Economists Urge ECB To Avoid Delaying Final Two Rate Cuts

Table of Contents

The Urgent Need for Further Rate Cuts to Combat Inflation

Persistent Inflationary Pressures

Inflation in the Eurozone remains a significant concern. While recent figures show a slight decrease, it still sits considerably above the ECB's target of 2%.

- Current Inflation Levels: The current inflation rate in the Eurozone (insert current data with source citation). This figure is significantly higher than the ECB's target.

- Underlying Pressures: Several factors are contributing to persistent inflation. These include:

- Elevated energy prices, exacerbated by the ongoing war in Ukraine and global supply chain disruptions.

- Supply chain bottlenecks, which continue to impact the availability and cost of goods.

- Increased demand, as economies recover from the pandemic.

- Impact on the Economy: Persistent inflation erodes purchasing power, dampening consumer spending and impacting business investment. This negative feedback loop could further slow economic growth and hinder recovery.

The Risk of Delayed Action

Delaying the planned rate cuts carries significant risks:

- Entrenched Inflation: Prolonging high inflation increases the risk of it becoming entrenched in the economy, making it harder to control in the long term. This could lead to a wage-price spiral, a dangerous cycle where rising prices lead to higher wages, which then further fuels inflation.

- Wage-Price Spirals: A wage-price spiral, where workers demand higher wages to keep pace with inflation, can become self-perpetuating, making inflation harder to control.

- Opportunity Cost: Delaying rate cuts means potentially accepting greater economic hardship in the long run. Early intervention could mitigate the severity of the economic downturn.

Economic Growth Concerns and the Importance of Timely Monetary Policy

Balancing Inflation Control and Economic Growth

The ECB faces the difficult task of balancing its inflation control mandate with the need to support economic growth. A premature tightening of monetary policy could stifle growth and deepen any potential recession. Conversely, prolonged high inflation would severely damage the economy.

- Impact on Growth Forecasts: Delaying rate cuts could negatively impact economic growth forecasts for the Eurozone, potentially leading to a more prolonged and deeper recession.

- Recession Risk: The risk of a deeper recession is significantly increased if the ECB fails to implement the necessary rate cuts to stimulate the economy.

- Monetary Policy Lags: It's crucial to remember that monetary policy operates with a lag, meaning the full effects of rate cuts may not be felt immediately. Proactive action is therefore essential.

Market Sentiment and Investor Confidence

ECB policy decisions significantly influence investor confidence and market sentiment. Uncertainty surrounding interest rates can lead to volatility in financial markets.

- Investor Confidence: Clear and timely communication from the ECB is crucial for maintaining investor confidence. Delayed or ambiguous signals can create uncertainty and harm investment.

- Market Volatility: Delaying rate cuts could exacerbate market volatility and increase uncertainty, potentially impacting the Eurozone's financial stability.

- Communication is Key: The ECB needs to communicate its intentions clearly to manage market expectations and avoid unnecessary shocks.

Counterarguments and Potential Risks of Immediate Rate Cuts

Concerns about the Effectiveness of Further Rate Cuts

Some argue that further rate cuts may be ineffective or even counterproductive.

- Asset Bubbles: Concerns exist that further rate cuts could fuel asset bubbles in certain sectors.

- Diminishing Returns: There's a possibility of diminishing returns from further rate reductions, meaning the impact on the economy might be less significant than previous cuts.

- Limitations of Monetary Policy: Monetary policy alone cannot solve all economic challenges. Fiscal policy and structural reforms also play critical roles.

Geopolitical Uncertainties and their Impact on the Eurozone

The current geopolitical landscape presents significant challenges for the ECB.

- War in Ukraine & Energy Crisis: The ongoing war in Ukraine and the resulting energy crisis are major headwinds for the Eurozone economy.

- Adaptability: The ECB needs to remain flexible and adaptable in its monetary policy approach to address unforeseen shocks.

- Complicated Decision-Making: Geopolitical uncertainty complicates the ECB's decision-making process, requiring careful consideration of various risks and scenarios.

