Election Promises: A Path To Economic Slowdown And Increased Deficits?

Table of Contents

The Allure of Populist Promises and Their Economic Repercussions

Populist election promises, such as sweeping tax cuts or significant increases in social spending, often hold strong appeal to voters. They promise immediate benefits and address pressing concerns, making them politically attractive. However, these promises frequently lack fiscal realism and sustainable funding mechanisms. The inherent problem lies in the disconnect between the short-term political gain and the long-term economic consequences.

- Examples of historically unsustainable election promises and their consequences: Many nations have experienced periods of rapid economic growth followed by sharp downturns due to unsustainable election promises. For instance, some countries have implemented large-scale tax cuts without corresponding spending reductions, leading to increased budget deficits and eventually, a need for austerity measures.

- The role of short-term political gains versus long-term economic stability: Politicians often prioritize short-term electoral success over long-term economic planning. This can lead to policies that provide immediate gratification to voters but ultimately harm the economy in the long run.

- The danger of neglecting long-term economic planning in favor of immediate gratification: Failing to adequately consider the long-term fiscal implications of election promises can create a cycle of debt and economic instability. A lack of forward-thinking economic planning undermines the country's future prosperity.

Analyzing the Impact of Increased Government Spending

Significantly increased government spending, while potentially stimulating the economy in the short-term, can have detrimental long-term effects. One key concern is the crowding-out effect, where increased government borrowing reduces the funds available for private sector investment, hindering economic growth. Furthermore, this increased borrowing can drive up interest rates, making it more expensive for businesses and individuals to borrow money.

- The impact of increased government spending on inflation: Excessive government spending can fuel inflation if it outpaces the economy's capacity to produce goods and services. This leads to a devaluation of the currency and a decrease in purchasing power.

- The potential for increased national debt and its long-term consequences: Persistent budget deficits, fueled by unsustainable government spending, contribute to a growing national debt. This debt necessitates increased interest payments, diverting resources from essential public services and potentially hindering future economic growth.

- Case studies of countries facing economic difficulties due to unsustainable government spending: Greece's economic crisis serves as a stark example of the dangers of unsustainable government spending and mounting national debt. The inability to manage fiscal responsibilities led to significant economic hardship and widespread social unrest.

The Role of Tax Cuts and Their Impact on Revenue

Large-scale tax cuts, particularly those not accompanied by corresponding spending cuts, can significantly impact government revenue. While proponents argue that tax cuts stimulate economic growth through supply-side economics, the actual effect often depends on various factors. The Laffer Curve, illustrating the relationship between tax rates and government revenue, suggests an optimal tax rate exists, but determining this point is complex and often debated.

- The potential for tax cuts to stimulate economic growth (supply-side economics): Supply-side economics argues that lower taxes incentivize investment and job creation, ultimately boosting economic growth and increasing tax revenue. However, this effect is not guaranteed and is often debated among economists.

- The potential for tax cuts to exacerbate income inequality: Tax cuts often disproportionately benefit higher-income earners, potentially widening the gap between the rich and the poor. This can lead to social unrest and undermine economic stability.

- Examples of tax cuts that have led to increased or decreased revenue: Historical examples demonstrate that the impact of tax cuts on revenue varies widely depending on economic conditions and the design of the tax cuts themselves. Some tax cuts have indeed spurred economic growth, but others have resulted in significant revenue losses without commensurate growth.

Evaluating the Credibility and Feasibility of Election Promises

Voters need tools to evaluate the economic feasibility of election promises. Independent economic analysis and transparent government budgeting are crucial. Citizens should critically assess promises based on realistic economic projections, not just catchy slogans.

- How to identify unrealistic election promises: Look for promises without detailed funding plans, those that ignore existing economic constraints, or those lacking independent verification.

- The importance of detailed cost-benefit analyses of election promises: Demand thorough cost-benefit analyses from candidates to understand the full implications of their proposals.

- The role of independent economists and think tanks in evaluating election pledges: Seek out the assessments of independent economists and reputable think tanks to gain an unbiased perspective on the economic feasibility of election promises.

Conclusion

Unrealistic election promises, driven by populist appeal or a lack of fiscal responsibility, can have severe consequences. Increased government spending without sustainable funding, coupled with large-scale tax cuts, can lead to increased deficits, economic slowdown, and heightened national debt. This can negatively impact essential public services, increase inflation, and hinder long-term economic growth. Before casting your vote, carefully scrutinize election promises and demand detailed economic plans that promote long-term fiscal stability. Understand the potential consequences of unsustainable election promises and make informed choices to safeguard your nation's economic future. Demand transparency and accountability from political candidates regarding their economic plans—your future depends on it.

