Elon Musk's Net Worth Fluctuations: Understanding The US Influence

Table of Contents

The Role of Tesla Stock in Musk's Net Worth

Tesla's stock performance is intrinsically linked to Elon Musk's net worth. A significant portion of his wealth is directly tied to his ownership stake in the electric vehicle giant. Understanding Tesla's stock price volatility is key to understanding the dramatic shifts in Musk's overall net worth.

- Ownership Stake: Elon Musk owns a substantial percentage of Tesla's outstanding shares, making him one of the largest individual shareholders globally. Fluctuations in Tesla's market capitalization directly translate into changes in his personal wealth.

- Market Sentiment and News Cycles: Positive news, such as successful product launches (like the Cybertruck or Model Y), record production numbers, or strong quarterly earnings reports, tend to boost Tesla's stock price and, consequently, Musk's net worth. Conversely, negative news, including production delays, regulatory challenges, or controversial tweets from Musk himself, can significantly impact the stock price and his wealth negatively.

- Regulatory Changes and Their Impact: Government regulations concerning electric vehicles, tax credits, and environmental policies in the US and globally play a crucial role. Favorable policies can fuel Tesla's growth and positively impact Musk's net worth, while stricter regulations or unexpected changes can have the opposite effect. For example, changes to EV tax credits in the US directly affect Tesla's competitiveness and profitability.

- Specific Examples: The launch of the Model 3, for example, marked a period of significant growth for Tesla, boosting the stock price and Musk’s net worth. Conversely, periods of production challenges or controversies surrounding Musk’s public statements have often led to temporary dips in his fortune.

SpaceX and its Influence on Musk's Overall Wealth

While Tesla dominates the headlines regarding Musk's net worth, SpaceX, his space exploration company, plays a significant, albeit less directly visible, role. SpaceX’s influence on his overall wealth is substantial and growing.

- Private Funding and Government Contracts: SpaceX secures substantial funding through private investment rounds, valuing the company at hundreds of billions of dollars. Government contracts for NASA missions and other space-related projects also contribute significantly to SpaceX's revenue and, indirectly, to Musk's net worth.

- Long-Term Potential: SpaceX's ambitious long-term goals, including space tourism with Starship and the development of Starlink satellite internet, hold enormous potential for future growth. The success of these ventures will significantly impact Musk's wealth in the coming years.

- Volatility Comparison: Compared to Tesla, SpaceX’s contribution to Musk's net worth is comparatively less volatile. This is due to the slower pace of revenue generation in the space industry and the less frequent fluctuations in valuation compared to the publicly traded Tesla.

- Financial Projections: Analysts regularly project future valuations for SpaceX based on anticipated revenue streams from Starlink and other ventures. These projections often feed into estimations of Musk’s overall wealth, providing a glimpse into the potential future impact of SpaceX on his net worth.

The Impact of US Economic Policy and Regulations

US economic policies and regulatory frameworks profoundly influence both Tesla and SpaceX, directly affecting Elon Musk's financial standing.

- Government Incentives: Tax credits and subsidies for electric vehicles in the US have been instrumental in Tesla's success, boosting demand and profitability, and thus positively impacting Musk's net worth. Changes to these incentives can drastically alter Tesla's market position.

- Future Regulations: Potential changes in US environmental policies, regulations on space launches, or tax laws could substantially affect both Tesla's and SpaceX's valuations and Musk's wealth. The uncertainty surrounding future regulatory landscapes adds another layer of complexity to his financial situation.

- Macroeconomic Factors: Broader US macroeconomic factors, such as interest rate changes, inflation, and overall economic growth, also indirectly influence the tech sector, impacting the valuations of both Tesla and SpaceX, and consequently, Musk's net worth.

Comparison to Other Tech Billionaires

Comparing Elon Musk's net worth fluctuations with those of other prominent US tech billionaires offers valuable context.

- Key Players: Jeff Bezos (Amazon) and Mark Zuckerberg (Meta) represent vastly different business models and sources of wealth. Bezos's wealth is primarily tied to Amazon's e-commerce dominance, while Zuckerberg's is heavily dependent on Meta's social media platforms.

- Sources of Wealth and Volatility: Each billionaire's wealth is impacted by distinct factors. For example, Amazon's stock price is sensitive to e-commerce trends and global economic conditions, while Meta's performance is influenced by advertising revenue and user engagement. Comparing the volatility of their net worth reveals differences in the stability of their respective business models.

- Similarities and Differences: While all three have experienced significant net worth fluctuations, the drivers of those fluctuations differ significantly, highlighting the unique characteristics of each company and its corresponding market sensitivities.

Conclusion

Elon Musk's net worth fluctuations are a complex interplay of Tesla's stock performance, SpaceX's progress, and the ever-shifting landscape of US economic policies and regulations. The US economy plays a pivotal role, influencing both the successes and challenges faced by his companies. Understanding these dynamics provides insight into not just Musk’s personal wealth but also the larger forces shaping the future of technology and innovation in the United States and globally. To stay informed about Elon Musk's net worth fluctuations and the ongoing impact of the US market, subscribe to reputable financial news sources, follow relevant industry experts, and continue to research this dynamic and ever-evolving subject. Understanding these fluctuations is key to understanding the broader implications for the US economy and the global technological landscape.

