Election Promises And Economic Slowdown: A Realistic Assessment Of Fiscal Implications

Table of Contents

Election promises, in this context, refer to commitments made by political parties during election campaigns. An economic slowdown signifies a period of reduced economic activity, characterized by lower GDP growth, increased unemployment, and potentially deflation. Fiscal implications refer to the impact of government policies, particularly spending and taxation, on the national budget and the overall economy.

Analyzing the Nature of Election Promises During Economic Slowdowns

Types of Promises and Their Fiscal Impact:

During economic slowdowns, the temptation to make populist promises increases. Let's examine some examples:

- Tax cuts: While popular, widespread tax cuts can significantly reduce government revenue, exacerbating budget deficits, particularly during a period of low economic activity. This requires careful consideration of fiscal policy.

- Increased social spending: Promises of expanded social safety nets (unemployment benefits, welfare programs) are often necessary during a downturn to alleviate hardship. However, this increased public spending strains government budgets.

- Infrastructure projects: While infrastructure spending can stimulate economic growth in the long term, the immediate fiscal impact involves significant upfront costs, potentially leading to increased government debt. This must be weighed against the potential for long-term economic benefits.

- Wage increases for public sector employees: While desirable to improve living standards, large-scale public sector wage increases place a substantial burden on the government budget during an economic slowdown.

The feasibility of any promise depends heavily on the current economic climate. Promises made without a realistic assessment of the available resources and revenue streams are often unsustainable.

The Role of Political Rhetoric and Public Expectations:

Unrealistic promises create inflated public expectations, potentially leading to voter disillusionment if the promises cannot be delivered. This can damage public trust in political institutions and erode confidence in the government's ability to manage the economy. Media coverage plays a significant role in shaping public perception. Sensationalist reporting of promises can overshadow a critical examination of their fiscal implications.

Assessing the Current Economic Climate and Its Constraints

Key Economic Indicators and Their Relevance:

Several key economic indicators provide a crucial framework for assessing the fiscal space available to governments:

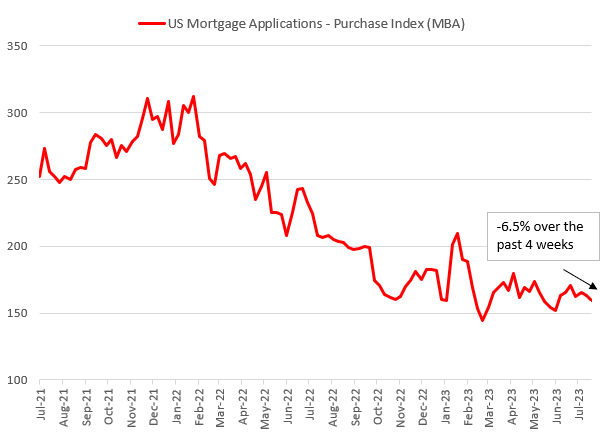

- GDP growth: Low or negative GDP growth directly impacts tax revenues, reducing the government's ability to fund existing programs, let alone new initiatives.

- Inflation: High inflation erodes the purchasing power of government funds, making it more expensive to implement policies and potentially contributing to wage-price spirals.

- Unemployment rate: High unemployment increases the demand for social safety nets and support programs, adding pressure on government budgets.

During slowdowns, low tax revenues coincide with increased demand for social safety nets, significantly limiting the government's fiscal capacity.

International Economic Factors and Their Influence:

Global economic trends significantly influence a nation's fiscal policy options:

- Global recession: A global recession can severely reduce export earnings and foreign investment, impacting government revenue and increasing the demand for economic stimulus.

- Trade wars: Trade conflicts disrupt supply chains and reduce international trade, negatively affecting economic growth and government revenue.

- International financial institutions: Conditions imposed by institutions like the IMF can constrain a government's ability to spend freely, demanding fiscal discipline even during an economic slowdown.