Featured Posts

-

Covid 19 Test Fraud Lab Owner Admits To Falsifying Results

Apr 25, 2025

Covid 19 Test Fraud Lab Owner Admits To Falsifying Results

Apr 25, 2025 -

Montana Senate Coalition Democrats And Republicans Battle For Control

Apr 25, 2025

Montana Senate Coalition Democrats And Republicans Battle For Control

Apr 25, 2025 -

Understanding Canberras Anzac Day Heater Tradition The Legend Of Tim The Yowie Man

Apr 25, 2025

Understanding Canberras Anzac Day Heater Tradition The Legend Of Tim The Yowie Man

Apr 25, 2025 -

2025 Nfl Draft Scouting Texas Wide Receiver Matthew Golden

Apr 25, 2025

2025 Nfl Draft Scouting Texas Wide Receiver Matthew Golden

Apr 25, 2025 -

Las Vegas Raiders Scout John Spytek Attends Ashton Jeantys Pro Day

Apr 25, 2025

Las Vegas Raiders Scout John Spytek Attends Ashton Jeantys Pro Day

Apr 25, 2025

Latest Posts

-

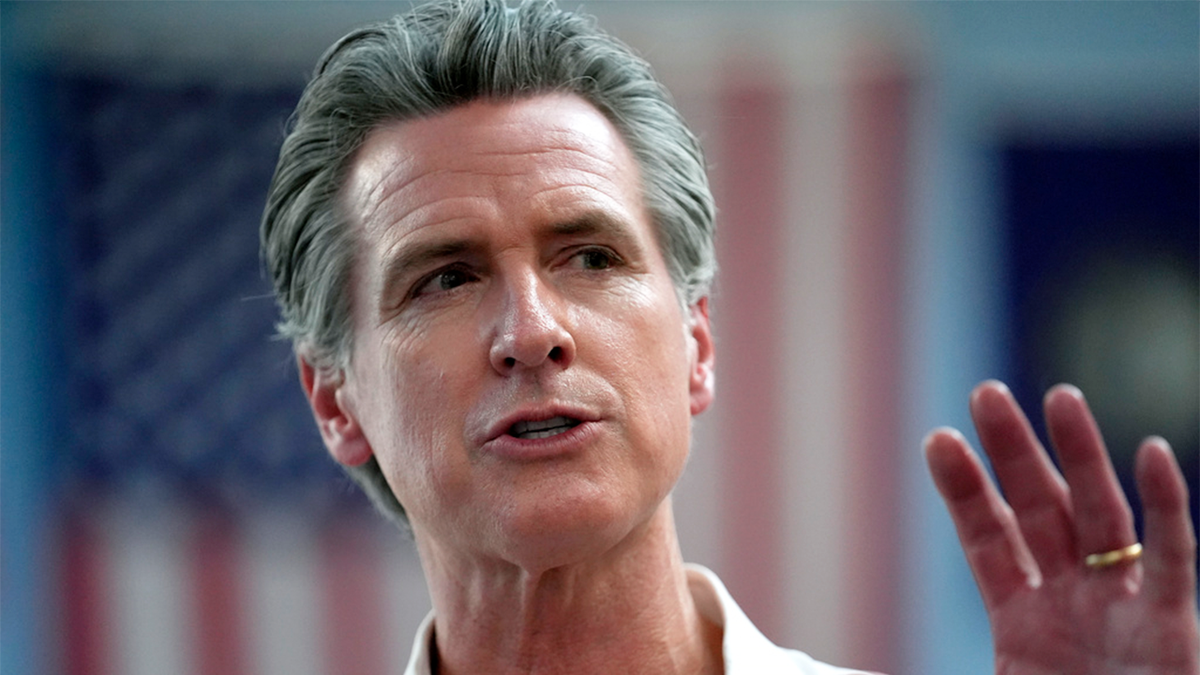

Newsoms Sharp Rebuke Of Toxic Democrats

Apr 26, 2025

Newsoms Sharp Rebuke Of Toxic Democrats

Apr 26, 2025 -

Gavin Newsom Criticizes Toxic And Judgmental Democrats

Apr 26, 2025

Gavin Newsom Criticizes Toxic And Judgmental Democrats

Apr 26, 2025 -

Newsom Faces Criticism For Toxic Democrats Comment

Apr 26, 2025

Newsom Faces Criticism For Toxic Democrats Comment

Apr 26, 2025 -

Gavin Newsoms Toxic Democrat Remark A Political Backlash

Apr 26, 2025

Gavin Newsoms Toxic Democrat Remark A Political Backlash

Apr 26, 2025