Economists React: Unpacking The Bank Of Canada's Interest Rate Decision

Table of Contents

The Bank of Canada's Announcement: A Deep Dive

The Bank of Canada announced a [insert actual rate change, e.g., 25 basis point] increase/decrease in its key interest rate, bringing the target overnight rate to [insert new rate]. This decision, announced on [date], follows [number] consecutive rate changes and reflects the Bank's ongoing efforts to manage inflation and maintain sustainable economic growth.

- Interest rate hike/decrease: [Specify the magnitude of the change]

- Rationale: The Bank cited [mention specific economic indicators like CPI, GDP growth, etc.] as key factors influencing its decision. They expressed concern about [mention specific concerns, e.g., persistent inflation pressures, labor market tightness].

- Monetary Policy Goals: The Bank reaffirmed its commitment to achieving its 2% inflation target. The statement emphasized the need for a measured approach to monetary policy, balancing the need to control inflation with the risks to economic growth.

- Economic Outlook: The Bank's accompanying Monetary Policy Report provided a detailed assessment of the current economic outlook, projecting [mention projected GDP growth, inflation rate, unemployment rate]. The overall sentiment expressed by the Bank was one of [describe the overall tone, e.g., cautious optimism, measured concern].

Positive Reactions: Optimism Amidst Uncertainty

Several prominent economists viewed the Bank of Canada's decision positively. For example, [Economist's Name], Chief Economist at [Institution], stated that "[Quote expressing positive view and reasoning, citing source]". The optimism stems from several factors:

- Effective Inflation Control: Many believe this interest rate hike will effectively curb inflation in the medium term by cooling down demand.

- Sustainable Economic Growth: The belief that the targeted approach will allow for a soft landing, avoiding a sharp recession, is shared by many.

- Positive Economic Outlook: Proponents point to [mention specific positive economic indicators] as evidence supporting a more positive outlook for the future.

Concerns and Cautious Optimism: Potential Downsides

However, not all economists share this optimistic outlook. Concerns have been raised about the potential negative consequences of the Bank of Canada's actions. [Economist's Name] from [Institution] warned that "[Quote expressing concerns and reasoning, citing source]". The potential downsides include:

- Recession Risk: Some economists fear that this interest rate hike could tip the economy into a recession, particularly given the current [mention current economic challenges, e.g., global economic uncertainty].

- Housing Market Impact: The increased interest rates could further dampen the already slowing housing market, impacting consumer confidence and spending.

- Consumer Spending: Higher borrowing costs could lead to reduced consumer spending, potentially slowing down overall economic activity.

Impact on the Canadian Dollar and Financial Markets

The Bank of Canada's interest rate decision had an immediate impact on the Canadian dollar (CAD) and broader financial markets. The CAD [describe the immediate movement of the CAD, e.g., strengthened slightly] against major currencies following the announcement.

- CAD Exchange Rate: The short-term forecast for the CAD exchange rate is [mention the short-term forecast]. Long term, experts predict [mention long-term forecast].

- Bond Market: Bond yields [describe the movement of bond yields, e.g., rose slightly] reflecting the market's response to the increased interest rates.

