Elliott Eyes Exclusive Russian Gas Pipeline Investment Opportunity

Table of Contents

Elliott's Investment Strategy and Rationale

Elliott Management is known for its aggressive, high-stakes investment strategies, often targeting undervalued assets and seeking significant returns. While this Russian gas pipeline investment opportunity is unconventional compared to some of their past ventures, several factors might explain their interest. Their typical approach involves deep due diligence, identifying potential for significant value creation, even in complex and politically charged environments.

- Potential for High Returns: Despite inherent risks, the potential for exceptionally high returns in the energy sector is a significant draw. Russian gas exports remain a crucial component of the global energy supply, making any significant pipeline project potentially immensely profitable.

- Diversification into Energy Sector: Expanding into the energy sector could be a strategic move for Elliott, diversifying its portfolio and hedging against risks in other investment areas.

- Long-term Strategic Vision: Elliott likely sees a long-term strategic opportunity in the Russian energy market, anticipating future growth and potential for influence.

- Potential for Influence: A substantial investment could grant Elliott considerable influence over the pipeline's operations and potentially shape future energy policy within Russia, though this is a highly speculative outcome.

The Russian Gas Pipeline Project: An Overview

While the specific pipeline project remains undisclosed, reports suggest Elliott is examining a major artery within the Russian gas infrastructure, potentially one connected to key European export routes. This pipeline likely boasts substantial capacity and plays a critical role in supplying gas to both domestic and international markets.

- Key Stakeholders: The stakeholders involved could include Gazprom, the Russian state-owned energy giant, along with various international partners and regulatory bodies. Understanding their roles is crucial in assessing the investment's feasibility.

- Existing Infrastructure & Upgrades: Existing infrastructure, potential upgrades, and future expansion plans directly impact the project’s overall profitability and risk profile. Any required modernization will significantly influence the project’s timeline and cost.

- Projected Revenue Streams & Profitability: The projected revenue streams are directly linked to gas demand and prices, making this investment sensitive to global market fluctuations. This analysis would be crucial to Elliott’s investment decision.

- Environmental Impact Assessment: Any environmental impact assessment, along with potential regulatory hurdles related to environmental concerns, will factor heavily into Elliott's risk assessment.

Geopolitical Implications and Risks

Investing in Russian energy projects currently carries significant geopolitical risk. The ongoing tensions between Russia and the West, coupled with the potential for sanctions, create a volatile investment environment.

- Sanctions and Legal Challenges: Existing and potential future sanctions imposed by Western governments pose a significant threat to the profitability, and even the legality, of the investment.

- Dependence on Russian Energy Resources: Europe's reliance on Russian energy resources is a double-edged sword, impacting both the demand for gas and the political sensitivities surrounding the investment.

- Impact of Global Energy Prices and Demand: Fluctuations in global energy prices and demand directly impact the pipeline's profitability, making this investment inherently volatile.

- Potential for Conflict or Political Instability: The geopolitical landscape around Russia presents inherent instability, adding another layer of uncertainty to the investment.

Competitive Landscape and Alternative Investments

Elliott is not alone in exploring energy sector investment opportunities. Numerous other international players are active in the energy sector. Therefore, a thorough competitive analysis is crucial.

- Comparison with Other Energy Investments: The attractiveness of this Russian gas pipeline investment must be weighed against alternative energy projects globally, considering their respective risks and rewards.

- Competitive Advantages and Disadvantages: Elliott must carefully weigh the unique advantages and disadvantages of this project compared to its competitors' offerings.

- Potential for Partnerships or Joint Ventures: Collaboration with other investors could mitigate some risks and enhance expertise, but will also necessitate careful consideration of partnership agreements.

- Market Saturation and Future Growth Potential: Careful assessment of market saturation and future growth potential is crucial; understanding future demand is essential to a successful investment.

Conclusion: Elliott's Potential Russian Gas Pipeline Investment: A Calculated Gamble?

Elliott's potential involvement in this Russian gas pipeline investment opportunity presents a compelling case study in high-stakes investing. The potential for high-yield returns is undeniable, but the geopolitical risks are substantial. The firm’s decision will hinge on a thorough assessment of these competing factors. The success of this investment hinges on a deep understanding of the Russian energy market, precise geopolitical forecasting, and a tolerance for significant risk. This Russian gas pipeline investment opportunity, with its significant potential and considerable risks, represents a fascinating gamble. Follow the developments of this exciting investment opportunity and learn more about Elliott's strategic investments in the energy sector.

Featured Posts

-

Le Bayern Munich Dit Au Revoir A Thomas Mueller Apres Un Quart De Siecle

May 11, 2025

Le Bayern Munich Dit Au Revoir A Thomas Mueller Apres Un Quart De Siecle

May 11, 2025 -

Experience The John Wick World Become Baba Yaga In Las Vegas

May 11, 2025

Experience The John Wick World Become Baba Yaga In Las Vegas

May 11, 2025 -

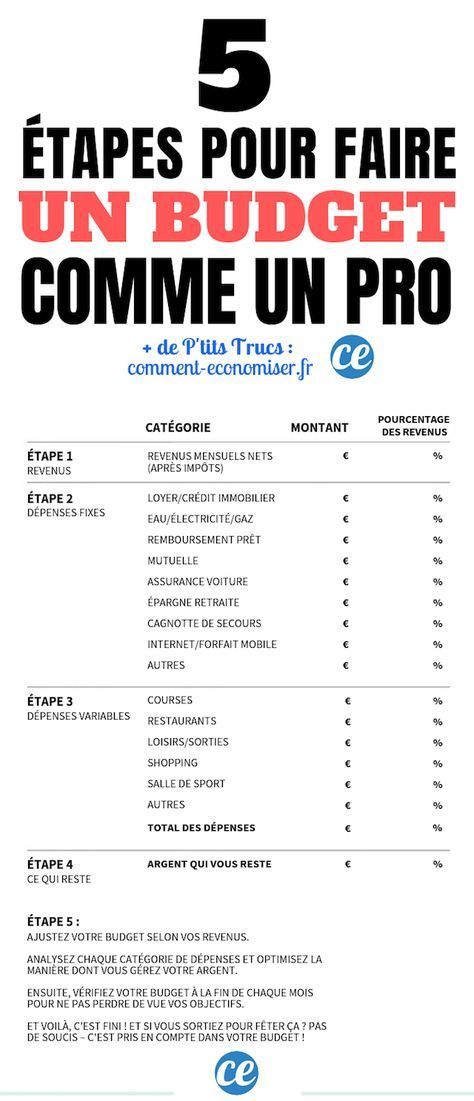

Optimiser Son Budget 12 Conseils Pour Economiser

May 11, 2025

Optimiser Son Budget 12 Conseils Pour Economiser

May 11, 2025 -

Analyzing The Henry Cavill Wolverine Casting Idea For World War Hulk

May 11, 2025

Analyzing The Henry Cavill Wolverine Casting Idea For World War Hulk

May 11, 2025 -

Nba Playoffs Pliris Enimerosi Gia Ta Zeygaria Kai To Programma

May 11, 2025

Nba Playoffs Pliris Enimerosi Gia Ta Zeygaria Kai To Programma

May 11, 2025