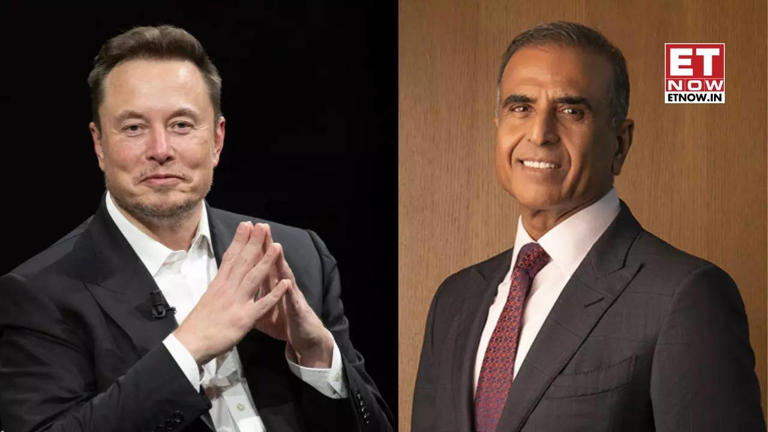

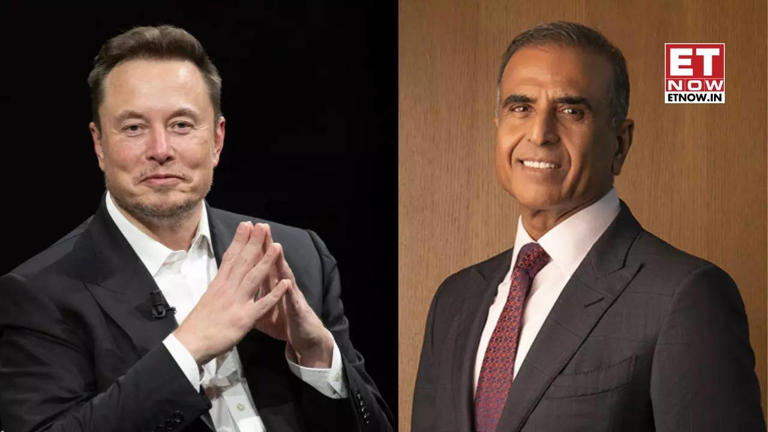

Elon Musk's Billions: Tesla Rally Fuels Wealth Increase Post-Dogecoin Step-Back

Table of Contents

Tesla's Stock Surge and its Impact on Musk's Net Worth

Tesla's remarkable stock performance has been the primary catalyst behind the recent increase in Elon Musk's net worth. The correlation between Tesla's market capitalization and Musk's personal wealth is undeniable; as Tesla's stock price rises, so does his fortune. Recent reports show a significant percentage increase in Tesla's stock price, directly translating to billions added to Musk's overall net worth.

- Recent positive financial reports from Tesla: Stronger-than-expected earnings and impressive vehicle delivery numbers have boosted investor confidence.

- Increased investor confidence in Tesla's future: Tesla's continued innovation in electric vehicle technology and its expansion into new markets have fueled optimism.

- Impact of new product announcements or technological advancements: The unveiling of new models, advancements in battery technology, and progress in autonomous driving capabilities consistently impact Tesla's stock valuation.

- Analysis of market trends favoring electric vehicle manufacturers: The growing global demand for electric vehicles and supportive government policies create a favorable environment for Tesla's continued success. This positive market sentiment is a major contributor to the rise in Tesla's stock price and, consequently, Elon Musk's billions.

The Dogecoin Dip and its Temporary Effect

Elon Musk's public embrace of Dogecoin, a meme cryptocurrency, significantly impacted his net worth in the past. While Dogecoin's price volatility resulted in fluctuations in Musk's wealth, this effect has proven to be temporary compared to the substantial increase driven by Tesla's recent success. The Dogecoin dip serves as a stark contrast to the current upward trajectory fueled by Tesla's performance.

- Historical overview of Dogecoin's price volatility: Dogecoin's history is marked by extreme price swings, making it a highly speculative asset.

- Musk's public statements regarding Dogecoin: Musk's tweets and pronouncements about Dogecoin have historically influenced its price, highlighting the risks associated with such volatile assets.

- The general market sentiment surrounding meme cryptocurrencies: The cryptocurrency market remains largely speculative and susceptible to rapid changes in investor sentiment.

- Experts' opinions on the long-term viability of Dogecoin: Many financial experts question the long-term viability of Dogecoin as a legitimate investment.

Diversification of Musk's Holdings and Future Projections

Beyond Tesla, Elon Musk's vast wealth is diversified across other ambitious ventures, including SpaceX and Neuralink. These companies contribute significantly to his overall net worth and offer further potential for growth. Predicting Musk's future net worth remains speculative, but analyzing the potential of his various endeavors provides a glimpse into future possibilities.

- SpaceX's progress and potential for future revenue: SpaceX's advancements in space exploration and its growing commercial space ventures are significant contributors to Musk's wealth.

- The potential of Neuralink's technology: Neuralink's brain-computer interface technology, while still in its early stages, holds immense long-term potential, potentially adding billions to Musk's net worth in the future.

- Analysis of Musk's investment strategies: Understanding Musk's approach to investment and risk-taking is crucial in assessing his potential future wealth.

- Expert opinions on the sustainability of Musk's wealth: While impressive, Musk's wealth is tied to the success of several high-risk ventures. Experts offer varied perspectives on the long-term sustainability of his fortune.

Conclusion

In conclusion, the recent surge in Elon Musk's billions is primarily attributable to the remarkable rally in Tesla's stock price. While the Dogecoin dip had a temporary impact, the sustained strength of Tesla and the potential of Musk's other ventures point to a continued upward trajectory for his net worth. The interplay between Tesla's market performance, the fluctuating value of Dogecoin, and the diverse portfolio of his companies paints a complex picture of the ever-evolving landscape of Elon Musk's financial empire. Stay informed about the continuing fluctuations of Elon Musk's billions by subscribing to our newsletter for the latest updates on Tesla, SpaceX, and other ventures impacting his net worth.

Featured Posts

-

Hollywood Shutdown Wga And Sag Aftra Strike Impacts Film And Television

May 10, 2025

Hollywood Shutdown Wga And Sag Aftra Strike Impacts Film And Television

May 10, 2025 -

Clarification Politique Elisabeth Borne Explore La Fusion De Renaissance Et Du Modem

May 10, 2025

Clarification Politique Elisabeth Borne Explore La Fusion De Renaissance Et Du Modem

May 10, 2025 -

The Nottingham Attacks Victims Stories Of Survival And Recovery

May 10, 2025

The Nottingham Attacks Victims Stories Of Survival And Recovery

May 10, 2025 -

Harry Styles Response To A Terrible Snl Impression

May 10, 2025

Harry Styles Response To A Terrible Snl Impression

May 10, 2025 -

100 Days Of Trump How Did It Affect Elon Musks Net Worth

May 10, 2025

100 Days Of Trump How Did It Affect Elon Musks Net Worth

May 10, 2025