Elon Musk's Net Worth Falls Below $300 Billion: Tesla, Tariffs, And Market Impacts

Table of Contents

Elon Musk, the enigmatic CEO of Tesla and SpaceX, recently saw his net worth dip below the $300 billion mark. This significant decline wasn't an isolated event but rather a reflection of converging factors impacting Tesla's stock performance, global economic uncertainties, and fluctuating market sentiment. This article delves into the key contributing factors behind this dramatic drop in Elon Musk's net worth, analyzing the interconnectedness of Tesla's performance, international trade policies, and overall market trends.

Tesla Stock Performance and its Impact on Elon Musk's Net Worth

The Volatility of Tesla Stock

The inherent volatility of Tesla's stock price is a significant factor influencing Elon Musk's net worth. Tesla stock, like many high-growth tech stocks, is highly susceptible to market shifts and news cycles. Even minor negative news can trigger significant price swings. The Tesla stock price is often driven by speculation and investor sentiment, making it particularly vulnerable.

- Examples of recent news impacting Tesla stock: Production delays at Gigafactories, increased competition from established automakers and new EV startups, regulatory investigations, and Musk's own public statements.

- A single controversial tweet or a perceived misstep in product development can drastically alter investor perception, leading to immediate and substantial drops in the Tesla stock price. This directly impacts Musk’s net worth, as a large portion of his wealth is tied to his Tesla stock ownership.

Impact of Elon Musk's Public Statements and Actions

Elon Musk's public persona and actions significantly influence Tesla's stock price and, consequently, his net worth. His frequent use of Twitter, sometimes with controversial or unexpected announcements, creates volatility.

- Examples of controversial tweets or actions impacting investor confidence: Musk's tweets about taking Tesla private, his involvement with Dogecoin, and his sometimes unpredictable management style.

- These actions, while sometimes generating excitement, can also erode investor confidence. Any perceived instability or uncertainty surrounding Musk's leadership can negatively impact the Elon Musk Twitter perception and lead to sell-offs, directly affecting the Elon Musk net worth.

Global Economic Factors and International Trade

The Role of Inflation and Interest Rate Hikes

Global economic factors play a significant role in the valuation of high-growth tech stocks like Tesla. Rising inflation and subsequent interest rate hikes by central banks worldwide create a challenging environment.

- Discuss the correlation between rising interest rates and decreased investor appetite for riskier assets: Higher interest rates make bonds and other fixed-income securities more attractive, diverting investment away from riskier, growth-oriented stocks like Tesla.

- This shift in investor preference directly affects Tesla's valuation and, therefore, Elon Musk's net worth. Macroeconomic headwinds, such as inflation and rising interest rates, contribute to global economic uncertainty, impacting the overall market sentiment and decreasing investor confidence in growth stocks.

Impact of Tariffs and Trade Wars

International trade policies and geopolitical events can also influence Tesla's performance and Elon Musk's wealth. Tariffs and trade disputes can disrupt Tesla's global supply chain and impact its international sales.

- Analyze the impact of potential trade barriers on Tesla's global supply chain and market access: Increased tariffs on imported components or restrictions on Tesla's exports can increase production costs and limit market reach.

- These trade barriers directly affect Tesla's profitability and revenue, consequently impacting its stock price and Elon Musk net worth. Geopolitical instability and international trade tensions can create uncertainty for investors, further contributing to market volatility.

Market Sentiment and Investor Confidence

The Psychological Impact on Investors

Investor sentiment and confidence are crucial drivers of stock prices, especially for companies like Tesla that rely heavily on investor optimism. Market psychology plays a significant role in the valuation of growth stocks.

- Examples of instances where overall market sentiment negatively affected Tesla's stock price: Periods of broader market downturns often see Tesla's stock price decline more sharply than the overall market.

- Negative news cycles, even if unrelated to Tesla's specific performance, can trigger sell-offs driven by overall market pessimism. This illustrates the importance of understanding investor confidence and market sentiment in the context of Tesla's stock performance and Elon Musk net worth.

