest rate cuts offer a quicker and more flexible response than fiscal policy changes, making them a more appropriate tool to address the immediate economic challenges posed by tariffs.

Potential Impact on the Housing Market

The predicted interest rate cuts will likely have a significant impact on the already sensitive Canadian housing market.

- How lower interest rates might affect mortgage rates: Lower interest rates generally lead to lower mortgage rates, making homeownership more affordable and potentially stimulating demand.

- The potential for increased housing demand: Reduced mortgage rates could lead to a surge in housing demand, pushing up prices and potentially reigniting concerns about a housing bubble.

- Potential risks of stimulating another housing bubble: A rapid increase in housing prices fuelled by lower interest rates could create a new housing bubble, with potentially severe consequences if it bursts.

- The need for cautious monitoring of the housing market: The Bank of Canada will need to carefully monitor the housing market’s response to interest rate cuts to avoid exacerbating existing vulnerabilities. The current state of the housing market, characterized by high levels of household debt in some areas, demands cautious consideration.

Conclusion

The confluence of weakening economic growth, inflationary pressures stemming from tariffs, and the limitations of alternative economic responses strongly suggests an increased likelihood of Bank of Canada interest rate cuts. The impact of tariffs on Canadian exports, coupled with the Bank of Canada's mandate to maintain price stability, necessitates a carefully calibrated response. The potential effects on the housing market also demand close attention. Stay informed about the evolving economic situation and the Bank of Canada’s response to tariff impacts. Follow reputable sources for up-to-date information on Bank of Canada interest rates and their implications for the Canadian economy. Monitor announcements regarding Bank of Canada interest rate cuts and their potential effect on your personal finances and investments.

Featured Posts

-

Office365 Data Breach Hacker Makes Millions Targeting Executives

May 14, 2025

Office365 Data Breach Hacker Makes Millions Targeting Executives

May 14, 2025 -

Barry Bonds Takes A Shot At Shohei Ohtani Analyzing The Get Off My Lawn Mentality

May 14, 2025

Barry Bonds Takes A Shot At Shohei Ohtani Analyzing The Get Off My Lawn Mentality

May 14, 2025 -

Huijsen Transfer News Chelsea Aim For June 14th Completion

May 14, 2025

Huijsen Transfer News Chelsea Aim For June 14th Completion

May 14, 2025 -

Jose Mujica El Legado De Un Presidente Uruguayo

May 14, 2025

Jose Mujica El Legado De Un Presidente Uruguayo

May 14, 2025 -

De Prijs Van Informatie Bayerns Onderzoek Naar Een Nederlander

May 14, 2025

De Prijs Van Informatie Bayerns Onderzoek Naar Een Nederlander

May 14, 2025