Conclusion

This article has highlighted the compelling arguments in favor of the ECB proceeding with its planned rate cuts without delay. Delaying these crucial adjustments poses significant risks to the Eurozone's economic recovery, potentially exacerbating inflationary pressures and prolonging economic hardship. While acknowledging the complexities and potential counterarguments, the urgency of addressing persistent inflation outweighs the perceived risks of immediate action.

Call to Action: The ECB must act decisively and avoid delaying the final two rate cuts to safeguard the Eurozone's economic future. Only through timely and effective monetary policy can the ECB effectively combat inflation and promote sustainable economic growth. Further discussion and analysis of the ECB’s planned interest rate cuts are crucial for informed decision-making and navigating the complexities of the Eurozone economy.

Featured Posts

-

Chase Lees Scoreless Mlb Return Roll Call May 12 2025

May 31, 2025

Chase Lees Scoreless Mlb Return Roll Call May 12 2025

May 31, 2025 -

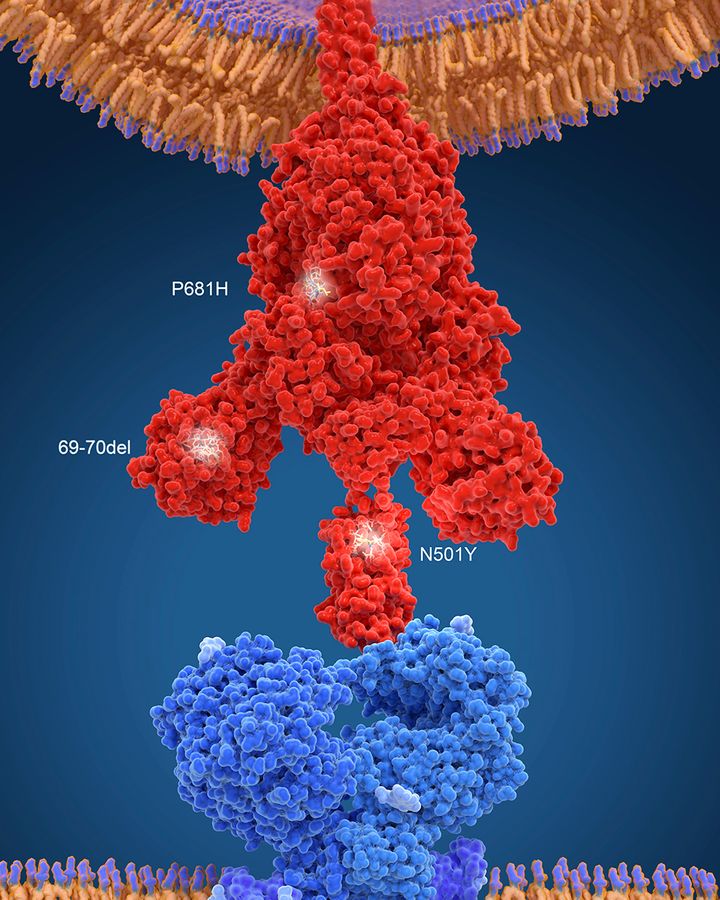

Covid 19 Case Spike Is A New Variant The Cause Who Investigation

May 31, 2025

Covid 19 Case Spike Is A New Variant The Cause Who Investigation

May 31, 2025 -

Budget Tablet Battle Samsungs 101 Offer Takes On Apples I Pad

May 31, 2025

Budget Tablet Battle Samsungs 101 Offer Takes On Apples I Pad

May 31, 2025 -

The Role Of Veterinary Watchdogs Protecting Patients And Practitioners

May 31, 2025

The Role Of Veterinary Watchdogs Protecting Patients And Practitioners

May 31, 2025 -

Ais Learning Limitations And The Importance Of Responsible Ai

May 31, 2025

Ais Learning Limitations And The Importance Of Responsible Ai

May 31, 2025