Exploring the Fiscal Implications of Unfunded or Underfunded Promises

Increased Budget Deficits and National Debt:

Unfunded or underfunded election promises directly contribute to:

- Increased budget deficits: The gap between government spending and revenue widens, leading to unsustainable fiscal positions.

- Accumulating national debt: Governments need to borrow to finance deficits, leading to a growing national debt burden. This increases the risk of future fiscal crises.

Potential for Credit Rating Downgrades and Increased Borrowing Costs:

High levels of national debt can negatively impact a country's credit rating:

- Credit rating downgrades: Lower credit ratings increase borrowing costs for governments, making it more expensive to finance future spending.

- Higher borrowing costs: Increased interest rates on government debt reduce the funds available for other essential programs and services, squeezing public spending.

Strategies for Fiscal Responsibility During Economic Slowdowns

Prioritizing Essential Public Services:

During an economic downturn, governments need to:

- Allocate resources efficiently: Prioritizing essential public services (healthcare, education, social safety nets) is critical, potentially delaying or scaling back less critical projects.

- Implement austerity measures: Though unpopular, these measures are sometimes needed to bring down the budget deficit and control government debt levels.

Exploring Alternative Funding Mechanisms:

Governments can explore alternative funding mechanisms:

- Public-private partnerships (PPPs): PPPs can share financial risks and potentially provide efficient infrastructure development, but require careful planning and transparency.

- Innovative financing models: Exploring creative financing models, such as green bonds or social impact bonds, can offer additional resources for specific programs. However, the feasibility depends on market conditions and investor confidence.

Election Promises and Economic Slowdowns: A Call for Fiscal Prudence

This article highlights the crucial link between election promises and their fiscal consequences during economic slowdowns. Unrealistic promises can lead to unsustainable budget deficits, accumulating national debt, and ultimately, economic instability. Both policymakers and voters need to engage in realistic assessments of fiscal implications. Demand accountability from your political leaders by carefully scrutinizing their election promises and their realistic fiscal implications. Informed voters are crucial for ensuring fiscal prudence during economic slowdowns. Further research into specific policy proposals and their economic impact is encouraged for informed civic engagement.

Featured Posts

-

Harry Kanes Brace Propels Bayern Munich To Victory Over Werder Bremen

Apr 25, 2025

Harry Kanes Brace Propels Bayern Munich To Victory Over Werder Bremen

Apr 25, 2025 -

Everything You Need To Know About Synduality Echo Of Ada Season 1

Apr 25, 2025

Everything You Need To Know About Synduality Echo Of Ada Season 1

Apr 25, 2025 -

April 23 2025 Key Developments In The Trump Presidency

Apr 25, 2025

April 23 2025 Key Developments In The Trump Presidency

Apr 25, 2025 -

Is Betting On The Los Angeles Wildfires A Sign Of The Times

Apr 25, 2025

Is Betting On The Los Angeles Wildfires A Sign Of The Times

Apr 25, 2025 -

Dope Thief Season Finale Preview Episode 7 Review

Apr 25, 2025

Dope Thief Season Finale Preview Episode 7 Review

Apr 25, 2025

Latest Posts

-

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025 -

Are We Normalizing Disaster Betting The Los Angeles Wildfires Example

Apr 26, 2025

Are We Normalizing Disaster Betting The Los Angeles Wildfires Example

Apr 26, 2025 -

The China Factor Analyzing The Difficulties Faced By Premium Car Brands

Apr 26, 2025

The China Factor Analyzing The Difficulties Faced By Premium Car Brands

Apr 26, 2025 -

Gambling On Catastrophe The Los Angeles Wildfires And The Future Of Disaster Betting

Apr 26, 2025

Gambling On Catastrophe The Los Angeles Wildfires And The Future Of Disaster Betting

Apr 26, 2025 -

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Auto Brands

Apr 26, 2025

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Auto Brands

Apr 26, 2025