Competition in the Electric Vehicle Market

The electric vehicle (EV) market is becoming increasingly competitive. The emergence of new players and the expansion of established automakers into the EV space put downward pressure on Tesla's market share and stock valuation.

- Mention key competitors and their market impact on Tesla: Companies like Ford, GM, Volkswagen, and numerous Chinese EV manufacturers are challenging Tesla's dominance.

- Increased competition leads to intensified price wars and a more challenging environment for maintaining high profit margins. This competition within the electric vehicle market contributes to the volatility of Tesla's stock price and indirectly influences Elon Musk net worth.

Conclusion

This article highlights the complex interplay of factors contributing to the recent drop in Elon Musk's net worth. Tesla's stock performance, global economic headwinds, international trade issues, and evolving market sentiment all played a significant role. The volatility of the market and the interconnectedness of global economics underscore the dynamic nature of wealth creation and loss in the modern economy.

Call to Action: Stay informed about the fluctuations of Elon Musk's net worth and the factors influencing Tesla's stock price. Understanding the interconnectedness of global markets and the forces impacting high-growth tech companies like Tesla is crucial for anyone interested in investing and understanding the dynamics of the modern economy. Continue to follow our updates on the ever-changing landscape of Elon Musk's net worth and the Tesla effect.

Featured Posts

-

Choppy Trading Ends Flat For Indian Stock Markets Sensex Nifty 50 Report

May 09, 2025

Choppy Trading Ends Flat For Indian Stock Markets Sensex Nifty 50 Report

May 09, 2025 -

Brekelmans Wil India Zo Veel Mogelijk Aan Onze Zijde Houden Analyse En Strategie

May 09, 2025

Brekelmans Wil India Zo Veel Mogelijk Aan Onze Zijde Houden Analyse En Strategie

May 09, 2025 -

F1 News Jeremy Clarkson Proposes Solution Amidst Ferrari Disqualification Concerns

May 09, 2025

F1 News Jeremy Clarkson Proposes Solution Amidst Ferrari Disqualification Concerns

May 09, 2025 -

Real Id Enforcement Begins How It Affects Your Summer Travel

May 09, 2025

Real Id Enforcement Begins How It Affects Your Summer Travel

May 09, 2025 -

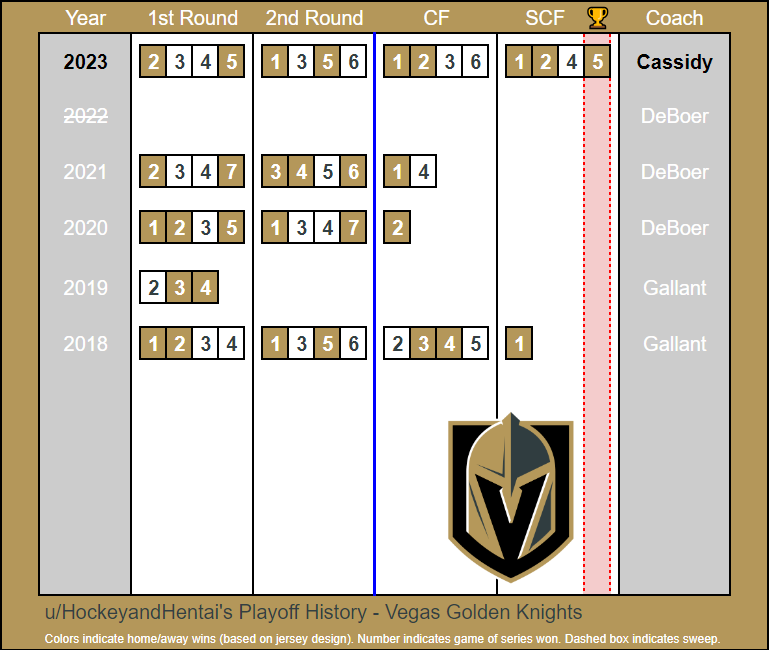

Hertls Injury Impact On Vegas Golden Knights Playoff Chances

May 09, 2025

Hertls Injury Impact On Vegas Golden Knights Playoff Chances

May 09, 2025