Featured Posts

-

Dijon Ou Donner Ses Cheveux Pour Aider Les Autres

May 10, 2025

Dijon Ou Donner Ses Cheveux Pour Aider Les Autres

May 10, 2025 -

Hlm Barys San Jyrman Alawrwby Thlyl Frs Alnjah

May 10, 2025

Hlm Barys San Jyrman Alawrwby Thlyl Frs Alnjah

May 10, 2025 -

Indian Equities Surge Sensex Gains 1 400 Points Nifty Crosses 23 800 Analysis

May 10, 2025

Indian Equities Surge Sensex Gains 1 400 Points Nifty Crosses 23 800 Analysis

May 10, 2025 -

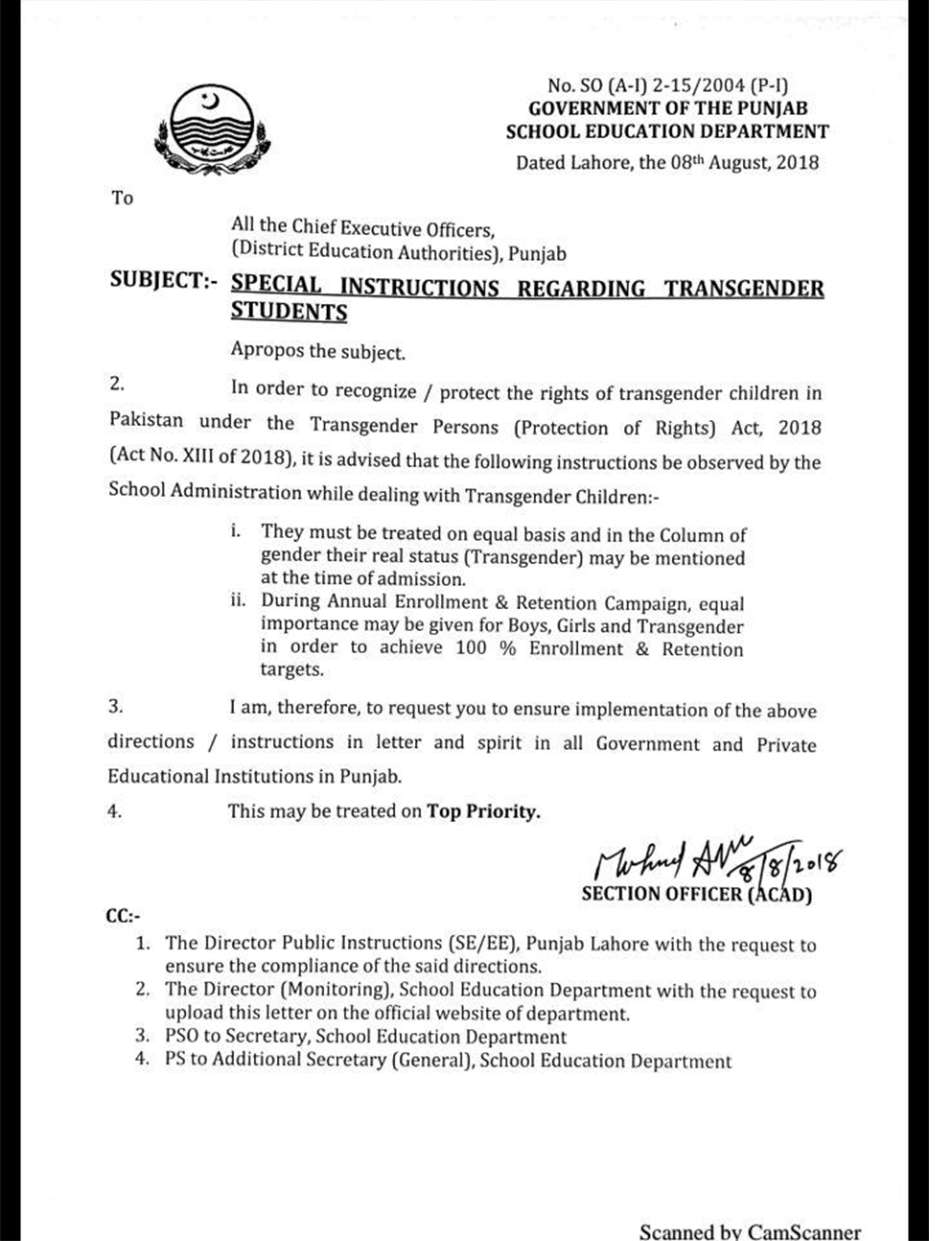

Punjab Launches Technical Training Program For Transgender Individuals

May 10, 2025

Punjab Launches Technical Training Program For Transgender Individuals

May 10, 2025 -

Britannian Kruununperimysjaerjestys Ketkae Seuraavat Kuningasta

May 10, 2025

Britannian Kruununperimysjaerjestys Ketkae Seuraavat Kuningasta

May 10, 2025