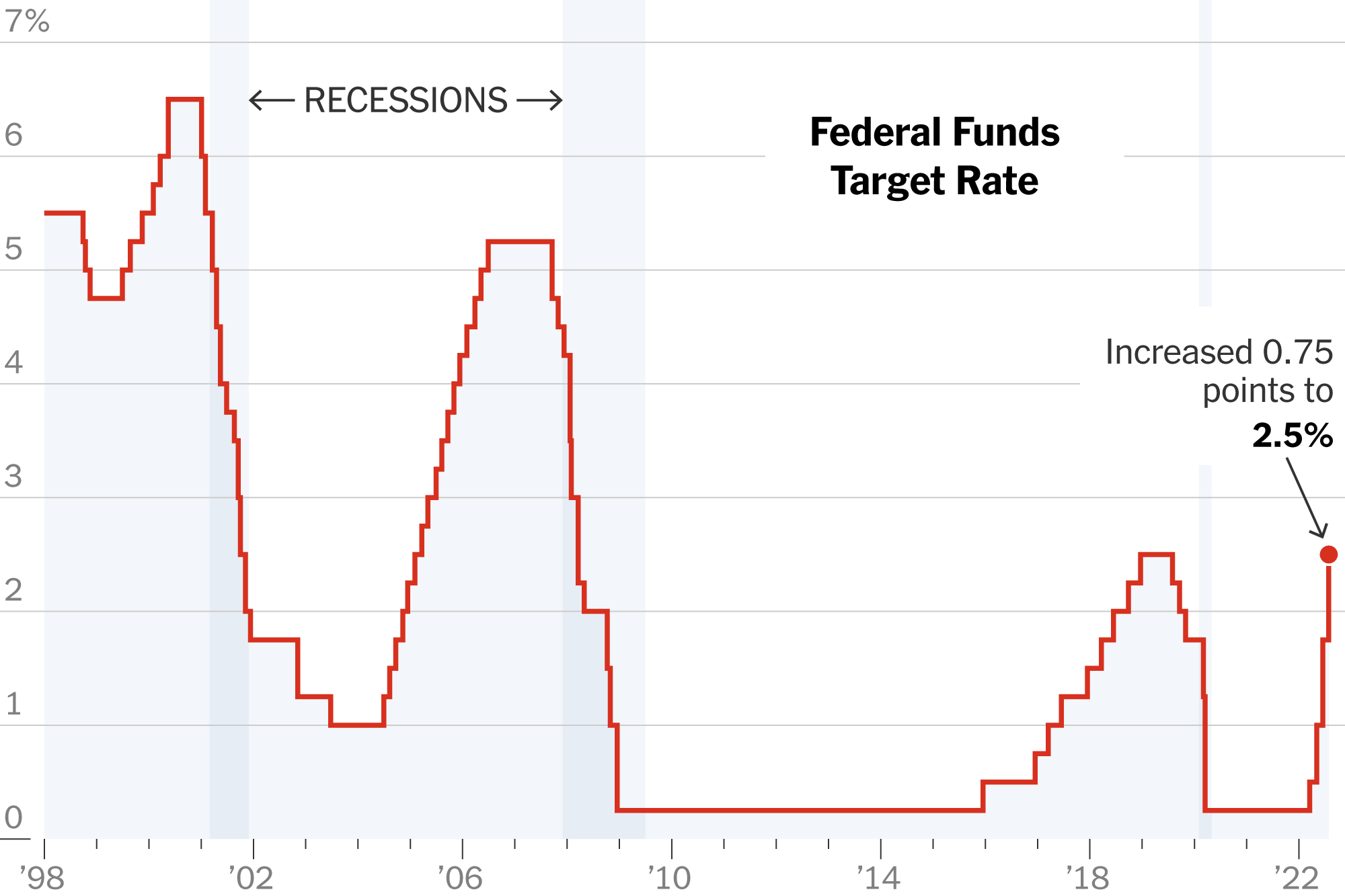

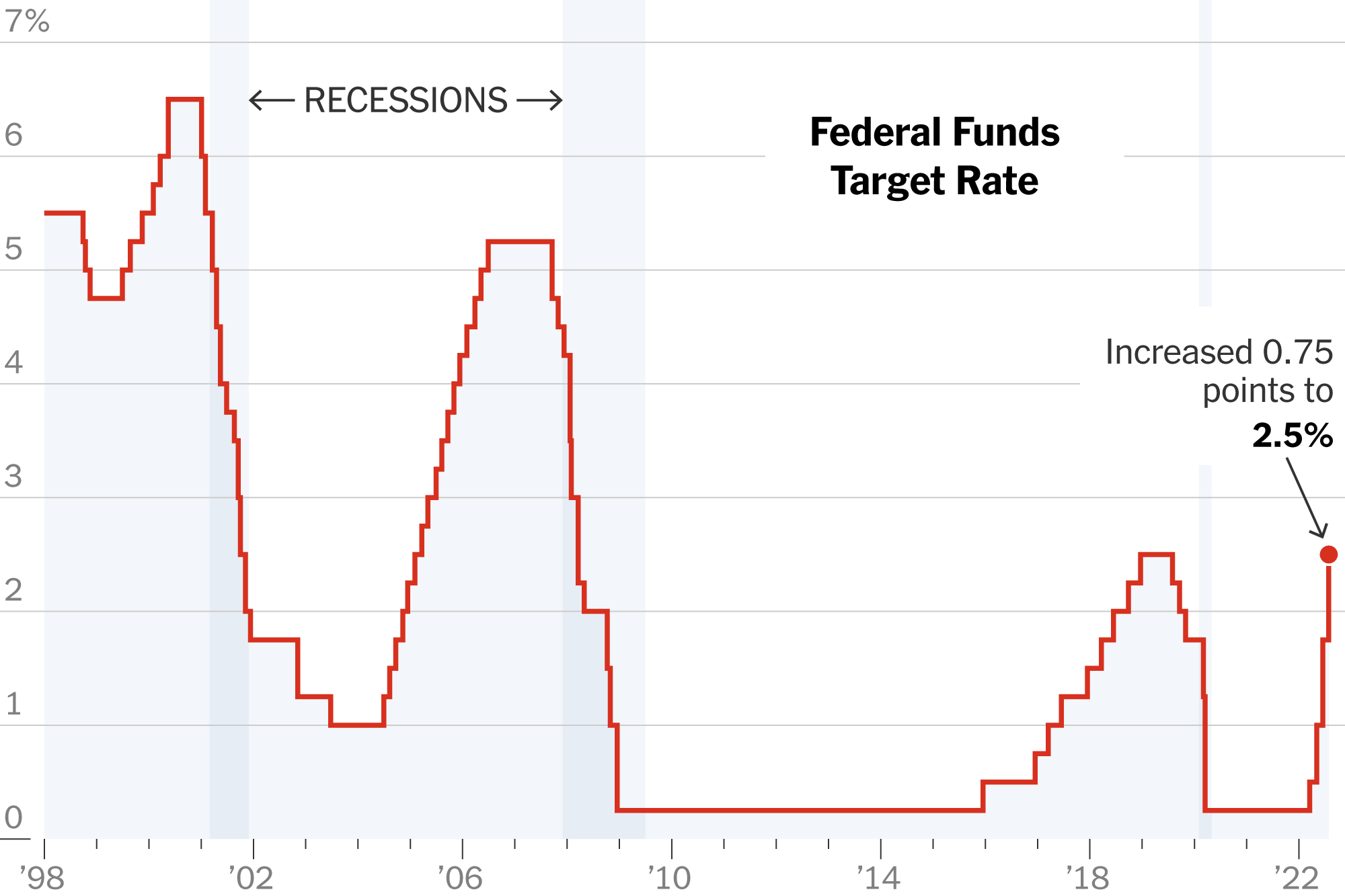

- Stock Market Reaction: The stock market [describe the stock market reaction, e.g., experienced a modest dip] initially, before recovering somewhat. [Include a chart illustrating market movements, if possible].

Conclusion

Economists' reactions to the Bank of Canada interest rate decision are mixed, with some expressing optimism about inflation control and sustainable economic growth, while others raise concerns about the potential for recession and negative impacts on the housing market and consumer spending. The decision's impact on the Canadian dollar and financial markets is already evident, but the long-term effects remain to be seen. The Bank of Canada's actions are crucial in navigating the delicate balance between inflation control and economic growth. Stay informed about future Bank of Canada Interest Rate Decisions by following our regular updates. Understanding these announcements is crucial for making informed financial decisions in the current economic climate.

Featured Posts

-

High Winds Cause Numerous Power Outages In Lehigh Valley

Apr 23, 2025

High Winds Cause Numerous Power Outages In Lehigh Valley

Apr 23, 2025 -

Analyse Du 17 Fevrier Performances De Fdj Et Schneider Electric A Paris

Apr 23, 2025

Analyse Du 17 Fevrier Performances De Fdj Et Schneider Electric A Paris

Apr 23, 2025 -

Analyse Du Portefeuille Bfm Decisions D Arbitrage Du 17 02

Apr 23, 2025

Analyse Du Portefeuille Bfm Decisions D Arbitrage Du 17 02

Apr 23, 2025 -

Exec Office365 Breach Crook Makes Millions Feds Say

Apr 23, 2025

Exec Office365 Breach Crook Makes Millions Feds Say

Apr 23, 2025 -

Yankees Smash Team Record With 9 Home Runs Judges 3 Hrs Power Victory

Apr 23, 2025

Yankees Smash Team Record With 9 Home Runs Judges 3 Hrs Power Victory

Apr 23, 2025